West Virginia Sample Letter for Employee Automobile Expense Allowance

Description

How to fill out Sample Letter For Employee Automobile Expense Allowance?

Selecting the appropriate legitimate document template may be challenging. Clearly, there are numerous templates accessible online, but how can you find the official form you require? Utilize the US Legal Forms website. The service offers thousands of templates, including the West Virginia Sample Letter for Employee Automobile Expense Allowance, suitable for business and personal use. All forms are reviewed by experts and comply with federal and state regulations.

If you are already registered, Log In to your account and click the Download button to obtain the West Virginia Sample Letter for Employee Automobile Expense Allowance. Use your account to browse through the legal forms you have previously purchased. Visit the My documents section of your account and retrieve another copy of the documents you need.

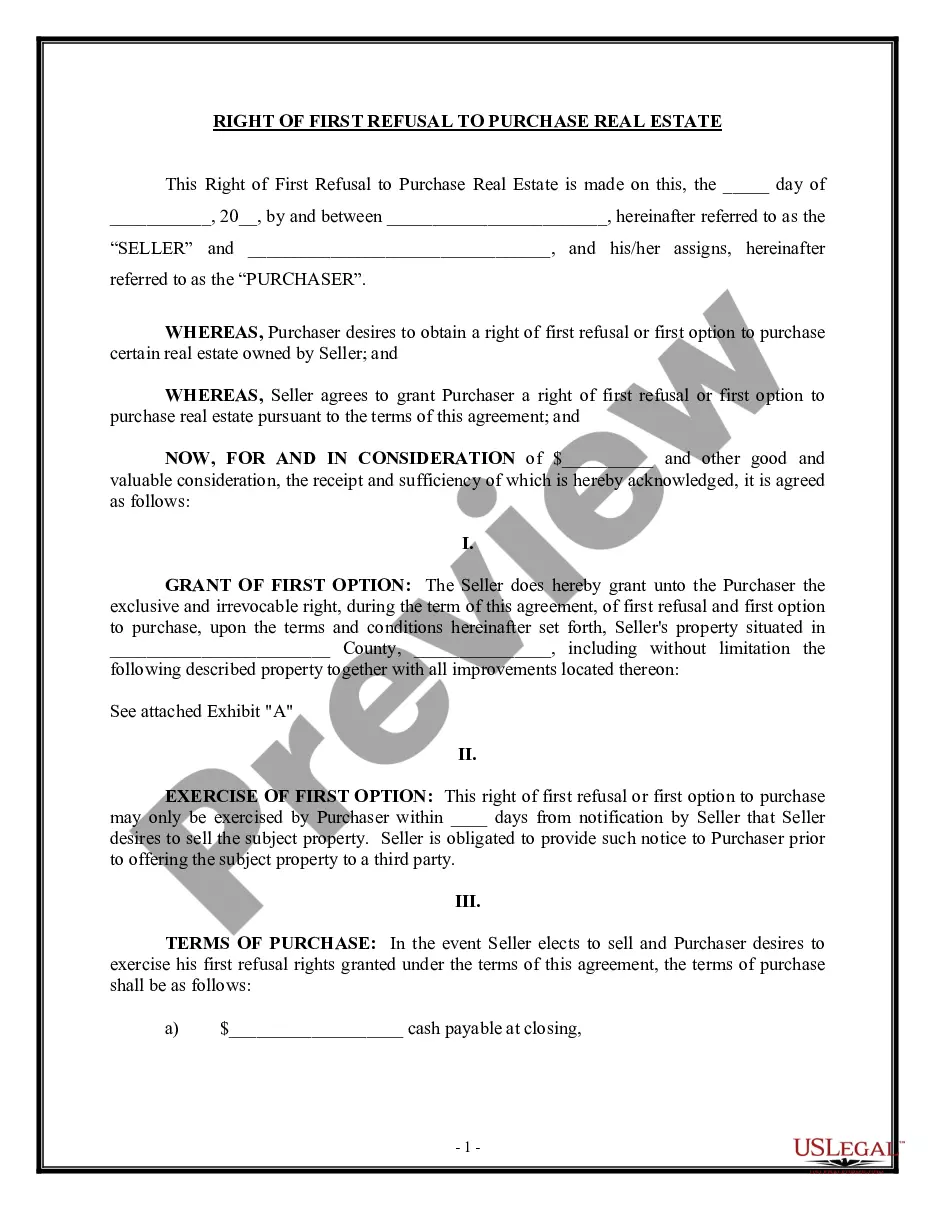

If you are a new user of US Legal Forms, here are some straightforward steps you should follow: First, ensure you have selected the correct form for your specific city or county. You can review the form using the Preview option and examine the form description to confirm it is the correct one for you.

US Legal Forms is the largest repository of legal forms where you can find numerous document templates. Utilize the service to download well-crafted documents that meet state requirements.

- If the form does not fulfill your needs, use the Search field to locate the appropriate form.

- Once you are confident that the form is suitable, click the Buy now button to acquire the form.

- Choose the payment plan you prefer and provide the necessary details.

- Create your account and pay for the order using your PayPal account or a credit card.

- Select the document format and download the legal document template to your device.

- Complete, modify, print, and sign the received West Virginia Sample Letter for Employee Automobile Expense Allowance.

Form popularity

FAQ

Form IT-140 is the personal income tax return that West Virginia residents must complete to report their income and calculate tax liabilities. This form covers various income types and deductions available for residents. If you include expenses documented by resources like a West Virginia Sample Letter for Employee Automobile Expense Allowance, ensure they are accurately reported to maximize your tax benefits.

A car allowance is a set amount that you give to your employees to cover a period of time. This car allowance is intended to cover typical costs of owning a vehicle, such as maintenance, wear-and-tear, insurance, fuel and depreciation.

A standard vehicle allowance is a monthly compensation for the costs of using a motor vehicle for work. This payment is typically part of a paycheck. It's up to the employee whether to put that money toward a car payment or to use it to defray gas expense, wear and tear, and other car costs.

A car allowance is taxable unless you substantiate business use of the payment. You can avoid taxation if you track business mileage and demonstrate that the allowance never exceeds the equivalent of the IRS business mileage rate ($. 585 per mile for 2022). This is called a mileage allowance, or mileage substantiation.

Using a standard vehicle of a certain age, you can generally predict the yearly maintenance costs for each band of miles driven. Divide it by 12, and you've got the monthly amount.

Because a standard car allowance is a non-accountable plan, it should be taxed fully as W-2 income. The employer should withhold federal income taxes, FICA/Medicare taxes, and (if applicable) state income taxes on the full allowance amount. The car allowance should be taxed at the employee's income bracket.

A fixed monthly car allowance is considered taxable income at federal and state levels. Both employee and employer must also pay FICA/Medicare taxes on the allowance. A typical car allowance may be reduced by 3040% after all these taxes.

A car allowance is a one-time cash sum you can use to buy a personal vehicle. The choice of vehicle is usually up to you. Yet, your employer may give you the minimum specifications for the vehicle. These specifications may include age, CO2 emissions, number of seats and more.

2021 Average Car Allowance The average car allowance in 2021 is $575. And, believe it or not, the average car allowance in 2020 was also $575. This allowance may be greater for different positions in the company. Executives for example may receive an allowance of around $800.

A company car can be great for those who commute lots of miles to benefit as the vehicle is paid for meaning you don't have to worry about unexpected costs. Car allowance is less common but offers more flexibility as the money can be used to purchase a new set of wheels or pay its running costs.