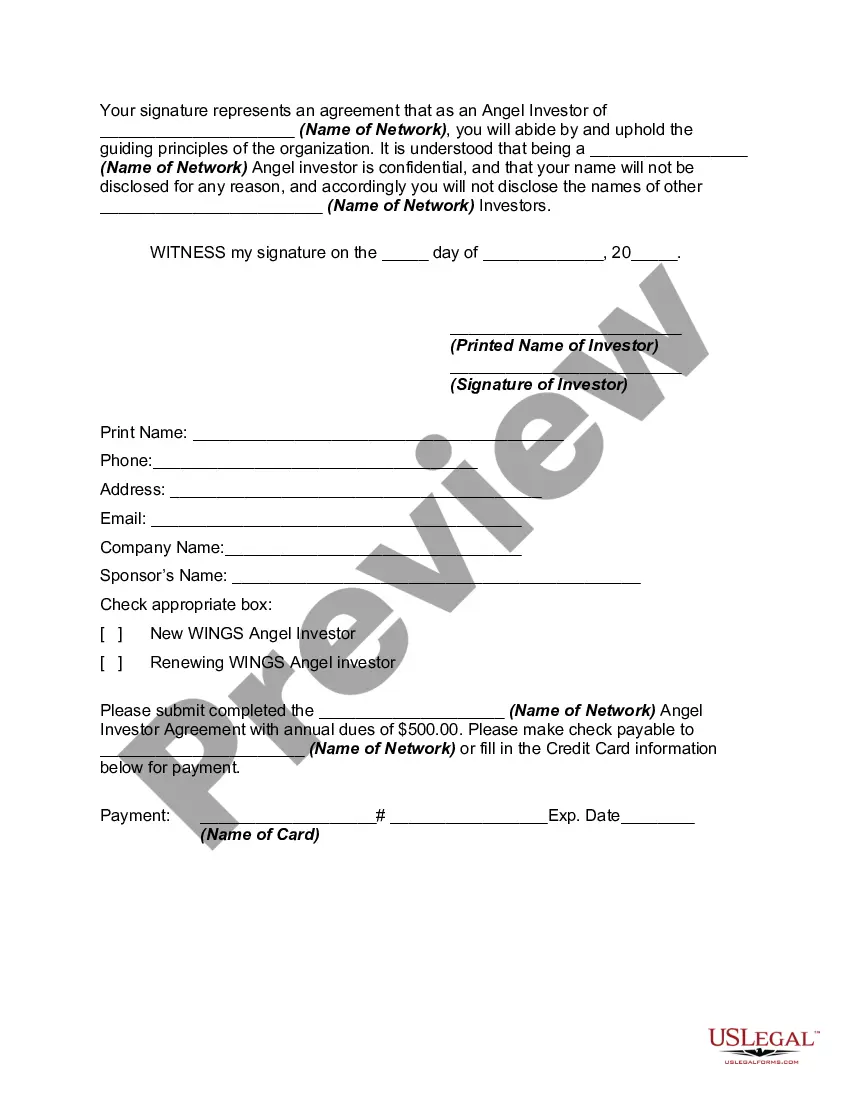

The West Virginia Angel Investor Agreement is a legally binding document that outlines the terms and conditions of an investment arrangement between an angel investor and an entrepreneur or startup company located in the state of West Virginia. This agreement serves as a crucial tool in facilitating investments and fostering economic growth within the state. One of the primary purposes of the West Virginia Angel Investor Agreement is to clearly define the rights, responsibilities, and obligations of both parties involved in the investment transaction. It establishes the investor's provision of capital in exchange for an equity stake or convertible debt in the startup company, along with any other specific terms agreed upon. The agreement typically covers various essential aspects, such as the investment amount, valuation of the startup, and the desired ownership percentage the investor will receive. Additionally, it outlines the timeline for the investment, including any milestones or conditions that must be met before subsequent funding rounds or investor exits. It is worth noting that there can be several types of West Virginia Angel Investor Agreements depending on the specific investment arrangement and the preferences of the parties involved. Some common variations include: 1. Convertible Note Agreement: This type of agreement defines the terms under which the investment made by the angel investor can convert into equity ownership in the future. The conversion typically occurs when certain predetermined conditions are met, such as a future funding round or a liquidity event. 2. Equity Purchase Agreement: This agreement outlines the terms for the direct purchase of equity shares in the startup company by the angel investor. It specifies the share price, the number of shares to be acquired, and any additional conditions or rights associated with the ownership. 3. Common Stock Subscription Agreement: In this agreement, the angel investor agrees to subscribe to a specific number of common stocks in the startup company at a predetermined price. It sets out the subscription price, the number of shares, and any potential restrictions on the transfer of shares. 4. SAFE (Simple Agreement for Future Equity): This type of agreement offers flexibility to both parties by deferring the determination of the exact equity ownership until a future triggering event occurs, such as a funding round or acquisition. The SAFE agreement ensures that the angel investor will receive equity or other agreed-upon benefits when the event takes place. In summary, the West Virginia Angel Investor Agreement is a critical legal instrument that provides a framework for investment transactions between angel investors and entrepreneurs or startups in West Virginia. Depending on the specific terms, there are various types of agreements available, such as Convertible Note Agreement, Equity Purchase Agreement, Common Stock Subscription Agreement, and SAFE. These agreements play a vital role in promoting entrepreneurial activity and attracting investment capital to the state.

