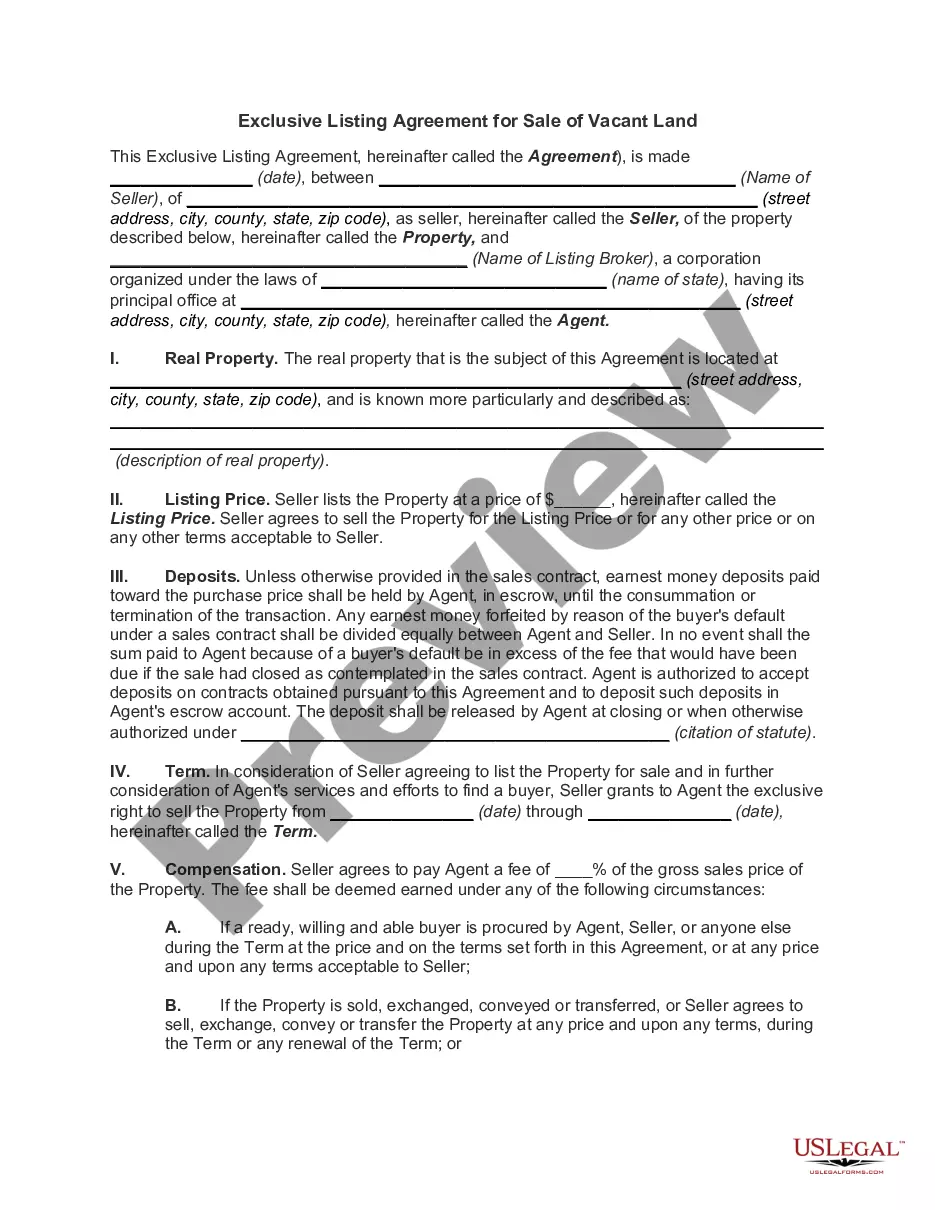

West Virginia Comprehensive Equipment Lease with Provision Regarding Investment Tax is a legal agreement entered into between a lessor (equipment owner) and a lessee (equipment user) in West Virginia. This lease agreement includes specific provisions related to investment tax credits, providing lessees with tax benefits for investments made in equipment leasing. The West Virginia Comprehensive Equipment Lease with Provision Regarding Investment Tax is designed to facilitate the financing and usage of various types of equipment, ranging from heavy machinery, vehicles, computer systems, to office equipment. This lease agreement helps businesses and individuals avoid the high upfront costs of purchasing equipment by allowing them to lease it instead. There are several types of West Virginia Comprehensive Equipment Leases available, each tailored to different industries and equipment needs: 1. Construction Equipment Lease: This lease type specifically caters to the construction industry, allowing contractors, builders, and developers to lease heavy machinery such as excavators, bulldozers, cranes, and loaders. 2. Technology Equipment Lease: This lease option is ideal for businesses that rely heavily on technology. It covers leasing computer systems, servers, networking equipment, software, and other technological devices required for efficient operations. 3. Medical Equipment Lease: This lease type focuses on providing healthcare organizations, clinics, hospitals, and private practices with the necessary medical equipment. It includes leasing of diagnostic machines, imaging equipment, patient monitoring systems, and surgical tools. 4. Vehicle Lease: This lease option enables individuals and businesses to lease vehicles such as cars, trucks, vans, and commercial fleets. It suits those needing reliable transportation without the burden of ownership. The provisions regarding investment tax embedded within the Comprehensive Equipment Lease can help lessees leverage tax advantages. West Virginia offers investment tax credits to lessees who invest in their businesses by leasing equipment. These tax credits can be claimed upon meeting certain criteria, providing a significant financial incentive to lease equipment rather than purchasing it outright. By utilizing the West Virginia Comprehensive Equipment Lease with Provision Regarding Investment Tax, businesses and individuals in West Virginia can access the equipment they need while benefiting from potential tax savings. This lease agreement streamlines the equipment acquisition process, saves upfront costs, and allows lessees to focus on their core operations and growth.

West Virginia Comprehensive Equipment Lease with Provision Regarding Investment Tax

Description

