Title: Understanding West Virginia Sample Letters for Tax Exemption: Comprehensive Review of a Sample Letter Received from a Tax Collector Introduction: West Virginia residents seeking tax exemption may encounter various situations where they receive sample letters from tax collectors. These letters provide crucial information regarding tax exemption eligibility and guidelines. This article aims to offer a detailed description and review of a typical West Virginia sample letter for tax exemption, analyzing its contents and purpose while highlighting keyword-rich variations for potential types. 1. Overview of West Virginia Sample Letter for Tax Exemption: — Purpose and Objectives of the Letter: Explain the primary purpose of the sample letter, which is to notify or guide taxpayers about their eligibility for tax exemption in West Virginia. — Identification of the Taxpayer: Describe how the letter identifies the taxpayer through their name, address, and any unique taxpayer identification number. — Tax Exemption Guidelines: Provide an overview of the specific guidelines, rules, and requirements mentioned in the sample letter that must be met to qualify for tax exemption. — Important Deadlines: Highlight any deadlines or time-sensitive instructions mentioned within the sample letter, such as submission dates for necessary documentation or appeals. — Contact Information: Explain how the letter typically provides contact information for the tax collector's office, allowing taxpayers to reach out for further assistance or clarification. 2. Key Components within the Sample Letter: — Explanation of Eligibility Criteria: Discuss how the sample letter outlines the various criteria taxpayers must satisfy to qualify for tax exemption, such as limited income, age, disability, or property-related requirements. — Required Documentation: Elaborate on the paperwork or supporting documents that the letter requests alongside the letter's submission. This may involve income statements, property deeds, medical records, or other relevant paperwork. — Details on Appeal Process: Highlight any information within the sample letter that pertains to the process of appealing a tax exemption denial, such as providing clear instructions on how to initiate an appeal or any associated deadlines. — Confidentiality and Legal Considerations: Address any legal disclaimers present in the sample letter, ensuring confidentiality of taxpayer information and emphasizing adherence to applicable laws and regulations. Types of West Virginia Sample Letters for Tax Exemption: 1. Low-Income Tax Exemption: This sample letter focuses on individuals or households with limited income who seek tax exemption to alleviate financial burdens. 2. Property Tax Exemption: This type of letter specifically addresses property owners who may qualify for tax exemptions based on certain circumstances, such as age or disability. 3. Senior Citizen Tax Exemption: Designed for older adults, this sample letter outlines the eligibility criteria for senior citizens seeking tax exemptions in West Virginia. 4. Disabled Persons Tax Exemption: This letter targets individuals with disabilities who aim to reduce their tax obligations based on specified conditions outlined by the state. 5. Charitable or Non-Profit Tax Exemption: This variation addresses non-profit organizations or charitable entities seeking tax exemption status in West Virginia. Conclusion: West Virginia sample letters for tax exemption play a vital role in informing taxpayers about their eligibility, outlining guidelines, specifying necessary documents, and providing contact information. By understanding the contents and variations of these letters, individuals can navigate the tax exemption process more effectively while ensuring compliance with state regulations.

West Virginia Sample Letter for Tax Exemption - Review of Sample Letter Received from Tax Collector

