A West Virginia Promissory Note in connection with a sale and purchase of a mobile home is a legally binding document that defines the terms and conditions under which a buyer promises to repay the seller for the purchase of a mobile home. It serves as a written agreement, outlining the agreed-upon terms of the loan, including the repayment schedule, interest rates, and consequences for non-payment. In West Virginia, there are several types of Promissory Notes that may be used in connection with the sale and purchase of a mobile home. These include: 1. Fixed-term Promissory Note: This type of note specifies a set repayment period during which the buyer is obligated to make regular payments to the seller, including both principal and interest. The total amount to be repaid and the interest rate are predetermined and stated in the note. 2. Adjustable-rate Promissory Note: Unlike a fixed-term note, an adjustable-rate note allows the interest rate to fluctuate over time. The interest rate is usually tied to an index, such as the Prime Rate, and may change periodically according to predetermined terms specified in the note. 3. Balloon Promissory Note: This type of note involves making smaller payments over a specified period, followed by a larger final payment, referred to as a "balloon payment." The interest rate and repayment terms are agreed upon in the note, but the final balloon payment is usually larger than the preceding payments. It is important for both parties to clearly understand and agree to the balloon payment terms upfront. 4. Installment Promissory Note: An installment note allows the buyer to repay the loan in regular installments over a specified period. The repayment amount and frequency (monthly, bi-monthly, quarterly, etc.) are mentioned in the note, along with the interest rate. 5. Secured Promissory Note: This type of note includes provisions to secure the loan with collateral, usually the mobile home itself. If the buyer defaults on the loan, the seller may have the right to seize or repossess the mobile home through legal means. When drafting or entering into a West Virginia Promissory Note in connection with the sale and purchase of a mobile home, it is essential to consult with legal professionals and ensure that the terms and conditions comply with state laws and regulations. It is also prudent to consider the advice of a real estate attorney to protect the interests of both the buyer and seller in the transaction.

West Virginia Promissory Note in Connection with a Sale and Purchase of a Mobile Home

Description

How to fill out West Virginia Promissory Note In Connection With A Sale And Purchase Of A Mobile Home?

If you have to complete, download, or printing authorized papers themes, use US Legal Forms, the biggest collection of authorized forms, which can be found on-line. Make use of the site`s simple and easy hassle-free search to discover the documents you require. Numerous themes for organization and specific functions are sorted by types and suggests, or keywords. Use US Legal Forms to discover the West Virginia Promissory Note in Connection with a Sale and Purchase of a Mobile Home in just a number of clicks.

In case you are presently a US Legal Forms consumer, log in to the bank account and then click the Down load option to have the West Virginia Promissory Note in Connection with a Sale and Purchase of a Mobile Home. You can even gain access to forms you earlier saved inside the My Forms tab of your respective bank account.

If you work with US Legal Forms the very first time, refer to the instructions below:

