West Virginia Invoice Template for Soldier

Description

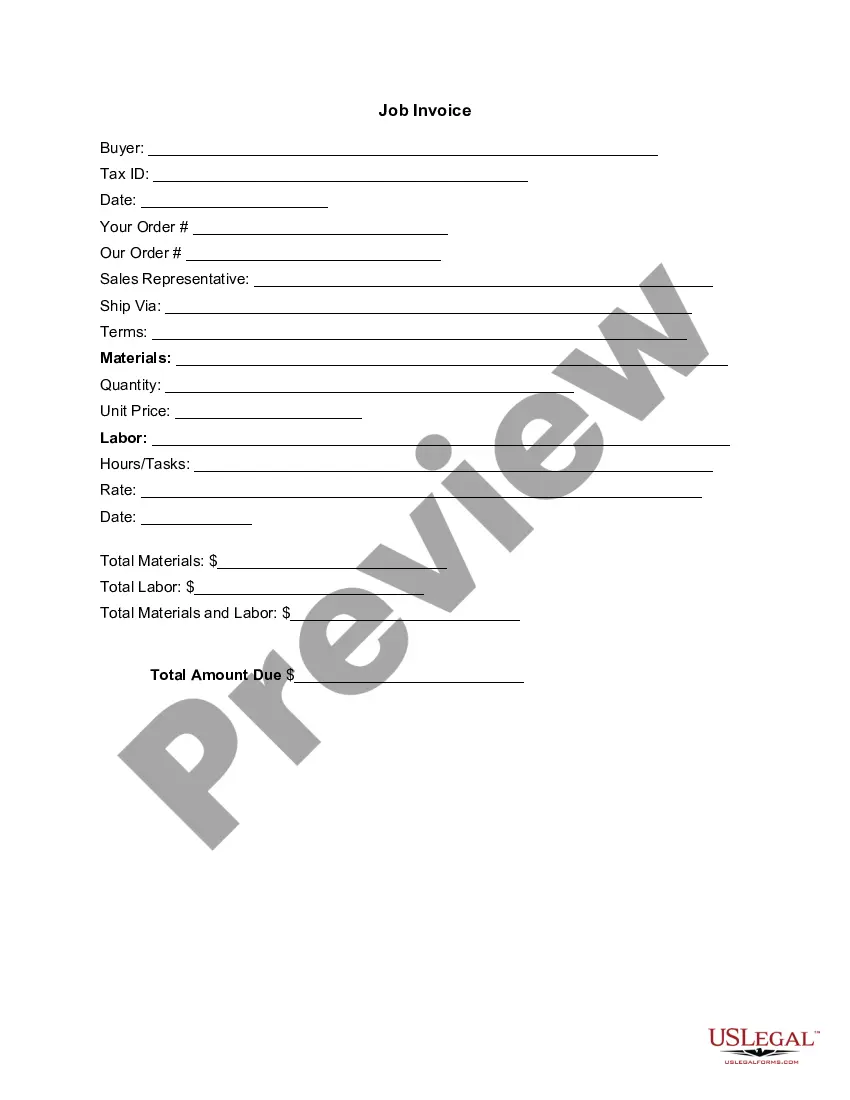

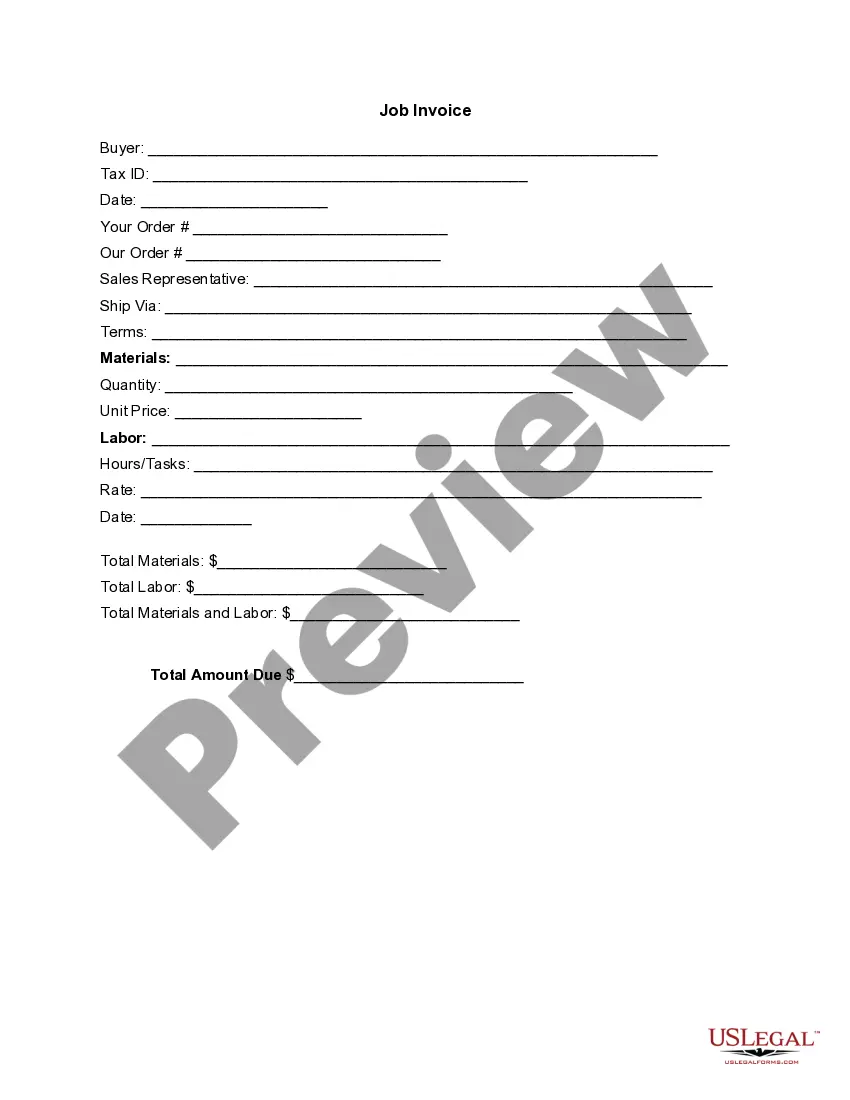

How to fill out Invoice Template For Soldier?

Are you currently in a position where you require documents for occasional business or personal activities almost every time.

There are numerous legitimate document templates accessible online, but locating ones you can trust is challenging.

US Legal Forms offers a vast array of template forms, including the West Virginia Invoice Template for Soldier, which are designed to comply with federal and state standards.

Once you find the correct form, simply click Get now.

Select the pricing plan you prefer, complete the necessary information to create your account, and pay for the order using your PayPal or credit card.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- Then, you can download the West Virginia Invoice Template for Soldier template.

- If you do not have an account and wish to use US Legal Forms, follow these steps.

- Locate the form you need and ensure it is for the correct area/county.

