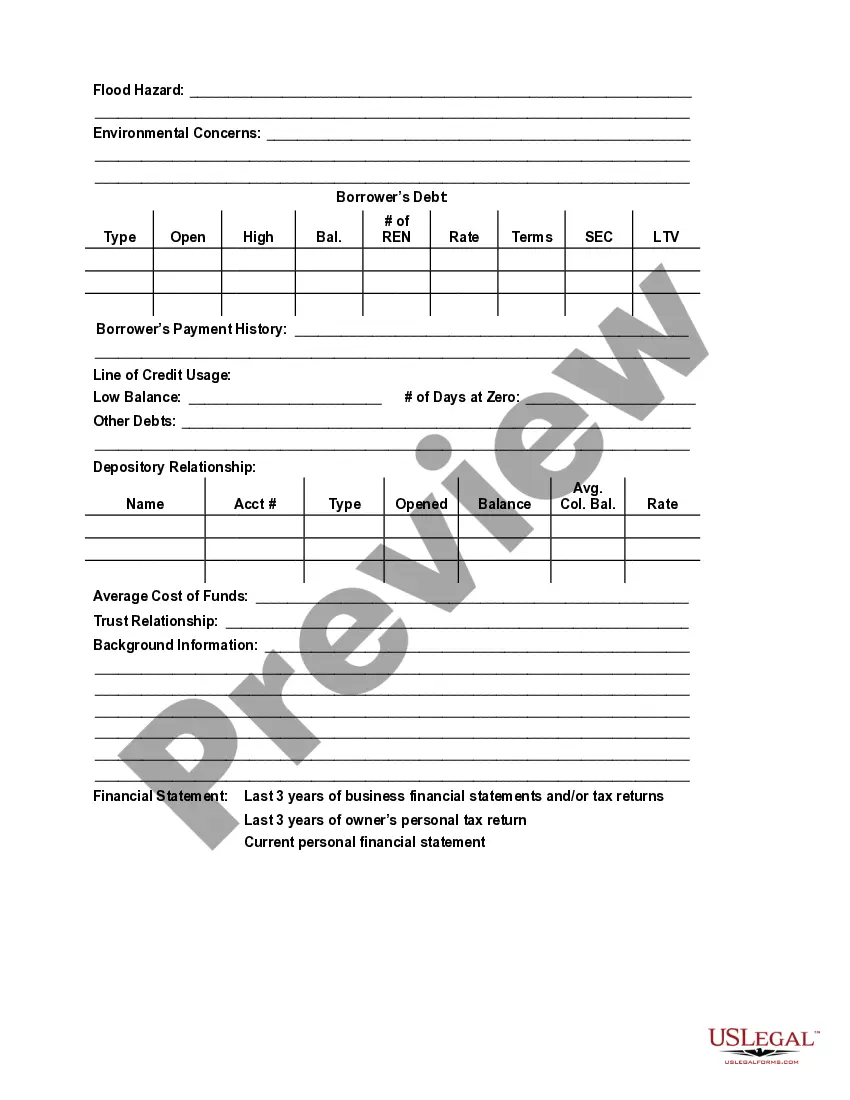

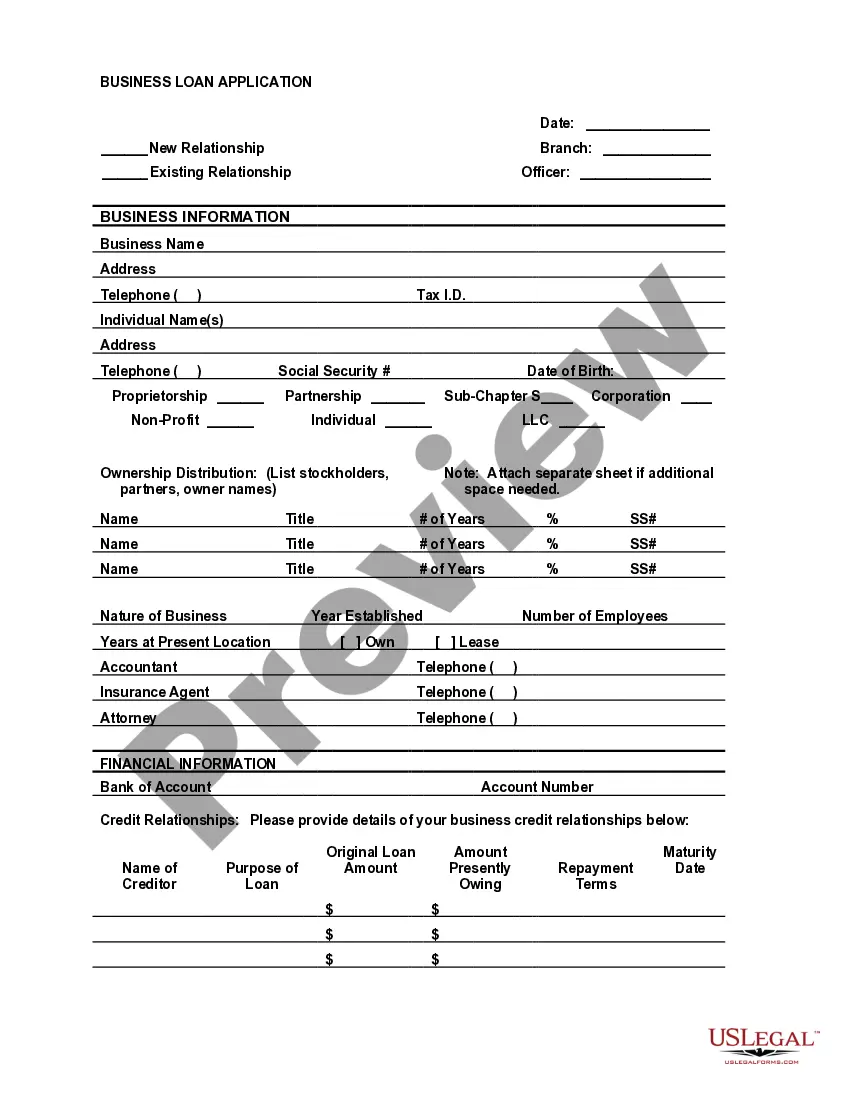

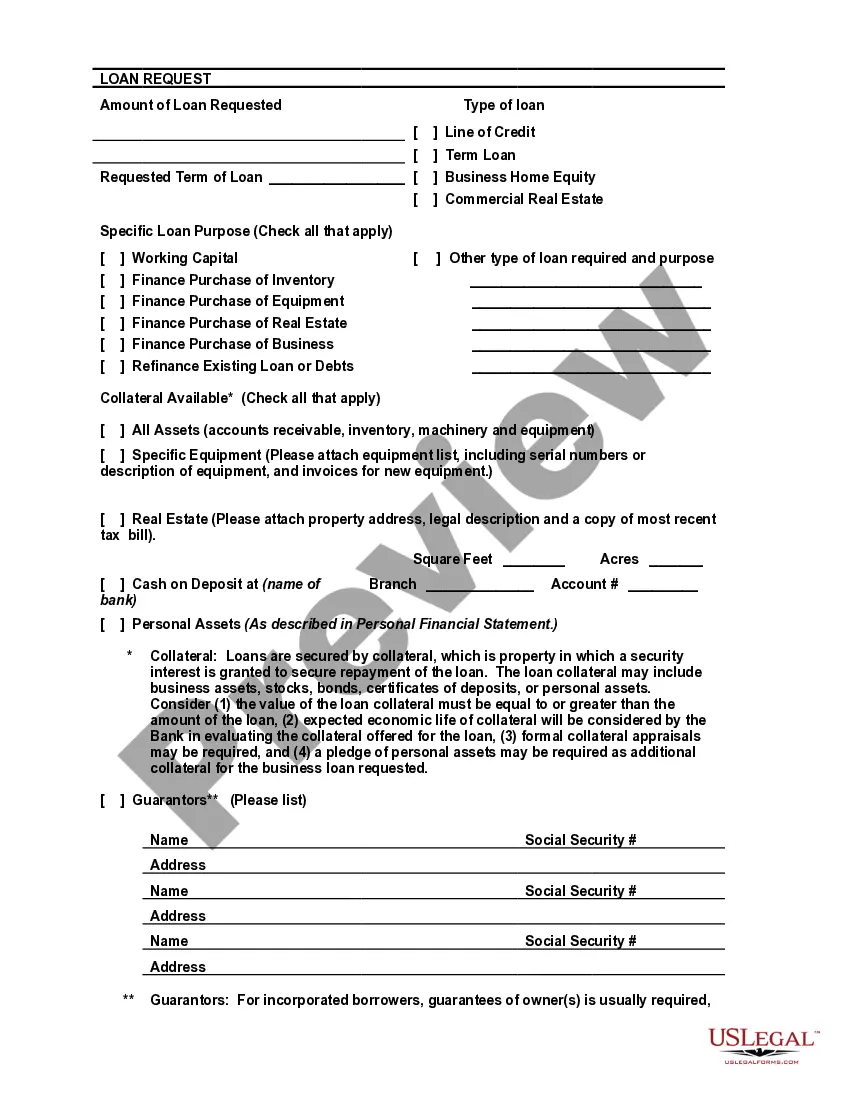

