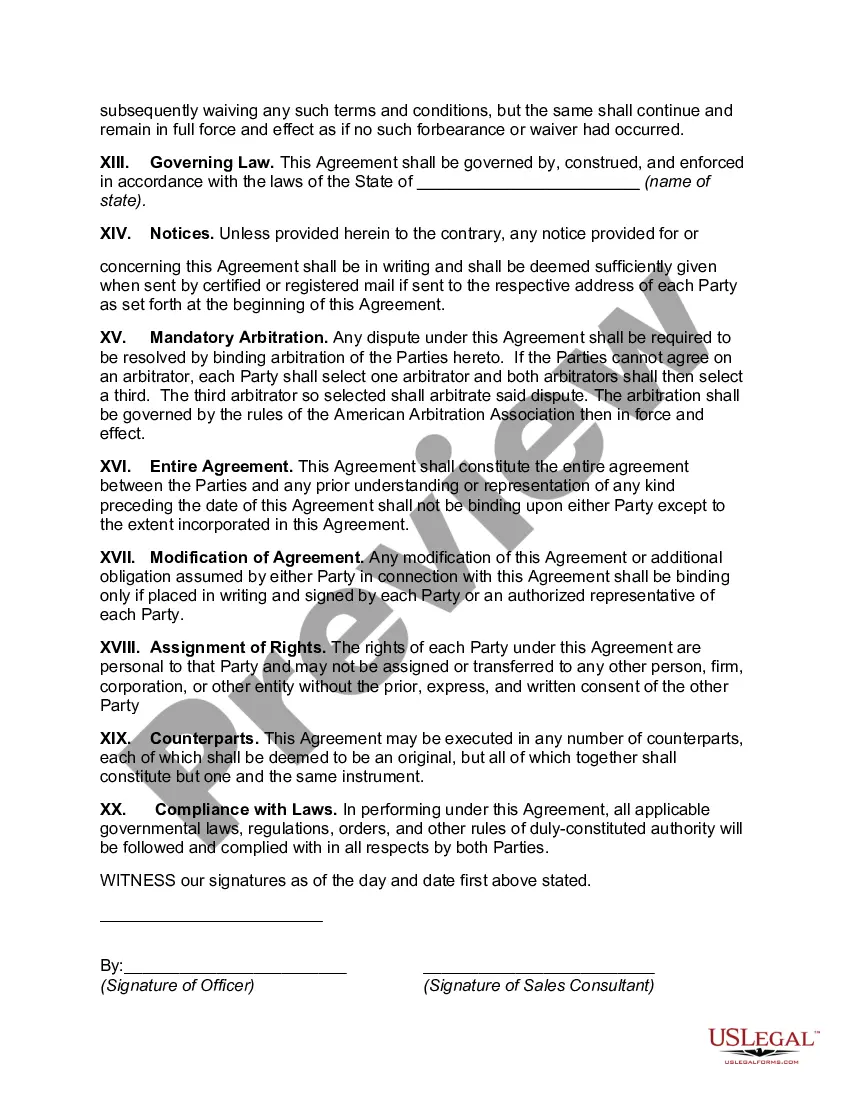

The West Virginia Sales Consultant Agreement with Consultant Operating as an Independent Contractor in a Defined Territory is a legally binding document that outlines the terms and conditions between a company and a sales consultant operating as an independent contractor in the state of West Virginia. This agreement serves as a framework to clarify the rights, responsibilities, and expectations of both parties involved. Keywords relevant to this topic include West Virginia sales consultant agreement, independent contractor, defined territory, terms and conditions, legally binding, rights, responsibilities, and expectations. Different types of West Virginia Sales Consultant Agreement with Consultant Operating as Independent Contractor in a Defined Territory may include variations such as: 1. Exclusive Territory Agreement: This type of agreement states that the sales consultant is granted exclusive rights to operate and sell within a specific defined territory in West Virginia. 2. Non-Exclusive Territory Agreement: In this agreement, the consultant operates as an independent contractor within a defined territory, but the company reserves the right to appoint other sales consultants to the same territory. 3. Commission-Based Agreement: This type of agreement focuses on the compensation structure, where the consultant earns a commission on each sale made within the defined territory. 4. Minimum Performance Agreement: This agreement establishes certain performance criteria or targets that the consultant must meet within the defined territory to maintain the independent contractor status. 5. Non-Disclosure Agreement (NDA): This type of agreement may be included within the overall sales consultant agreement, ensuring that confidential company information shared with the consultant remains protected. 6. Termination Agreement: This agreement outlines the terms and conditions regarding the termination of the sales consultant's contract, including notice periods, grounds for termination, and any post-termination obligations. 7. Renewal Agreement: This agreement details the process and terms for the renewal of the sales consultant's contract after the initial agreement period has ended. By considering these different types of agreements, businesses can ensure that the Sales Consultant Agreement with Consultant Operating as an Independent Contractor in a Defined Territory is tailored to their specific needs and circumstances in West Virginia.

