Title: West Virginia Credit Card Application with Bonus Features on Using Card: A Comprehensive Guide Keywords: West Virginia credit card application, bonus features, using card, types Introduction: Applying for a credit card tailored to your specific needs can provide a range of benefits, especially if it offers bonus features. In this comprehensive guide, we will explore the West Virginia Credit Card Application with Bonus Features on Using Card, shedding light on its various types and highlighting the key advantages they offer. Types of West Virginia Credit Card Application with Bonus Features on Using Card: 1. Travel Rewards Credit Card: A West Virginia credit card designed for travel enthusiasts offering bonus features such as air miles, hotel discounts, travel insurance, and lounge access. This type of card is ideal for frequent travelers, providing rewards and perks that make their journeys more enjoyable and cost-effective. 2. Cash Back Credit Card: West Virginia residents can apply for a credit card that offers cash back rewards on every purchase made. This type of card is suitable for individuals who prefer direct benefits, as it allows cardholders to earn a percentage of their spending back in cash or statement credits. 3. Point Rewards Credit Card: These West Virginia credit cards provide bonus rewards in the form of points, which can be redeemed for a wide range of products and services, including merchandise, gift cards, or even travel bookings. Points accumulation can vary based on spending categories, ensuring flexibility and choice for users. 4. Low Interest Credit Card: Catering to individuals seeking to minimize interest costs, this type of West Virginia credit card provides lower interest rates on balances transferred or new purchases for a specific period. It offers an excellent option for those who carry a balance or are planning larger purchases in the near future. Bonus Features on Using the West Virginia Credit Card Application: 1. Welcome Bonus: Most credit card applications offer a welcome bonus for approved cardholders. This bonus could include a lump sum of points, a cash back reward, or an introductory 0% APR period. 2. Annual Fee Waiver: Certain credit cards may waive the annual fee during the first year, providing immediate cost savings for new cardholders. 3. Purchase Rewards: Using the West Virginia credit card for everyday expenses can earn you bonus rewards on eligible purchases, such as groceries, gas, dining, or entertainment. 4. Balance Transfer Promotions: Some credit cards provide limited-time balance transfer promotions, allowing cardholders to transfer balances from other high-interest credit cards and enjoy lower or zero interest rates for a specified period. Conclusion: The West Virginia Credit Card Application with Bonus Features on Using Card offers a variety of options tailored to residents' preferences and requirements. Whether you value travel rewards, cash back, points, or low interest rates, there is a credit card suited to your needs. By considering these bonus features, individuals can make the most of their credit cards while enjoying substantial benefits. Apply for a West Virginia credit card today and start leveraging its many advantages!

