West Virginia Checklist of Matters to be Considered in Drafting a Verification of an Account

Category:

State:

Multi-State

Control #:

US-13326BG

Format:

Word;

Rich Text

Instant download

Description

Account verification is the process of verifying that a new or existing account is owned and operated by a specified real individual or organization.

How to fill out Checklist Of Matters To Be Considered In Drafting A Verification Of An Account?

Selecting the optimal legal document format can be a challenge.

Of course, there are numerous templates available online, but how can you find the legal document you need.

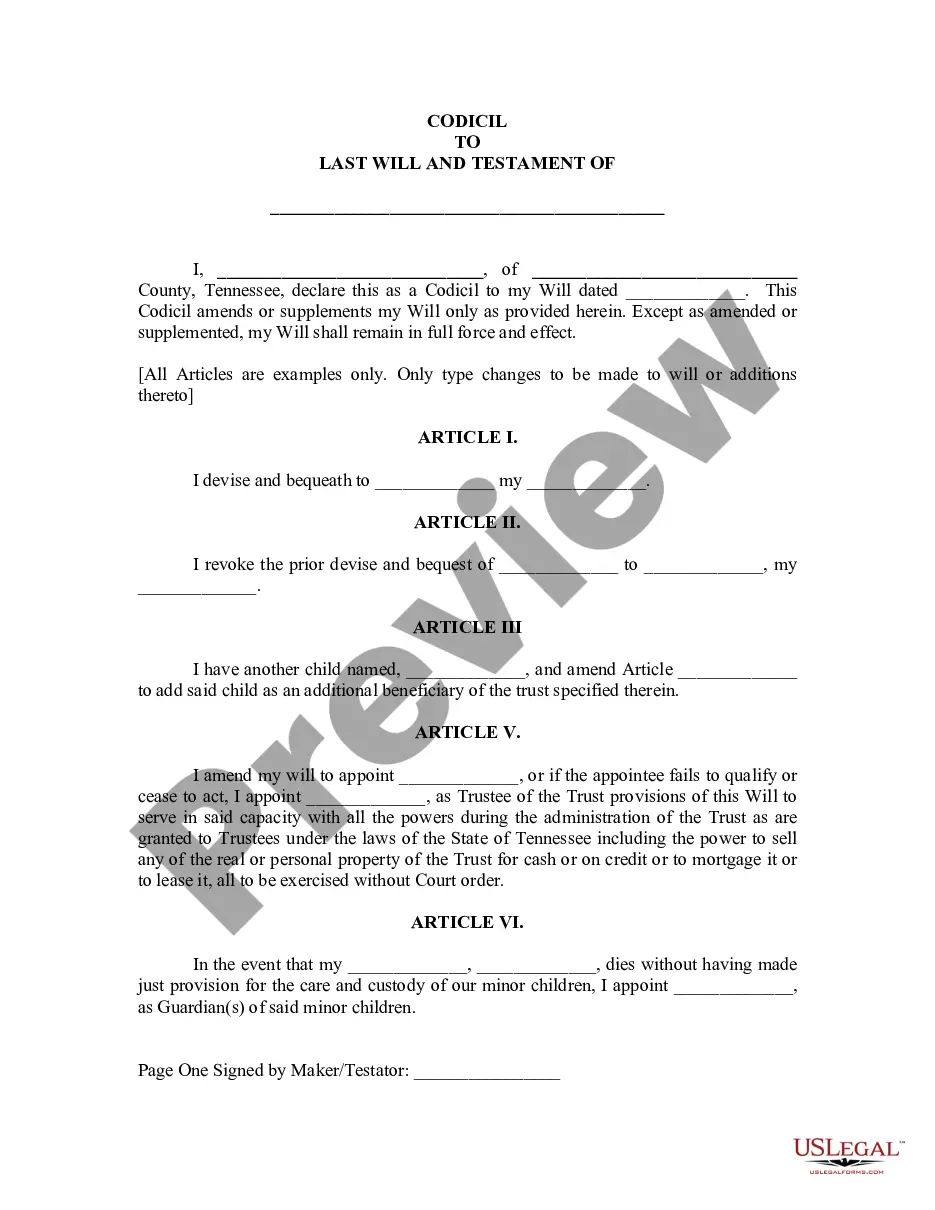

Utilize the US Legal Forms website. The platform offers a vast selection of templates, such as the West Virginia Checklist of Aspects to Consider in Drafting a Verification of an Account, which you may use for business and personal purposes.

First, verify that you have selected the correct document for your locality. You can review the form using the Preview button and examine the document outline to ensure it is appropriate for you.

- All templates are reviewed by experts and comply with federal and state regulations.

- If you are already registered, Log In to your account and click the Acquire button to locate the West Virginia Checklist of Aspects to Consider in Drafting a Verification of an Account.

- Use your account to browse the legal documents you have purchased previously.

- Navigate to the My documents section of your account to retrieve another copy of the document you require.

- If you are a new user of US Legal Forms, here are simple steps for you to follow.