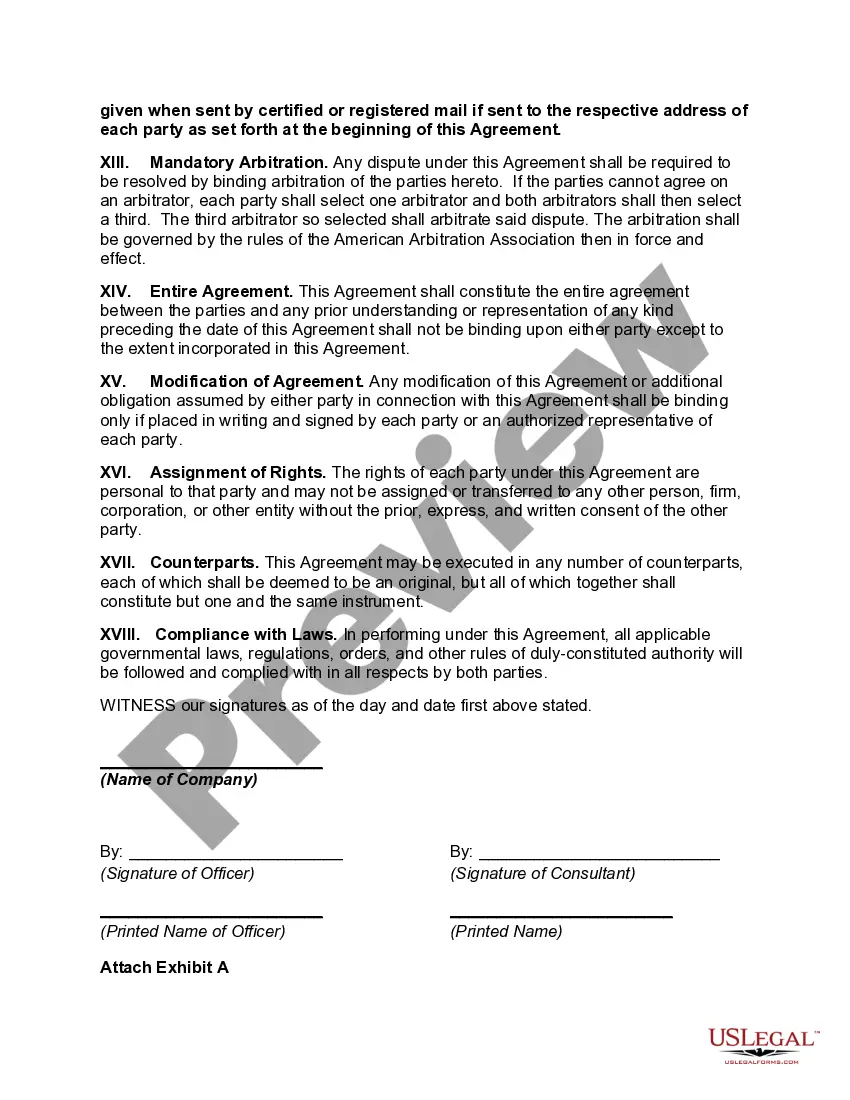

A Sales Consultant Agreement in West Virginia is a legal contract that outlines the terms and conditions between a sales consultant and a company, defining the nature of the relationship and the expectations of both parties. This agreement is essential for ensuring clarity and protection for all parties involved. Keywords: West Virginia, Sales Consultant Agreement, legal contract, terms and conditions, relationship, expectations, clarity, protection. 1. Basic Components: — Identification of the parties: The agreement should clearly state the names and addresses of both the sales consultant and the company. — Scope and nature of services: This section defines the specific services the sales consultant will provide, including sales targets, territories, and any limitations. — Compensation: The agreement should outline the compensation structure, including commissions, bonuses, and any additional benefits. — Termination clause: This clause specifies the circumstances under which either party can terminate the agreement, including notice periods and potential penalties. — Confidentiality and non-disclosure: This section ensures that the sales consultant will maintain the confidentiality of any sensitive company information. — Non-competition and non-solicitation: This clause prevents the sales consultant from engaging in similar activities with competitors or soliciting company clients during and after the agreement period. — Intellectual property rights: Clear guidelines should be established regarding the ownership and usage of any intellectual property developed during the engagement. — Governing law and dispute resolution: This section identifies the applicable laws governing the agreement and outlines the preferred methods for resolving any disputes. 2. Types of West Virginia Sales Consultant Agreements: — Independent Sales Consultant Agreement: This agreement is entered into when the sales consultant operates as an independent contractor and not as an employee of the company. — Exclusive Sales Consultant Agreement: This type of agreement grants exclusivity to the sales consultant in a specified territory, preventing the company from engaging other consultants or sales representatives in that area. — Non-Exclusive Sales Consultant Agreement: In this agreement, the sales consultant can work with multiple companies simultaneously, promoting and selling their products or services without exclusivity. — Commission-Only Sales Consultant Agreement: This type of agreement specifies that the sales consultant will only receive compensation based on a percentage of the sales generated, without a fixed salary or base pay. — Part-Time Sales Consultant Agreement: This agreement is suitable when the sales consultant intends to work part-time, either due to other professional engagements or personal preferences, and specifies the expected working hours and compensation accordingly. In summary, a West Virginia Sales Consultant Agreement is a legally binding contract that defines the relationship between a sales consultant and a company. It encompasses various essential elements and can differ based on the type of agreement and specific requirements of the engagement.

West Virginia Sales Consultant Agreement

Description

How to fill out West Virginia Sales Consultant Agreement?

Finding the right legitimate papers format can be quite a have difficulties. Of course, there are a variety of templates available on the Internet, but how can you get the legitimate type you will need? Make use of the US Legal Forms web site. The services delivers a large number of templates, including the West Virginia Sales Consultant Agreement, that can be used for company and private requirements. Each of the types are inspected by professionals and fulfill state and federal demands.

