A West Virginia Subcontractor Agreement for Insurance is a legally binding contract between a subcontractor and an insurance company operating in the state of West Virginia. This agreement outlines the terms and conditions under which the subcontractor will provide services to the insurance company, as well as the responsibilities and obligations of both parties involved. Keywords: West Virginia, subcontractor agreement, insurance, legally binding contract, services, responsibilities, obligations. There are various types of West Virginia Subcontractor Agreements for Insurance, depending on the specific nature of the insurance services being provided. Some common types of these agreements include: 1. General Subcontractor Agreement for Insurance: This type of agreement is used when a subcontractor is engaged in providing general insurance services to the insurance company. It covers a wide range of insurance services, such as property insurance, casualty insurance, liability insurance, and more. 2. Health Insurance Subcontractor Agreement: This specific type of agreement is used when the subcontractor is involved in providing health insurance services. It outlines the terms and conditions related to health insurance coverage, medical reimbursements, and other healthcare-related services. 3. Auto Insurance Subcontractor Agreement: This agreement is specifically designed for subcontractors engaged in providing auto insurance services. It includes clauses related to automobile coverage, claims processing, and other auto insurance-related activities. 4. Workers' Compensation Subcontractor Agreement: This type of agreement is used when a subcontractor is involved in providing workers' compensation insurance services. It specifies the terms and conditions related to workplace injuries, employee compensation, and the handling of workers' compensation claims. 5. Life Insurance Subcontractor Agreement: This agreement is used for subcontractors providing life insurance services. It outlines the terms and conditions related to life insurance coverage, policy terms, beneficiary claims, and other life insurance-related activities. These are just a few examples of the different types of West Virginia Subcontractor Agreements for Insurance. It's important to note that the content and specific clauses within each agreement may vary depending on the requirements of the subcontractor and the insurance company involved.

West Virginia Subcontractor Agreement for Insurance

Description

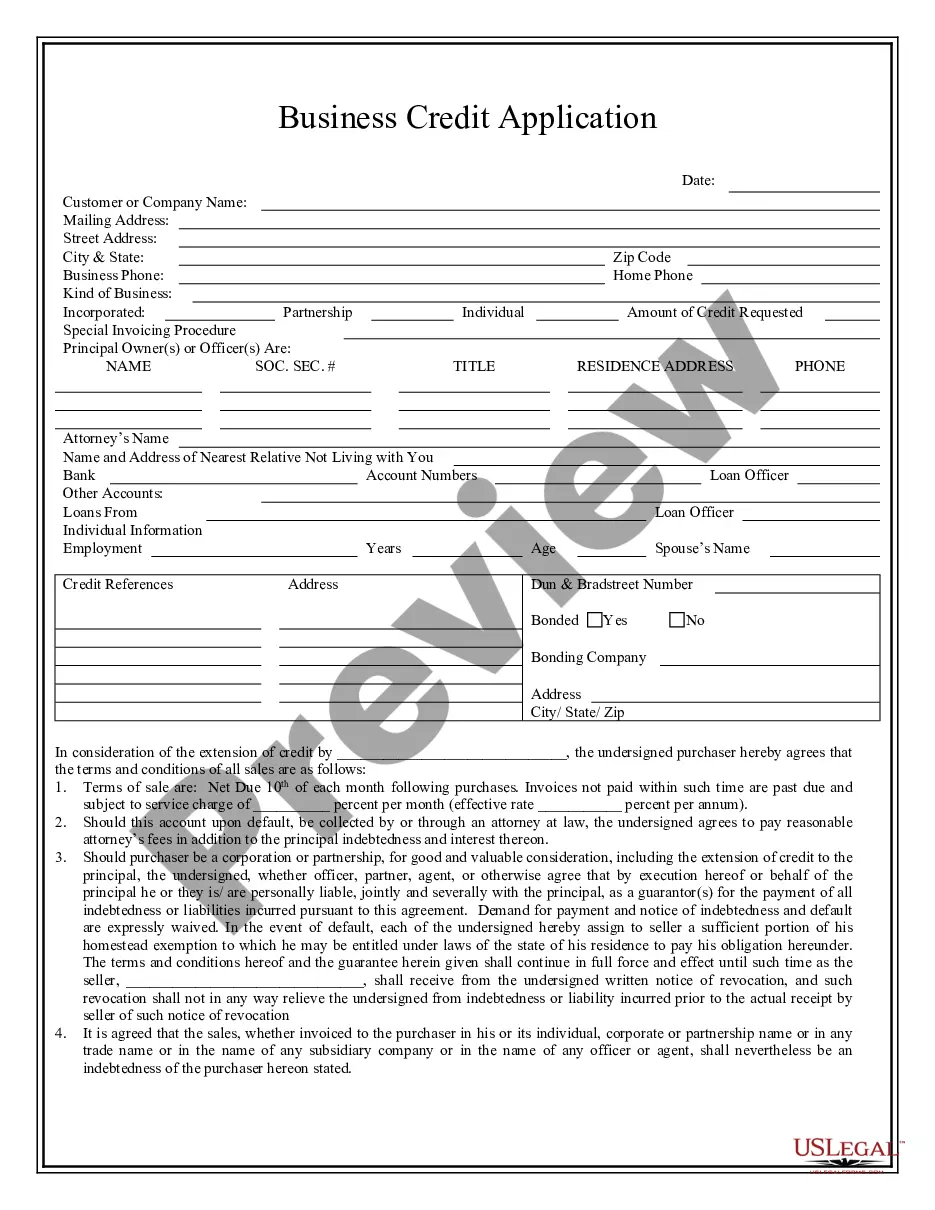

How to fill out West Virginia Subcontractor Agreement For Insurance?