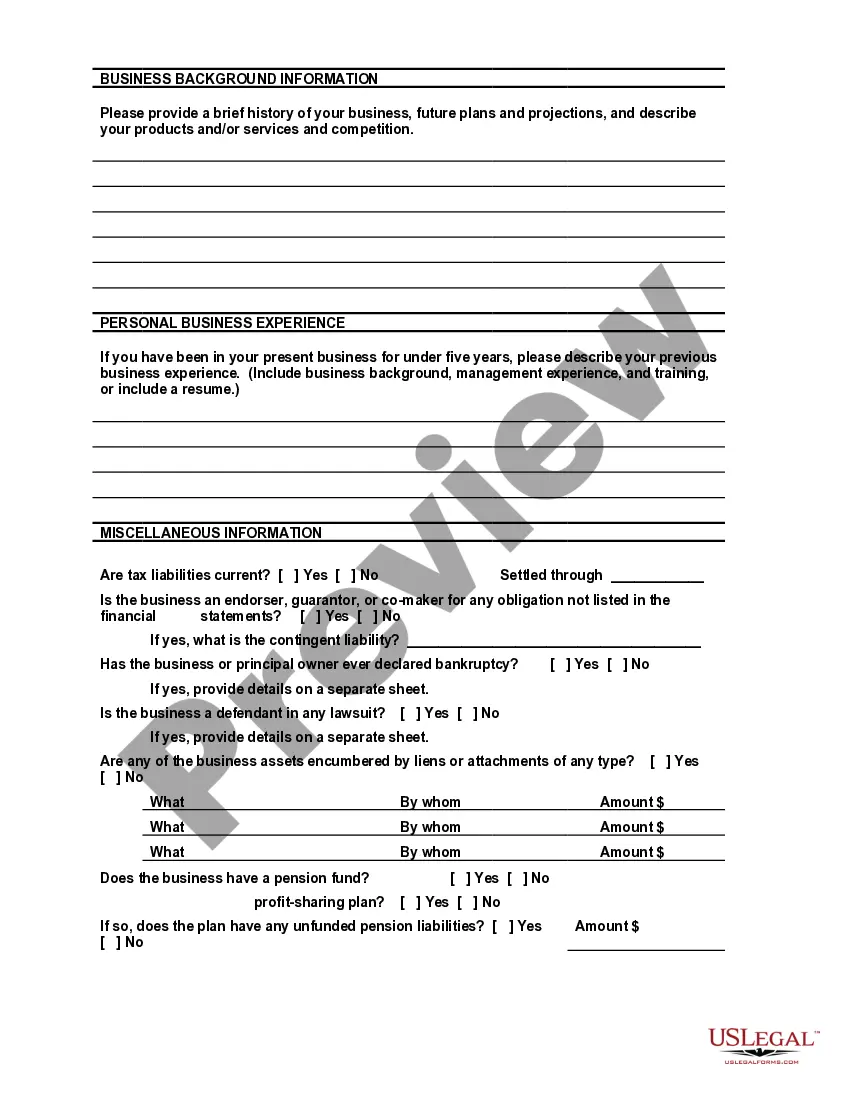

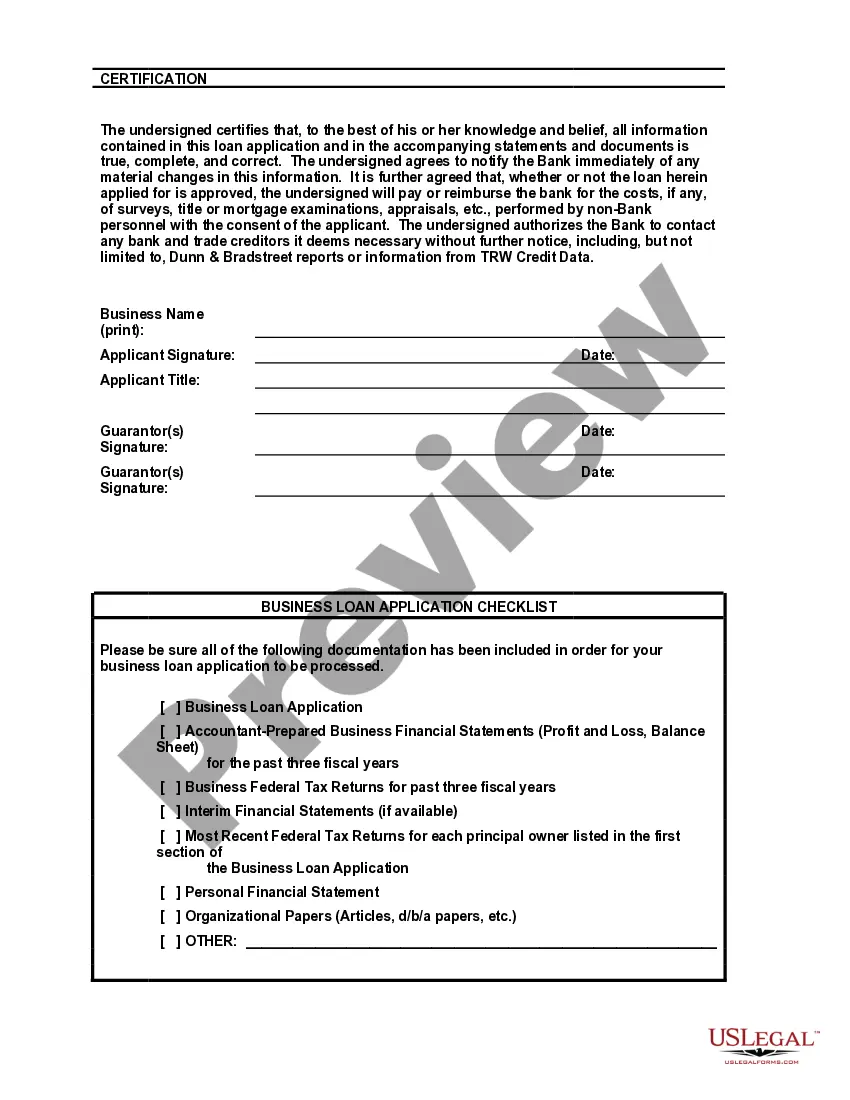

This document combines a representational bank loan application and the form used by a small community bank for an internal review of the application. Linking these two documents, may help you understand what information the bank wants from you as well as how the bank will use that information in making its decision on your business loan application.

