The purpose of this form is to show creditors the dire financial situation that the debtor is in so as to induce the creditors to compromise or write off the debt due.

West Virginia Debtor's Affidavit of Financial Status to Induce Creditor to Compromise or Write off the Debt which is Past Due - Assets and Liabilities

Description

How to fill out Debtor's Affidavit Of Financial Status To Induce Creditor To Compromise Or Write Off The Debt Which Is Past Due - Assets And Liabilities?

Have you ever encountered a scenario where you need documents for either business or personal purposes nearly all the time.

There are numerous lawful document templates accessible online, but finding ones you can trust is not easy.

US Legal Forms offers thousands of template designs, such as the West Virginia Debtor's Affidavit of Financial Status to Induce Creditor to Compromise or Write off the Debt that is Past Due - Assets and Liabilities, which are developed to comply with state and federal requirements.

Choose the pricing plan you want, provide the required information to create your account, and pay for your order using your PayPal or credit card.

Select a suitable file format and download your copy. Access all the document templates you have acquired in the My documents section. You can obtain an additional copy of the West Virginia Debtor's Affidavit of Financial Status to Induce Creditor to Compromise or Write off the Debt that is Past Due - Assets and Liabilities at any time, if needed. Click the necessary form to download or print the document template. Utilize US Legal Forms, one of the largest collections of legal forms, to save time and avoid errors. The service provides professionally drafted legal document templates that can be used for a variety of purposes. Create an account on US Legal Forms and start making your life a bit easier.

- If you are already familiar with the US Legal Forms site and have an account, simply Log In.

- After that, you can download the West Virginia Debtor's Affidavit of Financial Status to Induce Creditor to Compromise or Write off the Debt that is Past Due - Assets and Liabilities template.

- If you do not possess an account and wish to begin using US Legal Forms, follow these instructions.

- Find the form you need and ensure it is for the correct city/region.

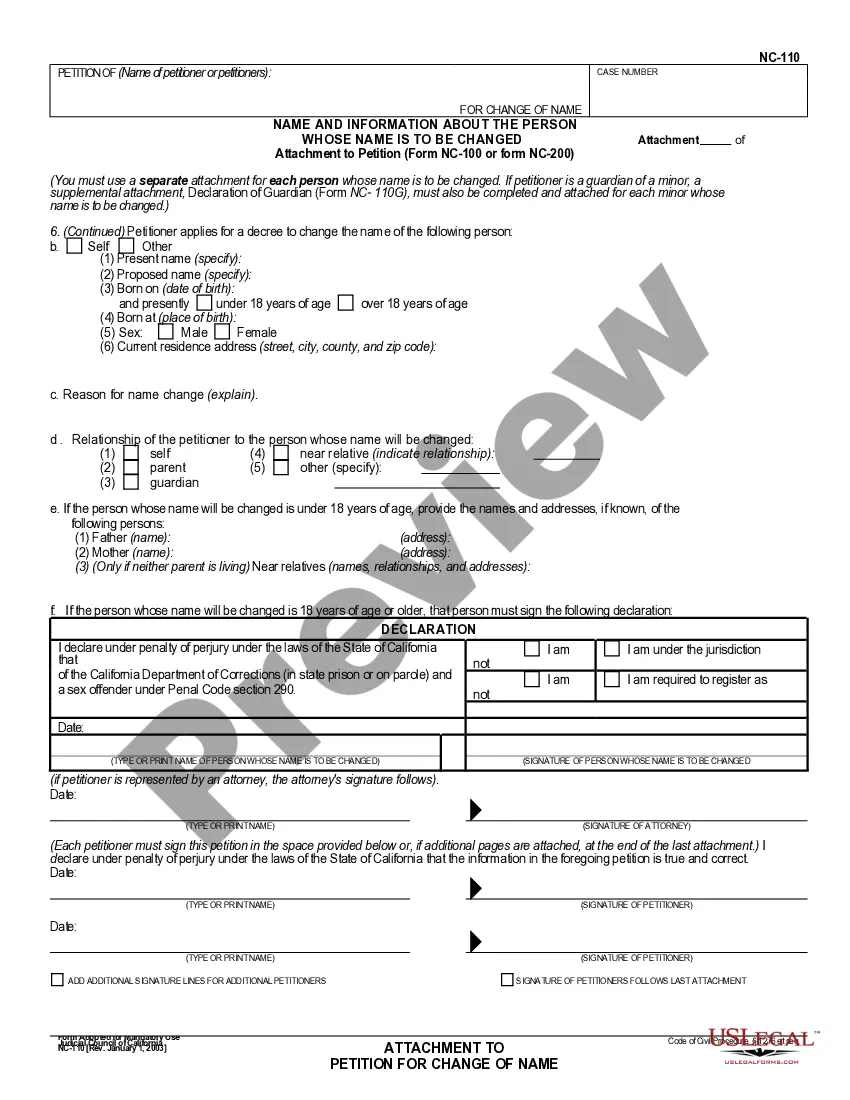

- Use the Preview button to examine the document.

- Review the information to confirm that you have chosen the right form.

- If the form is not what you are searching for, utilize the Lookup section to find the document that meets your needs and requirements.

- When you locate the correct form, click Acquire now.