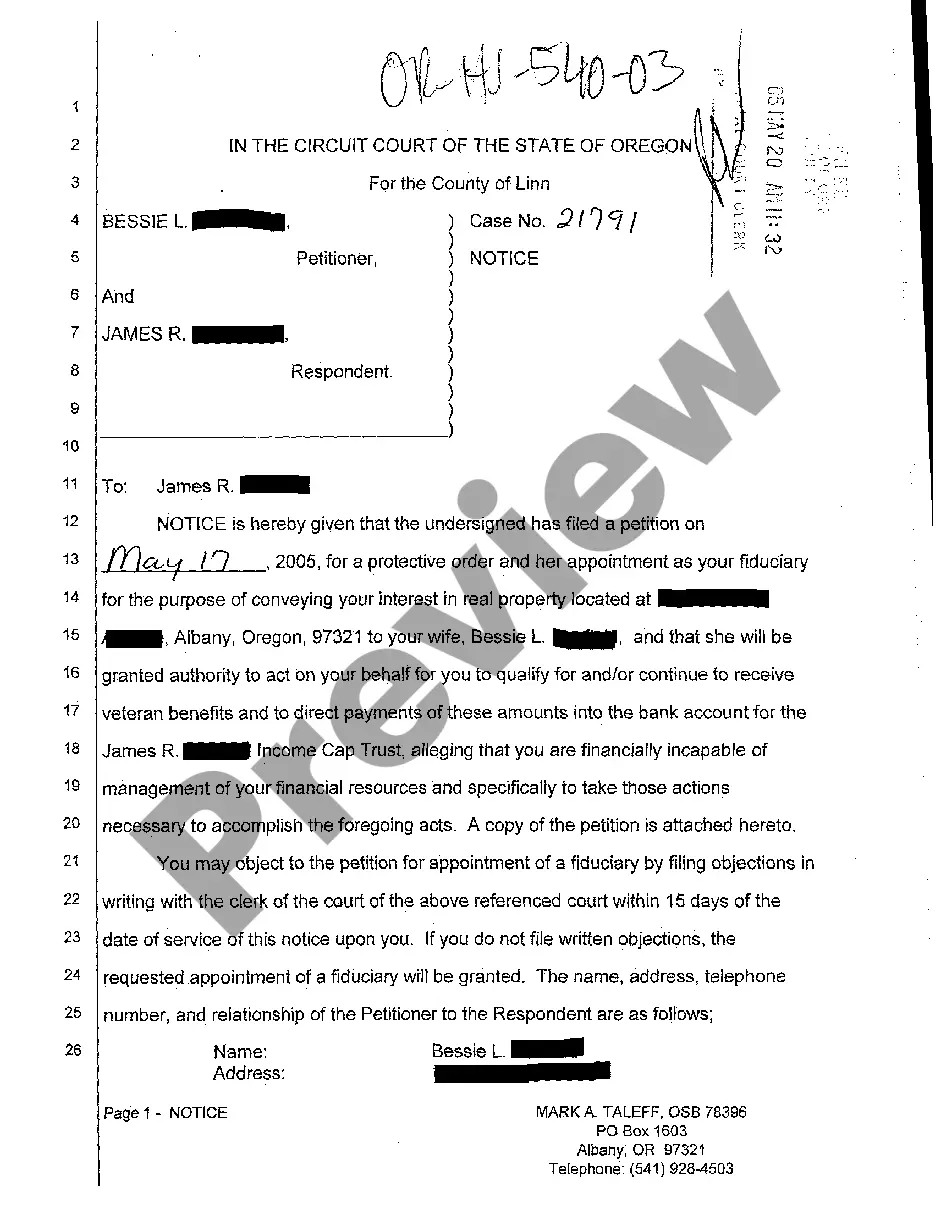

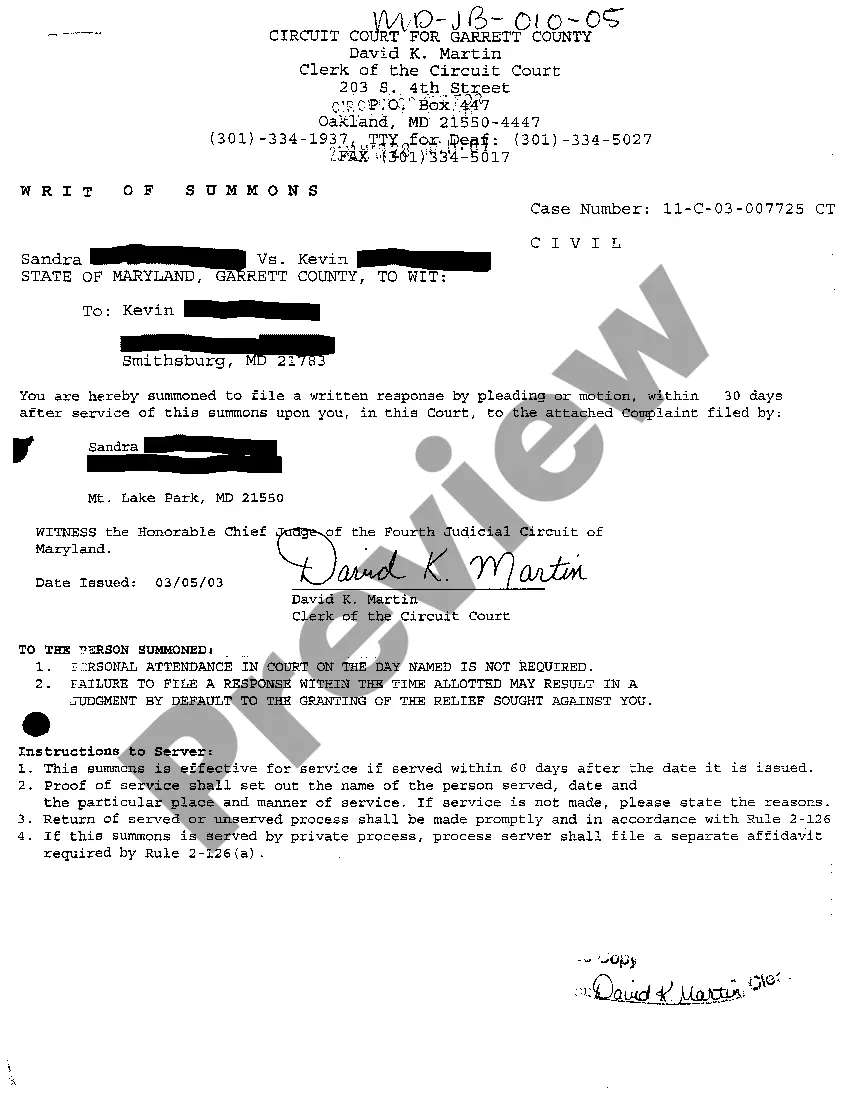

- Step 1. Be sure you have selected the form for that appropriate city/country.

- Step 2. Take advantage of the Preview choice to examine the form`s information. Don`t forget about to read through the explanation.

- Step 3. In case you are not satisfied using the form, use the Search discipline on top of the display to discover other types in the authorized form template.

- Step 4. When you have identified the form you require, click the Acquire now option. Pick the prices plan you like and add your references to sign up on an bank account.

- Step 5. Process the deal. You can utilize your bank card or PayPal bank account to finish the deal.

- Step 6. Select the file format in the authorized form and download it on your system.

- Step 7. Total, change and printing or indication the West Virginia Promissory Note in Connection with a Sale and Purchase of a Mobile Home.

Each and every authorized papers template you buy is your own property eternally. You have acces to every form you saved within your acccount. Select the My Forms portion and choose a form to printing or download yet again.

Remain competitive and download, and printing the West Virginia Promissory Note in Connection with a Sale and Purchase of a Mobile Home with US Legal Forms. There are millions of skilled and express-distinct forms you can utilize for your organization or specific requires.

Form popularity

FAQ

Generally, as long as the promissory note contains legally acceptable interest rates, the signatures of the two contracted parties, and are within the applicable Statute of Limitations, they can be upheld in a court of law.

What Happens When a Promissory Note Is Not Paid? Promissory notes are legally binding documents. Someone who fails to repay a loan detailed in a promissory note can lose an asset that secures the loan, such as a home, or face other actions.

A promissory note is not the same as a contract. A contract details all the terms of a legal agreement. A promissory note covers only the following: The date by when someone needs to be paid.

A promissory note must include the date of the loan, the dollar amount, the names of both parties, the rate of interest, any collateral involved, and the timeline for repayment. When this document is signed by the borrower, it becomes a legally binding contract.

