Cash flow is the movement of cash into or out of a business, project, or financial product. It is usually measured during a specified, finite period of time. Measurement of cash flow can be used for calculating other parameters that give information on a company's value and situation. Cash flow can e.g. be used for calculating parameters:

To determine a project's rate of return or value. The time of cash flows into and out of projects are used as inputs in financial models such as internal rate of return and net present value.

To determine problems with a business's liquidity. Being profitable does not necessarily mean being liquid. A company can fail because of a shortage of cash even while profitable.

As an alternative measure of a business's profits when it is believed that accrual accounting concepts do not represent economic realities. For example, a company may be notionally profitable but generating little operational cash (as may be the case for a company that barters its products rather than selling for cash). In such a case, the company may be deriving additional operating cash by issuing shares or raising additional debt finance.

Cash flow can be used to evaluate the 'quality' of income generated by accrual accounting. When net income is composed of large non-cash items it is considered low quality.

To evaluate the risks within a financial product, e.g. matching cash requirements, evaluating default risk, re-investment requirements, etc.

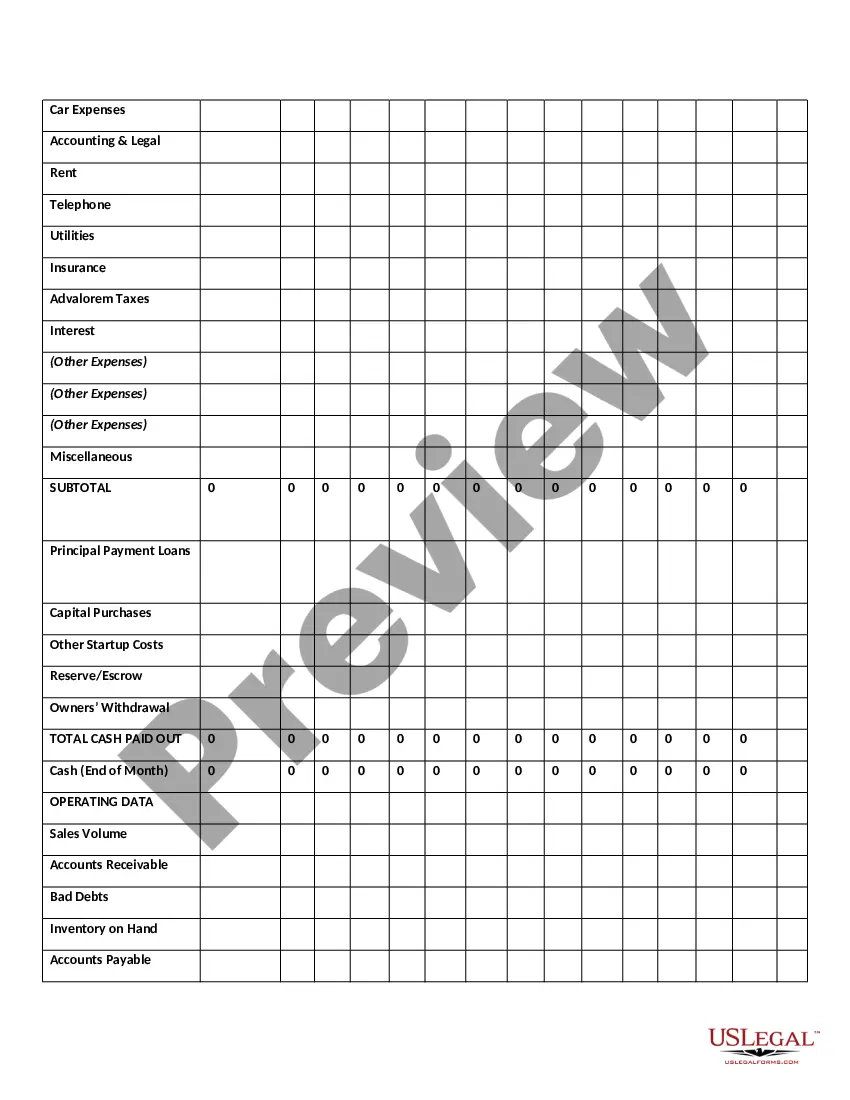

Title: Understanding West Virginia Twelve-Month Cash Flow: A Comprehensive Overview Introduction: In the world of finance and business planning, understanding the concept of cash flow is crucial for making informed decisions. This detailed description aims to provide insight into the specific context of West Virginia Twelve-Month Cash Flow, covering its definition, importance, and various types within the state. 1. Definition of West Virginia Twelve-Month Cash Flow: West Virginia Twelve-Month Cash Flow refers to a financial statement that outlines the inflows and outflows of cash in a business or personal context over a period of twelve months. It helps individuals, businesses, and organizations gauge their financial stability, identify potential issues, and optimize their financial planning for the long term. 2. Importance of West Virginia Twelve-Month Cash Flow: a. Accurate Financial Analysis: By examining cash inflows and outflows, this statement enables businesses to analyze financial performance, assess profitability, and plan for future investments or expenses. b. Budget Allocation: A comprehensive Twelve-Month Cash Flow aids in allocating resources effectively, ensuring that adequate funds are available for various operational needs, expansion plans, and contingencies. c. Risk Management: Understanding cash flow patterns allows businesses in West Virginia to identify potential periods of financial strain, take timely action, and develop strategies to mitigate risks. 3. Types of West Virginia Twelve-Month Cash Flow: While the fundamental principles behind cash flow analysis apply universally, specific cash flow types can vary based on industry, sector, or purpose. In West Virginia, some common variations include: a. Business Cash Flow: This type focuses on the cash movements within a business, capturing income from sales, investments, loans, and other financing mechanisms alongside the outflows spent on expenses such as salaries, rent, utilities, and equipment purchases. b. Personal Cash Flow: Individuals in West Virginia also utilize this statement to manage their personal finances effectively. It encompasses income from various sources (salary, investment returns, side businesses) and expenses (mortgage, bills, groceries, entertainment) to assess personal financial stability and plan for future goals. c. Agricultural Cash Flow: In West Virginia's agricultural sector, specialized cash flow analysis is vital for farmers and ranchers. It helps them understand cash inflows from crop sales, livestock sales, subsidies, as well as cash outflows for equipment, animal care, workers, and farm maintenance. d. Investment Property Cash Flow: Real estate