West Virginia Partnership Agreement for Restaurant Business

Description

How to fill out Partnership Agreement For Restaurant Business?

It is possible to commit several hours online trying to find the lawful record template which fits the federal and state needs you want. US Legal Forms supplies a huge number of lawful types which are reviewed by pros. It is possible to acquire or print the West Virginia Partnership Agreement for Restaurant Business from my support.

If you already have a US Legal Forms accounts, you may log in and then click the Obtain button. After that, you may full, change, print, or indication the West Virginia Partnership Agreement for Restaurant Business. Every lawful record template you get is the one you have for a long time. To get an additional copy associated with a obtained develop, check out the My Forms tab and then click the corresponding button.

If you are using the US Legal Forms web site for the first time, keep to the simple directions listed below:

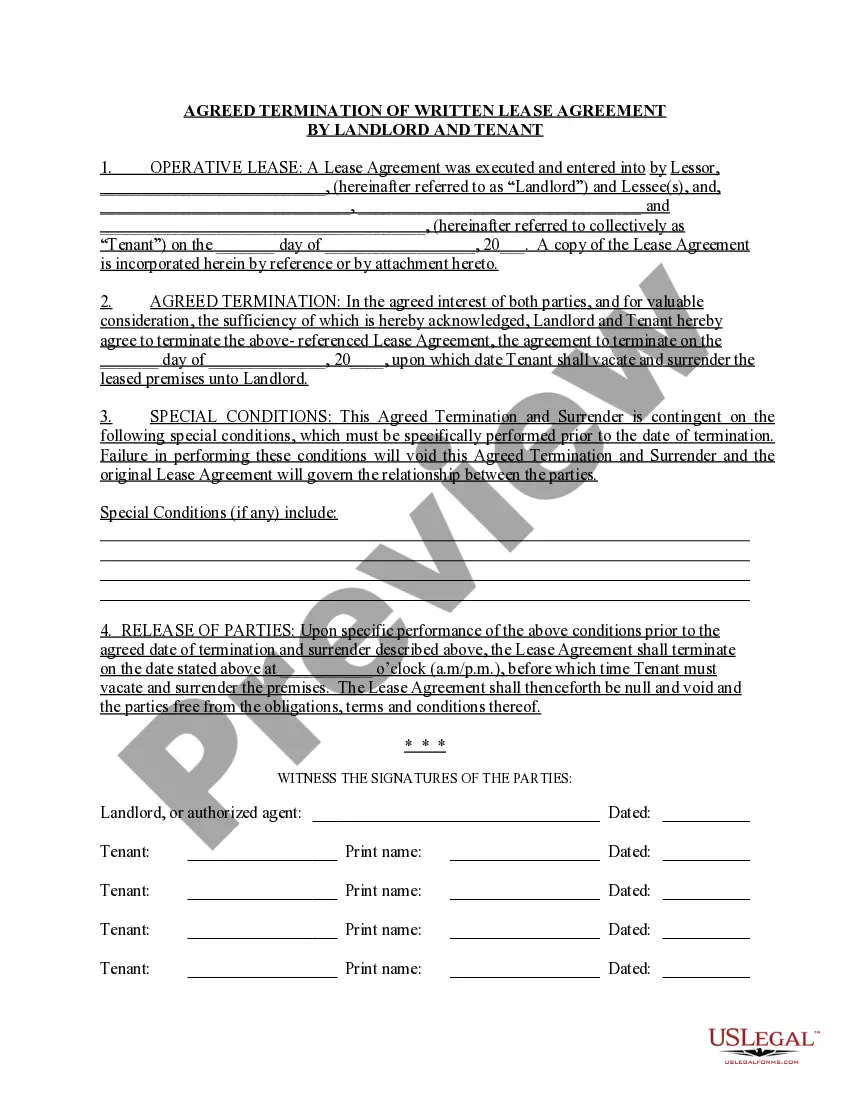

- First, be sure that you have chosen the correct record template for your county/town of your liking. Look at the develop explanation to ensure you have picked out the correct develop. If accessible, use the Review button to search from the record template as well.

- In order to locate an additional model of your develop, use the Research discipline to get the template that fits your needs and needs.

- Once you have discovered the template you need, simply click Buy now to carry on.

- Select the pricing strategy you need, type your references, and register for your account on US Legal Forms.

- Comprehensive the transaction. You should use your credit card or PayPal accounts to purchase the lawful develop.

- Select the structure of your record and acquire it for your product.

- Make adjustments for your record if required. It is possible to full, change and indication and print West Virginia Partnership Agreement for Restaurant Business.

Obtain and print a huge number of record web templates utilizing the US Legal Forms Internet site, that offers the greatest selection of lawful types. Use specialist and condition-distinct web templates to tackle your business or personal requirements.

Form popularity

FAQ

An LLC operating agreement is a document that customizes the terms of a limited liability company according to the specific needs of its members. It also outlines the financial and functional decision-making in a structured manner. It is similar to articles of incorporation that govern the operations of a corporation.

Every West Virginia LLC owner should have an operating agreement in place to protect the operations of their business. While not legally required by the state, having an operating agreement will set clear rules and expectations for your LLC while establishing your credibility as a legal entity.

Written partnership agreements protect the company and each partner's investment in it. If there is no written partnership agreement, partners are not allowed to draw a salary. Instead, they share the profits and losses in the business equally.

A partnership agreement is a foundational document and is legally binding on all partners. The agreement outlines the business's day-to-day operations and the rights and responsibilities of each partner. In this way, the document is not unlike a set of corporate bylaws.

Virginia does not require an operating agreement in order to form an LLC, but executing one is highly advisable.

California LLCs are required to have an Operating Agreement. This agreement can be oral or written. If it's written, the agreementsand all amendments to itmust be kept with the company's records. Limited Liability Companies in New York must have a written Operating Agreement.

A Partnership is defined by the Indian Partnership Act, 1932, as 'the relation between persons who have agreed to share profits of the business carried on by all or any of them acting for all'. Agreement is the essential part of partnership business. It secure the right of both party.

These are the four types of partnerships.General partnership. A general partnership is the most basic form of partnership.Limited partnership. Limited partnerships (LPs) are formal business entities authorized by the state.Limited liability partnership.Limited liability limited partnership.

A partnership operating agreement is a document that outlines the roles, responsibilities, and rights of the owners and managers of a partnership. It states the rules and regulations governing many aspects of the organization, ranging from voting powers to profit and loss distribution.

Why do you need an operating agreement? To protect the business' limited liability status: Operating agreements give members protection from personal liability to the LLC. Without this specific formality, your LLC can closely resemble a sole proprietorship or partnership, jeopardizing your personal liability.