A limited review of financial statements is an audit restricted to an examination either for a limited period or of a limited part of the records. A review does not contemplate obtaining an understanding of the entity's internal control; assessing fraud risk; tests of accounting records by obtaining sufficient appropriate audit evidence through inspection, observation, confirmation, or the examination of source documents (for example, cancelled checks or bank images); and other procedures ordinarily performed in an audit. Accordingly, a review does not provide assurance that we will become aware of all significant matters that would be disclosed in an audit. Therefore, a review provides only limited assurance that there are no material modifications that should be made to the financial statements in order for the statements to be in conformity with generally accepted accounting principles.

The definition of nonattest services is very inclusive. It includes, for example, preparation of the client's depreciation schedule and preparation of journal entries even if management has approved the journal entries. I have confirmed these examples directly with the AICPA ethics division. The definition of nonattest services includes preparation of tax returns.

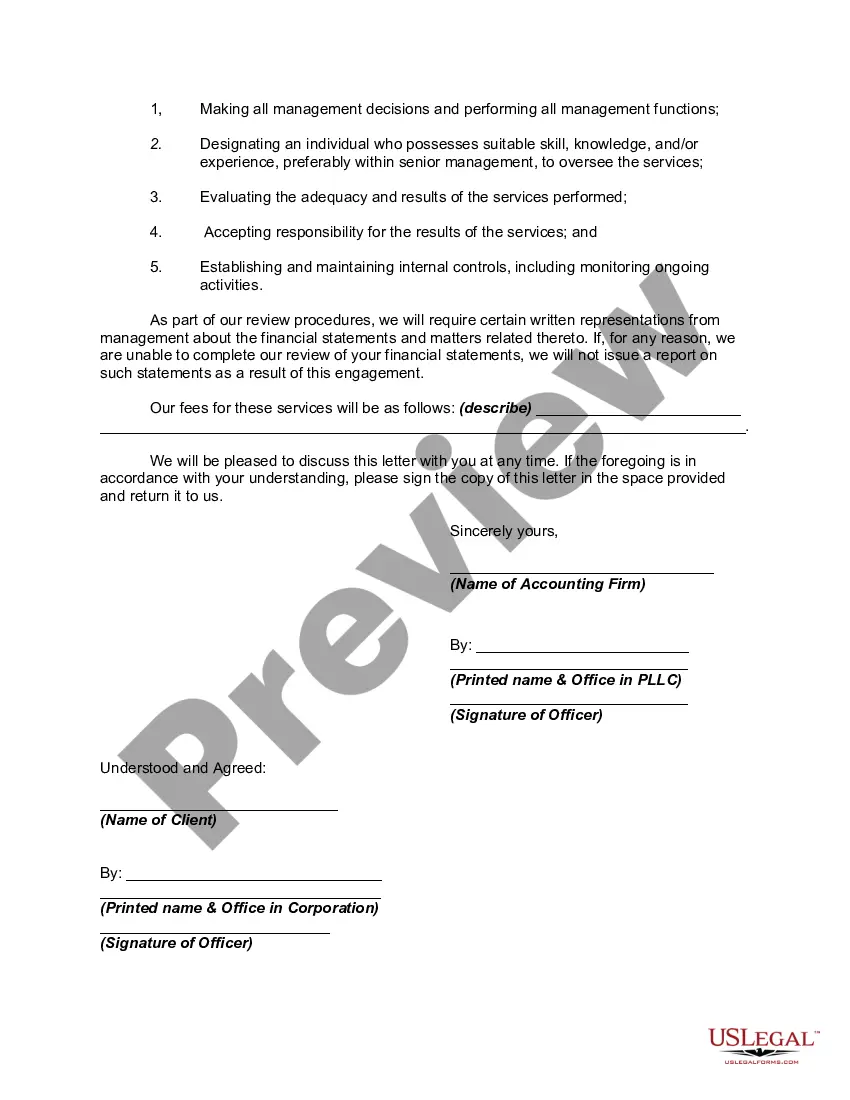

An engagement letter is a crucial document that establishes the terms and conditions of a professional relationship between an accounting firm and its client. Specifically, when it comes to the review of financial statements in West Virginia, an engagement letter plays a vital role in outlining the responsibilities and expectations of both parties involved. In this article, we will delve into the details of what the West Virginia Engagement Letter for Review of Financial Statements by an Accounting Firm entails, highlighting its essential components and varieties. An engagement letter serves as a legally binding agreement, ensuring that both the accounting firm and the client are on the same page regarding the review process. It provides a comprehensive outline of the services to be offered and establishes the scope and limitations of the review engagements. This letter is designed to protect the interests of both parties by clearly defining the responsibilities, procedures, and deliverables involved in the review of financial statements. Some significant components of the West Virginia Engagement Letter for the Review of Financial Statements may include: 1. Identification of Parties: The engagement letter starts by identifying the accounting firm and the client, clearly stating their full legal names, addresses, and contact information. 2. Objective and Scope of Engagement: This section outlines the specific objectives of the review engagement, such as evaluating the financial statements and providing limited assurance on their accuracy. It also defines the time period and the statement types (such as balance sheet, income statement, cash flow statement) to be reviewed. 3. Responsibilities of the Client: The engagement letter highlights the client's responsibilities, such as ensuring the accuracy of the financial records, providing access to necessary documents and information, and promptly addressing inquiries during the review process. 4. Responsibilities of the Accounting Firm: This section outlines the duties of the accounting firm, including performing the review engagement in accordance with Generally Accepted Accounting Principles (GAAP) and the Statements on Standards for Accounting and Review Services (STARS). It may also specify the qualifications and experience of the accounting firm. 5. Communication and Reporting: The engagement letter defines the frequency and nature of communication between the accounting firm and the client. It also outlines the format of the final review report to be issued, which typically includes the level of assurance, limitations, and any significant findings or recommendations. 6. Fees and Billing: This section clarifies the fee structure and billing arrangements for the review engagement, including the basis for calculating fees and the expected payment schedule. Different types of West Virginia Engagement Letters for the Review of Financial Statements by an Accounting Firm can exist based on various criteria such as the size and nature of the client's business, the level of assurance required (review, audit, compilation), and specific industry guidelines. For instance: 1. West Virginia Engagement Letter for Review of Financial Statements — Small Business: This type of engagement letter caters to small businesses, covering their specific needs and considering their limited resources. 2. West Virginia Engagement Letter for Review of Financial Statements — Nonprofit Organizations: This engagement letter focuses on nonprofit organizations, taking into account their unique financial reporting requirements and compliance regulations. 