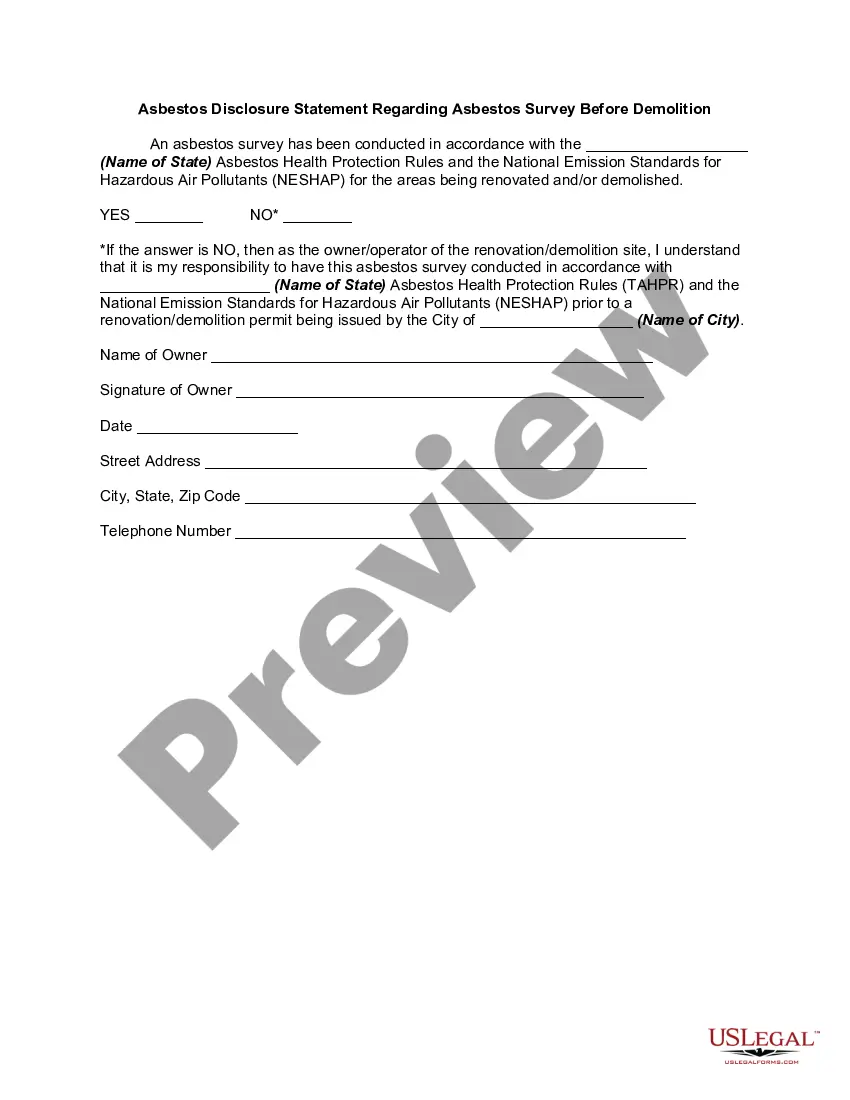

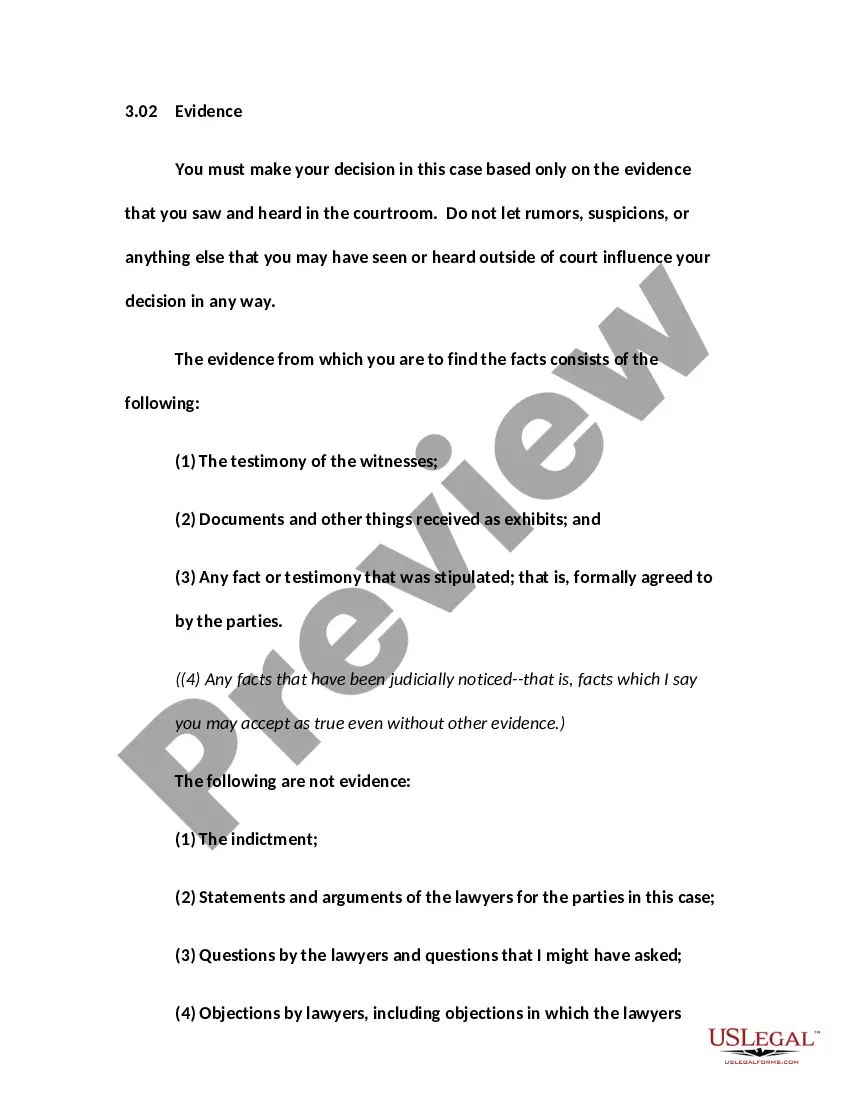

- Utilize the Review option to inspect the form.

- Read the description to confirm you have selected the right form.

- If the form is not what you're looking for, use the Research field to find the form that fulfills your needs and requirements.

Form popularity

FAQ

West Virginia does impose state income taxes, but military personnel may have different tax obligations depending on their home state. Typically, soldiers stationed in West Virginia can benefit from certain exemptions based on their residency status. Using a West Virginia Invoice Template for Soldier allows you to manage income reporting efficiently, ensuring compliance with state tax laws while accurately reflecting your military service. This can help enhance your overall financial planning effort.

Yes, West Virginia is a reciprocal state, which means it honors certain agreements with other states regarding taxation. This is particularly important for soldiers stationed in West Virginia, as they may keep their home state's tax benefits. Utilizing a West Virginia Invoice Template for Soldier can help streamline the documentation process for any financial transactions involved. You can stay organized and compliant, meeting both state and military requirements.

Yes, if you earn income in West Virginia, you are typically required to file a state tax return, regardless of your residency status. Active duty military members might have different rules, so it's wise to check with state tax guidelines. To simplify your tax return preparation, consider using a West Virginia Invoice Template for Soldier to maintain accurate financial records.

The WV IT 104 form is specifically designed for West Virginia residents to report their income for tax purposes. This form allows individuals to calculate their state tax obligations accurately. For military personnel, understanding how to fill this out correctly is essential for compliance. Incorporating the West Virginia Invoice Template for Soldier can help compile all necessary income details for this form.

