West Virginia Surety Agreement

Description

How to fill out Surety Agreement?

If you want to finalize, obtain, or produce legitimate document templates, utilize US Legal Forms, the richest collection of legal forms, which is accessible online.

Employ the site's straightforward and user-friendly search to locate the documents you require.

A selection of templates for business and personal purposes are categorized by types and titles, or keywords. Utilize US Legal Forms to locate the West Virginia Surety Agreement in just a few clicks.

Every legal document template you obtain is yours forever. You have access to every form you downloaded within your account. Choose the My documents section and select a form to print or download again.

Complete and acquire, and print the West Virginia Surety Agreement with US Legal Forms. There are countless professional and state-specific forms you can utilize for your business or personal needs.

- If you are already a US Legal Forms subscriber, sign in to your account and click the Acquire button to obtain the West Virginia Surety Agreement.

- You can also find forms you previously downloaded in the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the instructions below.

- Step 1. Ensure you have chosen the form for the correct city/state.

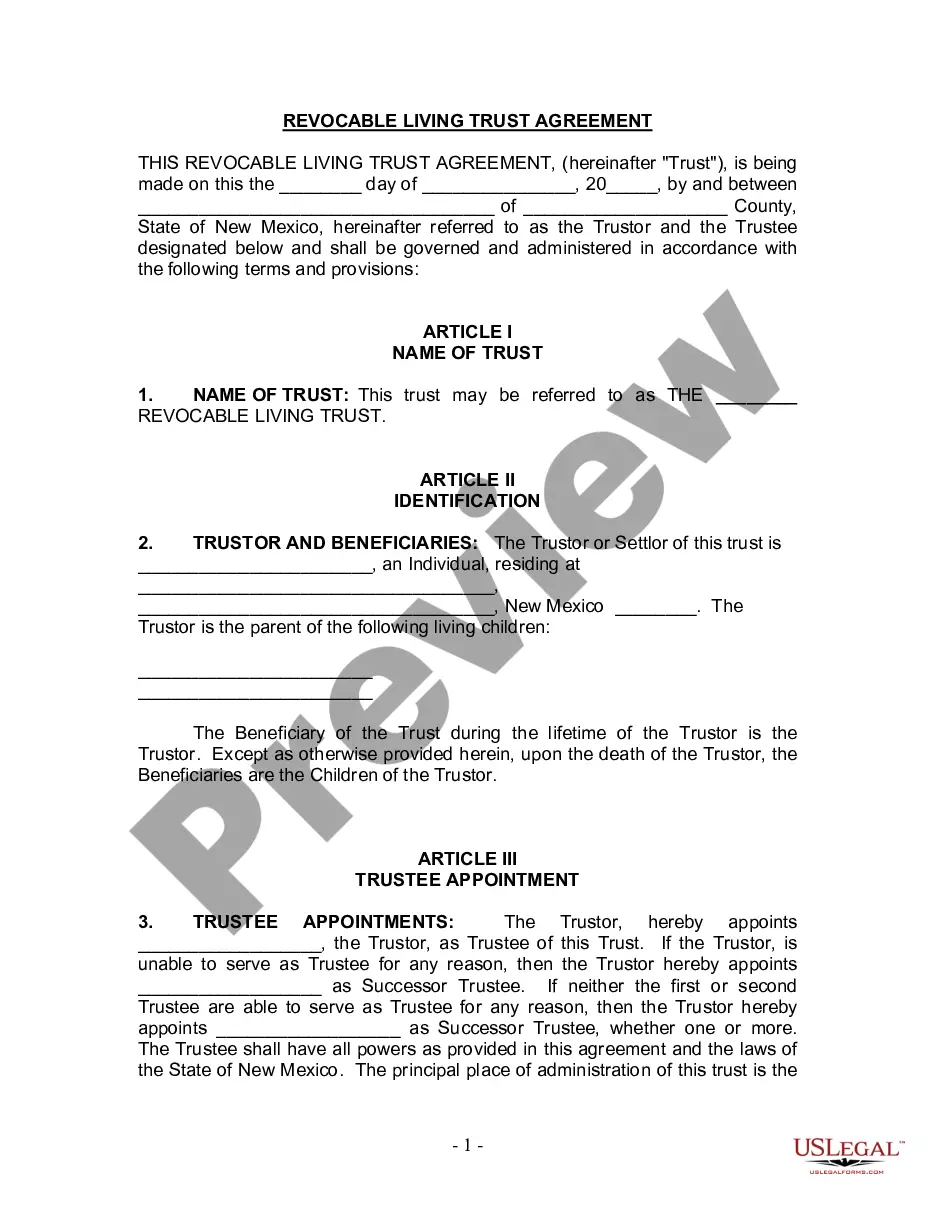

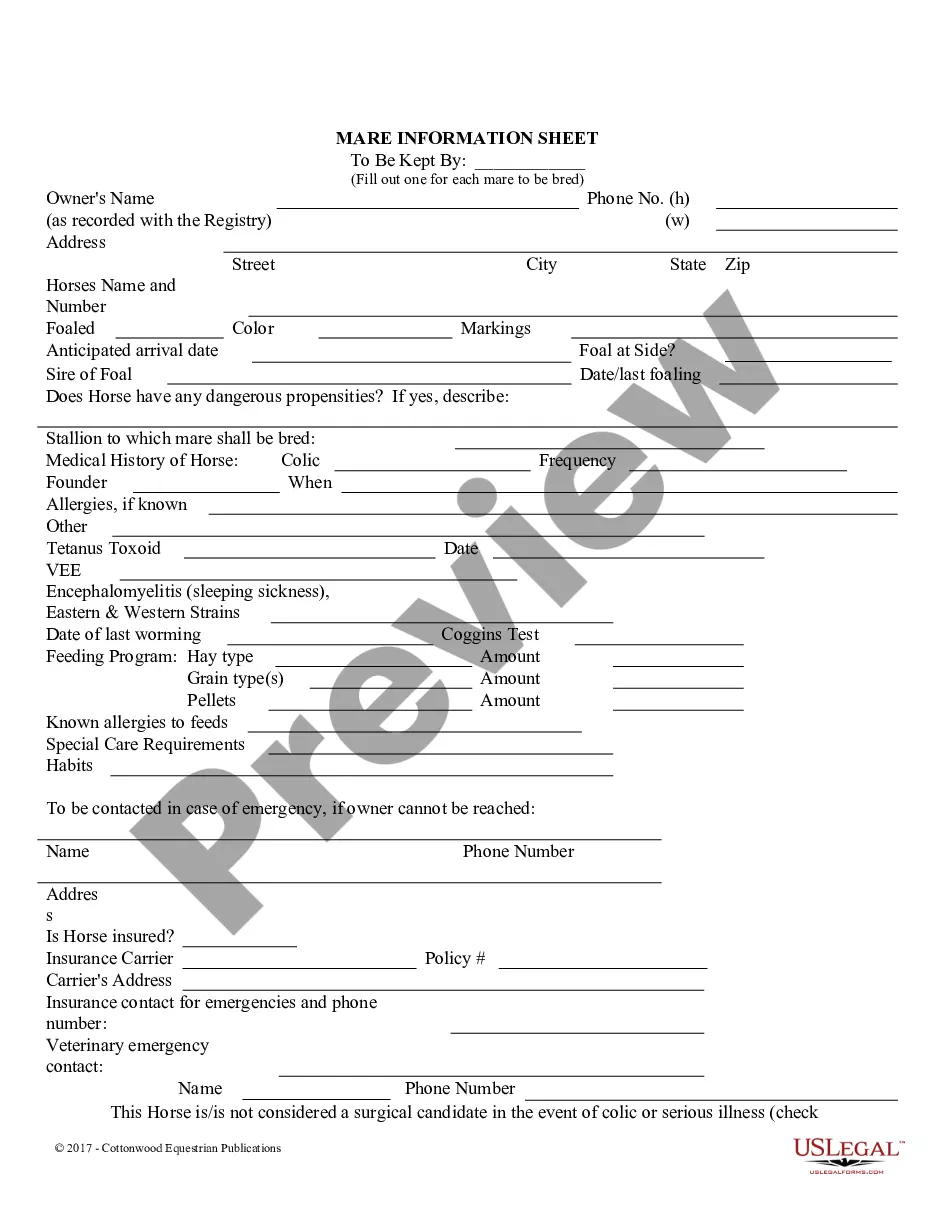

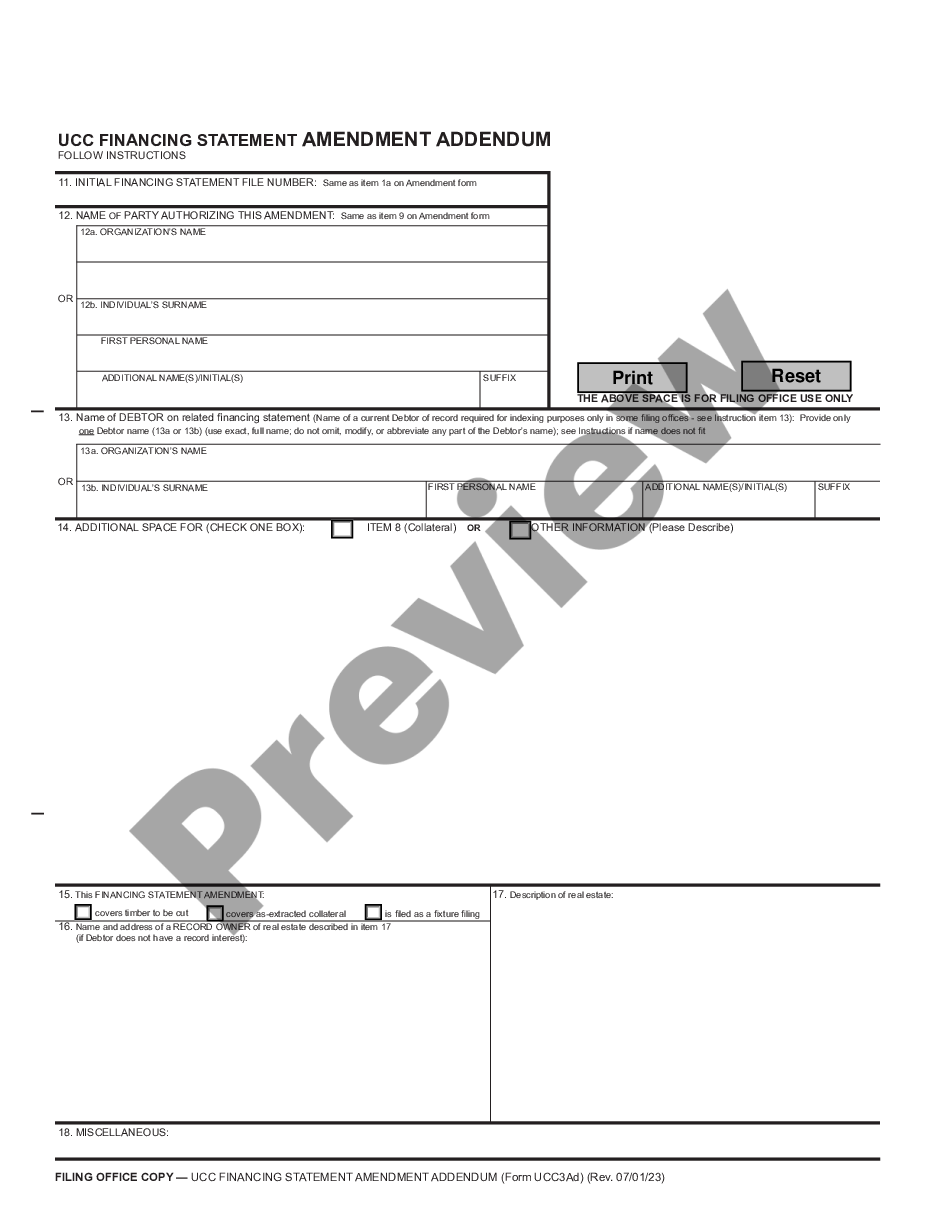

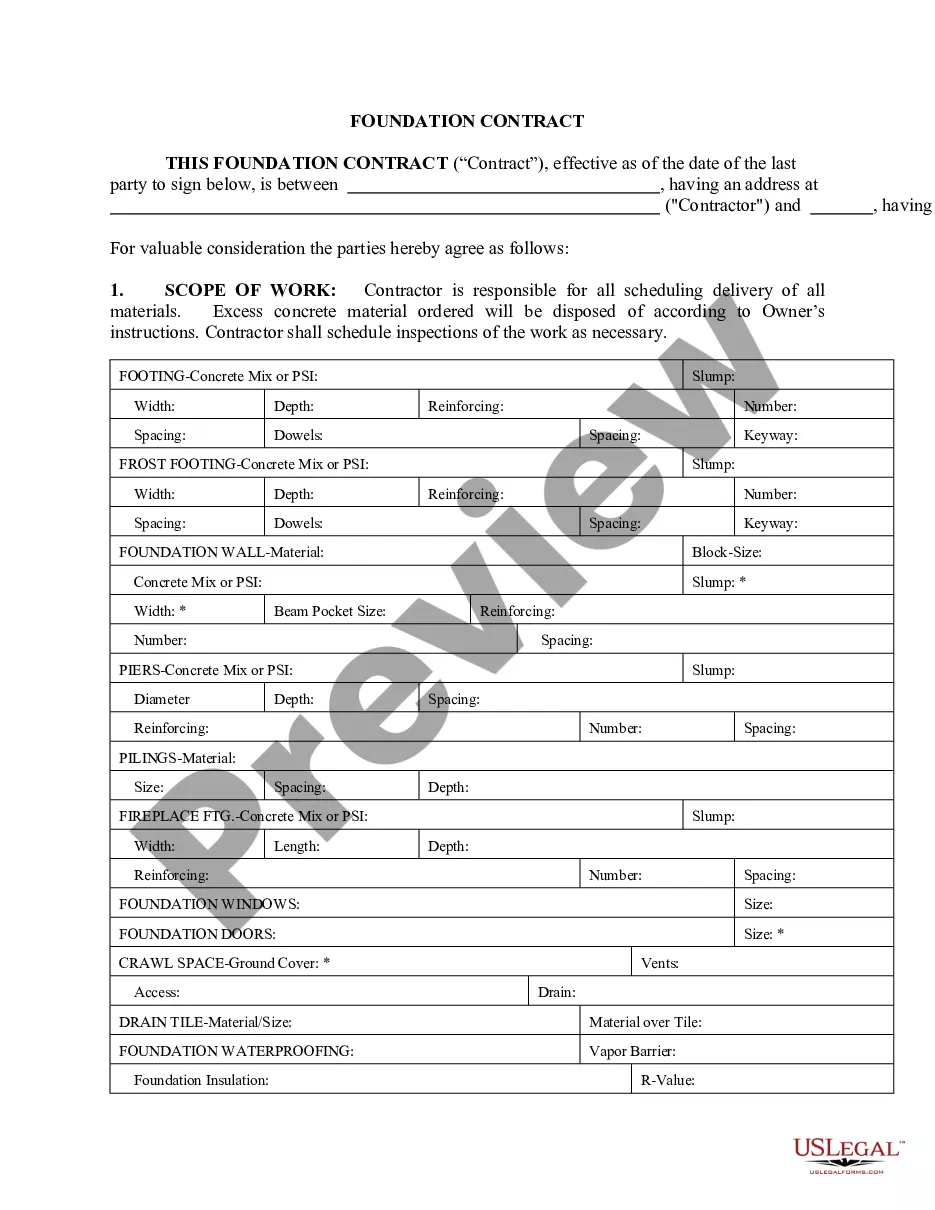

- Step 2. Use the Preview option to review the form's content. Don't forget to check the summary.

- Step 3. If you are not satisfied with the form, use the Search field at the top of the screen to find other types in the legal form collection.

- Step 4. Once you have found the form you need, click the Acquire now button. Choose the payment plan you prefer and enter your credentials to register for an account.

- Step 5. Process the transaction. You can use your credit card or PayPal account to complete the purchase.

- Step 6. Select the format of the legal form and download it to your device.

- Step 7. Complete, modify and print or sign the West Virginia Surety Agreement.

Form popularity

FAQ

Someone who assumes direct liability for another's obligation. Financial creditors may require the debtor to find a surety, who then signs the loan agreement along with the debtor.

