West Virginia Invoice Template for Receptionist: A Comprehensive Overview When it comes to managing invoices efficiently, West Virginia businesses understand the importance of having a well-organized and professional invoice template tailored specifically for receptionists. A West Virginia invoice template for receptionists ensures clarity and accuracy in recording transactions for various reception-related services provided. Key Elements of a West Virginia Invoice Template for Receptionist: 1. Header: The invoice template will typically begin with the header section, which includes the receptionist's contact details such as name, address, phone number, and email address. This information helps recipients easily identify the source of the invoice and facilitates effective communication. 2. Company Information: Following the header, the West Virginia receptionist invoice should include the company information, including the name, address, and contact details of the client or the organization receiving receptionist services. This ensures that the invoice is clearly associated with the right entity, avoiding any confusion or payment delays. 3. Invoice Number and Date: Another critical element is the inclusion of a unique invoice number, along with the date of issue. These details assist in maintaining accurate records, improving organization, and simplifying the tracking of payments for both the receptionist and the client. 4. Services Rendered: The main body of the invoice template should outline the reception-related services provided by the receptionist. This section may include items like answering telephone calls, scheduling appointments, greeting visitors, managing inquiries, and other administrative tasks commonly associated with the receptionist role. 5. Itemized Description: To ensure transparency, the West Virginia receptionist invoice template should offer an itemized breakdown of the services rendered. Each line item should include a description of the service provided, the quantity (if applicable), the hourly rate or total cost, and the subtotal for that specific service. 6. Taxes and Discounts: If applicable, the invoice template should clearly mention the tax rate (e.g., sales tax) and any discounts offered. This information enables proper tax calculation and highlights any deductions or savings for the client. 7. Total Amount Due: At the bottom of the invoice, the total amount due should be displayed prominently, including any applicable taxes and discounts. This allows the client to quickly identify the exact payment amount. Different Types of West Virginia Invoice Templates for Receptionist: 1. Hourly Rate Invoice: This template is suitable for receptionists who charge clients on an hourly basis. It includes hourly rates for each service provided, along with the total number of hours worked. 2. Flat-Fee Invoice: For receptionists who charge a fixed fee for their services, this template would be more appropriate. It lists the services provided, stating the fixed fee associated with each. 3. Retainer Invoice: Some receptionists work on a retainer basis, where clients pay a predetermined fee upfront to secure their services for a defined period. This invoice template would reflect the retainer amount, the duration, and any additional services provided beyond the retainer agreement. In conclusion, a West Virginia invoice template for receptionists is an invaluable tool for proper billing and record-keeping. By incorporating all the essential elements mentioned above and tailoring the template to fit various invoicing scenarios, receptionists can streamline their billing processes, ensure professionalism, and ultimately maintain healthy client relationships.