West Virginia Sales Consultant Agreement with Consultant Operating as Independent Contractor in a Defined Territory

Description

How to fill out West Virginia Sales Consultant Agreement With Consultant Operating As Independent Contractor In A Defined Territory?

You can spend several hours on the Internet trying to find the lawful document design that suits the federal and state needs you will need. US Legal Forms gives a huge number of lawful varieties which are reviewed by professionals. It is simple to obtain or printing the West Virginia Sales Consultant Agreement with Consultant Operating as Independent Contractor in a Defined Territory from the support.

If you already possess a US Legal Forms bank account, you can log in and click on the Down load option. Afterward, you can comprehensive, edit, printing, or signal the West Virginia Sales Consultant Agreement with Consultant Operating as Independent Contractor in a Defined Territory. Every single lawful document design you acquire is your own property for a long time. To obtain another version associated with a purchased develop, go to the My Forms tab and click on the corresponding option.

If you are using the US Legal Forms website initially, stick to the straightforward instructions under:

- First, be sure that you have selected the proper document design to the county/city that you pick. See the develop description to make sure you have picked out the correct develop. If readily available, utilize the Preview option to appear through the document design too.

- If you would like discover another variation from the develop, utilize the Research field to get the design that suits you and needs.

- Once you have identified the design you would like, just click Acquire now to continue.

- Choose the rates strategy you would like, enter your qualifications, and sign up for an account on US Legal Forms.

- Complete the deal. You should use your charge card or PayPal bank account to fund the lawful develop.

- Choose the structure from the document and obtain it to the gadget.

- Make alterations to the document if possible. You can comprehensive, edit and signal and printing West Virginia Sales Consultant Agreement with Consultant Operating as Independent Contractor in a Defined Territory.

Down load and printing a huge number of document layouts utilizing the US Legal Forms site, which provides the most important collection of lawful varieties. Use professional and status-distinct layouts to deal with your company or person demands.

Form popularity

FAQ

What should you include in a consulting contract?Receitals and Background. The recital clause is the opening section of the consulting agreement.Scope of Services.Ownership of Intellectual Property.Compensation, Expenses, and Schedules.Dispute Resolution.Termination of Services.Methods of Communication.Confidentiality.More items...?

Consultants Are Usually Self-Employed According to the IRS, you're self-employed if you're a business owner or contractor who provides services to other businesses. To remain a contractor rather than an employee, you must: Have the right to direct or control the work you perform.

If you are an independent contractor, then you are self-employed. The earnings of a person who is working as an independent contractor are subject to self-employment tax. To find out what your tax obligations are, visit the Self-Employed Individuals Tax Center.

Contracts play an essential role in the relationships that consultants have their clients. These legally binding documents tell a client what work you will perform, how long you expect the project to take, what compensation you expect, and more.

Freelancers and consultants are known as "independent contractors" in legal terms. An independent contractor (IC) is a person who contracts to perform services for others without having the legal status of an employee.

When you do consulting work in the U.S., you can be paid two different ways: as an employee on a W-2 tax basis, or on a 1099 tax basis as an independent contractor. As a consultant, being paid on a 1099 tax basis is a huge plus for two key reasons: You save more for retirement.

What is the difference between a Consultant and a Contractor? The short answer is that the Consultants role is evaluate a client's needs and provide expert advice and opinion on what needs to be done while the Contractors role is generally to evaluate the client's needs and actually perform the work.

The consulting agreement is an agreement between a consultant and a client who wishes to retain certain specified services of the consultant for a specified time at a specified rate of compensation.

In general, the difference is that the consultant's role is to evaluate a client's needs and provide expert advice and opinions on what needs to be done, while the contractors role is generally to evaluate the client's needs and actually perform the work.

A standard consulting agreement is the most common (and often most important) type of consultant agreement. It is a basic contract that outlines the number of hours and the rate of pay, the scope of the work to be performed and deliverables.