investors in West Virginia assess the cash flow generated by rental properties. This analysis includes rental income, mortgage payments, property management expenses, repairs, and maintenance costs, helping investors evaluate profitability and make informed decisions. Conclusion: West Virginia Twelve-Month Cash Flow serves as a valuable financial tool for individuals, businesses, and specific industries within the state. By providing a detailed understanding of the cash inflows and outflows, it facilitates effective financial management, risk assessment, and strategic decision-making. Whether in business, personal finance, agriculture, or real estate, mastering cash flow analysis is critical for long-term financial stability and growth in West Virginia.Title: Understanding West Virginia Twelve-Month Cash Flow: A Comprehensive Overview Introduction: In the world of finance and business planning, understanding the concept of cash flow is crucial for making informed decisions. This detailed description aims to provide insight into the specific context of West Virginia Twelve-Month Cash Flow, covering its definition, importance, and various types within the state. 1. Definition of West Virginia Twelve-Month Cash Flow: West Virginia Twelve-Month Cash Flow refers to a financial statement that outlines the inflows and outflows of cash in a business or personal context over a period of twelve months. It helps individuals, businesses, and organizations gauge their financial stability, identify potential issues, and optimize their financial planning for the long term. 2. Importance of West Virginia Twelve-Month Cash Flow: a. Accurate Financial Analysis: By examining cash inflows and outflows, this statement enables businesses to analyze financial performance, assess profitability, and plan for future investments or expenses. b. Budget Allocation: A comprehensive Twelve-Month Cash Flow aids in allocating resources effectively, ensuring that adequate funds are available for various operational needs, expansion plans, and contingencies. c. Risk Management: Understanding cash flow patterns allows businesses in West Virginia to identify potential periods of financial strain, take timely action, and develop strategies to mitigate risks. 3. Types of West Virginia Twelve-Month Cash Flow: While the fundamental principles behind cash flow analysis apply universally, specific cash flow types can vary based on industry, sector, or purpose. In West Virginia, some common variations include: a. Business Cash Flow: This type focuses on the cash movements within a business, capturing income from sales, investments, loans, and other financing mechanisms alongside the outflows spent on expenses such as salaries, rent, utilities, and equipment purchases. b. Personal Cash Flow: Individuals in West Virginia also utilize this statement to manage their personal finances effectively. It encompasses income from various sources (salary, investment returns, side businesses) and expenses (mortgage, bills, groceries, entertainment) to assess personal financial stability and plan for future goals. c. Agricultural Cash Flow: In West Virginia's agricultural sector, specialized cash flow analysis is vital for farmers and ranchers. It helps them understand cash inflows from crop sales, livestock sales, subsidies, as well as cash outflows for equipment, animal care, workers, and farm maintenance. d. Investment Property Cash Flow: Real estate investors in West Virginia assess the cash flow generated by rental properties. This analysis includes rental income, mortgage payments, property management expenses, repairs, and maintenance costs, helping investors evaluate profitability and make informed decisions. Conclusion: West Virginia Twelve-Month Cash Flow serves as a valuable financial tool for individuals, businesses, and specific industries within the state. By providing a detailed understanding of the cash inflows and outflows, it facilitates effective financial management, risk assessment, and strategic decision-making. Whether in business, personal finance, agriculture, or real estate, mastering cash flow analysis is critical for long-term financial stability and growth in West Virginia.