A West Virginia Bill of Sale by Corporation of all or Substantially all of its Assets is a legal document that facilitates the transfer of assets from one entity to another within the state of West Virginia. When a corporation decides to sell all or a significant portion of its assets, it is crucial to use a Bill of Sale to officially record and document the transaction. This document outlines the terms and conditions of the sale, ensuring both parties are protected and aware of their responsibilities. Some relevant keywords for this topic include: 1. West Virginia Corporation: Refers to a business entity registered and operating in the state of West Virginia. 2. Bill of Sale: A legal document that serves as proof of a transaction or sale between parties. 3. Assets: Refers to all tangible and intangible properties owned by a corporation, including equipment, inventory, real estate, intellectual property rights, contracts, and more. 4. Substantially all: This term indicates that the majority or a significant portion of a corporation's assets are being sold. 5. Transfer of assets: Relates to the process of conveying ownership rights of assets from one entity to another. 6. Legal requirements: Pertains to the regulations, laws, and guidelines that need to be followed when conducting a sale of assets. 7. Terms and conditions: The specific provisions and conditions agreed upon by both parties involved in the asset sale. 8. Protections: The legal safeguards put in place to ensure both the buyer and the seller fulfill their obligations. Different types of West Virginia Bill of Sale by Corporation of all or Substantially all of its Assets may vary based on the nature of the assets being sold, such as: 1. Equipment Bill of Sale: Specifically for the transfer of machinery, tools, vehicles, or other types of equipment. 2. Real Estate Bill of Sale: Pertains to the sale of land, buildings, or any other real property assets. 3. Intellectual Property Bill of Sale: Deals with the transfer of intangible assets like trademarks, copyrights, and patents. 4. Contractual Bill of Sale: Involves the sale of contracts, including leases, licensing agreements, and service contracts. Regardless of the specific type of assets being sold, a West Virginia Bill of Sale by Corporation of all or Substantially all of its Assets serves as a legally binding agreement between the parties involved, ensuring a smooth and transparent transfer of ownership. It is advisable to consult with legal professionals to draft and review the document to ensure compliance with state laws and protect the interests of all parties involved.

West Virginia Bill of Sale by Corporation of all or Substantially all of its Assets

Description

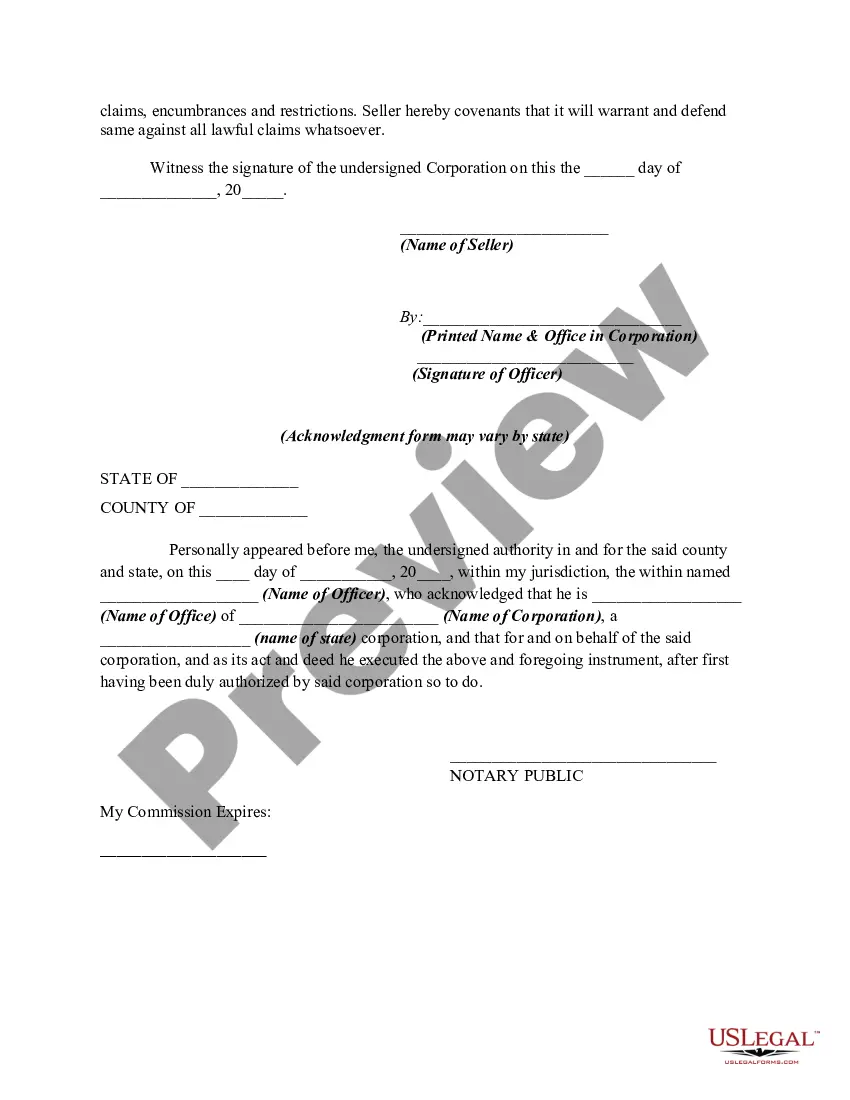

How to fill out West Virginia Bill Of Sale By Corporation Of All Or Substantially All Of Its Assets?

If you need to comprehensive, obtain, or printing legal papers layouts, use US Legal Forms, the most important variety of legal types, that can be found on the Internet. Take advantage of the site`s basic and hassle-free search to discover the documents you need. Various layouts for company and person functions are sorted by groups and states, or keywords and phrases. Use US Legal Forms to discover the West Virginia Bill of Sale by Corporation of all or Substantially all of its Assets within a few mouse clicks.

If you are currently a US Legal Forms consumer, log in to the profile and then click the Obtain option to have the West Virginia Bill of Sale by Corporation of all or Substantially all of its Assets. Also you can access types you previously downloaded in the My Forms tab of the profile.

If you work with US Legal Forms initially, follow the instructions below:

- Step 1. Be sure you have selected the form for the appropriate city/land.

- Step 2. Use the Review method to look through the form`s content material. Never forget about to read through the explanation.

- Step 3. If you are not satisfied with the form, utilize the Research discipline towards the top of the display to locate other variations of your legal form web template.

- Step 4. Once you have identified the form you need, click the Buy now option. Pick the prices plan you favor and add your accreditations to sign up for an profile.

- Step 5. Process the transaction. You should use your bank card or PayPal profile to accomplish the transaction.

- Step 6. Choose the formatting of your legal form and obtain it in your device.

- Step 7. Full, revise and printing or sign the West Virginia Bill of Sale by Corporation of all or Substantially all of its Assets.

Every legal papers web template you buy is your own property eternally. You may have acces to every form you downloaded in your acccount. Click the My Forms portion and decide on a form to printing or obtain yet again.

Contend and obtain, and printing the West Virginia Bill of Sale by Corporation of all or Substantially all of its Assets with US Legal Forms. There are thousands of skilled and state-particular types you can use for the company or person needs.