A Trust is an entity which owns assets for the benefit of a third person (the beneficiary). A Living Trust is an effective way to provide lifetime and after-death property management and estate planning. When you set up a Living Trust, you are the Grantor. Anyone you name within the Trust who will benefit from the assets in the Trust is a beneficiary. In addition to being the Grantor, you can also serve as your own Trustee. As the Trustee, you can transfer legal ownership of your property to the Trust. A revocable living trust does not constitute a gift, so there are no gift tax consequences in setting it up.

West Virginia Revocable Trust Agreement Regarding Coin Collection

Description

How to fill out Revocable Trust Agreement Regarding Coin Collection?

If you require extensive, acquire, or create authentic document templates, utilize US Legal Forms, the largest assortment of legal forms available online. Employ the site's straightforward and user-friendly search to find the paperwork you need.

Numerous templates for commercial and personal use are organized by categories and jurisdictions, or keywords. Use US Legal Forms to obtain the West Virginia Revocable Trust Agreement Concerning Coin Collection in just a few clicks.

If you are already a US Legal Forms user, Log In to your account and click the Download button to receive the West Virginia Revocable Trust Agreement Concerning Coin Collection. You can also access forms you have previously downloaded in the My documents tab of your account.

Every legal document template you purchase is yours indefinitely. You have access to every form you downloaded in your account. Click the My documents section and select a form to print or download again.

Compete and obtain, and print the West Virginia Revocable Trust Agreement Concerning Coin Collection with US Legal Forms. There are thousands of professional and jurisdiction-specific forms you can use for your business or personal needs.

