The West Virginia Membership Certificate of Nonprofit or Non Stock Corporation is an official document that verifies an individual's membership in a nonprofit or non-stock corporation registered in the state of West Virginia. This certificate serves as proof of membership and often includes key information about the individual's rights and obligations as a member. Keywords: West Virginia, membership certificate, nonprofit corporation, non-stock corporation, detailed description, keywords. There are various types of West Virginia Membership Certificates of Nonprofit or Non Stock Corporation that can be issued based on the specific organization's structure and requirements. Here are some notable types: 1. Individual Membership Certificate: This type of certificate is issued to individuals who have obtained membership in a nonprofit or non-stock corporation in West Virginia. It typically includes the member's name, membership number, and the date of issuance. 2. Organizational Membership Certificate: Organizations that have become members of a nonprofit or non-stock corporation in West Virginia are issued this type of certificate. It may display the organization's name, legal entity type, membership number, and other relevant details. 3. Voting Membership Certificate: Some nonprofit or non-stock corporations grant voting rights to their members. In such cases, a specific certificate may be issued to individuals who possess voting rights within the corporation. This document would typically feature additional information, such as any limitations or conditions on the member's voting rights. 4. Honorary Membership Certificate: This certificate is designated for individuals who receive an honorary membership in a nonprofit or non-stock corporation. It acknowledges their contributions, achievements, or notable services to the organization. The certificate may include the recipient's name, a statement explaining the honorary status, and the organization's seal or logo. 5. Lifetime Membership Certificate: Certain nonprofit or non-stock corporations offer lifetime memberships to individuals who have demonstrated long-term commitment or support. The lifetime membership certificate typically confirms the individual's lifelong affiliation with the organization, often without the need for annual renewals. It may showcase special privileges or benefits accorded to lifetime members. 6. Founding Membership Certificate: Specifically for corporations formed by a group of individuals, a founding membership certificate is issued to those who were involved in the establishment of the nonprofit or non-stock corporation in West Virginia. This certificate acknowledges their pivotal role in the organization's inception and may list their names alongside the founding date. Each of these membership certificates is tailored to fulfill the unique requirements of different nonprofit or non-stock corporations, highlighting the specific rights, privileges, or honors bestowed upon the members. In conclusion, the West Virginia Membership Certificate of Nonprofit or Non Stock Corporation is a crucial document that verifies an individual's membership in a registered nonprofit or non-stock corporation in the state. With various types of certificates available, organizations can customize them to acknowledge different levels of membership, honor special contributors, or recognize founding members. These certificates not only strengthen the bond between the organization and its members but also serve as official records of their roles and responsibilities within the corporation.

