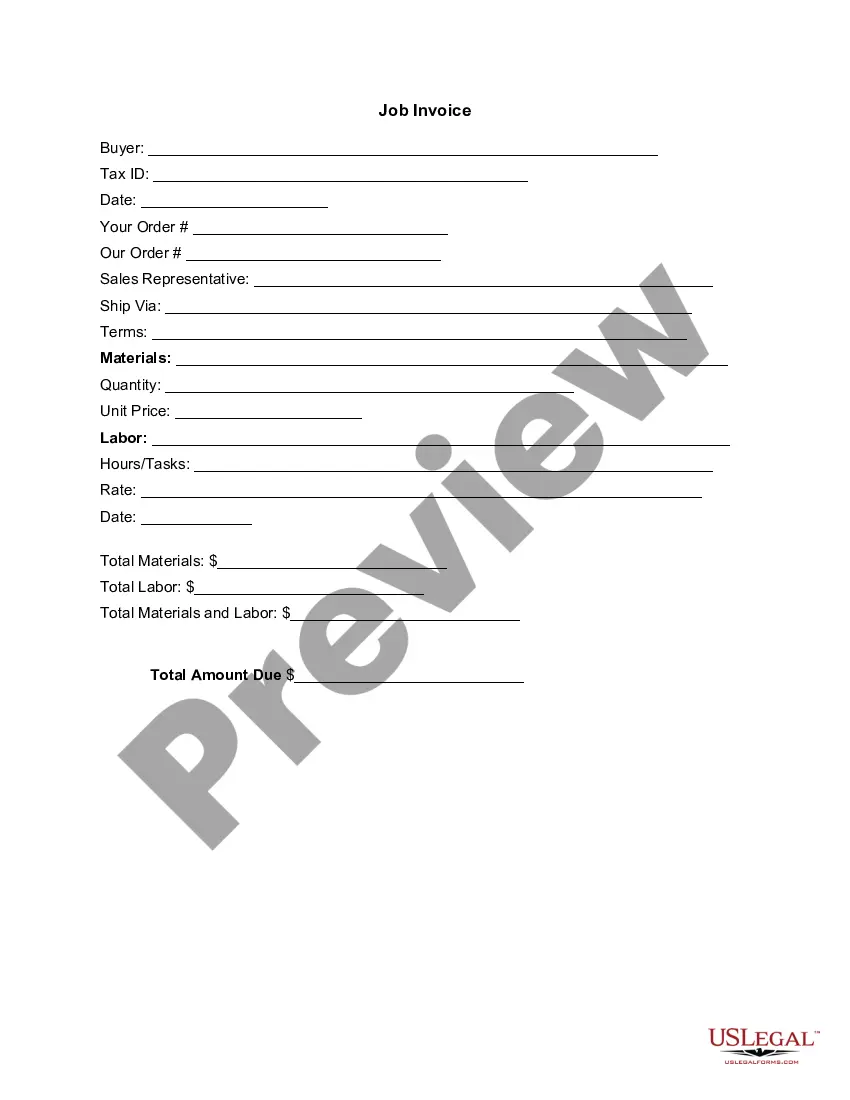

A West Virginia invoice template for economists is a professionally designed document used to outline the financial details of services provided by an economist in West Virginia. It serves as a tool for recording and requesting payment for consultations, research, analysis, or any other economic services rendered. The West Virginia invoice template for economists typically features a header with the economist's contact information, such as name, address, phone number, and email. The upper section also includes the invoice number, date, and due date to ensure accuracy and facilitate tracking of payments. Following the header, the template includes a section for the client's information, including their name or company name, address, and contact details. This ensures that invoices are properly addressed and enhance communication between the economist and the client. The body of the invoice template consists of itemized sections that detail the services provided and the corresponding charges. Each item typically includes a description of the service, the date it was performed, the number of hours or units worked, and the hourly or unit rate. This section allows economists to clearly outline the scope and cost of their services, ensuring transparency and avoiding potential misunderstandings. Additionally, the invoice template may include subsections for any additional expenses incurred during the project, such as travel expenses, research materials, or software licenses. These expenses are typically listed separately and accompanied by corresponding receipts or supporting documents. Towards the bottom of the template, a subtotal of all the services and expenses is calculated. This subtotal is often followed by sections for applicable taxes, such as sales tax or value-added tax, as per West Virginia's tax regulations. The template then calculates the total amount due, including all charges and taxes, ensuring accurate invoicing. Lastly, the West Virginia invoice template for economists includes a payment section, indicating the preferred payment method, such as bank transfer, check, or online payment platforms. It also includes the economist's preferred bank account details or mailing address for check payments. Different types of West Virginia invoice templates for economists may vary in design or features, but they generally follow the same structure outlined above. Some variations may include options for adding additional terms and conditions, such as late payment policies, confidentiality agreements, or project-specific terms. In conclusion, the West Virginia invoice template for economists is a versatile tool that helps economists in West Virginia streamline their invoicing process, ensuring accurate recording of services rendered and prompt payment for their expertise. It provides a professional and organized format for presenting financial information to clients and serves as a valuable document for both parties to maintain proper financial records.

West Virginia Invoice Template for Economist

Description

How to fill out West Virginia Invoice Template For Economist?

US Legal Forms - one of many biggest libraries of legal forms in the USA - offers a wide array of legal papers themes you are able to obtain or printing. Utilizing the web site, you may get a large number of forms for enterprise and personal functions, sorted by types, says, or keywords and phrases.You will find the newest types of forms much like the West Virginia Invoice Template for Economist in seconds.

If you currently have a monthly subscription, log in and obtain West Virginia Invoice Template for Economist through the US Legal Forms collection. The Download key will appear on each and every type you look at. You have accessibility to all in the past downloaded forms from the My Forms tab of your own account.

If you wish to use US Legal Forms initially, listed below are straightforward guidelines to help you get started off:

- Make sure you have picked out the correct type for your personal area/area. Click on the Review key to analyze the form`s content material. Look at the type outline to actually have selected the appropriate type.

- If the type doesn`t suit your needs, utilize the Lookup discipline towards the top of the screen to obtain the one who does.

- In case you are pleased with the form, confirm your option by visiting the Get now key. Then, opt for the rates prepare you prefer and supply your credentials to sign up on an account.

- Method the transaction. Make use of your charge card or PayPal account to perform the transaction.

- Choose the file format and obtain the form on your gadget.

- Make changes. Complete, modify and printing and sign the downloaded West Virginia Invoice Template for Economist.

Every design you added to your account does not have an expiration particular date and it is the one you have permanently. So, in order to obtain or printing one more version, just visit the My Forms portion and click about the type you require.

Get access to the West Virginia Invoice Template for Economist with US Legal Forms, by far the most substantial collection of legal papers themes. Use a large number of specialist and express-specific themes that meet your small business or personal requires and needs.