West Virginia Call of Special Stockholders' Meeting By Board of Directors of Corporation

Description

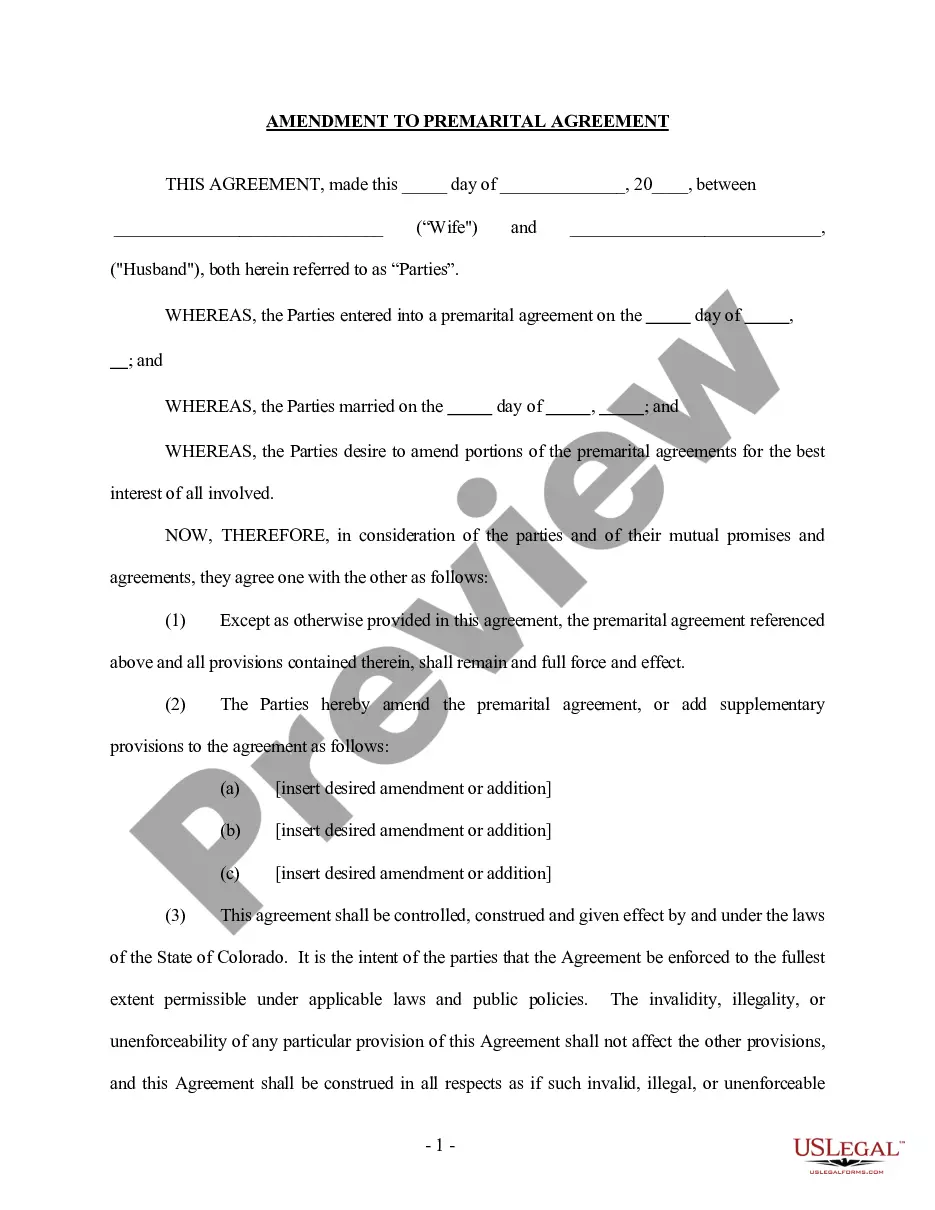

How to fill out Call Of Special Stockholders' Meeting By Board Of Directors Of Corporation?

If you need to comprehensive, down load, or produce authorized document themes, use US Legal Forms, the greatest collection of authorized forms, which can be found on-line. Utilize the site`s basic and convenient search to get the paperwork you need. Various themes for organization and individual uses are sorted by types and says, or search phrases. Use US Legal Forms to get the West Virginia Call of Special Stockholders' Meeting By Board of Directors of Corporation in a handful of click throughs.

When you are already a US Legal Forms client, log in in your profile and click the Acquire key to obtain the West Virginia Call of Special Stockholders' Meeting By Board of Directors of Corporation. You can even access forms you previously delivered electronically inside the My Forms tab of your profile.

If you use US Legal Forms initially, refer to the instructions beneath:

- Step 1. Make sure you have chosen the form for your right city/land.

- Step 2. Make use of the Review choice to examine the form`s articles. Do not forget to learn the explanation.

- Step 3. When you are unhappy with all the form, utilize the Look for industry towards the top of the display screen to locate other models from the authorized form template.

- Step 4. When you have located the form you need, go through the Buy now key. Opt for the prices program you favor and add your accreditations to sign up on an profile.

- Step 5. Process the deal. You should use your Мisa or Ьastercard or PayPal profile to complete the deal.

- Step 6. Choose the structure from the authorized form and down load it in your system.

- Step 7. Total, change and produce or indication the West Virginia Call of Special Stockholders' Meeting By Board of Directors of Corporation.

Each and every authorized document template you get is yours forever. You possess acces to each form you delivered electronically in your acccount. Go through the My Forms portion and pick a form to produce or down load once more.

Be competitive and down load, and produce the West Virginia Call of Special Stockholders' Meeting By Board of Directors of Corporation with US Legal Forms. There are thousands of expert and status-certain forms you can utilize for your personal organization or individual demands.

Form popularity

FAQ

Under section 61 of the Companies Act 71 of 2008 (Companies Act), only the board of a company, or any other person specified in the company's Memorandum of Incorporation (MOI) or rules, has the power to call a shareholders' meeting.

A special shareholder meeting is sometimes called to handle issues that occur in between annual meetings, and often have certain requirements for calling and holding the meeting. Annual shareholder meetings have become something that is expected from investors.

Who can call the meeting? An AGM can be called by two or more members who own at least 10% of the company's share capital.

Key Takeaways. An annual general meeting (AGM) is the yearly gathering of a company's interested shareholders. At an annual general meeting (AGM), directors of the company present the company's financial performance and shareholders vote on the issues at hand.

Typically either the president or a majority vote of the board (or both) can call a special meeting. You need to give proper notice to members and, of course, you need a quorum to do business. The procedure should be spelled out in your bylaws.

The corporation can allow others to call a special meeting, such as the BoD Chair, CEO, or yes, shareholders.

The term shareholders refers to the people directly involved in the corporation who are participating in the company's gains or losses. The special meeting aims to enable the shareholders to know the company's affairs and vote on the management's recommendations in the proposed resolution.

Special meetings of the shareholders may be called for any purpose or purposes, at any time, by the Chief Executive Officer; by the Chief Financial Officer; by the Board or any two or more members thereof; or by one or more shareholders holding not less than 10% of the voting power of all shares of the corporation

Legal Definition of special meeting : a meeting held for a special and limited purpose specifically : a corporate meeting held occasionally in addition to the annual meeting to conduct only business described in a notice to the shareholders.