Are you currently within a placement in which you require files for both organization or personal purposes virtually every working day? There are tons of legitimate document layouts available online, but getting kinds you can rely isn`t straightforward. US Legal Forms offers a huge number of type layouts, such as the West Virginia Objection to Allowed Claim in Accounting, which can be composed to fulfill state and federal needs.

Should you be currently familiar with US Legal Forms site and also have a free account, basically log in. Following that, you are able to acquire the West Virginia Objection to Allowed Claim in Accounting design.

If you do not provide an profile and want to begin to use US Legal Forms, follow these steps:

- Discover the type you want and make sure it is for that right metropolis/state.

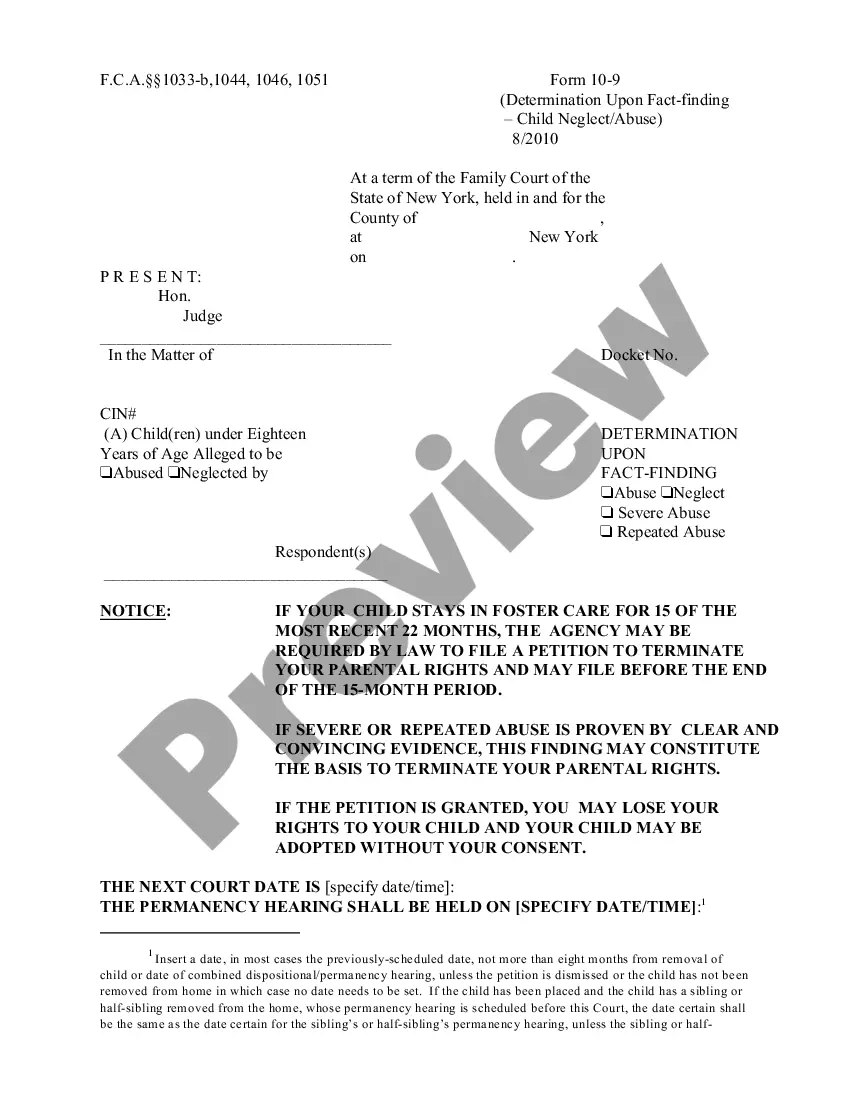

- Utilize the Review switch to review the shape.

- Read the outline to ensure that you have selected the proper type.

- In the event the type isn`t what you are looking for, make use of the Look for area to obtain the type that fits your needs and needs.

- Once you obtain the right type, click on Get now.

- Select the prices program you want, submit the specified info to produce your account, and pay for the transaction using your PayPal or charge card.

- Choose a hassle-free file format and acquire your backup.

Get all the document layouts you have bought in the My Forms menu. You can aquire a additional backup of West Virginia Objection to Allowed Claim in Accounting whenever, if required. Just go through the required type to acquire or produce the document design.

Use US Legal Forms, the most extensive assortment of legitimate kinds, to save some time and stay away from faults. The support offers expertly manufactured legitimate document layouts that you can use for a selection of purposes. Produce a free account on US Legal Forms and begin creating your daily life a little easier.