West Virginia Accounts Receivable Write-Off Approval Form

Description

How to fill out Accounts Receivable Write-Off Approval Form?

Finding the suitable legal document format can be a challenge. Clearly, there are numerous templates accessible online, but how will you obtain the legal document you need? Use the US Legal Forms website.

The platform offers thousands of templates, including the West Virginia Accounts Receivable Write-Off Approval Form, that can be utilized for business and personal purposes. All forms are verified by experts and adhere to federal and state regulations.

If you are already registered, Log In to your account and click on the Download button to access the West Virginia Accounts Receivable Write-Off Approval Form. Use your account to browse through the legal forms you have previously purchased. Visit the My documents section of your account and retrieve another copy of the documents you need.

Choose the file format and download the legal document template to your device. Complete, modify, print, and sign the received West Virginia Accounts Receivable Write-Off Approval Form. US Legal Forms is the largest repository of legal templates from which you can find various document formats. Utilize the service to download professionally crafted documents that comply with state regulations.

- Firstly, ensure you have chosen the correct form for your locality.

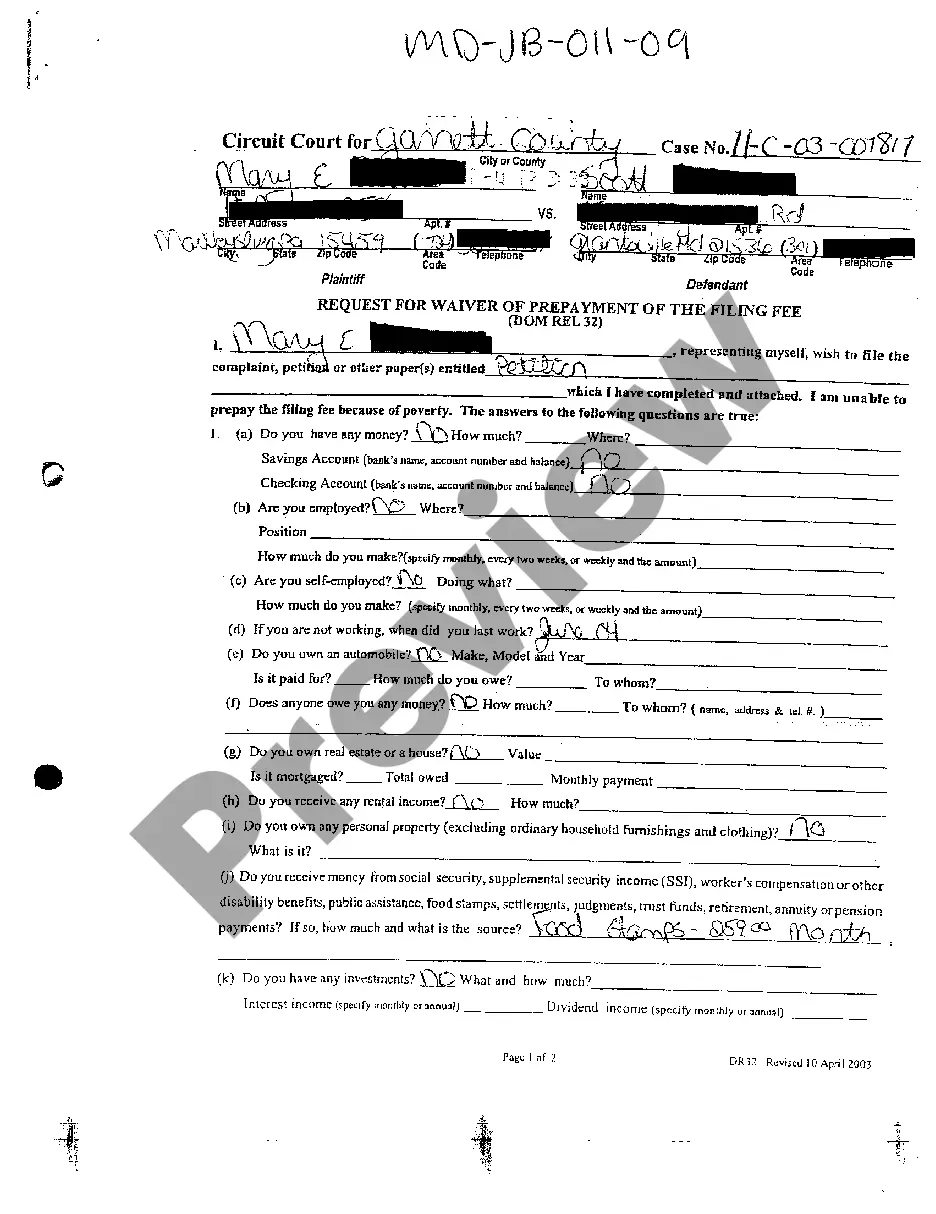

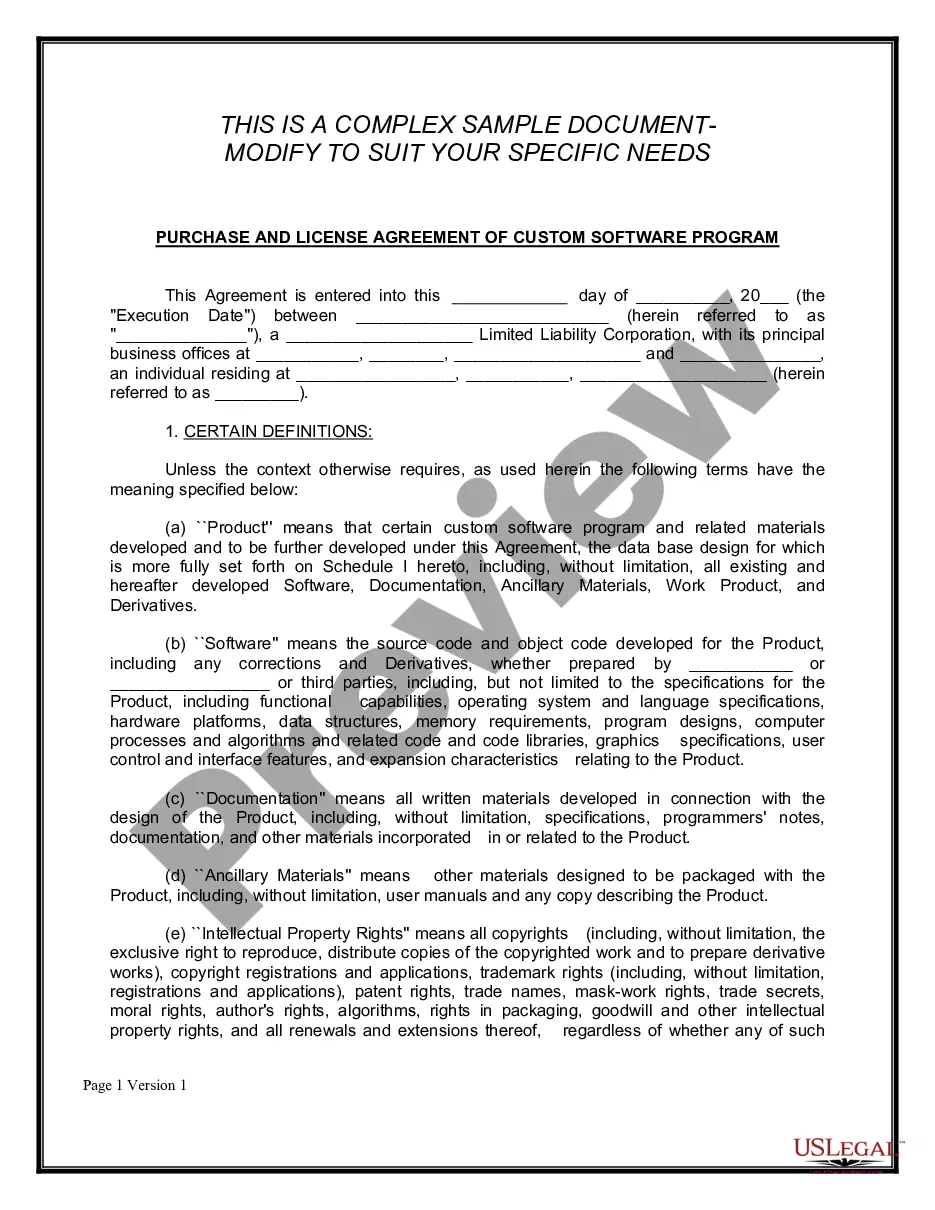

- You can review the form using the Preview button and examine the form summary to confirm it is suitable for you.

- If the form does not meet your requirements, use the Search field to locate the correct form.

- Once you are certain that the form is appropriate, click the Purchase Now button to acquire the form.

- Select the pricing plan you want and enter the necessary information.