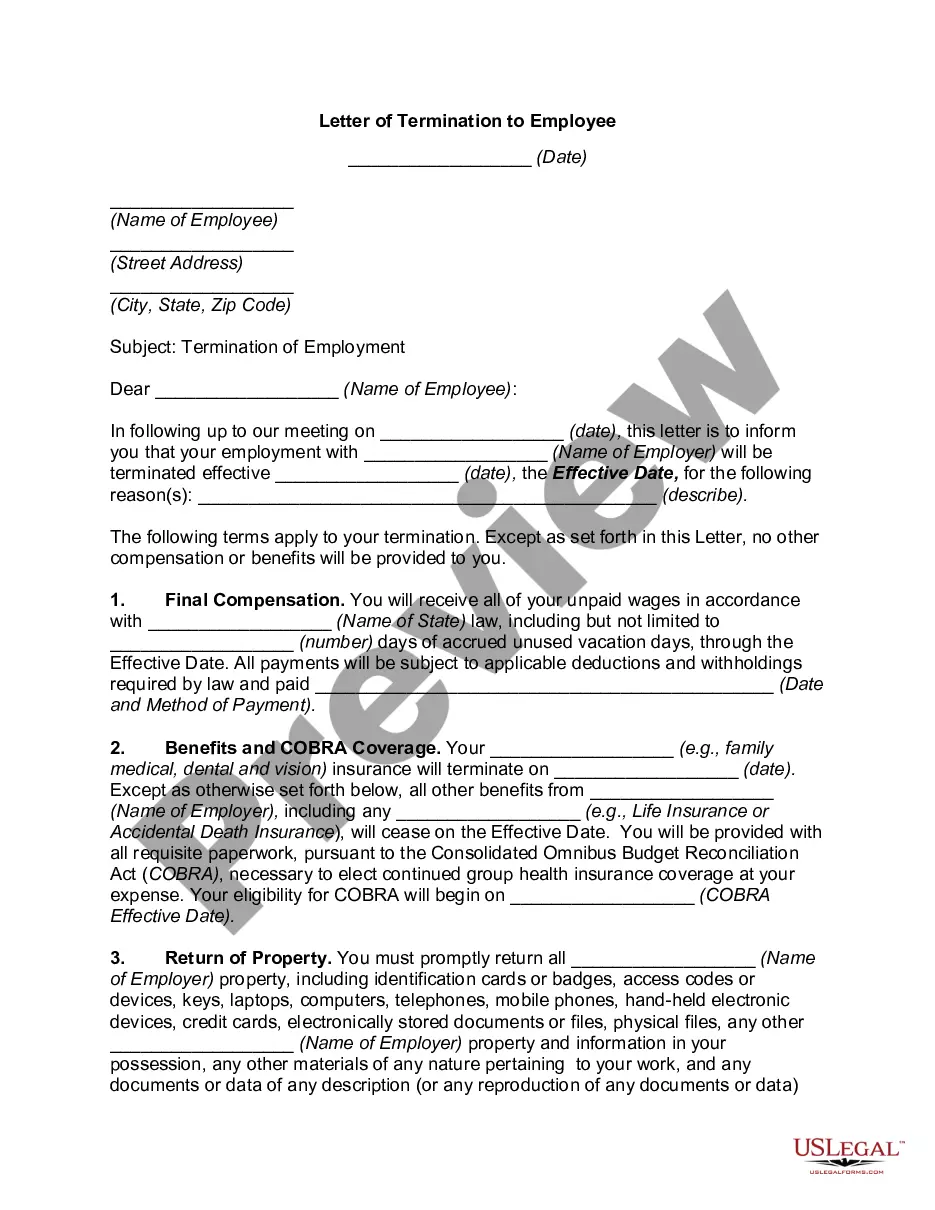

- Step 1. Ensure you have selected the form for your specific region/state.

- Step 2. Use the Review option to examine the form's details. Don’t forget to read through the information.

- Step 3. If you are not satisfied with the form, use the Search field at the top of the screen to find other variations of the legal form template.

- Step 4. Once you have located the form you need, select the Purchase now button. Choose the pricing plan you prefer and enter your details to register for the account.

- Step 5. Complete the transaction. You can use your credit card or PayPal account to finalize the payment.

- Step 6. Select the format of the legal form and download it to your device.

- Step 7. Complete, edit, and print or sign the West Virginia Revocable Trust Agreement Concerning Coin Collection.

Form popularity

FAQ

US Legal Forms offers a streamlined platform to assist you in crafting a West Virginia Revocable Trust Agreement Regarding Coin Collection. With user-friendly templates and guidance, you can navigate the complexities of trust formation with confidence. This service simplifies the process and ensures that all necessary elements are in place. Utilizing US Legal Forms helps you create a secure framework for your valuable collection.

Yes, credit card companies can attempt to access assets in a revocable trust to settle outstanding debts. If you have created a West Virginia Revocable Trust Agreement Regarding Coin Collection, the assets might still face claims from creditors after your passing. It's vital to keep this in mind when structuring your trust. Seeking professional legal counsel can provide guidance on how to protect your collection from such situations.

A revocable trust does not inherently protect assets from creditors. Since you maintain control over the assets in a West Virginia Revocable Trust Agreement Regarding Coin Collection during your lifetime, creditors can access them if needed. To enhance asset protection, consider discussing with a legal expert about strategies that can help ensure your collection remains safeguarded. Taking proactive measures will give you peace of mind.

Yes, creditors can pursue assets in a revocable trust after the owner's death. When you create a West Virginia Revocable Trust Agreement Regarding Coin Collection, the trust assets may still be subject to claims from creditors unless appropriately protected. It's essential to consult with a legal professional to explore specific strategies for shielding your collection from potential claims. This way, you can better understand how to manage your assets effectively.

The biggest mistake parents often make when setting up a trust fund, like the West Virginia Revocable Trust Agreement Regarding Coin Collection, is failing to update the trust as circumstances change. Life events such as marriage, divorce, or the birth of new family members should prompt revisions to ensure the trust reflects current wishes. Engaging a professional service can help keep the trust aligned with their goals.

One downside of placing assets in a West Virginia Revocable Trust Agreement Regarding Coin Collection is the loss of direct control over those assets. Once assets are transferred to the trust, they must be managed according to the trust's terms. This may feel restricting for some individuals who prefer managing their assets freely.

A common disadvantage of a family trust, including a West Virginia Revocable Trust Agreement Regarding Coin Collection, is the potential for family disputes over management decisions. If the trust isn’t clearly defined, family members may have differing opinions on handling the coin collection and other assets. Clear communication and proper documentation can help mitigate these issues.

Creating a West Virginia Revocable Trust Agreement Regarding Coin Collection allows your parents to manage their assets effectively. This trust provides flexibility and control over how their assets are distributed. Additionally, it can simplify the process of passing on their coin collection and other valuables, reducing stress for family during challenging times.

The best trust for asset protection tends to be irrevocable trusts, as they remove assets from your estate, offering better protection against creditors. However, a West Virginia Revocable Trust Agreement Regarding Coin Collection can still be beneficial for managing your coin collection and facilitating estate planning. Each individual's situation is different, so it's best to explore your options with a skilled attorney in West Virginia.

A West Virginia Revocable Trust Agreement Regarding Coin Collection allows you to maintain control over your assets while providing a clear plan for their distribution. This arrangement can help avoid probate, ensuring a smoother transition for your heirs. However, it's important to understand that while this trust offers flexibility, it does not completely insulate your assets from legal claims.