West Virginia Statement of Reduction of Capital of a Corporation

Description

How to fill out Statement Of Reduction Of Capital Of A Corporation?

US Legal Forms - one of the greatest libraries of lawful types in America - offers an array of lawful file themes it is possible to acquire or print. Using the site, you will get a large number of types for organization and individual functions, sorted by groups, states, or search phrases.You will discover the latest models of types just like the West Virginia Statement of Reduction of Capital of a Corporation within minutes.

If you already have a monthly subscription, log in and acquire West Virginia Statement of Reduction of Capital of a Corporation from the US Legal Forms collection. The Download button can look on each and every form you perspective. You get access to all in the past downloaded types within the My Forms tab of the accounts.

If you wish to use US Legal Forms initially, listed here are basic directions to help you started:

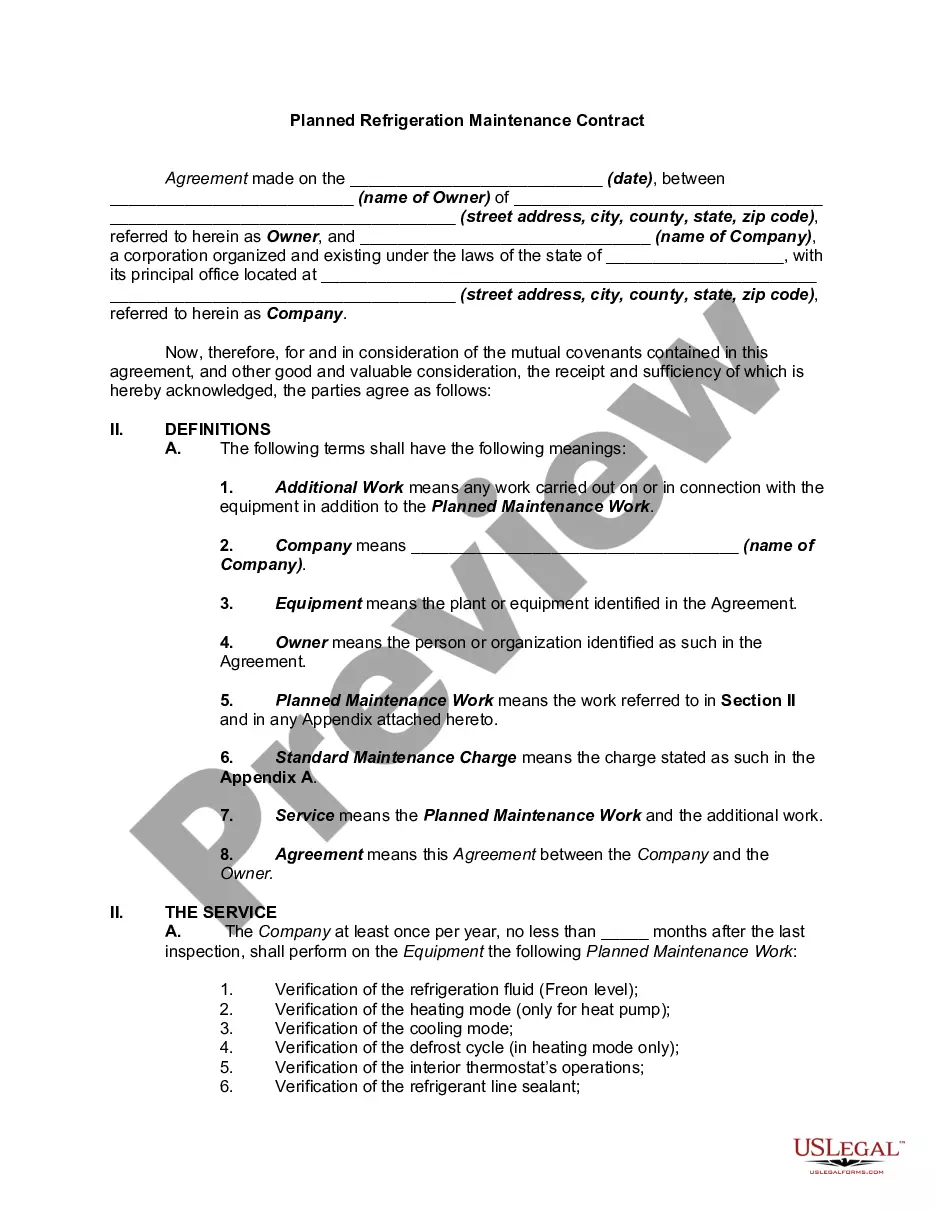

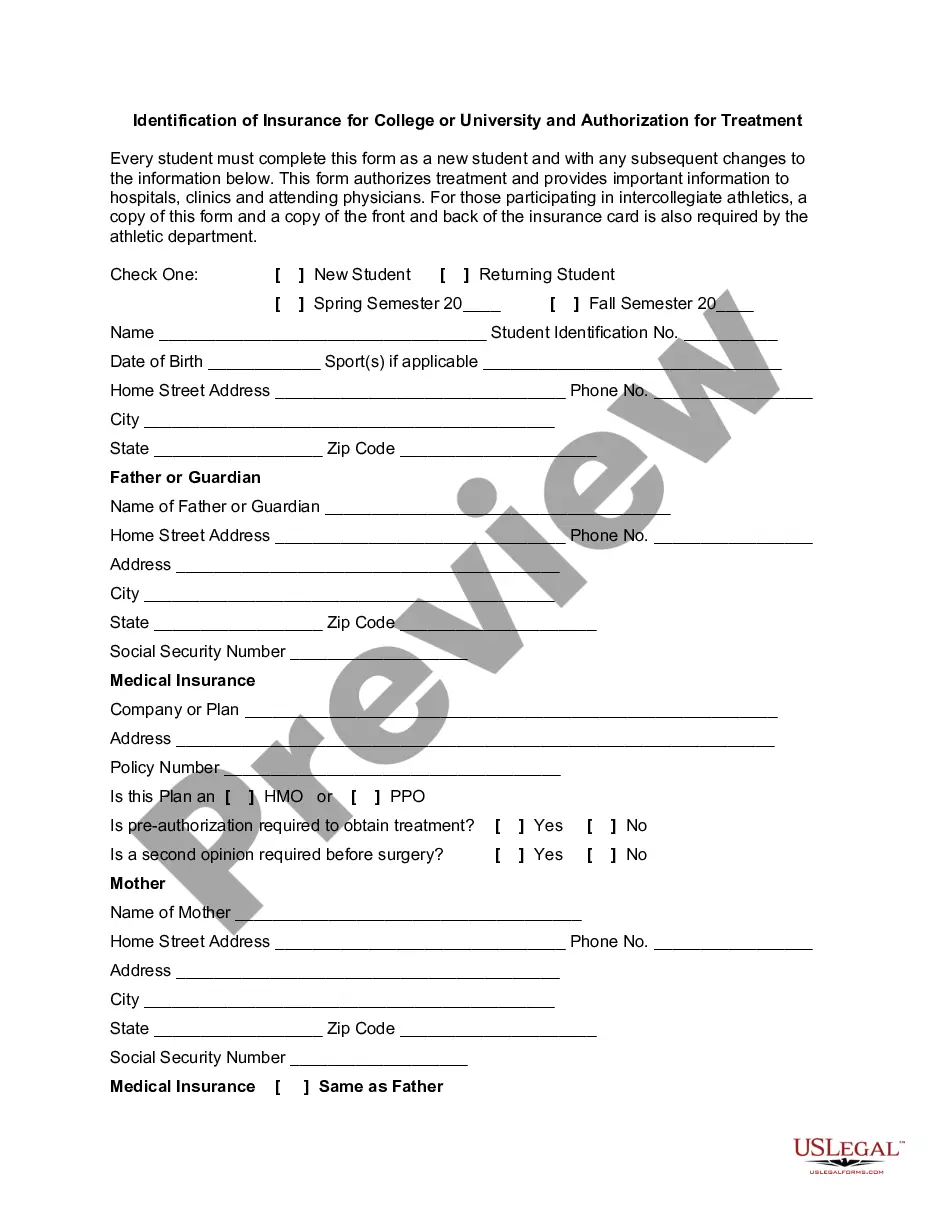

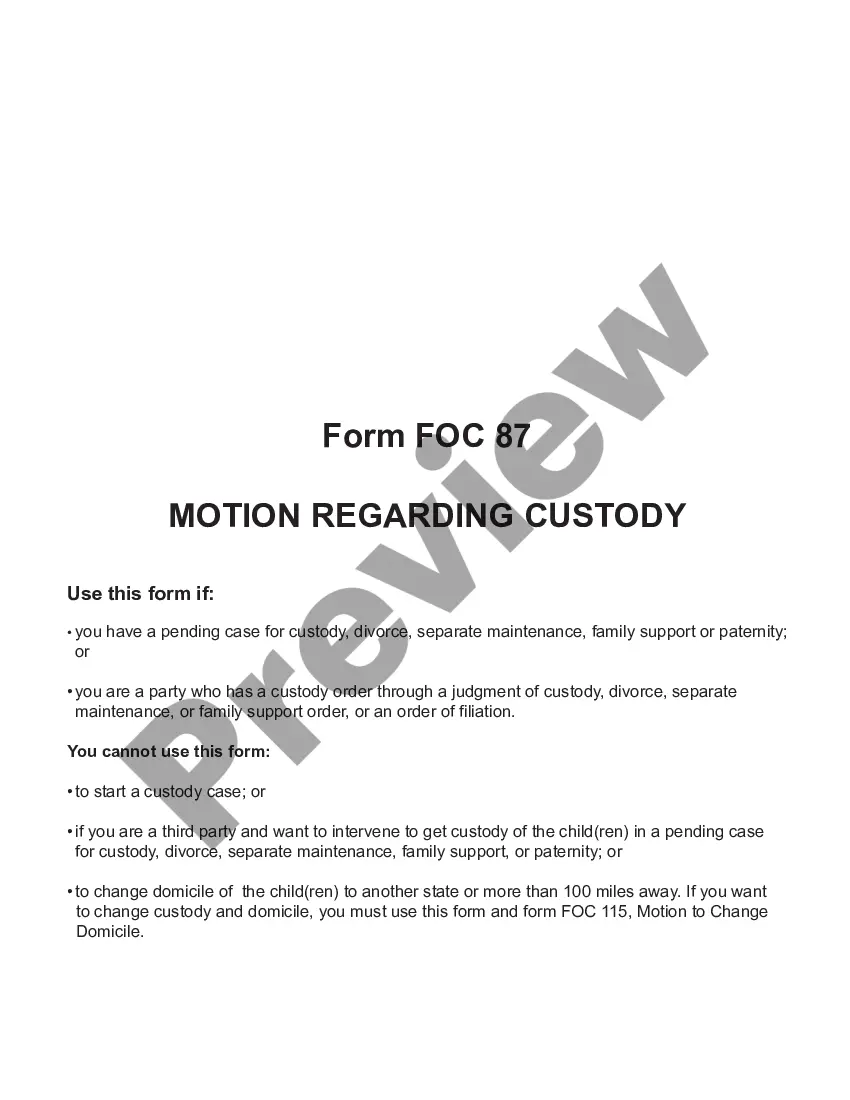