- Create your account and pay for your order using your PayPal account or credit card.

Form popularity

FAQ

If you are a resident or non-resident earning income from sources within West Virginia, you must file a state tax return. This also applies to businesses that operate within the state. Stay informed about your obligations, and use tools like the West Virginia Accounts Receivable Write-Off Approval Form to manage your accounts effectively.

Currently, West Virginia is not eliminating its state income tax. Discussions regarding tax reforms occur regularly, but any significant changes will be communicated through formal state announcements. Meanwhile, understanding your filing obligations, possibly using the West Virginia Accounts Receivable Write-Off Approval Form for any credits, is still important.

You can mail your completed West Virginia state tax return to the West Virginia State Tax Department. The specific address may vary based on whether you are enclosing a payment or not, so please check the official tax department's website for the latest mailing instructions. If you have questions regarding your submission, the West Virginia Accounts Receivable Write-Off Approval Form can provide clarity on write-off procedures.

Failing to file a state tax return can lead to penalties and interest on unpaid taxes. The state may also take further action to collect any owed taxes, which could include wage garnishment. It's crucial to stay in compliance and address any tax obligations, utilizing resources like the West Virginia Accounts Receivable Write-Off Approval Form if applicable.

Yes, West Virginia has its own state tax forms, such as the WV Personal Income Tax Return. These forms are necessary for filing state taxes and can be accessed online or through designated state offices. To simplify the process, consider using the West Virginia Accounts Receivable Write-Off Approval Form when managing your tax paperwork.