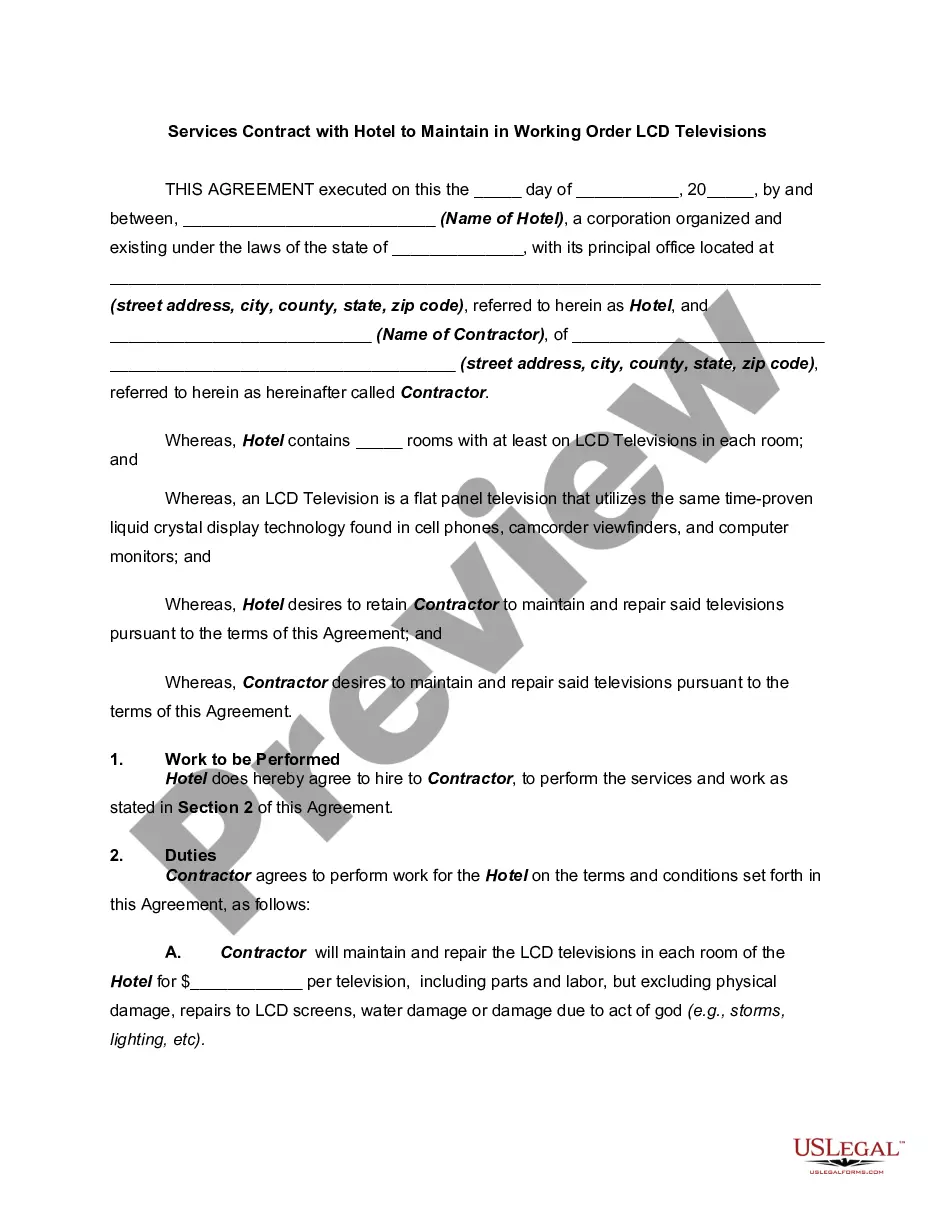

Title: West Virginia Bank Loan Application Form and Checklist — Business Loan: A Comprehensive Guide Introduction: Applying for a business loan in West Virginia involves a detailed process, including filling out the official West Virginia Bank Loan Application Form and adhering to a checklist. This guide provides a comprehensive overview of the West Virginia Bank Loan Application Form and Checklist for various business loans available. Types of West Virginia Bank Loan Application Form and Checklist — Business Loan: 1. Start-Up Business Loan: The Start-Up Business Loan Application Form and Checklist are specifically designed for entrepreneurs looking to establish a new business venture. This form includes sections for business plans, financial projections, and details about the business structure. 2. Working Capital Loan: For businesses needing additional liquidity or financial stability, the Working Capital Loan Application Form and Checklist offers a means to apply for the necessary funds. This form focuses on current assets, accounts payable and receivable, and cash flow statements. 3. Equipment Financing Loan: Businesses requiring new equipment or upgrades can utilize the Equipment Financing Loan Application Form and Checklist. This form emphasizes the type of equipment, estimated costs, and its contribution to the business's productivity. 4. Expansion Loan: The Expansion Loan Application Form and Checklist are suitable for businesses planning to expand their current operations. The form seeks information related to growth projections, market analysis, expansion project details, and financial capabilities for repayment. 5. Real Estate Loan: For commercial real estate investment or development, the Real Estate Loan Application Form and Checklist should be used. This form typically requires property details, construction plan or documentation, appraisal information, and revenue projections. Application Form and Checklist Details: 1. Personal Information: Full legal name, contact information, social security number, and personal identification documents. 2. Business Details: Business name, contact details, nature of business, years in operation, and business structure. 3. Financial Information: Complete financial statements, income statements, tax returns, and bank statements for the business. 4. Loan Details: Desired loan amount, purpose of the loan, repayment plan, and collateral details (if applicable). 5. Business Plan: Detailed business plan covering company history, products/services offered, target market analysis, competitive analysis, marketing strategy, revenue and expense projections, and future goals. 6. Supporting Documents: Required documentation may include business licenses, permits, contracts, lease agreements, insurance policies, financial evidence, and relevant legal documents. Conclusion: Whether you are a start-up, looking for working capital, equipment financing, expansion, or real estate investment, West Virginia Bank offers various tailored loan applications and checklists. It is essential to complete the designated application form accurately and collect all supporting documents before submitting them for smoother loan processing. Be sure to consult with West Virginia Bank representatives or loan officers for further guidance during the