West Virginia Drivers License Template

Description

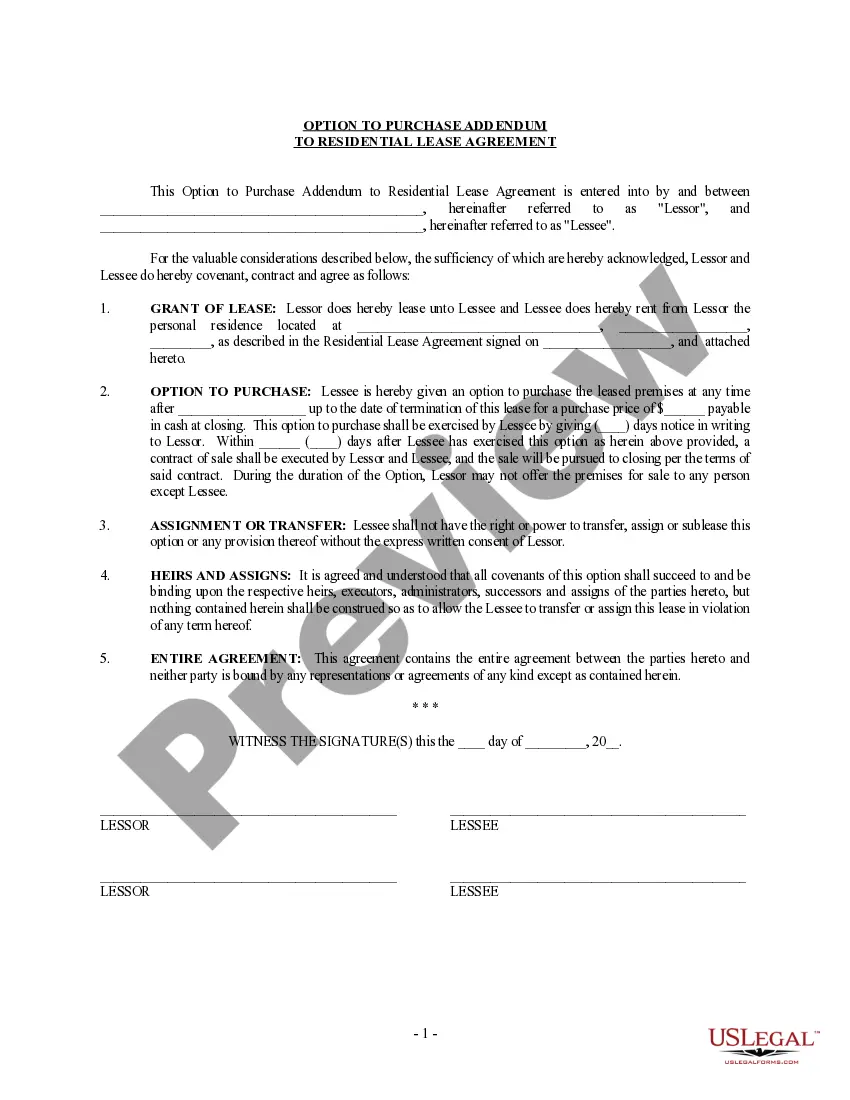

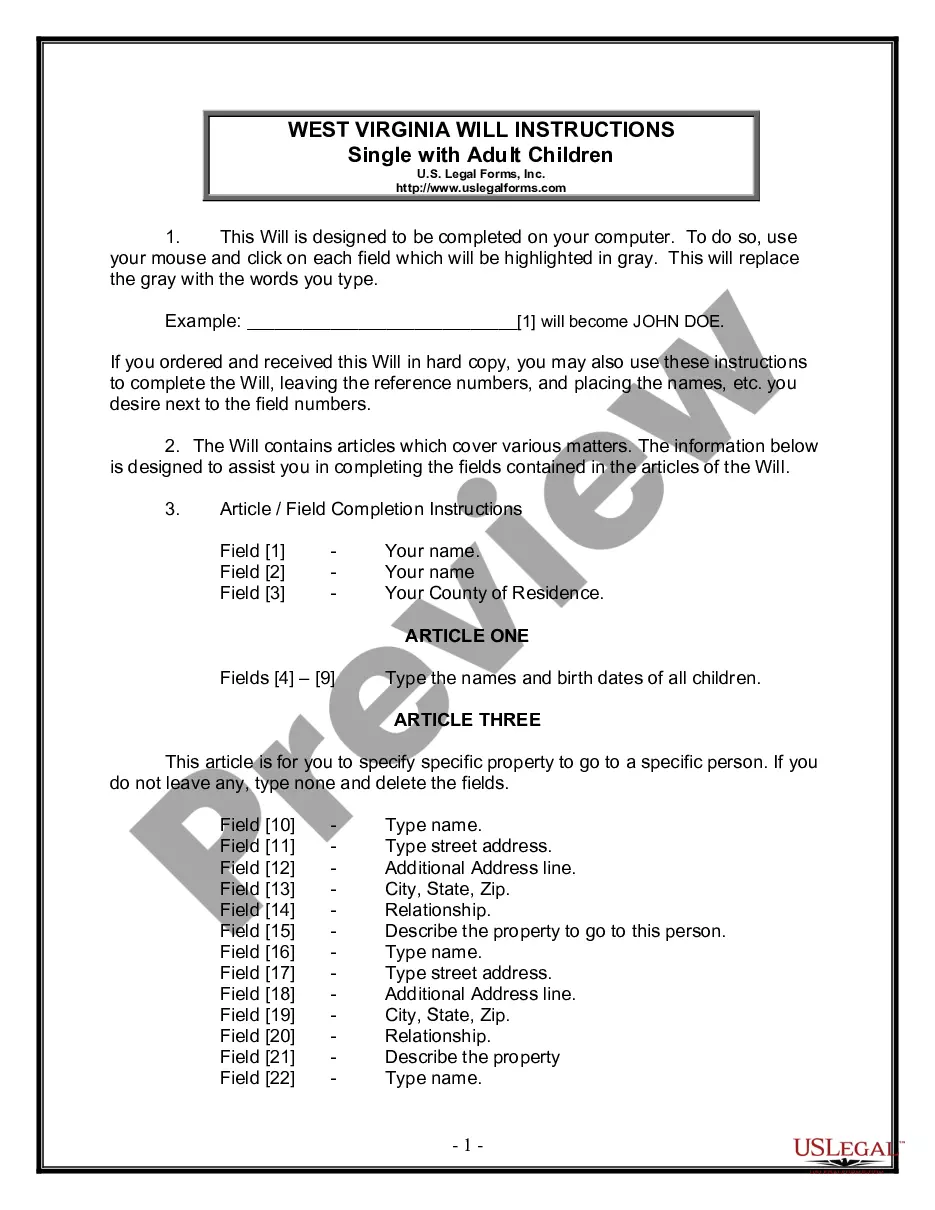

How to fill out West Virginia Invoice Template For Receptionist?

If you have to complete, down load, or print authorized file templates, use US Legal Forms, the greatest collection of authorized forms, that can be found on the Internet. Take advantage of the site`s simple and easy practical lookup to obtain the papers you will need. A variety of templates for company and specific functions are categorized by types and claims, or search phrases. Use US Legal Forms to obtain the West Virginia Invoice Template for Receptionist in a few clicks.

In case you are previously a US Legal Forms buyer, log in for your accounts and click on the Download button to find the West Virginia Invoice Template for Receptionist. You can also access forms you previously acquired from the My Forms tab of the accounts.

If you are using US Legal Forms initially, refer to the instructions listed below:

- Step 1. Ensure you have chosen the form to the right metropolis/country.

- Step 2. Make use of the Review choice to look over the form`s information. Do not forget about to see the information.

- Step 3. In case you are not happy with all the develop, take advantage of the Look for discipline towards the top of the screen to locate other variations from the authorized develop template.

- Step 4. After you have discovered the form you will need, click on the Get now button. Choose the costs plan you favor and add your credentials to register for an accounts.

- Step 5. Procedure the financial transaction. You can utilize your Мisa or Ьastercard or PayPal accounts to complete the financial transaction.

- Step 6. Select the structure from the authorized develop and down load it in your device.

- Step 7. Full, edit and print or indicator the West Virginia Invoice Template for Receptionist.

Every single authorized file template you get is your own property for a long time. You possess acces to each and every develop you acquired inside your acccount. Click on the My Forms portion and select a develop to print or down load yet again.

Compete and down load, and print the West Virginia Invoice Template for Receptionist with US Legal Forms. There are thousands of expert and express-particular forms you can use for the company or specific requirements.