How to fill out West Virginia Comprehensive Equipment Lease With Provision Regarding Investment Tax?

You can invest hours on the Internet trying to find the lawful document format that fits the federal and state specifications you will need. US Legal Forms gives a large number of lawful types which can be analyzed by experts. You can actually acquire or printing the West Virginia Comprehensive Equipment Lease with Provision Regarding Investment Tax from my assistance.

If you already have a US Legal Forms profile, it is possible to log in and click on the Down load switch. Next, it is possible to comprehensive, change, printing, or sign the West Virginia Comprehensive Equipment Lease with Provision Regarding Investment Tax. Every lawful document format you acquire is the one you have eternally. To obtain one more version of any purchased form, visit the My Forms tab and click on the corresponding switch.

Should you use the US Legal Forms website the first time, adhere to the simple directions below:

- Very first, make certain you have selected the proper document format for that region/metropolis of your choice. See the form information to ensure you have picked the correct form. If accessible, make use of the Review switch to appear from the document format at the same time.

- If you wish to find one more edition of the form, make use of the Lookup field to get the format that fits your needs and specifications.

- After you have discovered the format you would like, just click Acquire now to carry on.

- Find the costs program you would like, enter your references, and register for an account on US Legal Forms.

- Total the deal. You can utilize your credit card or PayPal profile to fund the lawful form.

- Find the file format of the document and acquire it to the device.

- Make alterations to the document if possible. You can comprehensive, change and sign and printing West Virginia Comprehensive Equipment Lease with Provision Regarding Investment Tax.

Down load and printing a large number of document themes making use of the US Legal Forms site, which provides the most important variety of lawful types. Use specialist and express-distinct themes to handle your business or personal requirements.

Form popularity

FAQ

When you lease a car in West Virginia, the sales tax applies to the total amount of the lease payments. This tax rate typically reflects the state’s sales tax, along with any applicable local taxes. In the context of a West Virginia Comprehensive Equipment Lease with Provision Regarding Investment Tax, understanding these tax implications can help you manage your financial commitments effectively. Additionally, using resources like USLegalForms can provide clarity on legal obligations and streamline the leasing process.