application process.Title: West Virginia Bank Loan Application Form and Checklist — Business Loan: A Comprehensive Guide Introduction: Applying for a business loan in West Virginia involves a detailed process, including filling out the official West Virginia Bank Loan Application Form and adhering to a checklist. This guide provides a comprehensive overview of the West Virginia Bank Loan Application Form and Checklist for various business loans available. Types of West Virginia Bank Loan Application Form and Checklist — Business Loan: 1. Start-Up Business Loan: The Start-Up Business Loan Application Form and Checklist are specifically designed for entrepreneurs looking to establish a new business venture. This form includes sections for business plans, financial projections, and details about the business structure. 2. Working Capital Loan: For businesses needing additional liquidity or financial stability, the Working Capital Loan Application Form and Checklist offers a means to apply for the necessary funds. This form focuses on current assets, accounts payable and receivable, and cash flow statements. 3. Equipment Financing Loan: Businesses requiring new equipment or upgrades can utilize the Equipment Financing Loan Application Form and Checklist. This form emphasizes the type of equipment, estimated costs, and its contribution to the business's productivity. 4. Expansion Loan: The Expansion Loan Application Form and Checklist are suitable for businesses planning to expand their current operations. The form seeks information related to growth projections, market analysis, expansion project details, and financial capabilities for repayment. 5. Real Estate Loan: For commercial real estate investment or development, the Real Estate Loan Application Form and Checklist should be used. This form typically requires property details, construction plan or documentation, appraisal information, and revenue projections. Application Form and Checklist Details: 1. Personal Information: Full legal name, contact information, social security number, and personal identification documents. 2. Business Details: Business name, contact details, nature of business, years in operation, and business structure. 3. Financial Information: Complete financial statements, income statements, tax returns, and bank statements for the business. 4. Loan Details: Desired loan amount, purpose of the loan, repayment plan, and collateral details (if applicable). 5. Business Plan: Detailed business plan covering company history, products/services offered, target market analysis, competitive analysis, marketing strategy, revenue and expense projections, and future goals. 6. Supporting Documents: Required documentation may include business licenses, permits, contracts, lease agreements, insurance policies, financial evidence, and relevant legal documents. Conclusion: Whether you are a start-up, looking for working capital, equipment financing, expansion, or real estate investment, West Virginia Bank offers various tailored loan applications and checklists. It is essential to complete the designated application form accurately and collect all supporting documents before submitting them for smoother loan processing. Be sure to consult with West Virginia Bank representatives or loan officers for further guidance during the application process.