West Virginia Settlement Agreement between the Estate of a Deceased Partner and the Surviving Partners

Description

the remaining partners of a business partnership.

How to fill out Settlement Agreement Between The Estate Of A Deceased Partner And The Surviving Partners?

US Legal Forms - one of several largest libraries of legitimate varieties in the USA - offers a variety of legitimate record templates it is possible to obtain or print. While using site, you may get a huge number of varieties for enterprise and personal reasons, categorized by types, says, or key phrases.You can find the latest variations of varieties much like the West Virginia Settlement Agreement between the Estate of a Deceased Partner and the Surviving Partners within minutes.

If you have a registration, log in and obtain West Virginia Settlement Agreement between the Estate of a Deceased Partner and the Surviving Partners through the US Legal Forms library. The Down load option can look on each and every form you view. You have access to all earlier acquired varieties within the My Forms tab of your own profile.

If you would like use US Legal Forms initially, listed below are basic guidelines to help you started:

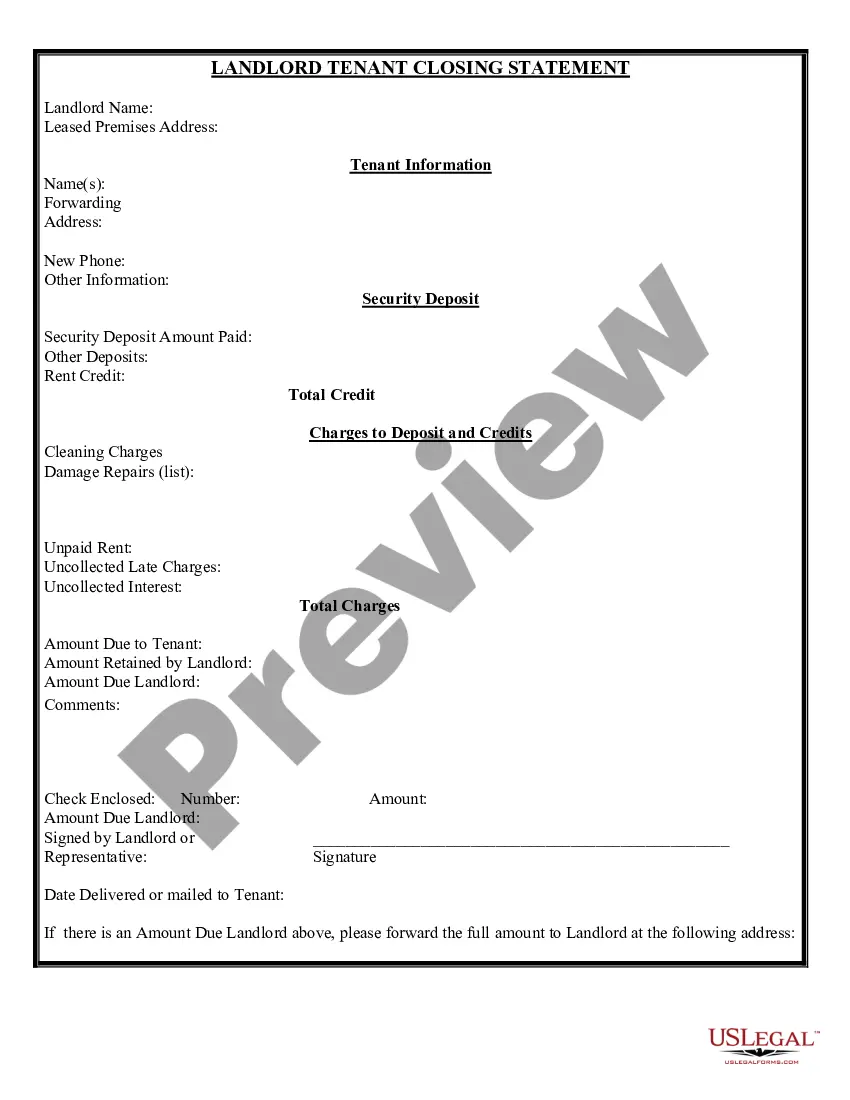

- Ensure you have picked the right form for your personal city/state. Select the Preview option to examine the form`s content. Read the form description to ensure that you have selected the appropriate form.

- In the event the form does not fit your needs, take advantage of the Lookup area on top of the display screen to find the one which does.

- Should you be content with the shape, affirm your option by clicking the Buy now option. Then, opt for the pricing prepare you like and supply your credentials to register for the profile.

- Method the deal. Make use of your Visa or Mastercard or PayPal profile to complete the deal.

- Pick the structure and obtain the shape on your own device.

- Make adjustments. Load, revise and print and sign the acquired West Virginia Settlement Agreement between the Estate of a Deceased Partner and the Surviving Partners.

Every single template you included in your bank account lacks an expiry time and it is your own property permanently. So, if you wish to obtain or print one more duplicate, just check out the My Forms segment and then click on the form you require.

Gain access to the West Virginia Settlement Agreement between the Estate of a Deceased Partner and the Surviving Partners with US Legal Forms, the most substantial library of legitimate record templates. Use a huge number of professional and condition-particular templates that satisfy your business or personal requires and needs.

Form popularity

FAQ

There two ways to close the estate: (1) final settlement; or (2) waiver of final settlement. Generally, you must close the estate within 5 years of starting the probate process. W. Va.

West Virginia state law does not have a deadline for the maximum time allowed for the probate process to occur. In general, smaller, simple estates with no disputes between beneficiaries can be settled and closed within a matter of weeks.

Then the court can decide to allow the executor to distribute the assets without having to go through the regular probate process. If the executor gets permission, they must then file an affidavit, no sooner than 60 days after providing any notice required by law to close the estate.

Checklist for Settling an Estate in 9 Easy StepsOrganize important information.Determine need for probate or attorney help.File the Will and notify necessary persons.Take inventory and appraise all assets.Set up a bank account.Pay taxes.Pay off any debts.Distribute assets according to deceased person's Will.More items...

Excluding real estate, the probate estate is valued at $100,000 or less; or. The personal representative is the only beneficiary of the estate; or. The surviving spouse is the only beneficiary of the estate; or. All parties agree, and state that there are enough assets to pay debts and taxes.

Probate will not usually be needed if all the assets in the estate were jointly owned by both spouses. This can include assets such as a property, bank, building society accounts and savings accounts. Jointly held assets, usually pass to the surviving spouse automatically by the Right of Survivorship.

Wait Six Months (or sometimes longer) By law the Executor has to hold onto estate assets for six months from the date Probate is granted, and cannot pay out any money to the beneficiaries before this time is up.

There two ways to close the estate: (1) final settlement; or (2) waiver of final settlement. Generally, you must close the estate within 5 years of starting the probate process. W.