It is possible to commit several hours on-line looking for the legal file template that meets the state and federal specifications you require. US Legal Forms supplies 1000s of legal kinds that happen to be analyzed by professionals. You can actually download or print the West Virginia Subcontractor Agreement for Insurance from your support.

If you already have a US Legal Forms account, you are able to log in and click on the Download option. After that, you are able to complete, modify, print, or indication the West Virginia Subcontractor Agreement for Insurance. Each and every legal file template you purchase is your own property eternally. To acquire yet another version of any bought form, proceed to the My Forms tab and click on the corresponding option.

If you use the US Legal Forms internet site the very first time, stick to the easy directions under:

- Initial, make sure that you have selected the correct file template for the region/town of your choice. See the form description to ensure you have selected the proper form. If readily available, take advantage of the Review option to look through the file template at the same time.

- If you wish to find yet another model of the form, take advantage of the Search discipline to obtain the template that meets your needs and specifications.

- When you have located the template you want, click Buy now to continue.

- Choose the rates prepare you want, type in your qualifications, and sign up for your account on US Legal Forms.

- Total the financial transaction. You should use your Visa or Mastercard or PayPal account to purchase the legal form.

- Choose the file format of the file and download it to the gadget.

- Make changes to the file if required. It is possible to complete, modify and indication and print West Virginia Subcontractor Agreement for Insurance.

Download and print 1000s of file themes while using US Legal Forms site, which offers the most important assortment of legal kinds. Use skilled and condition-distinct themes to deal with your business or personal demands.

Form popularity

FAQ

Setting up an independent contractor agreement begins with specifying the work to be performed, the schedule, and payment details. It's important to state that the contractor is not an employee to maintain proper legal boundaries. Implementing a West Virginia Subcontractor Agreement for Insurance can help cover essential aspects of your arrangement. You can find comprehensive forms on uslegalforms that guide you through this process, ensuring a smooth setup.

Creating subcontractor agreements involves outlining the scope of work, payment terms, and timelines. Start by clearly defining each party's responsibilities to avoid misunderstandings. Using a West Virginia Subcontractor Agreement for Insurance can simplify this process, ensuring that all necessary legal protections are included. You can utilize platforms like uslegalforms to access customizable templates designed specifically for West Virginia regulations.

In most cases, the general contractor pays for subcontractor default insurance as a part of their risk management strategy. By doing so, they protect not only their interests but also ensure that subcontractors comply with the terms laid out in the West Virginia Subcontractor Agreement for Insurance. It's crucial to review your specific contract terms, as these can influence the financial responsibilities in your project.

Filling out an independent contractor agreement is similar to completing a subcontractor agreement. Utilize a West Virginia Subcontractor Agreement for Insurance as a reference. Make sure to include the names and roles of the parties, the nature of work, and payment terms. Lastly, review the entire document to confirm all information is correct before signing.

Completing an agreement involves reviewing all the necessary details listed in a West Virginia Subcontractor Agreement for Insurance. After filling in all sections, obtain signatures from both parties to make the document legally binding. Check that all conditions related to payment and performance are clearly stated. Once completed, keep copies for your records.

Writing out an agreement starts with understanding the project’s requirements. A West Virginia Subcontractor Agreement for Insurance should be clear and detailed, reflecting the scope of work, payment terms, and duration. Structure the document logically, and use straightforward language to avoid confusion. Lastly, ensure both parties sign the agreement to affirm their commitment.

Filling out a subcontractor agreement is an essential step in ensuring successful project execution. Begin with a West Virginia Subcontractor Agreement for Insurance template to guide you. Input relevant information such as the contractor’s and subcontractor’s details, job description, and payment terms. It's vital to check for completeness and accuracy before finalizing the document.

To fill an agreement properly, you should start with a West Virginia Subcontractor Agreement for Insurance template. Include all essential details about the project, payment structure, and deadlines. Ensure that both parties review and sign the document to validate the agreement. A clear and concise agreement helps prevent misunderstandings later on.

Subcontractors need to provide specific information in a West Virginia Subcontractor Agreement for Insurance. This includes personal details, the type of work to be performed, and any necessary licenses or insurance information. Additionally, subcontractors should outline payment terms and conditions to establish clear expectations. Using a reliable platform, like uslegalforms, simplifies this process.

Filling out a West Virginia Subcontractor Agreement for Insurance is straightforward. Start by entering the names and addresses of all parties involved. Make sure to specify the project details, including scope of work, compensation, and timelines. Carefully review the agreement to ensure all information is accurate.