Yes, if you have earned income while living or working in West Virginia, you are required to file a state tax return. This includes wages, salaries, and any self-employment income. It is essential to comply with state tax laws to avoid penalties. The West Virginia Accounts Receivable Write-Off Approval Form may be useful if you need to address any tax-related write-offs.

For the allowance method of accounting, the journal entry typically involves debiting bad debt expense and crediting the allowance for doubtful accounts when establishing the allowance. This helps track potential future losses. The West Virginia Accounts Receivable Write-Off Approval Form can assist in formalizing this process, aiding in transparency and record accuracy.

The allowance for receivables accounts for potential losses from accounts deemed uncollectible. It is essential to maintain an accurate estimate based on historical data. The West Virginia Accounts Receivable Write-Off Approval Form can help you determine and justify adjustments to this allowance, making the process clearer and more streamlined.

To record the write-off of accounts receivable, you need to recognize that the amount is no longer collectible. You do this by debiting the allowance for doubtful accounts and crediting accounts receivable. Utilizing the West Virginia Accounts Receivable Write-Off Approval Form adds a layer of efficiency, making your record-keeping more straightforward.

When writing off accounts receivable, the journal entry involves debiting the bad debt expense account and crediting accounts receivable. This action reflects the loss on your financial statements. Using the West Virginia Accounts Receivable Write-Off Approval Form ensures you maintain accurate records and comply with accounting standards.