West Virginia Sample Letter for Insufficient Amount to Reinstate Loan

Description

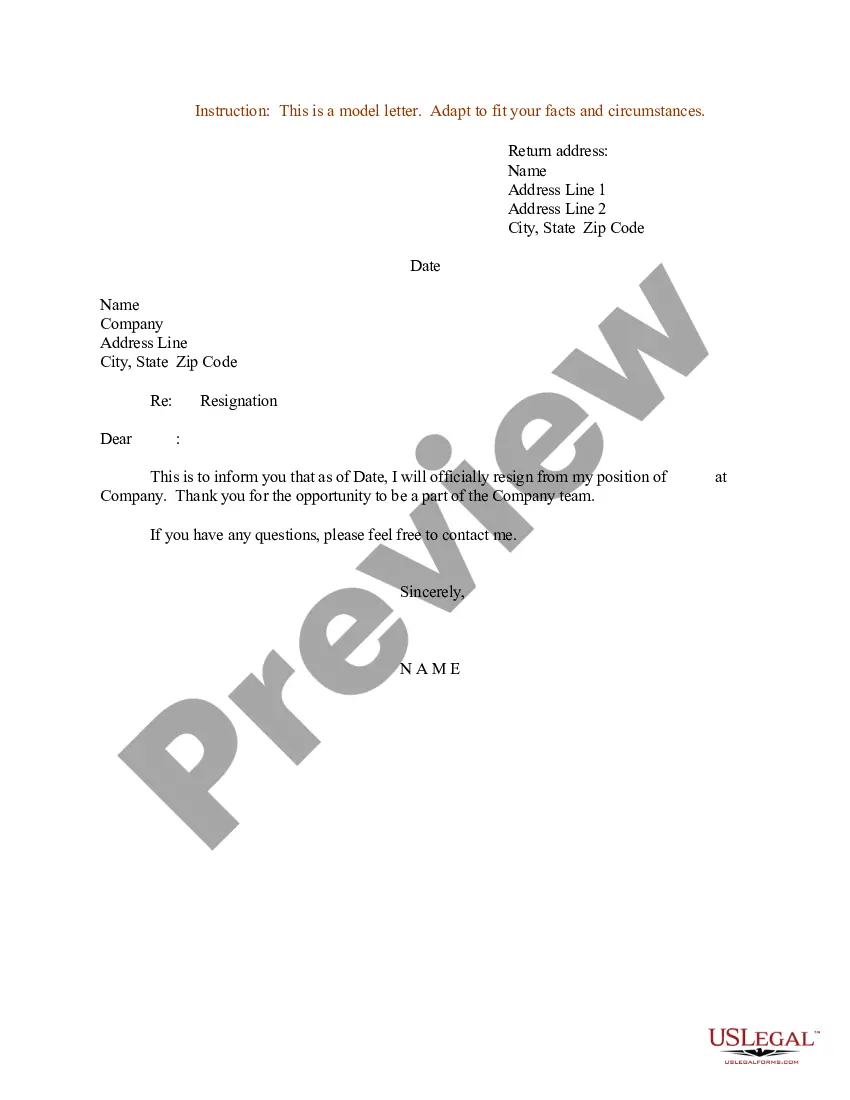

How to fill out Sample Letter For Insufficient Amount To Reinstate Loan?

Are you presently situated in a location where you are required to have paperwork for various organizational or personal activities nearly every day.

There are numerous genuine document templates accessible online, but finding ones you can trust is not simple.

US Legal Forms provides a vast array of form templates, including the West Virginia Sample Letter for Insufficient Amount to Reinstate Loan, which can be completed to satisfy state and federal regulations.

Choose a convenient document format and download your copy.

Access all the document templates you have purchased in the My documents menu. You can get an additional copy of the West Virginia Sample Letter for Insufficient Amount to Reinstate Loan anytime if needed. Just go through the required form to download or print the document template. Use US Legal Forms, the most extensive collection of legal forms, to save time and avoid errors. The service offers well-crafted legal document templates that can be utilized for a variety of purposes. Create your account on US Legal Forms and begin making your life easier.

- If you are already familiar with the US Legal Forms website and have an account, simply sign in.

- Then, you can download the West Virginia Sample Letter for Insufficient Amount to Reinstate Loan template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Obtain the form you need and ensure it matches the correct city/state.

- Use the Review button to examine the form.

- Read the description to verify that you have selected the correct form.

- If the form is not what you are looking for, utilize the Search field to find the form that meets your requirements and criteria.

- Once you find the right form, click on Purchase now.

- Select the pricing plan you prefer, provide the necessary information to create your account, and pay for your order using PayPal or Visa or Mastercard.

Form popularity

FAQ

Reinstatement involves making a single payment to catch up with everything due on a loan. By contrast, payoff involves paying the lender the total remaining balance of the loan. (Payoff before a foreclosure sale is commonly known as redemption, which is an equitable right available in every state.)

To reinstate a loan, you must first find out the amount needed to bring the loan current. You can get this information by requesting a "reinstatement quote" or "reinstatement letter" from the loan servicer.

Reinstatement involves making a single payment to catch up with everything due on a loan. By contrast, payoff involves paying the lender the total remaining balance of the loan. (Payoff before a foreclosure sale is commonly known as redemption, which is an equitable right available in every state.)

Reinstating a loan stops a foreclosure because the borrower catches up on the defaulted payments. The borrower also has to pay any overdue fees and expenses incurred because of the default. Once the loan is reinstated, the borrower resumes making regular payments on the debt.

In foreclosure, a house is sold as collateral after the homeowners default on their loan. Housing repossession is a more general term for when a mortgage lender or loan provider takes ownership of a property because the owners haven't paid their bills. It's a consequence of foreclosure.

You may be able to reinstate the loan by catching up on payments. However, you will need to repay all past due bills, including late fees and the costs a lender incurs from repossession.

Mortgage reinstatement, sometimes called loan reinstatement, is the process of restoring your mortgage after a mortgage default by paying the total amount past due. You will arrive at the point of a mortgage default after missing payments for several months.

Negotiating a ReinstatementDefaulting property owners can also negotiate reinstatement of their mortgage loans with their lenders. Negotiating a reinstatement of a defaulted mortgage with that loan's lender is a bit more involved than simply paying all missed payments and late fees though.

Reinstatement involves making a single payment to catch up with everything due on a loan. By contrast, payoff involves paying the lender the total remaining balance of the loan. (Payoff before a foreclosure sale is commonly known as redemption, which is an equitable right available in every state.)