West Virginia: Breakdown of Savings for Budget and Emergency Fund When it comes to financial planning, setting aside savings for both your budget and emergency fund is crucial for maintaining stability and preparedness. In the context of West Virginia, a breakdown of savings for budget and emergency fund can vary based on individual needs and circumstances. 1. Budget Savings for West Virginia Residents: Budget savings in West Virginia can be categorized into several key areas, ensuring that individuals have enough funds to cover their regular expenses and obligations. Some relevant keywords include: — Housing: This includes mortgage or rent payments, property taxes, and home insurance. — Utilities: Covers essential services like electricity, water, heating, and internet. — Transportation: Allocates money for monthly car payments, fuel costs, insurance, and maintenance. — Groceries: Reserved for grocery bills and essential household items. — Healthcare: Provides funds for health insurance premiums, prescription drugs, and medical emergencies. — Education: Savings for tuition fees, textbooks, school supplies, or other educational expenses. — Entertainment: Set aside for recreational activities, dining out, or hobbies. — Personal Care: Covers costs associated with grooming, clothing, and personal hygiene products. — Debt Repayment: Allows for paying off loans, credit cards, or other outstanding debts. 2. Emergency Fund Savings for West Virginia Residents: Building an emergency fund is essential to handle unforeseen situations or financial crises. West Virginia residents should aim to save a certain percentage of their income each month, with the goal of accumulating three to six months' worth of living expenses. Some keywords associated with emergency fund savings in West Virginia include: — Medical Emergencies: Covering unexpected healthcare costs or medical bills. — Job Loss: Acts as a safety net in case of sudden unemployment or reduced income. — Home or Car Repairs: Provides funds for unexpected repairs or maintenance. — Natural Disasters: Preparedness for damages caused by floods, storms, or other natural disasters. — Family Emergencies: Assists with unforeseen expenses related to family emergencies. — Legal Issues: Provides a cushion for unexpected legal fees or court-related costs. Remember, the breakdown of savings for budget and emergency fund varies from person to person, depending on income, lifestyle, and financial goals. It's essential to evaluate your own situation and determine specific savings targets and priorities. By establishing a well-balanced saving strategy, West Virginia residents can achieve financial security, peace of mind, and be better prepared for any unexpected events that may arise in the future.