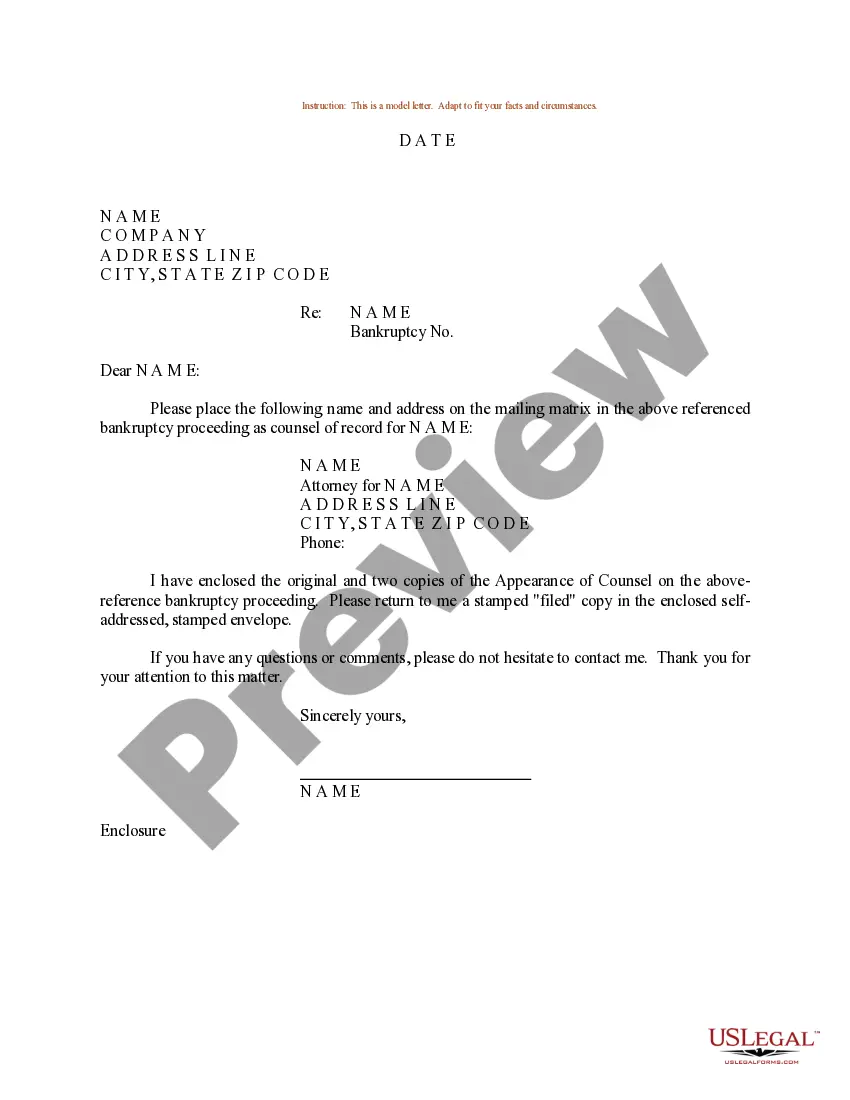

- Be sure to have picked out the correct form for the city/region. Select the Review button to review the form`s content. Read the form explanation to actually have chosen the right form.

- In the event the form does not match your specifications, utilize the Search field on top of the screen to get the one which does.

- If you are content with the form, affirm your selection by clicking on the Get now button. Then, pick the costs plan you want and offer your credentials to sign up for an accounts.

- Method the transaction. Make use of charge card or PayPal accounts to perform the transaction.

- Pick the format and acquire the form on your device.

- Make modifications. Fill out, change and print and sign the downloaded West Virginia Statement of Reduction of Capital of a Corporation.

Each and every design you put into your money does not have an expiration particular date which is the one you have eternally. So, if you would like acquire or print one more copy, just check out the My Forms portion and click around the form you will need.