The personal exemption in West Virginia allows residents to deduct a specific amount from their taxable income, lowering their tax liability. This exemption amount may vary based on filing status and dependents. Soldiers should take note of these separate exemptions when preparing their state taxes. A West Virginia Invoice Template for Soldier can assist in managing your deductions smoothly.

Declaring residency in another state can take different lengths of time, often ranging from 30 days to a year depending on the state’s regulations. Factors like registration and voting can also influence this timeline. If you are in the military, transitioning between states might require careful planning. Utilizing a West Virginia Invoice Template for Soldier can streamline your documentation during your move.

To become a West Virginia resident, you need to establish a physical presence in the state and demonstrate an intent to stay. This process often involves securing local employment, obtaining a driver’s license, and registering to vote. For military members, keeping documentation consistent, such as using a West Virginia Invoice Template for Soldier, can support your residency efforts.

The military incentive credit in West Virginia helps reduce state taxes for active duty military members. This tax credit is designed to provide additional financial relief and can significantly influence your state tax bill. If you're a soldier stationed in the state, you may benefit from this credit. A West Virginia Invoice Template for Soldier may help keep your financials organized for tax purposes.

To qualify for Medicaid in West Virginia, you generally need to reside in the state for 30 days. However, specific eligibility requirements may depend on your circumstances, including income and family size. Soldiers should ensure they meet all necessary criteria before applying. Creating a budget with a West Virginia Invoice Template for Soldier can simplify financial planning related to healthcare.

To be considered a resident of West Virginia, you typically need to live in the state for at least 12 months with the intent to remain. Military personnel may face unique situations, so understanding local regulations is crucial. If you are new to West Virginia, using a West Virginia Invoice Template for Soldier can help organize your move and establish residency.