Title: West Virginia Proposal to Buy a Business: A Comprehensive Guide and Types Introduction: When considering the West Virginia Proposal to Buy a Business, several key factors need to be taken into account to ensure a successful acquisition. This detailed description will explore the ins and outs of the proposal, outlining the various types available and incorporating relevant keywords to provide a comprehensive understanding. 1. Understanding the West Virginia Proposal to Buy a Business: — A West Virginia Proposal to Buy a Business refers to the formal document prepared by potential buyers, stating their intent to acquire an existing business within the state's borders. — The proposal showcases the potential buyer's interests, financial status, acquisition plan, and strategies to grow the acquired business. 2. Key Components of a West Virginia Proposal to Buy a Business: — Industry Analysis: Conduct a thorough assessment of the target business's industry, market trends, competitors, and growth potential, highlighting the buyer's expertise and ability to leverage opportunities. — Buyout Structure: Detail the proposed structure of the acquisition, whether it's a complete purchase, asset transfer, or merger, along with a breakdown of the financial considerations, including the purchase price, funding sources, and proposed payment terms (e.g., cash, stock, or a combination). — Business Valuation: Present an accurate valuation of the company to justify the proposed purchase price, outlining the methodology used, such as market approaches, income approaches, or asset-based approaches. — Strategic Plan: Outline a comprehensive strategy to drive growth and profitability after the acquisition, including plans for operational enhancements, marketing initiatives, customer retention, and integration timelines. — Due Diligence: Emphasize the importance of conducting thorough due diligence to assess the target business's financial records, legal compliance, employee agreements, contracts, and potential liabilities, demonstrating the buyer's commitment to a well-informed decision. 3. Types of West Virginia Proposals to Buy a Business: — Complete Acquisition Proposal: This type involves the purchase of an existing business as a whole, including its assets, liabilities, and customer base. — Partial Acquisition Proposal: In some cases, buyers may propose acquiring only a portion of an existing business, such as specific assets, IP rights, or branches, potentially allowing the seller to retain some operations. — Merger Proposal: This proposal suggests combining the buyer's business with the target business to create a stronger entity, leveraging synergies and expanding market reach. — Franchise Acquisition Proposal: Buyers looking to acquire franchise businesses in West Virginia must present a proposal that showcases their understanding of the franchisor's requirements, their ability to meet financial obligations, and the potential for growth within the state. Conclusion: In conclusion, the West Virginia Proposal to Buy a Business is a critical document that outlines a buyer's intentions, strategy, and financial capabilities when seeking to acquire a business in the state. By considering different types of proposals, buyers can tailor their offerings to meet the unique requirements of various acquisition scenarios. Successful proposals encompass industry analysis, strategic planning, due diligence, and comprehensive financial details, ultimately leading to a mutually beneficial agreement between the buyer and the seller.

West Virginia Proposal to Buy a Business

Description

How to fill out West Virginia Proposal To Buy A Business?

Discovering the right lawful document web template can be quite a have difficulties. Needless to say, there are a variety of layouts available on the net, but how would you discover the lawful develop you need? Utilize the US Legal Forms internet site. The services gives a large number of layouts, including the West Virginia Proposal to Buy a Business, that can be used for company and private requirements. All the kinds are inspected by professionals and satisfy state and federal specifications.

When you are already listed, log in to your bank account and click on the Acquire button to have the West Virginia Proposal to Buy a Business. Utilize your bank account to search with the lawful kinds you may have ordered earlier. Proceed to the My Forms tab of the bank account and get yet another version from the document you need.

When you are a brand new user of US Legal Forms, here are easy recommendations for you to adhere to:

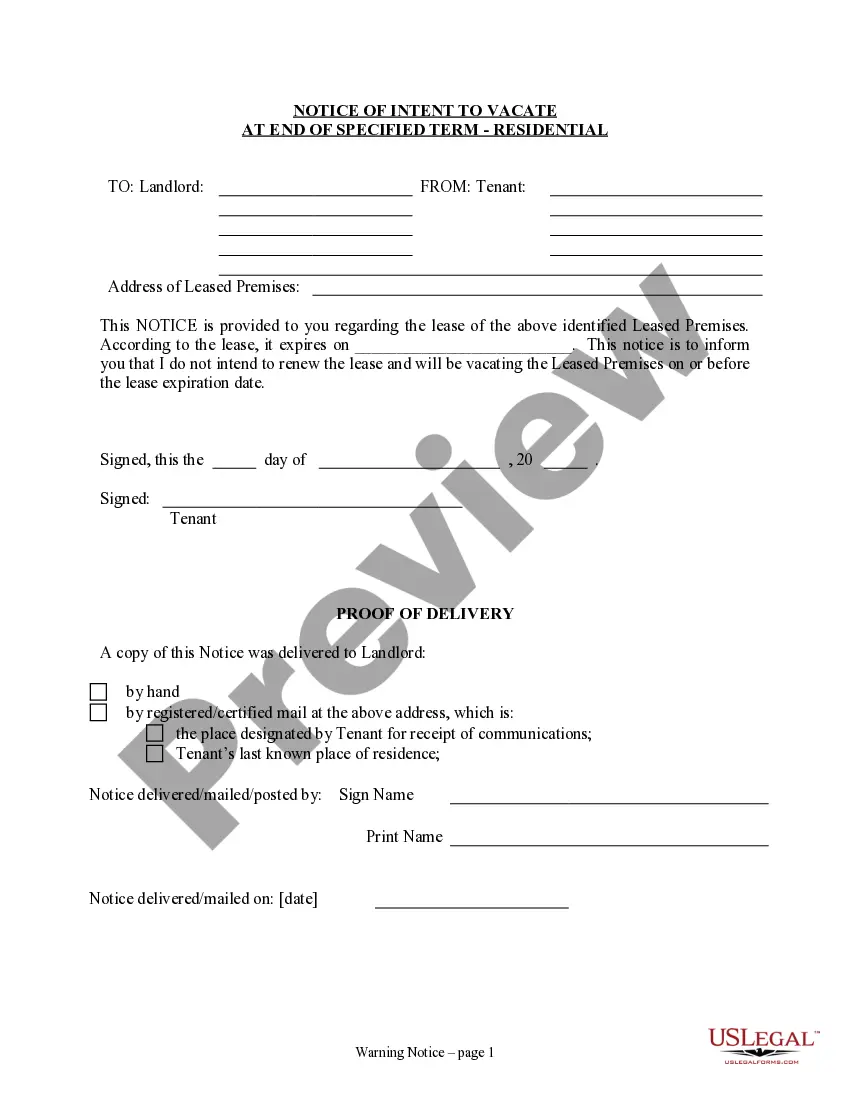

- First, ensure you have selected the proper develop for your personal town/state. It is possible to look over the shape utilizing the Review button and browse the shape outline to make certain this is basically the right one for you.

- In case the develop fails to satisfy your needs, utilize the Seach field to discover the correct develop.

- When you are certain the shape is proper, click on the Purchase now button to have the develop.

- Pick the pricing program you need and type in the necessary info. Make your bank account and purchase the transaction using your PayPal bank account or charge card.

- Select the file structure and obtain the lawful document web template to your gadget.

- Comprehensive, change and print out and sign the attained West Virginia Proposal to Buy a Business.

US Legal Forms is definitely the largest collection of lawful kinds where you will find numerous document layouts. Utilize the service to obtain skillfully-created paperwork that adhere to state specifications.