Description

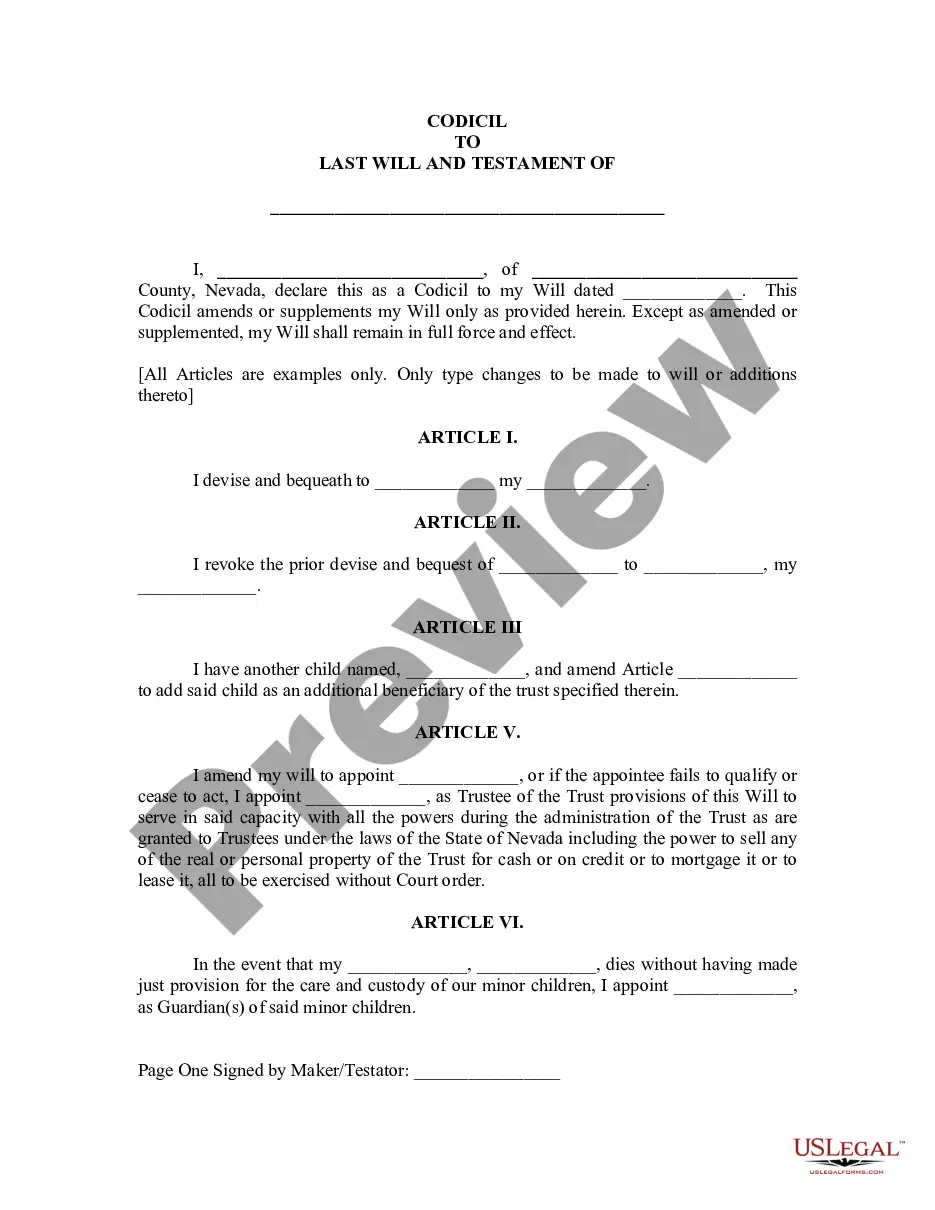

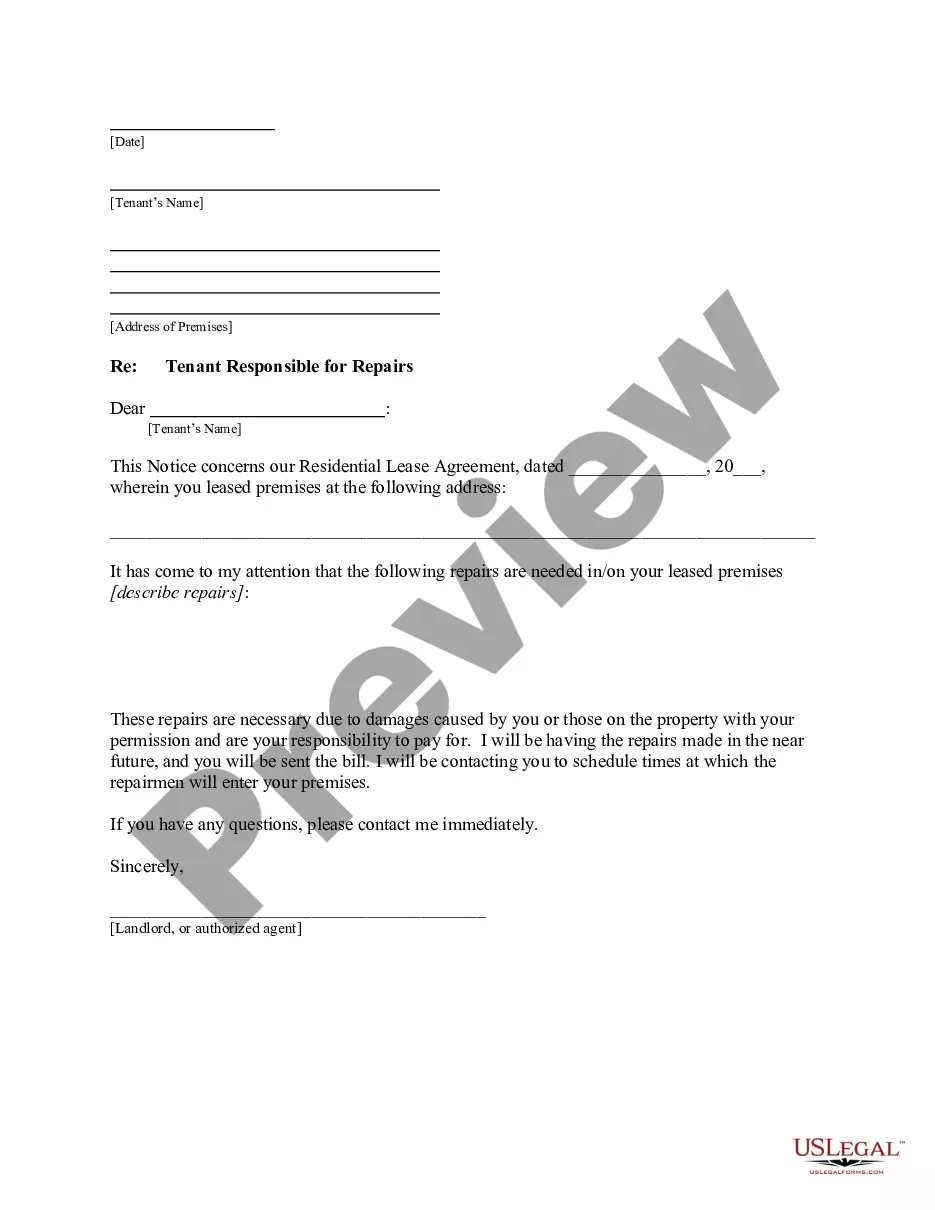

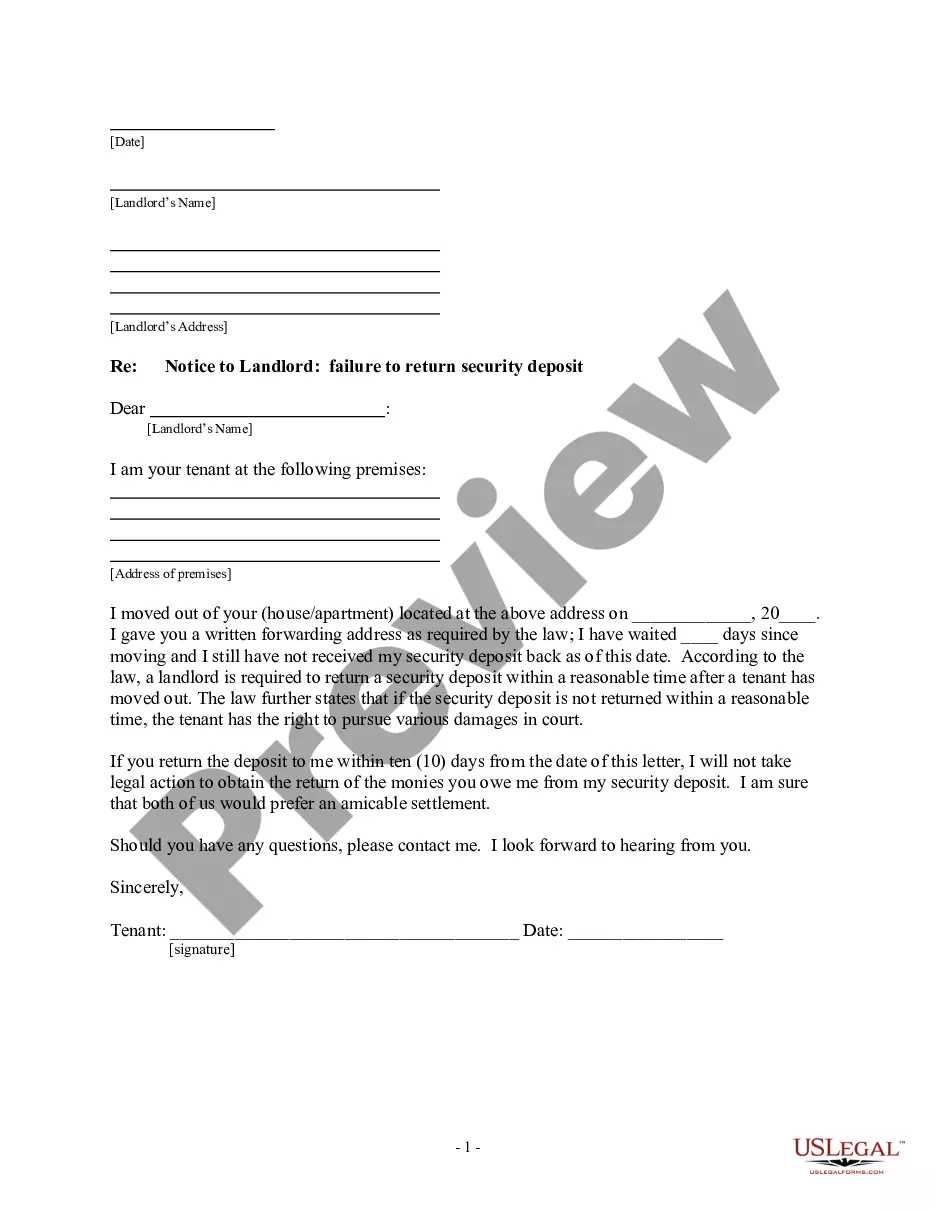

How to fill out West Virginia Sample Letter For Tax Exemption - Review Of Sample Letter Received From Tax Collector?

US Legal Forms - one of many largest libraries of authorized varieties in the States - provides an array of authorized papers templates it is possible to download or print. Utilizing the site, you can find a large number of varieties for organization and personal purposes, sorted by types, states, or key phrases.You will find the newest variations of varieties such as the West Virginia Sample Letter for Tax Exemption - Review of Sample Letter Received from Tax Collector in seconds.

If you have a membership, log in and download West Virginia Sample Letter for Tax Exemption - Review of Sample Letter Received from Tax Collector from your US Legal Forms local library. The Download switch will show up on each and every kind you look at. You have accessibility to all formerly downloaded varieties in the My Forms tab of your respective account.

If you would like use US Legal Forms the first time, listed here are easy guidelines to obtain began:

- Ensure you have chosen the right kind for the area/area. Select the Preview switch to review the form`s content material. See the kind information to actually have chosen the right kind.

- If the kind doesn`t satisfy your specifications, make use of the Lookup field near the top of the screen to find the one which does.

