A West Virginia Loan Agreement for Employees is a legal document that outlines the terms and conditions between an employer and an employee regarding a loan provided by the employer to the employee. This agreement serves as a written contract that defines the specific loan details, repayment terms, and any additional provisions related to the loan. The loan agreement is a vital tool for both the employer and the employee, as it ensures clarity and minimizes potential disputes regarding the loan. It protects the interests of both parties and helps maintain a healthy working relationship. This agreement also ensures compliance with West Virginia state laws and regulations governing employee loans. Key terms and provisions typically included in a West Virginia Loan Agreement for Employees may include: 1. Loan Amount: The total amount of money being loaned to the employee, which is mutually agreed upon by the employer and the employee. 2. Interest: If applicable, the agreement may specify the interest rate on the loan, which may be fixed or variable. 3. Repayment Schedule: The agreement should clearly define the repayment terms, including the frequency of payments (e.g., weekly, monthly), the due dates, and the method of payment (e.g., check, direct deposit). 4. Late Payment: This provision outlines any penalties or consequences for late payments, such as late fees or interest charges. 5. Deductions: If the loan repayment is to be deducted from the employee's wages or salary, this provision specifies the amount and duration of the deductions. 6. Default and Remedies: This section details the actions or remedies available to the employer in case of default, including acceleration of the loan, legal action, or imposing additional penalties. 7. Confidentiality: To protect the privacy of the loan agreement, this provision ensures that the terms and conditions are kept confidential between the employer and the employee. 8. Governing Law: The agreement specifies that it is governed by and interpreted in accordance with the laws of the state of West Virginia. Different types of West Virginia Loan Agreements for Employees can exist based on various factors, such as the purpose of the loan or the specific terms established by the employer. Some common types include: 1. Personal Loan Agreement: This agreement is used when an employer provides a loan to an employee for personal reasons, such as housing expenses, medical emergencies, or education purposes. 2. Advance Salary Agreement: In cases where an employee requires an advance on their salary, this type of agreement outlines the terms and conditions for receiving the advance and the repayment plan. 3. Employer-sponsored Educational Loan Agreement: This agreement is designed for employees seeking education-related financial assistance from their employer, typically covering tuition fees or training costs. It is crucial for both the employer and the employee to carefully review and understand the terms of the West Virginia Loan Agreement for Employees before signing. Seeking legal advice, if necessary, can help ensure that the agreement complies with applicable laws and protects the rights and interests of both parties involved.

West Virginia Loan Agreement for Employees

Description

How to fill out West Virginia Loan Agreement For Employees?

US Legal Forms - one of several greatest libraries of legitimate forms in the States - delivers a wide range of legitimate document layouts you are able to acquire or print out. Using the internet site, you will get a huge number of forms for business and personal reasons, categorized by groups, says, or keywords.You can get the most up-to-date variations of forms such as the West Virginia Loan Agreement for Employees within minutes.

If you already possess a membership, log in and acquire West Virginia Loan Agreement for Employees in the US Legal Forms collection. The Down load option can look on every single kind you view. You gain access to all earlier saved forms from the My Forms tab of the profile.

If you wish to use US Legal Forms for the first time, listed here are straightforward recommendations to obtain started:

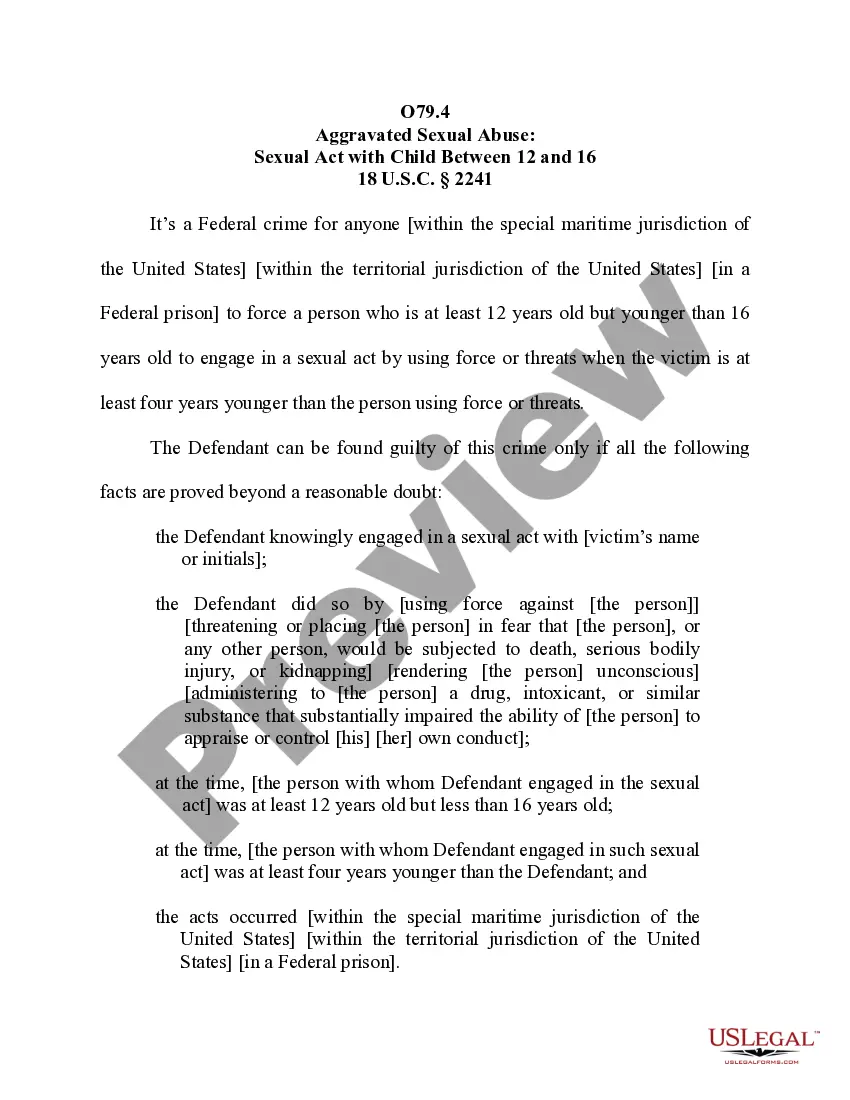

- Make sure you have selected the correct kind for the metropolis/county. Click the Review option to check the form`s content. Look at the kind information to ensure that you have selected the correct kind.

- If the kind does not fit your needs, take advantage of the Look for industry on top of the screen to discover the one which does.

- Should you be satisfied with the form, verify your selection by clicking on the Acquire now option. Then, opt for the prices program you like and offer your references to sign up on an profile.

- Method the transaction. Utilize your credit card or PayPal profile to accomplish the transaction.

- Choose the structure and acquire the form on your own system.

- Make changes. Load, change and print out and indicator the saved West Virginia Loan Agreement for Employees.

Each web template you included in your account lacks an expiration particular date and is yours forever. So, if you wish to acquire or print out another duplicate, just check out the My Forms segment and click on around the kind you want.

Obtain access to the West Virginia Loan Agreement for Employees with US Legal Forms, probably the most considerable collection of legitimate document layouts. Use a huge number of professional and state-certain layouts that meet up with your small business or personal needs and needs.

Form popularity

FAQ

The West Virginia employment contract recognizes and establishes a new business relationship between an employer and its employee. If the employment is longterm then other benefits can be discussed and implemented in the agreement.

Include key terms of the loan, such as the lender and borrower's contact information, the reason for the loan, what is being loaned, the interest rate, the repayment plan, what would happen if the borrower can't make the payments, and more. The amount of the loan, also known as the principal amount.

You must also sign a promissory note in order to borrow any money. The promissory note is a contract between you and the lender that explains in detail what is expected from you and the lender. ALWAYS READ THE PROMISSORY NOTE CAREFULLY.

Loan contracts are written agreements between financial lenders and borrowers. Both parties sign the loan contract in writing in case one of the parties breaches the contract. This agreement states that the borrower will repay the loan and that the lender will give the borrower money.

The two sides must sign a promissory note that spells out the interest rate, terms and conditions, length of repayment period, and ability to transfer the loan to another party.

A Loan Agreement is a legal contract regulating the terms and conditions of a loan, and can be used by both individuals and corporations to lend or borrow money. Shareholders can also draft a Loan Agreement to borrow money from a corporation.

There are 10 basic provisions that should be in a loan agreement. Identity of the parties. The names of the lender and borrower need to be stated. ... Date of the agreement. ... Interest rate. ... Repayment terms. ... Default provisions. ... Signatures. ... Choice of law. ... Severability.

What should be in a personal loan contract? Names and addresses of the lender and the borrower. Information about the loan co-borrower or cosigner, if it's a joint personal loan. Loan amount and the method for disbursement (lump sum, installments, etc.) Date the loan was provided. Expected repayment date.