West Virginia Angel Investor Agreement

Description

How to fill out West Virginia Angel Investor Agreement?

You are able to commit hours online trying to find the lawful file template that suits the federal and state needs you will need. US Legal Forms gives 1000s of lawful forms that happen to be evaluated by pros. You can actually acquire or print the West Virginia Angel Investor Agreement from my assistance.

If you currently have a US Legal Forms accounts, you may log in and click on the Acquire switch. After that, you may complete, revise, print, or signal the West Virginia Angel Investor Agreement. Every single lawful file template you get is yours for a long time. To have another copy for any obtained kind, proceed to the My Forms tab and click on the related switch.

If you are using the US Legal Forms site initially, stick to the easy instructions beneath:

- Initially, make certain you have selected the proper file template for the county/city of your choice. Browse the kind outline to ensure you have selected the correct kind. If readily available, utilize the Review switch to check throughout the file template also.

- In order to locate another model of the kind, utilize the Search field to discover the template that suits you and needs.

- Once you have identified the template you desire, click on Purchase now to continue.

- Pick the rates prepare you desire, enter your references, and sign up for an account on US Legal Forms.

- Total the financial transaction. You can utilize your charge card or PayPal accounts to pay for the lawful kind.

- Pick the format of the file and acquire it to the product.

- Make modifications to the file if necessary. You are able to complete, revise and signal and print West Virginia Angel Investor Agreement.

Acquire and print 1000s of file layouts making use of the US Legal Forms website, which provides the most important assortment of lawful forms. Use professional and express-particular layouts to tackle your company or specific needs.

Form popularity

FAQ

Writing off an angel investment involves reporting the loss on your taxes if the investment fails. Consult with a tax professional to navigate this process accurately, as there may be specific forms and procedures involved. Be sure to keep detailed records of your West Virginia Angel Investor Agreement, as documentation can assist in substantiating your claims during tax filing.

When writing an investment document, begin with an introduction that describes the investment opportunity clearly. Follow this with sections on investment terms, expectations, and exit strategies. For a reliable starting point, consider utilizing the West Virginia Angel Investor Agreement from uslegalforms, which provides a structured format tailored for your needs.

To write a simple contract agreement, focus on clarity and conciseness. Begin by stating the parties involved, the purpose of the agreement, and the terms of the engagement. By adapting the West Virginia Angel Investor Agreement framework available at uslegalforms, you create a straightforward document that outlines the essential details and protects each party's interests.

Creating investment agreements involves outlining the terms of investment, including financial contributions and equity stakes. Start by detailing the objectives, roles, and expectations of both parties. Using the West Virginia Angel Investor Agreement template from uslegalforms can streamline this process, ensuring you cover all critical aspects and legal requirements.

The equity you give an angel investor depends on the valuation of your business and the amount of investment. Usually, angel investors may receive between 10% to 30% equity in exchange for their investment. When drafting your West Virginia Angel Investor Agreement, clearly outline the terms and ensure that both parties understand the equity share. This transparency fosters trust and keeps your business relationship strong.

The process of angel investors involves identifying potential startups, evaluating their business plans, and negotiating terms through a formal agreement. Once an investment is secured, the angel investor often provides not just capital, but guidance as well. A clear West Virginia Angel Investor Agreement ensures that both parties have aligned expectations and responsibilities throughout the investment journey.

Typically, to be classified as an angel investor, you should have a minimum of $25,000 to $100,000 available for investment. This amount can vary depending on the specific startup and funding requirements. The West Virginia Angel Investor Agreement will help you delineate how this capital will be utilized and the expected return on investment.

To structure an investor agreement, begin by specifying the details of the investment, including financial contributions and ownership percentages. Next, incorporate details such as milestones, exit strategies, and terms for future funding, if applicable. A thorough West Virginia Angel Investor Agreement will ensure both parties are clear on the terms and conditions of their collaboration.

Writing an investor agreement starts with outlining the essential terms, such as investment amount and equity distribution. It should also include clauses for dispute resolution and exit strategies. Utilizing templates from platforms like uslegalforms can simplify this process, guiding you through the creation of a comprehensive West Virginia Angel Investor Agreement.

An investment agreement is a legal document that defines the relationship between an investor and a business. Specifically, a West Virginia Angel Investor Agreement delineates the terms of funding, the ownership share, and the responsibilities of both parties. It serves as a foundational document, guiding the investment process and protecting the interests of everyone involved.