- When you are satisfied with the form, confirm your selection by clicking on the Acquire now switch. Then, choose the rates plan you prefer and give your accreditations to sign up for an account.

- Approach the purchase. Utilize your charge card or PayPal account to accomplish the purchase.

- Select the formatting and download the form on your system.

- Make adjustments. Complete, change and print and sign the downloaded West Virginia Sample Letter for Tax Exemption - Review of Sample Letter Received from Tax Collector.

Each and every design you included with your money does not have an expiration particular date which is the one you have permanently. So, in order to download or print an additional duplicate, just check out the My Forms section and click on the kind you want.

Obtain access to the West Virginia Sample Letter for Tax Exemption - Review of Sample Letter Received from Tax Collector with US Legal Forms, the most considerable local library of authorized papers templates. Use a large number of professional and condition-particular templates that meet up with your small business or personal requirements and specifications.

Form popularity

FAQ

The 501(c)(3) determination letter is proof of your organization's tax-exempt status.

Eligibility Requirements You must have been a resident of West Virginia for the 2 consecutive calendar years prior to your application. You must be 65 years of age on or before June 30th of the next year. Proof of age will be required (Valid WV driver's license, birth certificate, etc.)

A letter of good standing is requested by completing a GSR-01 form. If you have a MyTaxes account, you may complete this form from your My Taxes account. The form is found under the "I Want To" section.

West Virginia Tax Account Numbers If you are a new business, register online with the WV State Tax Department to retrieve your account number. You can find additional information on registering by mail in this booklet.

In addition, there are six regional offices that offer in-person taxpayer assistance across the State. All inquiries about tax returns should be directed to one of the Regional Office Locations listed below or by calling 304-558-3333 or 800-982-8297 during regular business hours.

Below is a representative, nonexclusive list of property that may be exempt from property tax: The first $20,000 of assessed value of owner-occupied residential property owned by a person age 65 or older or by a person who is permanently and totally disabled is exempt.

Every person or company intending to do business in this State, including every individual who is self-employed or hires employees, must obtain a business registration certificate from the West Virginia State Tax Department (See Section A, pages 7 & 8).

You are considered a resident of West Virginia if you spend more than 30 days in West Virginia with the intent of West Virginia becoming your permanent residence, or if you are a domiciliary resident of Pennsylvania or Virginia and you maintain a physical presence in West Virginia for more than 183 days of the taxable ...