When Incorporators in a corporation call for a meeting of incorporators, a formally notification is sent to all the required participants prior to the actual day when the meeting will be held. If an incorporator realizes that he doesn’t need to go to the meeting or if he won’t be able to make to the meeting, he can waive the notice by stating that he surrenders his voting rights and allow the other participants to discuss the matter and decide whatever they want or prefer without him.

West Virginia Waiver of Notice of Organizational Meeting of Incorporators of Church Nonprofit Corporation

Description

How to fill out Waiver Of Notice Of Organizational Meeting Of Incorporators Of Church Nonprofit Corporation?

If you aim to summarize, download, or print approved document templates, utilize US Legal Forms, the largest collection of legal forms available online.

Leverage the site’s straightforward and convenient search to locate the files you need.

Various templates for business and personal use are organized by categories and suggestions, or keywords.

Step 3. If you are not satisfied with the form, utilize the Search box at the top of the screen to find other versions of the legal form template.

Step 4. Once you have found the form you need, click the Purchase now button. Choose your preferred pricing plan and enter your details to register for an account.

- Utilize US Legal Forms to quickly find the West Virginia Waiver of Notice of Organizational Meeting of Incorporators of Church Nonprofit Corporation.

- If you are already a US Legal Forms user, sign in to your account and click the Obtain button to access the West Virginia Waiver of Notice of Organizational Meeting of Incorporators of Church Nonprofit Corporation.

- You can also view forms you previously saved in the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the steps below.

- Step 1. Make sure you have selected the form for the correct city/state.

- Step 2. Use the Review option to browse through the form’s content. Remember to check the description.

Form popularity

FAQ

To waive notice in court means that a party agrees to proceed with a legal process without receiving the formal notifications typically required. This is important in ensuring that cases move forward efficiently. In the context of the West Virginia Waiver of Notice of Organizational Meeting of Incorporators of Church Nonprofit Corporation, this allows for swifter inclusion of crucial topics on a meeting’s agenda, promoting engagement and prompt decision-making.