While specific tax rates for 2025 are still being finalized, West Virginia typically follows a progressive tax structure. Being diligent in understanding how these rates may apply to your financial strategies, especially if you engage in transactions involving a West Virginia Comprehensive Equipment Lease with Provision Regarding Investment Tax, is crucial. Regular updates from the state tax department will provide you with the most accurate information.

Yes, rental income is indeed taxable in West Virginia. This includes income derived from property leases and is essential to consider when you’re structuring your West Virginia Comprehensive Equipment Lease with Provision Regarding Investment Tax arrangements. Proper reporting of your rental income allows you to remain compliant with state tax regulations while optimizing your lease agreements.

Currently, there are discussions about reforming the state income tax in West Virginia, but there is no confirmed plan to eliminate it entirely. Legislative actions may propose changes that affect your financial landscape, including impacts on the West Virginia Comprehensive Equipment Lease with Provision Regarding Investment Tax. Therefore, keeping track of state budget proposals will help you stay informed.

Whether or not you need to file a West Virginia tax return largely depends on your income level and filing status. If you have a substantial income, particularly from sources such as a West Virginia Comprehensive Equipment Lease with Provision Regarding Investment Tax, it is advisable to file. To ensure compliance and avoid potential penalties, consider reaching out to a tax professional who understands the intricacies of West Virginia tax laws.

Tax rates in West Virginia for 2025 will likely reflect adjustments that follow federal guidelines. While specific numbers are still developing, it's wise to consult updated resources or professionals to understand how the West Virginia Comprehensive Equipment Lease with Provision Regarding Investment Tax will fit into your financial planning. Staying informed will help you navigate potential changes in tax rates effectively.

As of now, West Virginia does not tax Social Security benefits. This means that your Social Security income remains unaffected when it comes to your West Virginia Comprehensive Equipment Lease with Provision Regarding Investment Tax. It's important to keep an eye on legislative changes as new tax policies can emerge, but currently, you can plan your taxes knowing Social Security income is exempt.

In West Virginia, several items are exempt from sales tax, including certain foods for home consumption and prescription medications. Additionally, inputs used in manufacturing can also qualify for exemption. If you enter into a West Virginia Comprehensive Equipment Lease with Provision Regarding Investment Tax, it may provide some benefits in terms of sales tax exemptions for applicable equipment and services. Exploring uslegalforms can help clarify what is taxable and what is not.

Yes, rental income is taxable in West Virginia. If you earn income from a West Virginia Comprehensive Equipment Lease with Provision Regarding Investment Tax, you must report this income when filing your state taxes. However, you can also deduct certain expenses related to the rental property, which can help reduce your taxable income. To ensure compliance and optimize your tax reporting, consider using resources from uslegalforms.

In West Virginia, the tax on a leased car is typically based on the monthly lease payment amount. This tax is a form of sales tax, calculated at the start of the lease agreement. To effectively manage your finances while leasing a vehicle, consider how the West Virginia Comprehensive Equipment Lease with Provision Regarding Investment Tax applies to your overall tax obligations.

More info

Best Balance Transfers 1. Best Balance Transfer Credit Card Cash for Cash Visa® Card. Borrowers have saved over 11,000% with this Visa credit card. In addition, the average cash back rate from cashback offers that we have analyzed is 2.3%. This credit card is ideal for those looking for high cash back rates; however, it might take longer to earn enough points to earn 5X miles. This can be a big deal for borrowers who have several credit cards because the miles on this card can be used for frequent flyer miles, and it can be transferred to up to five airline miles per month. Since this credit card doesn't have the standard interest rate bonus, it has the lowest cash back rates of any credit card from the top 5% with 0% rate period. 2. Best Balance Transfer Credit Card Best Rate Cash Back Rewards Visa® Card. Borrowers have saved over 12,500% with this card. In addition, the average cash back rate from cashback offers that we have analyzed is 3.3%.