3. West Virginia Engagement Letter for Review of Financial Statements — Government Entities: This variant is tailored to meet the specific needs of government entities, adhering to relevant governmental accounting standards and principles. In conclusion, the West Virginia Engagement Letter for Review of Financial Statements by an Accounting Firm is a crucial document that ensures a clear understanding of the expectations and responsibilities between the accounting firm and the client. It outlines the objectives, scope, responsibilities, and communication protocols while setting the groundwork for a successful review engagement.An engagement letter is a crucial document that establishes the terms and conditions of a professional relationship between an accounting firm and its client. Specifically, when it comes to the review of financial statements in West Virginia, an engagement letter plays a vital role in outlining the responsibilities and expectations of both parties involved. In this article, we will delve into the details of what the West Virginia Engagement Letter for Review of Financial Statements by an Accounting Firm entails, highlighting its essential components and varieties. An engagement letter serves as a legally binding agreement, ensuring that both the accounting firm and the client are on the same page regarding the review process. It provides a comprehensive outline of the services to be offered and establishes the scope and limitations of the review engagements. This letter is designed to protect the interests of both parties by clearly defining the responsibilities, procedures, and deliverables involved in the review of financial statements. Some significant components of the West Virginia Engagement Letter for the Review of Financial Statements may include: 1. Identification of Parties: The engagement letter starts by identifying the accounting firm and the client, clearly stating their full legal names, addresses, and contact information. 2. Objective and Scope of Engagement: This section outlines the specific objectives of the review engagement, such as evaluating the financial statements and providing limited assurance on their accuracy. It also defines the time period and the statement types (such as balance sheet, income statement, cash flow statement) to be reviewed. 3. Responsibilities of the Client: The engagement letter highlights the client's responsibilities, such as ensuring the accuracy of the financial records, providing access to necessary documents and information, and promptly addressing inquiries during the review process. 4. Responsibilities of the Accounting Firm: This section outlines the duties of the accounting firm, including performing the review engagement in accordance with Generally Accepted Accounting Principles (GAAP) and the Statements on Standards for Accounting and Review Services (STARS). It may also specify the qualifications and experience of the accounting firm. 5. Communication and Reporting: The engagement letter defines the frequency and nature of communication between the accounting firm and the client. It also outlines the format of the final review report to be issued, which typically includes the level of assurance, limitations, and any significant findings or recommendations. 6. Fees and Billing: This section clarifies the fee structure and billing arrangements for the review engagement, including the basis for calculating fees and the expected payment schedule. Different types of West Virginia Engagement Letters for the Review of Financial Statements by an Accounting Firm can exist based on various criteria such as the size and nature of the client's business, the level of assurance required (review, audit, compilation), and specific industry guidelines. For instance: 1. West Virginia Engagement Letter for Review of Financial Statements — Small Business: This type of engagement letter caters to small businesses, covering their specific needs and considering their limited resources. 2. West Virginia Engagement Letter for Review of Financial Statements — Nonprofit Organizations: This engagement letter focuses on nonprofit organizations, taking into account their unique financial reporting requirements and compliance regulations. 3. West Virginia Engagement Letter for Review of Financial Statements — Government Entities: This variant is tailored to meet the specific needs of government entities, adhering to relevant governmental accounting standards and principles. In conclusion, the West Virginia Engagement Letter for Review of Financial Statements by an Accounting Firm is a crucial document that ensures a clear understanding of the expectations and responsibilities between the accounting firm and the client. It outlines the objectives, scope, responsibilities, and communication protocols while setting the groundwork for a successful review engagement.