West Virginia Credit Card Application with Bonus Features on Using Card

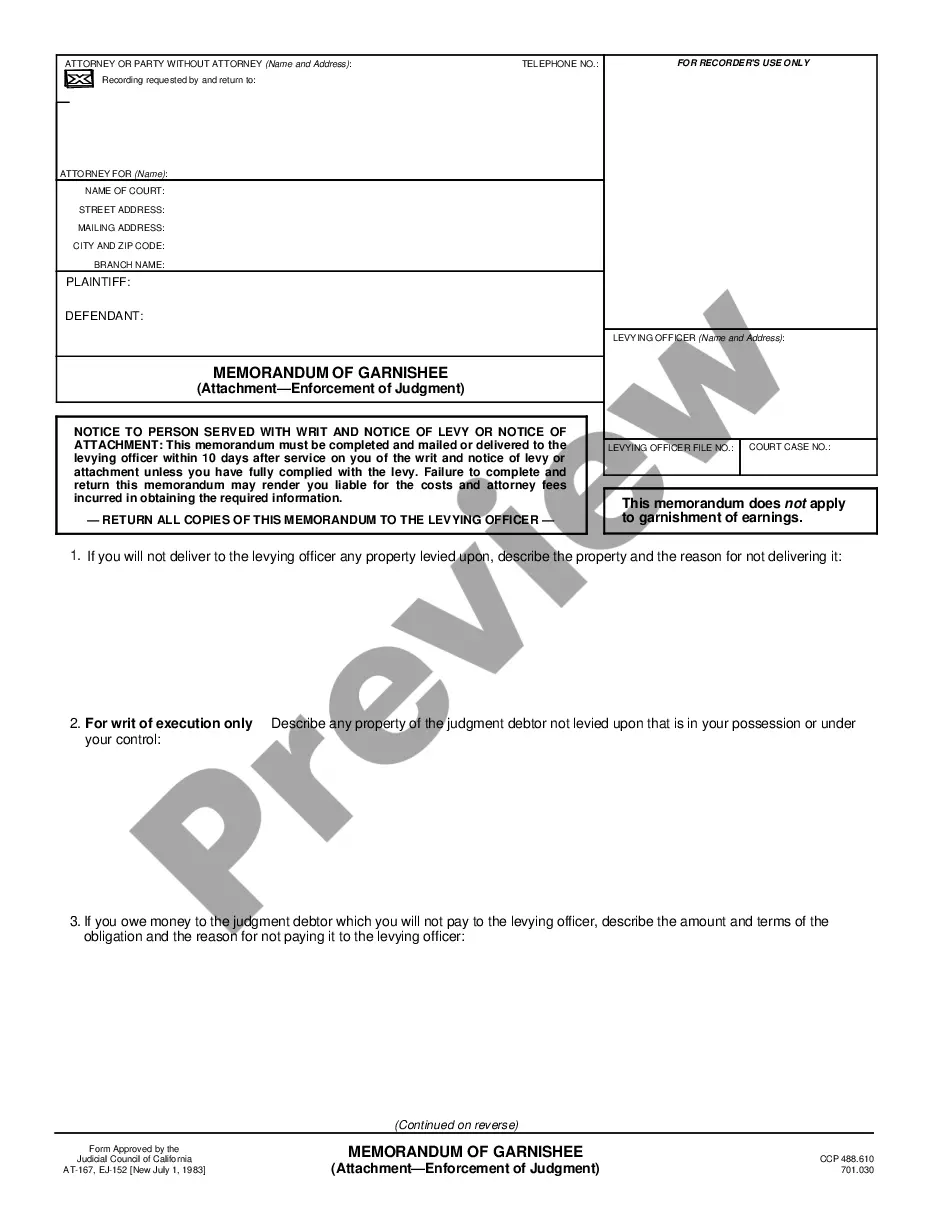

Description

How to fill out West Virginia Credit Card Application With Bonus Features On Using Card?

Are you currently within a position in which you need paperwork for sometimes company or specific uses virtually every working day? There are a lot of lawful file web templates accessible on the Internet, but getting versions you can rely on isn`t simple. US Legal Forms delivers 1000s of kind web templates, such as the West Virginia Credit Card Application with Bonus Features on Using Card, that are published in order to meet federal and state requirements.

In case you are presently acquainted with US Legal Forms site and also have your account, just log in. Afterward, it is possible to down load the West Virginia Credit Card Application with Bonus Features on Using Card format.

Unless you have an accounts and wish to begin using US Legal Forms, abide by these steps:

- Discover the kind you need and make sure it is to the right area/area.

- Take advantage of the Review switch to examine the shape.

- Look at the description to ensure that you have chosen the right kind.

- When the kind isn`t what you`re trying to find, utilize the Research field to discover the kind that meets your needs and requirements.

- If you discover the right kind, just click Get now.

- Select the costs plan you need, submit the required information and facts to create your money, and buy your order with your PayPal or bank card.

- Decide on a handy data file file format and down load your copy.

Find every one of the file web templates you might have bought in the My Forms menu. You may get a further copy of West Virginia Credit Card Application with Bonus Features on Using Card at any time, if necessary. Just click on the required kind to down load or printing the file format.

Use US Legal Forms, probably the most substantial variety of lawful varieties, to conserve time and prevent mistakes. The assistance delivers expertly created lawful file web templates which you can use for a range of uses. Make your account on US Legal Forms and initiate making your way of life a little easier.

Form popularity

FAQ

You can: Receive a statement credit. The cash back gets applied to your credit card's balance. Request a check. The issuer sends you a check for your cash back rewards. Transfer rewards to a bank account. The rewards are electronically transferred into a linked bank account. ... Use your cash rewards as rewards points.

Many card issuers will allow you to redeem your cash back with a statement credit, a direct deposit to your bank account or a check payable to you. Some issuers also offer redemption options like gift cards, tickets to concerts and sporting events or even charitable donations.

View card list Bank of America® Customized Cash Rewards credit card: Best for choice of cash back category. Chase Sapphire Preferred® Card: Biggest travel sign-up bonus. Ink Business Unlimited® Credit Card: Biggest business sign-up bonus. Southwest Rapid Rewards® Plus Credit Card: Best airline sign-up bonus.

How a credit card sign-up offer works. Most sign-up offers involve spending a required sum of money within a defined time that can range over a couple of months to several months. Once you meet the bonus requirements you will receive the sign-up bonus, which can be anything from points to cash back.

Redeeming rewards for cash back Cash rewards can take a few forms: direct deposit, statement credit or check. Gift cards will sometimes be an option, too, as a "cash equivalent," but for more on that, see No. 4 below. Redeeming for a statement credit is a popular option, as it reduces your credit card balance.

The most common ways to redeem cash back are: A statement credit. A direct deposit to a bank account. A check. Gift cards. Merchandise.

Rewards programs may offer cash back on purchases, tangible services like airline miles, no interest as an introductory period or low interest, or discounts and special rates on travel and travel amenities. Some credit card reward programs combine these and other benefits.

Incentives and offers Most credit cards come packed with offers and incentives to use your card. These range from cash back to rewards point accumulation each time you swipe your card, which can later be redeemed as air miles or used towards paying your outstanding card dues.