West Virginia Breakdown of Savings for Budget and Emergency Fund

Description

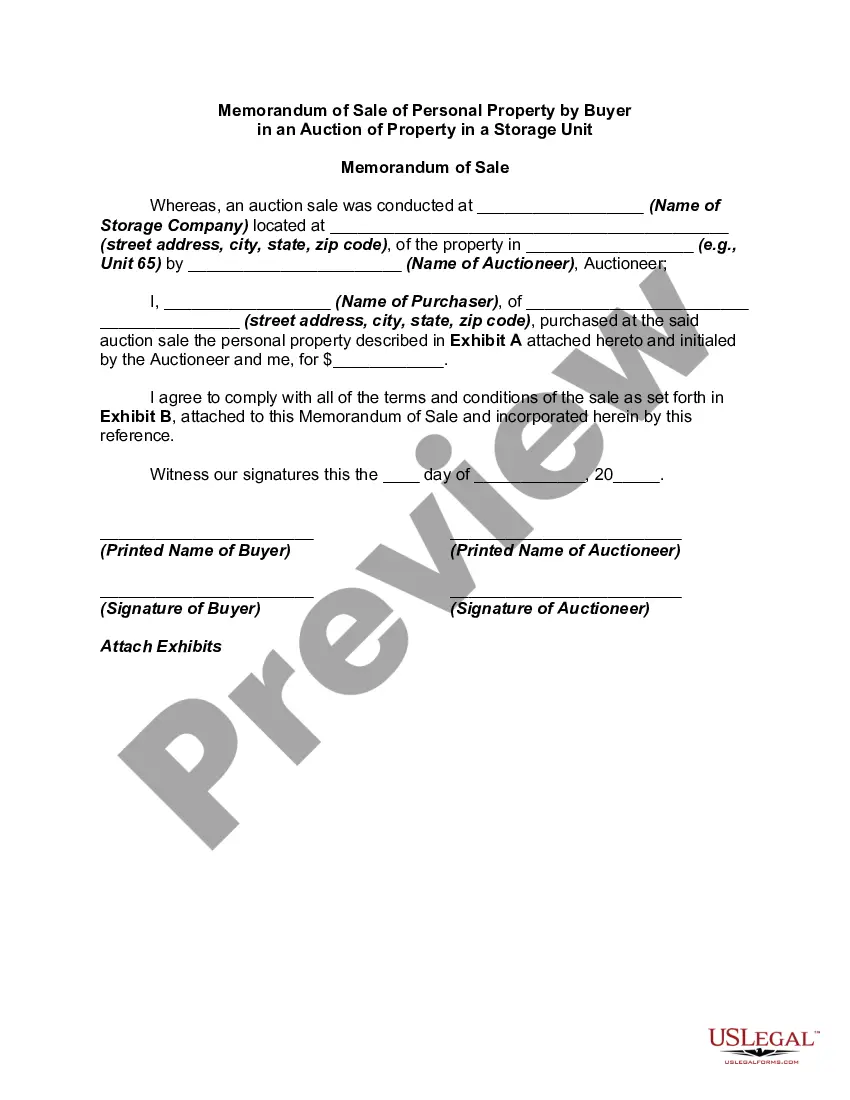

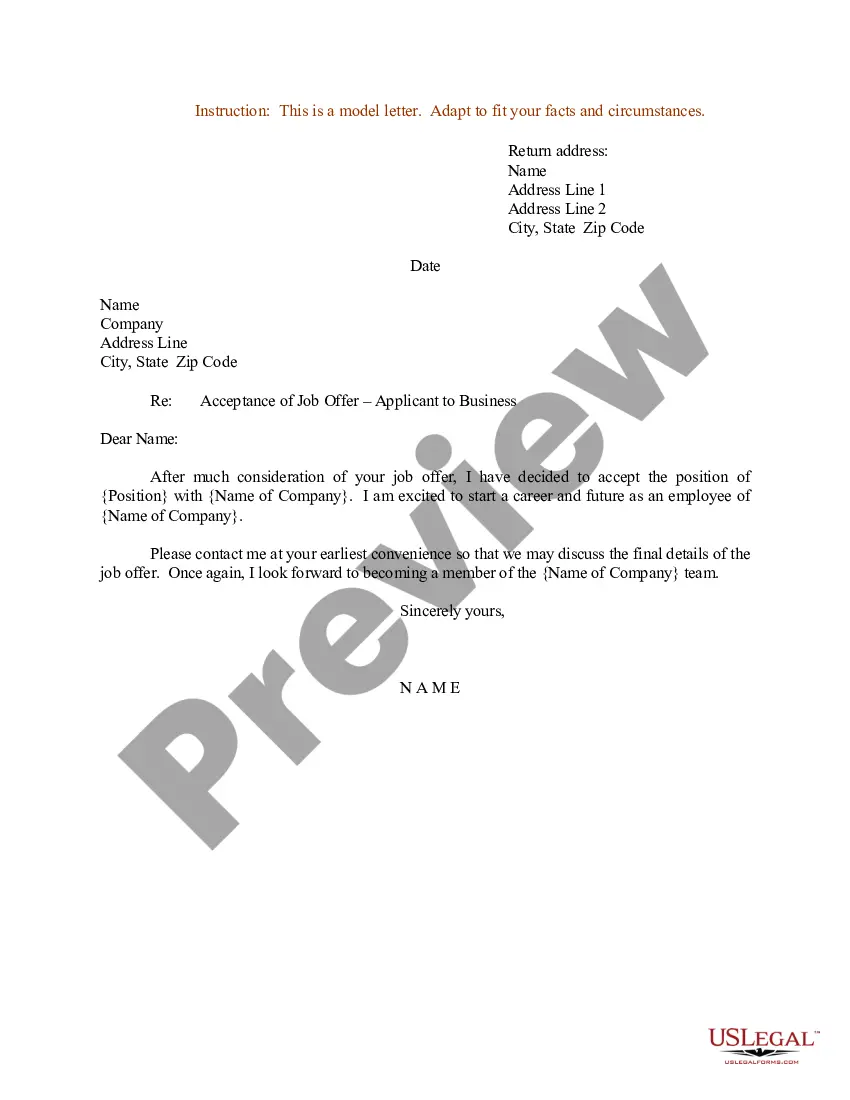

How to fill out Breakdown Of Savings For Budget And Emergency Fund?

