West Virginia Partnership Agreement for Startup

Description

How to fill out Partnership Agreement For Startup?

Finding the appropriate legal document format can be a challenge.

Certainly, there are multiple templates available online, but how do you locate the legal form you require.

Utilize the US Legal Forms website. The service offers numerous templates, including the West Virginia Partnership Agreement for Startup, which can be utilized for both business and personal needs.

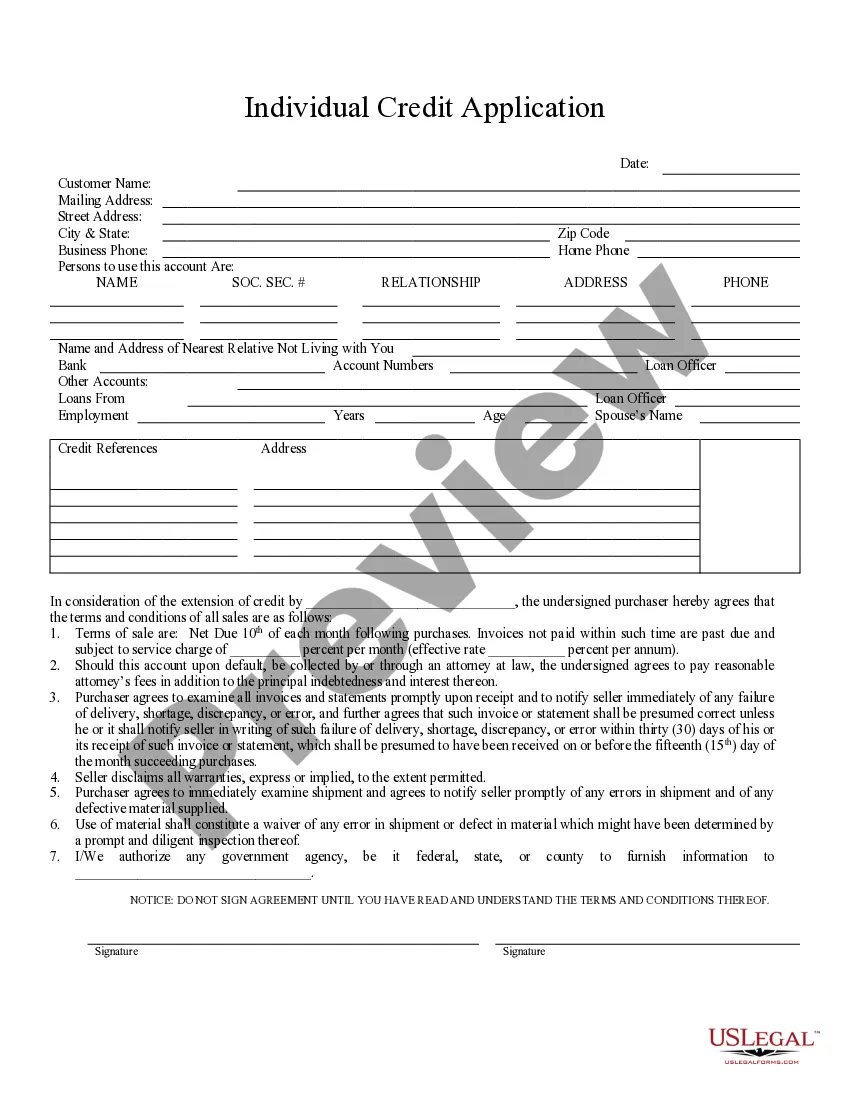

If the form does not satisfy your requirements, use the Search area to find the suitable form. Once you are certain the form is correct, click the Get now button to acquire the form. Choose the pricing plan you prefer and provide the necessary details. Create your account and pay for the order using your PayPal account or credit card. Select the document format and download the legal document format to your device. Complete, edit, print, and sign the acquired West Virginia Partnership Agreement for Startup. US Legal Forms is the largest repository of legal forms where you can find various paperwork templates. Utilize the service to download professionally crafted documents that comply with state requirements.

- All of the forms are reviewed by experts and comply with federal and state regulations.

- If you are already registered, Log In to your account and click the Download button to retrieve the West Virginia Partnership Agreement for Startup.

- Use your account to search through the legal forms you have previously ordered.

- Navigate to the My documents tab of your account and obtain another copy of the paperwork you need.

- If you are a new user of US Legal Forms, here are simple instructions for you to follow.

- First, ensure you have selected the correct form for your region/area. You can review the form using the Review button and read the form details to confirm this is the right one for you.

Form popularity

FAQ

A sales tax permit can be obtained by registering online through the WV State Tax Department or by mailing the Business Registration Application (Form WV/BUS-APP). Information needed to register includes: Federal Employer Identification Number (FEIN), or SSN if a sole proprietorship with no employees.

If you operate a business the IRS may require you to obtain an Employee Identification Number (EIN), which is also referred to as your business tax ID number. Each EIN is unique in the same way that your Social Security number is.

The fee for obtaining a Business Registration Certificate is $30.00. A separate certificate is required for each fixed business location from which property or services are offered for sale or lease or at which customer accounts may be opened, closed, or serviced. The Business Registration fee cannot be prorated.

Apply for an EIN with the IRS assistance tool. It will guide you through questions and ask for your name, social security number, address, and your "doing business as" (DBA) name. Your nine-digit federal tax ID becomes available immediately upon verification.

Apply for a Virginia Tax ID (EIN) Number Online To begin your application select the type of organization or entity you are attempting to obtain a Tax ID (EIN) Number in Virginia for. After completing the application you will receive your Tax ID (EIN) Number via e-mail.

West Virginia does permit the use of a blanket resale certificate, which means a single certificate on file with the vendor can be re-used for all exempt purchases made from that vendor. A new certificate does not need to be made for each transaction.

Every West Virginia LLC owner should have an operating agreement in place to protect the operations of their business. While not legally required by the state, having an operating agreement will set clear rules and expectations for your LLC while establishing your credibility as a legal entity.

How to get a sales tax permit in West Virginia. You can complete the form WV/BUS-APP found in this booklet or register online at Business for West Virginia. You need this information to register for a sales tax permit in West Virginia: Personal identification info (SSN, address, etc.)

The West Virginia Tax Identification Number is your nine character ID number plus a three digit adjustment code. Personal Income Tax filers should enter '000' in this field. Business filers are defaulted to '001'.

To request the SS-4 forms to obtain a taxpayer identification number from the Internal Revenue Service, call 1-800-829-4933. You may apply for your FEIN by mail or by calling the 800 number above or by visiting the website .