West Virginia Assignment of Bank Account refers to a legal process in which an individual or entity transfers their rights to a bank account to another party. This transfer is generally done for various reasons, including debt repayment, business transfers, or estate planning. The Assignment of Bank Account in West Virginia involves signing a written agreement, known as an Assignment Agreement, which outlines the terms and conditions of the transfer. The agreement is generally prepared by a licensed attorney to ensure its compliance with state laws. It is essential to have the agreement notarized and properly executed to ensure its validity. Different types of West Virginia Assignment of Bank Account can include: 1. Personal Assignment of Bank Account: This type of assignment occurs when an individual transfers their personal bank account rights to another party. It often happens during divorce settlements, debt settlements, or when one party grants authority to another to handle their finances temporarily or permanently. 2. Business Assignment of Bank Account: Businesses may assign their bank accounts to other parties for several reasons. This can include transferring ownership of a business, merging with another company, or when a parent company assigns the bank account of its subsidiary or affiliate. 3. Estate Planning Assignment of Bank Account: Individuals, especially those with significant assets, often assign their bank accounts as part of their estate planning. This allows the designated beneficiaries to access the funds easily upon the account holder's death, thereby avoiding probate complications. 4. Debt Assignment of Bank Account: In cases of delinquency or default, creditors may seek an assignment of a debtor's bank account to recover outstanding debts. This is often done after obtaining a judgment from the court, allowing the creditor to collect the owed amount directly from the assigned bank account. 5. Temporary Assignment of Bank Account: Some assignments may be temporary, allowing another party to access funds from the account for a specified period. This can occur in situations where someone is incapacitated, hospitalized, or unable to manage their finances for a short duration. It's important to remember that the specific requirements and regulations for West Virginia Assignment of Bank Account may vary, so consulting a legal professional is strongly advised to ensure compliance with state laws and achieve the desired outcome.

West Virginia Assignment of Bank Account

Description

How to fill out West Virginia Assignment Of Bank Account?

US Legal Forms - one of the greatest libraries of lawful varieties in the States - offers an array of lawful record templates you are able to obtain or produce. Using the internet site, you can get a huge number of varieties for company and specific purposes, sorted by types, states, or search phrases.You will discover the newest types of varieties much like the West Virginia Assignment of Bank Account in seconds.

If you have a registration, log in and obtain West Virginia Assignment of Bank Account from the US Legal Forms library. The Download key will appear on every type you see. You have accessibility to all formerly downloaded varieties from the My Forms tab of your respective profile.

If you want to use US Legal Forms initially, listed below are straightforward instructions to get you began:

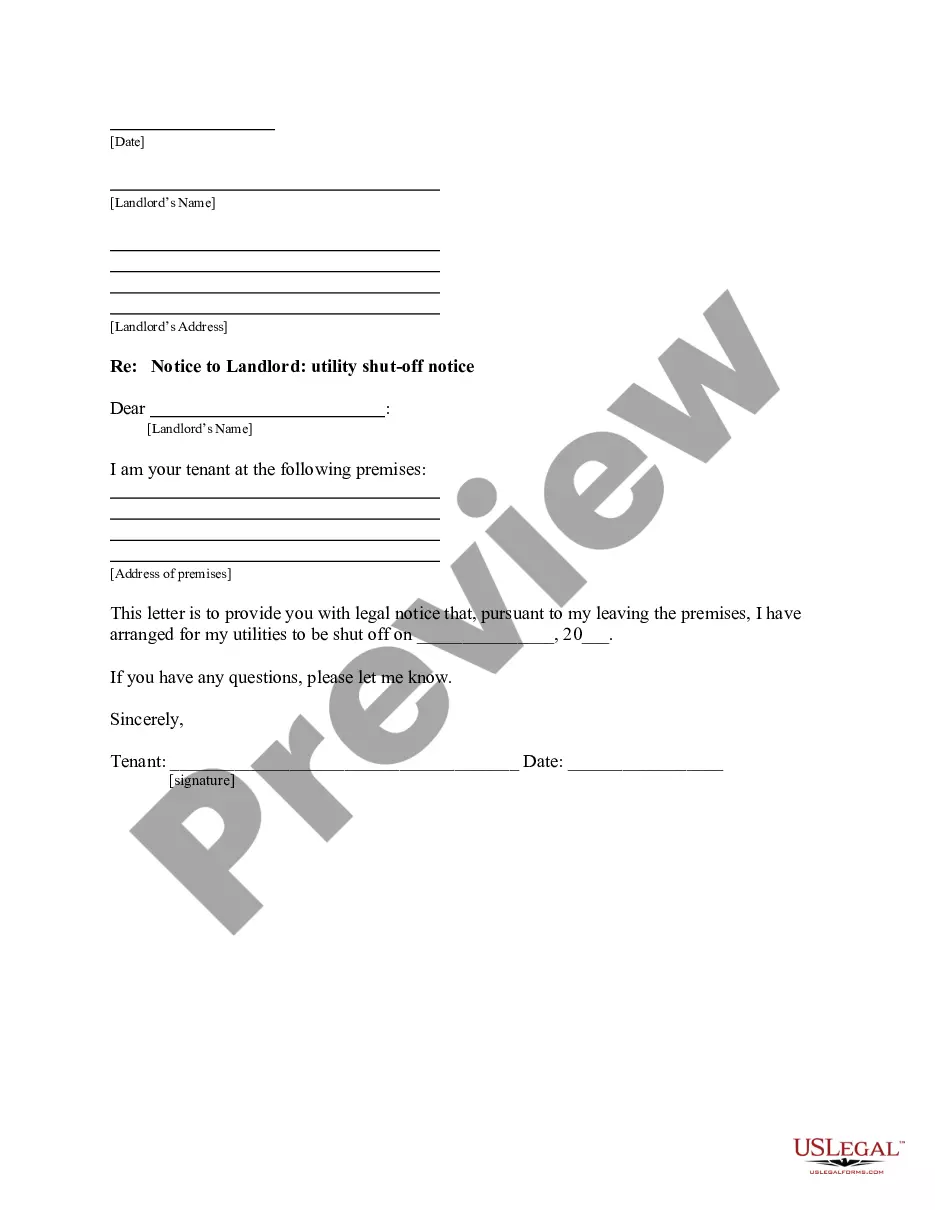

- Make sure you have picked the best type for the area/state. Click on the Review key to examine the form`s information. Browse the type description to actually have selected the appropriate type.

- In the event the type does not suit your requirements, use the Search industry towards the top of the display to obtain the one who does.

- If you are content with the shape, validate your selection by visiting the Purchase now key. Then, select the pricing prepare you favor and provide your credentials to register for the profile.

- Approach the financial transaction. Make use of charge card or PayPal profile to accomplish the financial transaction.

- Select the formatting and obtain the shape on your system.

- Make alterations. Fill up, modify and produce and indicator the downloaded West Virginia Assignment of Bank Account.

Each and every web template you added to your bank account lacks an expiration date and is the one you have forever. So, if you wish to obtain or produce yet another backup, just visit the My Forms area and click in the type you need.

Obtain access to the West Virginia Assignment of Bank Account with US Legal Forms, by far the most substantial library of lawful record templates. Use a huge number of professional and condition-particular templates that meet your business or specific requires and requirements.