West Virginia Joint Trust with Income Payable to Trustors During Joint Lives

Description

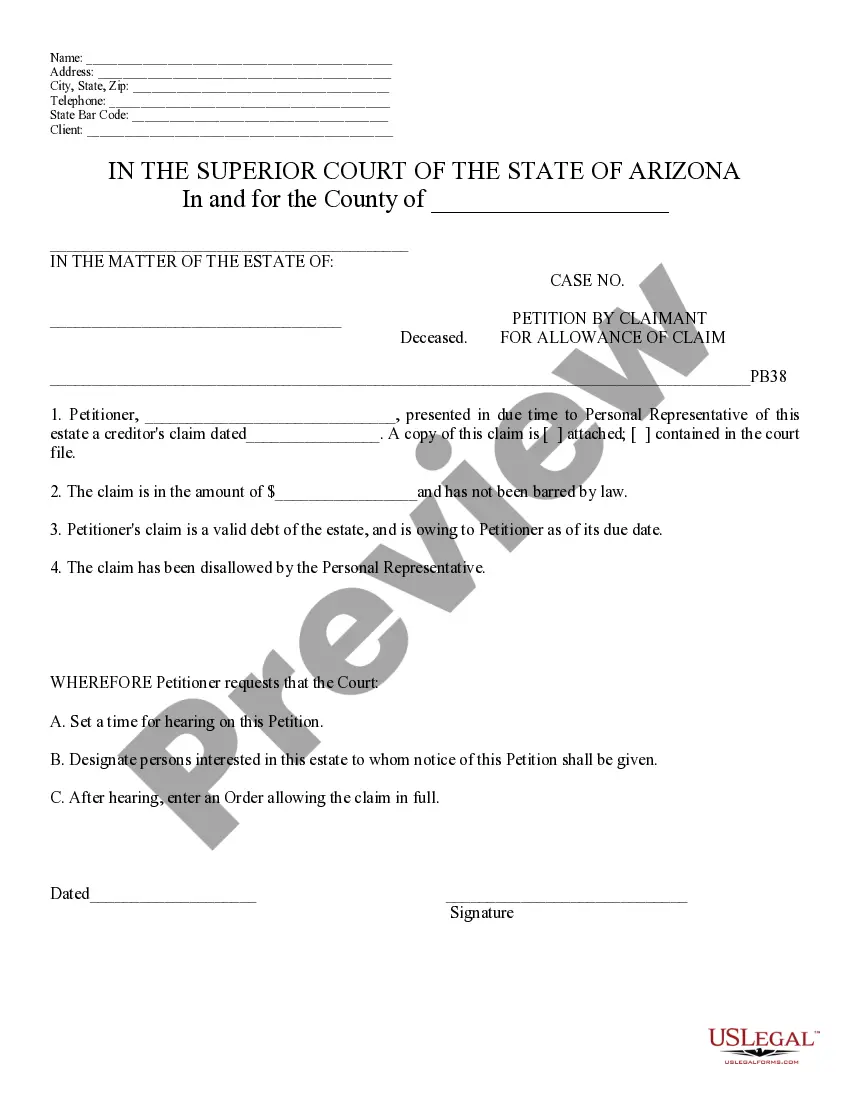

How to fill out Joint Trust With Income Payable To Trustors During Joint Lives?

US Legal Forms - one of the largest collections of legal documents in the United States - offers a vast array of legal form templates that you can download or create.

By utilizing the site, you can access thousands of forms for business and personal purposes, categorized by types, states, or keywords. You can find the latest editions of forms such as the West Virginia Joint Trust with Income Payable to Trustors During Joint Lives in just a few minutes.

If you already possess a subscription, Log In to obtain the West Virginia Joint Trust with Income Payable to Trustors During Joint Lives from the US Legal Forms library. The Download button will be available on each form you view. You can also find all previously downloaded forms in the My documents section of your account.

Complete the financial transaction using your credit card or PayPal account.

Select the format and download the form to your device. Edit it as needed. Fill out, modify, print, and sign the downloaded West Virginia Joint Trust with Income Payable to Trustors During Joint Lives. Each template you add to your account has no expiration date and remains yours indefinitely. Therefore, if you would like to download or print another copy, simply visit the My documents section and click on the form you need. Access the West Virginia Joint Trust with Income Payable to Trustors During Joint Lives from US Legal Forms, the most extensive collection of legal document templates. Utilize a multitude of professional and state-specific templates that meet your personal or organizational needs and requirements.

- First, ensure you have selected the correct form for your city/state.

- Click the Preview button to review the content of the form.

- Check the description of the form to confirm it is the correct one.

- If the form does not meet your needs, utilize the Search bar at the top of the page to find one that does.

- Once satisfied with the form, confirm your choice by clicking the Acquire now button.

- Then, choose your preferred pricing plan and provide your credentials to create an account.

Form popularity

FAQ

The Joint Trust. Typically, when a married couple utilizes a Revocable Living Trust based estate plan, each spouse creates and funds his or her own separate Revocable Living Trust. This results in two trusts.

A joint revocable trust is a single trust document that two persons establish to hold title to assets which they typically own together as a married couple. While both spouses are alive and competent, they both retain full control of the trust assets and can change the trust at any time.

The West Virginia living trust is an agreement created by a person (Grantor) so they may protect and continue to use their assets while they're alive and, when they die, the Beneficiaries are able to claim the assets left to them outside of probate.

What happens in this type of trust is that the trust is a joint revocable trust when both spouses are alive. When one of the spouses dies, the trust will then split into two trusts automatically. Each trust will have half the assets of the trust along with the separate property of the spouse.

After one spouse dies, the surviving spouse is free to amend the terms of the trust document that deal with his or her property, but can't change the parts that determine what happens to the deceased spouse's trust property.

A joint revocable trust is a single trust document that two persons establish to hold title to assets which they typically own together as a married couple. While both spouses are alive and competent, they both retain full control of the trust assets and can change the trust at any time.

What happens in this type of trust is that the trust is a joint revocable trust when both spouses are alive. When one of the spouses dies, the trust will then split into two trusts automatically. Each trust will have half the assets of the trust along with the separate property of the spouse.

In general, most experts agree that Separate Trusts can provide more asset protection. Joint Trust: Marital assets are all together in a single trust. This means there's less asset protection, because if there's ever a judgment over one of the spouses, all of the assets could end up being at risk.

If you created a revocable living trust with your spouse, you can change the whole trust or part of the trust following the his or her death. A living trust allows to you make any changes to the terms by creating amendments or by creating a new trust entirely.