Obtaining a Replacement TitleBring your current registration card and your driver's license or ID card to your local customer service center. Complete either an "Application for Transfer and Supplemental Liens (VSA 66) or an "Application for Replacement and Substitute Titles" (VSA 67).

How do Virginia Residents Obtain a Bonded Title?Step 1 Contact the DWR. Bonded title applicants in Virginia should contact the Department of Wildlife Resources (DWR) prior to purchasing a surety bond.Step 2 Purchase a Surety Bond.Step 3 Complete the Application.28-Sept-2021

The surety is the guarantee of the debts of one party by another. A surety is an organization or person that assumes the responsibility of paying the debt in case the debtor policy defaults or is unable to make the payments. The party that guarantees the debt is referred to as the surety, or as the guarantor.

Surety Explained in Detail A surety bond is a legal binding agreement signed between three partiesthe lender, the trustee, and the guarantor. The obligee, generally a government agency, allows the principal to receive a security bond as a protection against future work output, normally a business owner or contractor.

When you receive a job offer and start date, your employer will need to contact the Virginia Bond Coordinator to have a bond issued. A public service agency can also request a bond on your behalf by using the bond request form or by contacting the Virginia Bonding Program Coordinator.

These bond types are also referred to as commercial bonds" or business bonds." Examples of license and permit surety bonds include auto dealer bonds, mortgage broker bonds, and collection agency bonds.

A bonded title, also known as a Certificate of Title Surety Bond or Lost Title Bond, is a document that establishes who owns a car. A bonded title can be used instead of a traditional car title to register a vehicle with the Department of Motor Vehicles (DMV), get insurance for the vehicle, or sell the vehicle.

The surety is the guarantee of the debts of one party by another. A surety is an organization or person that assumes the responsibility of paying the debt in case the debtor policy defaults or is unable to make the payments. The party that guarantees the debt is referred to as the surety, or as the guarantor.