US Legal Forms - one of many greatest libraries of legitimate kinds in the United States - provides a wide range of legitimate papers templates it is possible to obtain or produce. Utilizing the site, you will get a huge number of kinds for organization and individual uses, categorized by categories, says, or keywords.You will find the latest variations of kinds much like the West Virginia Breakdown of Savings for Budget and Emergency Fund within minutes.

If you already possess a subscription, log in and obtain West Virginia Breakdown of Savings for Budget and Emergency Fund through the US Legal Forms local library. The Down load button will appear on each and every type you see. You have accessibility to all previously saved kinds within the My Forms tab of the bank account.

If you would like use US Legal Forms for the first time, listed here are basic recommendations to help you get started:

- Be sure you have picked the proper type for the city/county. Go through the Preview button to examine the form`s content material. See the type information to ensure that you have chosen the correct type.

- In the event the type doesn`t satisfy your specifications, take advantage of the Research discipline near the top of the monitor to discover the the one that does.

- When you are content with the form, confirm your choice by clicking the Purchase now button. Then, choose the prices strategy you like and provide your qualifications to sign up for the bank account.

- Process the purchase. Utilize your bank card or PayPal bank account to accomplish the purchase.

- Find the structure and obtain the form in your gadget.

- Make modifications. Complete, modify and produce and signal the saved West Virginia Breakdown of Savings for Budget and Emergency Fund.

Every format you included with your bank account does not have an expiry time and it is your own property permanently. So, if you would like obtain or produce an additional copy, just proceed to the My Forms portion and click on in the type you need.

Get access to the West Virginia Breakdown of Savings for Budget and Emergency Fund with US Legal Forms, one of the most extensive local library of legitimate papers templates. Use a huge number of professional and express-particular templates that meet your company or individual requires and specifications.

Form popularity

FAQ

Creating a budgetStep 1: Calculate your net income. The foundation of an effective budget is your net income.Step 2: Track your spending.Step 3: Set realistic goals.Step 4: Make a plan.Step 5: Adjust your spending to stay on budget.Step 6: Review your budget regularly.

What is the 50/30/20 rule? The 50/30/20 rule is an easy budgeting method that can help you to manage your money effectively, simply and sustainably. The basic rule of thumb is to divide your monthly after-tax income into three spending categories: 50% for needs, 30% for wants and 20% for savings or paying off debt.

Justice announces $38.7 million revenue surplus for October 2021. CHARLESTON, WV Gov. Jim Justice announced today that West Virginia's General Revenue collections for October 2021 came in at $38.7 million above estimates.

The West Virginia State Budget Office is a division of the Department of Revenue. The State Budget Office: Prepares the annual executive budget for the Governor.

How much money should you have left after paying bills? This will vary from person to person but a good rule of thumb is to follow the 50/20/30 formula. 50% of your money to expenses, 30% into debt payoff, and 20% into savings.

West Virginia will become the first and only state in the mid-Atlantic or Northeast region to eliminate state income taxes. The Governor's plan will enable West Virginians to keep more of their hard-earned money.

Justice announces $38.7 million revenue surplus for October 2021. CHARLESTON, WV Gov. Jim Justice announced today that West Virginia's General Revenue collections for October 2021 came in at $38.7 million above estimates.

The West Virginia State Budget Office is a division of the Department of Revenue. The State Budget Office: Prepares the annual executive budget for the Governor.

Poorman suggests the popular 50/30/20 rule of thumb for paycheck allocation: 50% of gross pay for essentials like bills and regular expenses (groceries, rent, or mortgage) 30% for spending on dining/ordering out and entertainment. 20% for personal saving and investment goals.

A budget surplus occurs when income exceeds expenditures. The term often refers to a government's financial state, as individuals have "savings" rather than a "budget surplus." A surplus is an indication that a government's finances are being effectively managed.

More info

Facebook Google+ Pinterest.