A West Virginia Qualified Domestic Trust Agreement, often referred to as a DOT, is a legal tool used for estate planning purposes in West Virginia. It is designed specifically for non-citizen spouses who inherit assets from their citizen spouses. This agreement allows the non-citizen spouse to defer any estate tax liability until the time when the inherited assets are distributed from the trust. Under federal tax laws, when a non-citizen spouse inherits assets from a citizen spouse, the estate tax exemption applicable to citizens is not applicable to them. This exemption allows a certain amount of assets to pass free of estate tax. However, the DOT agreement helps solve this issue by providing an opportunity to qualify for the exemption. The West Virginia Qualified Domestic Trust Agreement is drafted by an attorney specialized in estate planning and must meet certain requirements set by the Internal Revenue Service (IRS). The trust agreement must designate a qualified U.S. trustee, who may be an individual or an institution, with the responsibility to ensure tax compliance and administration of the trust. To qualify as a DOT, the trust agreement must include provisions such as mandatory distributions of income, which must be reported for income tax purposes, and limitations on distribution of principal. Additionally, it must contain a provision that any distribution from the trust is subject to U.S. estate tax. However, it is important to note that there are no specific different types of West Virginia Qualified Domestic Trust Agreements. The DOT agreement is a uniform concept, but its terms and provisions can be tailored to meet the specific needs and circumstances of the individuals involved. In conclusion, a West Virginia Qualified Domestic Trust Agreement (DOT) is an essential estate planning tool for non-citizen spouses inheriting assets from citizen spouses. It allows the non-citizen spouse to defer estate tax liability until distributions are made from the trust. Although there are no distinct types of DOT agreements in West Virginia, each agreement can be individually customized to suit the particular requirements of the parties involved.

West Virginia Qualified Domestic Trust Agreement

Description

How to fill out West Virginia Qualified Domestic Trust Agreement?

It is possible to spend time on-line attempting to find the lawful document web template which fits the federal and state requirements you will need. US Legal Forms gives a huge number of lawful varieties which are evaluated by specialists. It is possible to down load or printing the West Virginia Qualified Domestic Trust Agreement from the service.

If you already have a US Legal Forms accounts, you can log in and click the Obtain switch. Next, you can total, modify, printing, or sign the West Virginia Qualified Domestic Trust Agreement. Every lawful document web template you purchase is your own for a long time. To obtain another backup of any obtained develop, visit the My Forms tab and click the corresponding switch.

Should you use the US Legal Forms website for the first time, follow the basic directions listed below:

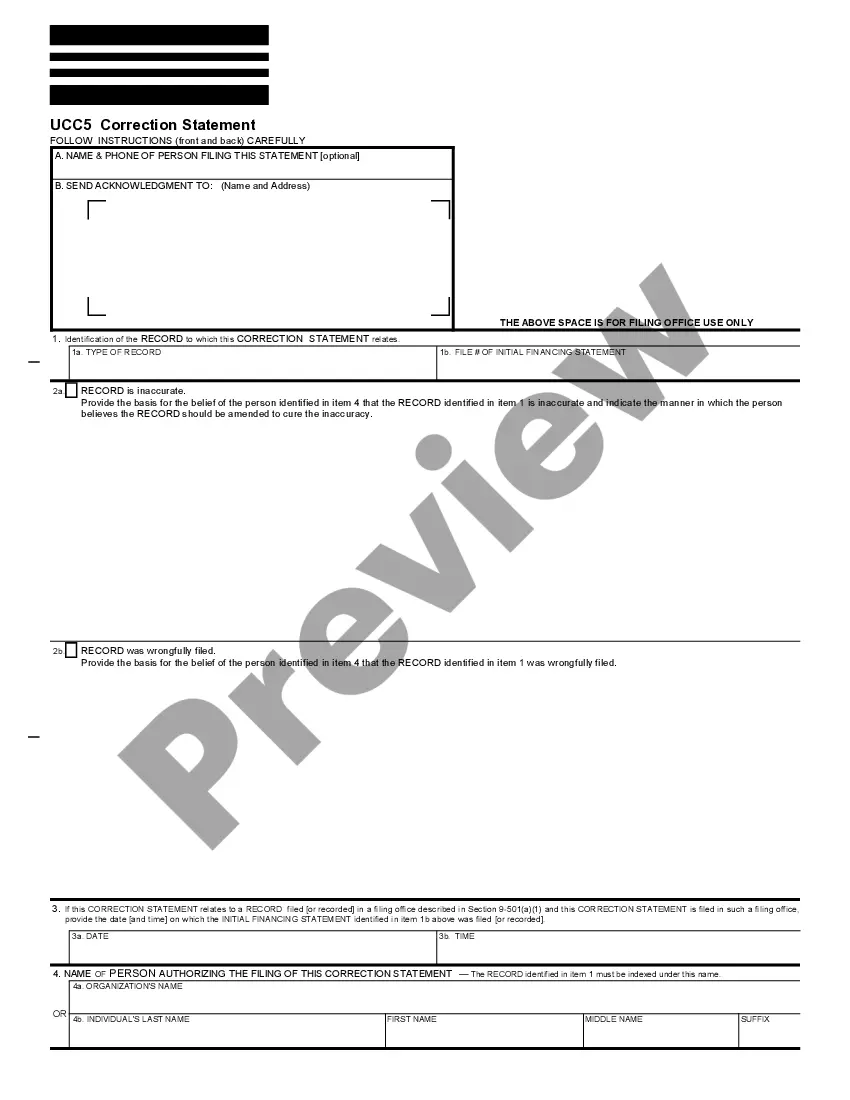

- First, make sure that you have chosen the proper document web template for that state/city of your choosing. Browse the develop description to make sure you have chosen the right develop. If available, use the Review switch to check throughout the document web template too.

- If you wish to find another edition of the develop, use the Search discipline to obtain the web template that suits you and requirements.

- Upon having discovered the web template you desire, simply click Acquire now to proceed.

- Select the pricing plan you desire, key in your qualifications, and sign up for an account on US Legal Forms.

- Comprehensive the deal. You can use your Visa or Mastercard or PayPal accounts to fund the lawful develop.

- Select the formatting of the document and down load it to your device.

- Make changes to your document if required. It is possible to total, modify and sign and printing West Virginia Qualified Domestic Trust Agreement.

Obtain and printing a huge number of document themes using the US Legal Forms web site, which offers the biggest collection of lawful varieties. Use expert and state-specific themes to deal with your business or individual demands.