Should you be already registered, log in in your bank account and then click the Obtain option to have the West Virginia Sales Consultant Agreement. Utilize your bank account to check through the legitimate types you may have bought earlier. Go to the My Forms tab of your respective bank account and have another version in the papers you will need.

Should you be a whole new user of US Legal Forms, listed here are basic recommendations that you can adhere to:

- Very first, be sure you have selected the correct type for the area/state. You can check out the form utilizing the Preview option and browse the form description to make sure this is the best for you.

- In the event the type does not fulfill your requirements, take advantage of the Seach area to get the correct type.

- When you are positive that the form is suitable, go through the Purchase now option to have the type.

- Pick the pricing program you need and enter the required information and facts. Design your bank account and buy an order with your PayPal bank account or bank card.

- Opt for the submit structure and obtain the legitimate papers format in your gadget.

- Comprehensive, change and print out and signal the received West Virginia Sales Consultant Agreement.

US Legal Forms will be the biggest collection of legitimate types for which you can discover different papers templates. Make use of the company to obtain professionally-created documents that adhere to condition demands.

Form popularity

FAQ

A consulting agreement is a legally binding document that affirms a client's request for assistance from a consultant. It's a contract detailing the terms of service between a consultant ? operating as an independent contractor ? and a client.

Being hired as a sales consultant typically requires you to possess certain qualifications, depending on the companies or roles to which you're applying, including: Education. ... Training. ... Certifications. ... Skills. ... Pursue a relevant education. ... Gain work experience. Find your niche. ... Build your network.

The consulting agreement is an agreement between a consultant and a client who wishes to retain certain specified services of the consultant for a specified time at a specified rate of compensation. As indicated previously, the terms of the agreement can be quite simple or very complex.

Here are six best practices to write a consulting contract that defines your project scope and protects both you and your business. Define Duties, Deliverables, and Roles. ... Prepare for Potential Risk. ... Specify Project Milestones and Engagement Time. ... Identify Expenses and Outline Payment Terms. ... Specify Product Ownership.

It's much more common for a consultant to charge for their work on a large, per-project basis, while independent contractors are more likely to charge an hourly fee.

Consultancy Agreement vs Employment Agreement - what's the difference? While Employment Agreements concern hiring persons to suitable long-term positions within the company, Consultancy Agreements particularly deal with services of an independent person to fulfil periodic or temporary requirements of the company.

One of the best or at least most accessible theoretical frameworks I found was Gerald Weinburgers ?secrets of consulting? which presents his three laws: There's always a problem. It's always a people problem. Never forget they're paying you by the hour.