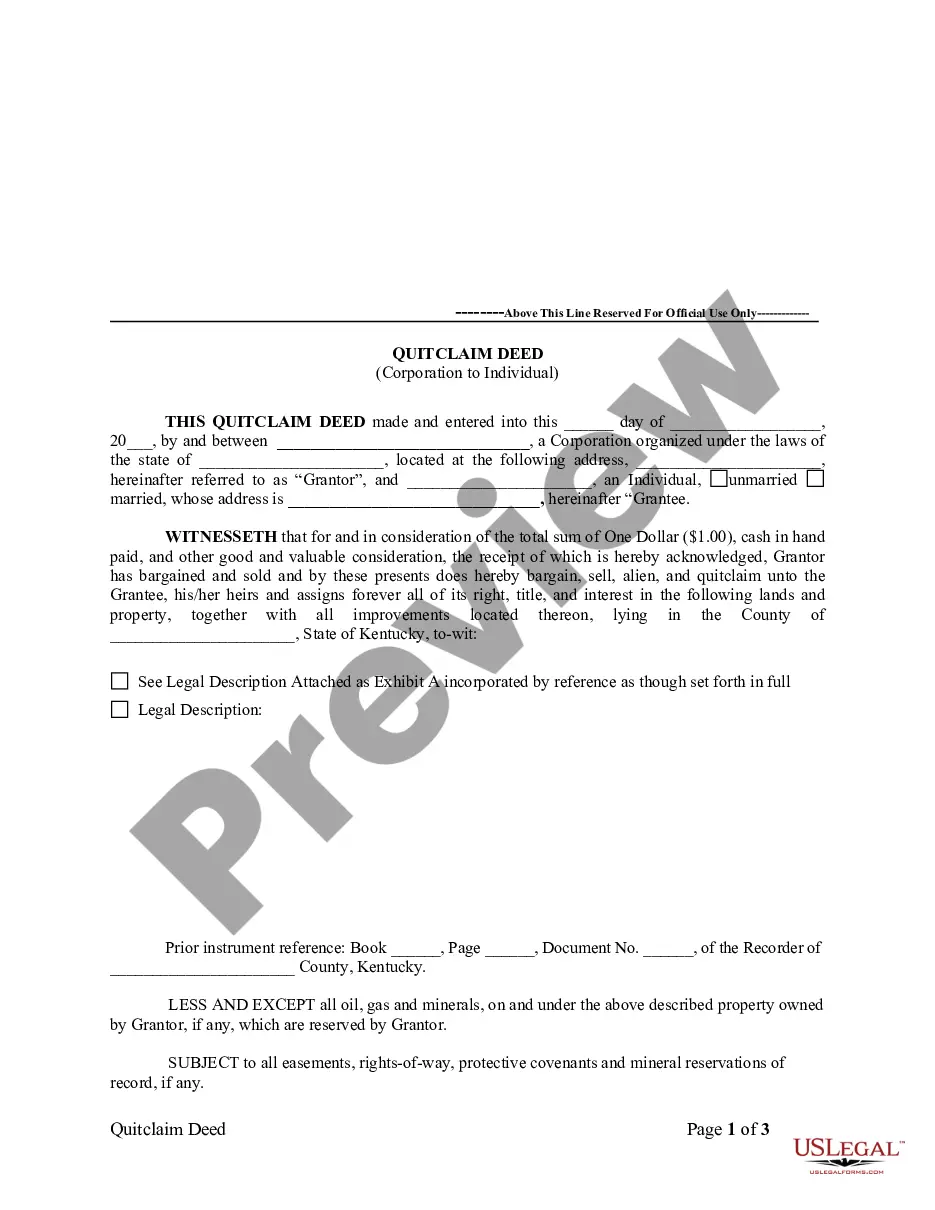

A waiver of notice is a legal document signifying that an individual or group agrees to bypass the standard notice requirements for meetings. In a West Virginia Waiver of Notice of Organizational Meeting of Incorporators of Church Nonprofit Corporation, this document helps incorporate decisions without the delays from formal notifications. It's an important tool for maintaining efficiency in nonprofit governance.

The main purpose of a waiver is to remove certain legal requirements, allowing for smoother operations within an organization. In the context of a West Virginia Waiver of Notice of Organizational Meeting of Incorporators of Church Nonprofit Corporation, it enables members to proceed with meetings without the usual formalities of notification. This facilitates quicker decision-making and encourages member participation.

A waiver of notice of meeting is a formal agreement by participants to dispense with the requirement of receiving notice about an upcoming meeting. This can happen in various organizations, including church nonprofit corporations in West Virginia. By utilizing the West Virginia Waiver of Notice of Organizational Meeting of Incorporators of Church Nonprofit Corporation, members can focus on the agenda rather than administrative details.

An example of a waiver of notice is when the incorporators of a church nonprofit corporation sign a document agreeing to forgo the formal notification of an upcoming meeting. This document serves as a West Virginia Waiver of Notice of Organizational Meeting of Incorporators of Church Nonprofit Corporation. By signing it, stakeholders express their readiness to participate in the meeting without receiving prior notice, thus streamlining the process.

While it is possible to start a nonprofit on your own, having a supportive board can make management more effective. In West Virginia, regulations require at least three directors for incorporation, which helps in diverse decision-making. Although you can lead your nonprofit as a founder, collaboration with others can enhance your organization’s credibility and effectiveness. Consider using tools like US Legal Forms to simplify your incorporation process and ensure compliance.

Starting a nonprofit organization in West Virginia involves several key steps. You should first develop a clear mission statement and gather a group of individuals who share your vision. After that, you will need to draft your articles of incorporation and include a West Virginia Waiver of Notice of Organizational Meeting of Incorporators of Church Nonprofit Corporation, if you plan to eliminate formal notice. Finally, submit your incorporation documents to the state and apply for necessary tax exemptions.

To start a nonprofit in West Virginia, you need to follow specific steps. First, gather your founding members and draft your nonprofit's bylaws. Next, file articles of incorporation with the West Virginia Secretary of State, and include your West Virginia Waiver of Notice of Organizational Meeting of Incorporators of Church Nonprofit Corporation if applicable. Finally, apply for 501(c)(3) status with the IRS to gain tax-exempt status, and ensure compliance with ongoing state and federal regulations.

A waiver of notice of a special meeting allows corporate members to forgo the standard notification requirement. In the context of the West Virginia Waiver of Notice of Organizational Meeting of Incorporators of Church Nonprofit Corporation, this document enables incorporators to proceed with important decisions without a formal meeting notice. This option streamlines the decision-making process and accelerates the establishment of nonprofit entities. Understanding this waiver can enhance your organizational efficiency.