West Virginia Membership Certificate of Nonprofit or Non Stock Corporation

Description

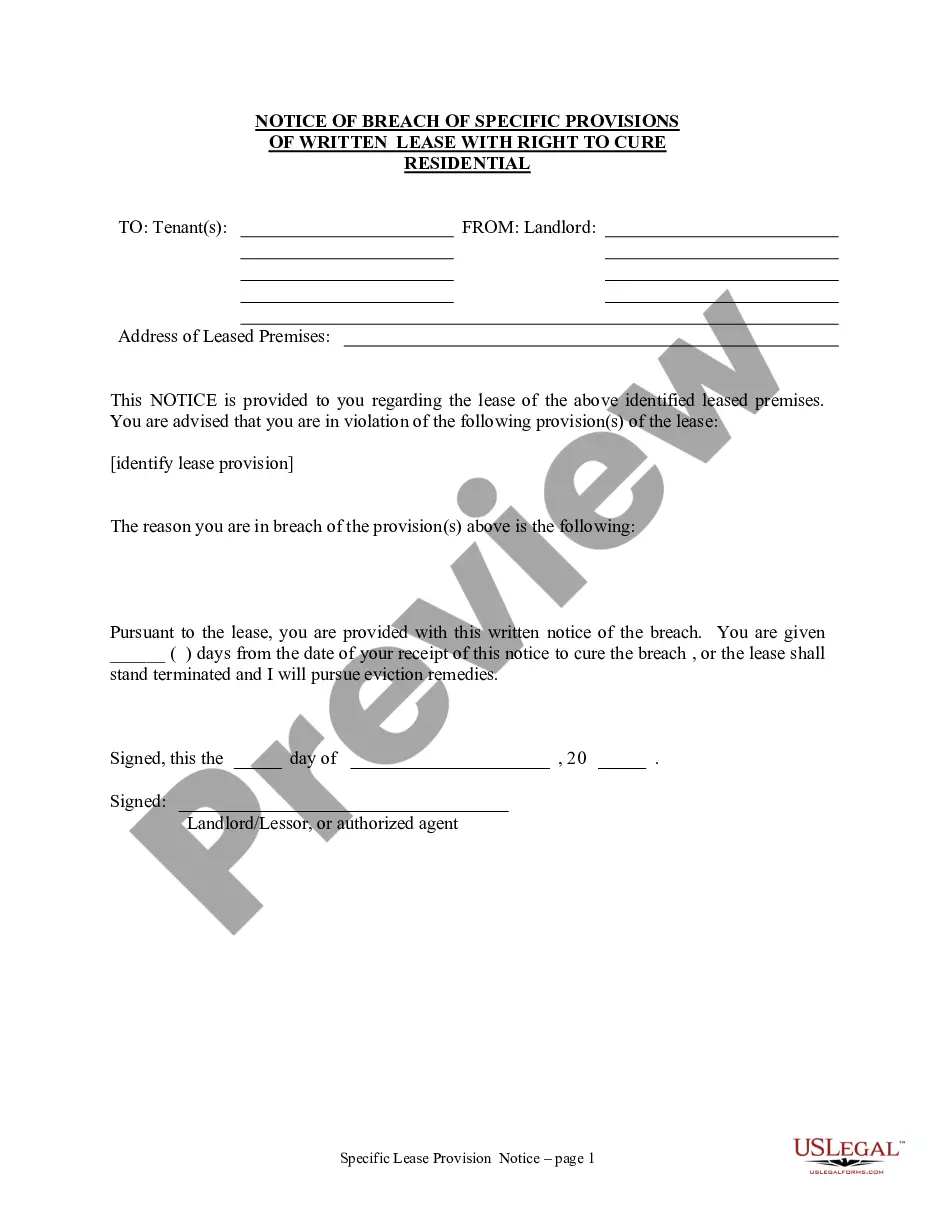

How to fill out West Virginia Membership Certificate Of Nonprofit Or Non Stock Corporation?

If you have to comprehensive, download, or printing legitimate file web templates, use US Legal Forms, the greatest collection of legitimate kinds, that can be found on the web. Use the site`s simple and easy handy lookup to get the documents you require. A variety of web templates for company and person reasons are sorted by groups and states, or search phrases. Use US Legal Forms to get the West Virginia Membership Certificate of Nonprofit or Non Stock Corporation with a few click throughs.

When you are already a US Legal Forms customer, log in to your accounts and then click the Down load option to find the West Virginia Membership Certificate of Nonprofit or Non Stock Corporation. You can also access kinds you formerly saved inside the My Forms tab of your own accounts.

If you use US Legal Forms initially, refer to the instructions listed below:

- Step 1. Ensure you have selected the shape for that right city/country.

- Step 2. Take advantage of the Review choice to check out the form`s articles. Don`t forget about to see the explanation.

- Step 3. When you are unhappy with all the type, make use of the Research field on top of the monitor to locate other variations of your legitimate type template.

- Step 4. Once you have located the shape you require, select the Buy now option. Pick the rates plan you prefer and put your references to sign up on an accounts.

- Step 5. Approach the financial transaction. You should use your Мisa or Ьastercard or PayPal accounts to perform the financial transaction.

- Step 6. Pick the formatting of your legitimate type and download it in your gadget.

- Step 7. Comprehensive, revise and printing or signal the West Virginia Membership Certificate of Nonprofit or Non Stock Corporation.

Every legitimate file template you buy is the one you have for a long time. You possess acces to each type you saved within your acccount. Select the My Forms portion and decide on a type to printing or download again.

Contend and download, and printing the West Virginia Membership Certificate of Nonprofit or Non Stock Corporation with US Legal Forms. There are many expert and condition-certain kinds you can use for your personal company or person demands.

Form popularity

FAQ

Generally, for-profit companies seek to provide a product or service to consumers and make a profit by doing so. A nonprofit organization's purpose is to provide a service or benefit to the community with no intention of earning a profit.

Nonprofit organizations in Virginia are NOT automatically exempt from sales and use tax. The only way to be exempt from sales and use tax is apply for a Sales and Use Tax Exemption. You can apply on-line but there are conditions which must be met.

NAICs code for Non Profit The NAICs code for Civic and Social Organizations is 813410. The establishments in this industry are mainly involved in promoting the civic and social interests of their members. They may also operate bars and restaurants and provide other recreational services to their members.

To start a nonprofit corporation in West Virginia, you must file a document called the Articles of Incorporation with Non-Profit IRS Attachment (Form CD-INP) with the West Virginia Secretary of State. You can file this document by mail or online. The articles of incorporation cost $25 to file.

Answer and Explanation: As non-profit organizations are formed with the objective of public benefit, they are not allowed to go public and trade their stocks in the market.

Costs of starting a new nonprofit in West Virginia Filing Articles of Incorporation: $25. 501(c) or Federal tax exemption application: $275 or $600 IRS fee.

Any non-profit conducting business in Virginia must register as a Non-Stock Corporation or Limited Liability Company (LLC) with the Virginia State Corporation Commission. Procedures for filing as a Non-Stock Corporation can be found in the Code of Virginia Nonstock Corporation Act, Sections 13.1-801 through 13.1-946.

12 Steps to Starting a Nonprofit in Virginia Name Your Organization. Name Incorporators and Directors. Appoint a Registered Agent. File Virginia Articles of Incorporation. Publish Incorporation. Apply for an Employer Identification Number (EIN) Hold Organization Meeting and Establish Nonprofit Bylaws.