Gain access to the West Virginia Statement of Reduction of Capital of a Corporation with US Legal Forms, by far the most comprehensive collection of lawful file themes. Use a large number of specialist and express-distinct themes that meet up with your business or individual requires and specifications.

Form popularity

FAQ

West Virginia already allows capital expenditure deductions including federal deductions under Section 179 of the Internal Revenue Code as well as federal depreciation allowances, including bonus depreciation.

The tax rate for West Virginia's PTET is the highest marginal individual income tax rate, which is 6.5% for 2022 and 5.12% for 2023. PTE owners are eligible to receive a non-refundable tax credit for their proportional share of the PTET paid. Unused credits may be carried forward for up to five years.

Entering the United States Use the designated NEXUS lane. Stop and hold your membership card in front of the card reader. Proceed to the inspection booth for a visual inspection. Unless you are directed to an inspection area, you may proceed into the United States.

Which US States have Economic Nexus? NameThresholdsCalifornia$500,000Colorado$100,000Connecticut200 transactions and $100,000Florida$100,00044 more rows

West Virginia businesses deriving income from the state while operating as an S corporation or partnership and acting as a pass-through entity should use a form SPF-100 to file their state tax due. Before you can complete this document, you will need to complete the separate Schedule SP form.

Physical nexus means having enough tangible presence or activity in a state to merit paying sales tax in that state. Economic nexus means passing a states' economic threshold for total revenue or the number of transactions in that state.

To be considered a nexus, a business must have ?sufficient presence? in the state and be ?engaged in business? in the state. The requirement of sufficient presence is satisfied by the brief physical presence of someone at a trade show to something more permanent, such as a warehouse.

Any kind of economic activity could trigger the nexus, once your total sales reach a certain threshold amount. The threshold in West Virginia is $100,000 in annual sales or 200 separate sales transactions, whichever your business reaches first.