Promissory notes are legally binding whether the note is secured by collateral or based only on the promise of repayment. If you lend money to someone who defaults on a promissory note and does not repay, you can legally possess any property that individual promised as collateral.

In order for a promissory note to be valid and legally binding, it needs to include specific information. "A promissory note should include details including the amount loaned, the repayment schedule and whether it is secured or unsecured," says Wheeler.

A promissory note must include the date of the loan, the dollar amount, the names of both parties, the rate of interest, any collateral involved, and the timeline for repayment. When this document is signed by the borrower, it becomes a legally binding contract.

Even if you have the original note, it may be void if it was not written correctly. If the person you're trying to collect from didn't sign it and yes, this happens the note is void. It may also become void if it failed some other law, for example, if it was charging an illegally high rate of interest.

Even if you have the original note, it may be void if it was not written correctly. If the person you're trying to collect from didn't sign it and yes, this happens the note is void. It may also become void if it failed some other law, for example, if it was charging an illegally high rate of interest.

More info

What this means for a person who are looking to purchase or sell a mortgage note is that: You need to convince someone to offer you the mortgage. This can be a realtor or even a bank. You must convince them that they want to buy it. In addition to asking a number of other questions to make sure you are offering a good deal, one of the biggest concerns that the typical buyer or seller has is whether they have enough money in their account to finance the mortgage. The key to making a successful transaction is having enough money to afford the mortgage, whether you have enough in your bank account to make the payment or not. There are some banks out there that will insure the entire cost of a mortgage, even if you owe more to them. While this is a good policy, it generally doesn't work out as planned since most people find the initial deposit difficult to carry.