West Virginia Employment of Bookkeeper: A Comprehensive Overview: West Virginia Employment of Bookkeeper refers to the various job opportunities and roles available for professionals skilled in financial record-keeping and accounting practices within the state of West Virginia. Bookkeepers play a vital role in maintaining accurate financial records, ensuring compliance with regulations, and facilitating smooth financial transactions for businesses and organizations. Key Responsibilities: 1. Financial Record Maintenance: Bookkeepers are responsible for accurately recording financial transactions, including sales, purchases, receipts, and payments using accounting software or manual systems. 2. Bank Reconciliation: Bookkeepers regularly reconcile bank statements with the organization's financial records to ensure accuracy and identify discrepancies. 3. Accounts Payable and Receivable: They handle invoicing, maintaining ledgers, tracking payments, conducting collections, and accurately recording accounts payable and accounts receivable transactions. 4. Payroll Processing: Bookkeepers play a crucial role in calculating employee wages, preparing payroll checks, and ensuring compliance with tax regulations. 5. Financial Reporting: They generate financial reports, including profit and loss statements, balance sheets, cash flow statements, and other financial metrics to provide insights for decision-making. 6. Compliance and Regulation: Bookkeepers adhere to tax laws, financial regulations, and company policies while maintaining proper documentation and records. 7. Communication and Collaboration: They often collaborate with internal teams such as accountants, financial analysts, and auditors to provide necessary financial data and support. Types of West Virginia Employment of Bookkeeper: 1. Full-Time Bookkeeper: These positions offer regular, year-round employment with set working hours and benefits. Full-time bookkeepers are generally responsible for managing all financial aspects of an organization. Keywords: full-time, employment, regular, year-round, bookkeeper job, finance, accounting. 2. Part-Time Bookkeeper: Part-time bookkeeping positions are often suitable for individuals seeking flexible working arrangements or those looking to supplement their income. These roles may involve fewer working hours or specific project-based employment. Keywords: part-time, flexible, working arrangements, supplemental income, time flexibility, part-time job. 3. Remote Bookkeeper: With the rise of virtual workspaces and technology advancements, remote bookkeepers can provide accounting services to clients from any location. These positions usually require strong communication skills and proficiency in accounting software and cloud-based tools. Keywords: remote, virtual, work from home, telecommute, online bookkeeping, cloud accounting software. 4. Freelance Bookkeeper: Freelance bookkeepers operate independently and offer their services on a project basis or based on contractual agreements. They often cater to multiple clients simultaneously and may work remotely or on-site. Keywords: freelance, independent, project-based, contractual, self-employed, bookkeeping services. 5. Bookkeeper for Small Businesses: Many small businesses in West Virginia require bookkeepers to handle day-to-day financial tasks. These bookkeepers often have a versatile skill set and may take on additional responsibilities beyond core bookkeeping tasks. Keywords: small business, local business, sole proprietorship, financial management, small business bookkeeping. 6. Bookkeeper for Non-Profit Organizations: Bookkeepers specializing in non-profit organizations are familiar with unique financial reporting requirements and compliance regulations specific to the non-profit sector. They work closely with nonprofit management to maintain transparent financial records and report on funding sources and expenditure. Keywords: non-profit, charity, grant, fundraising, financial transparency, fund accounting. In conclusion, West Virginia offers diverse employment opportunities for bookkeepers in various settings such as full-time, part-time, remote, freelance, and catering to specific industries like small businesses and non-profit organizations. The bookkeeping profession continues to be in demand due to its importance in maintaining accurate financial records and supporting organizational decision-making processes.

West Virginia Employment of Bookkeeper

Description

How to fill out West Virginia Employment Of Bookkeeper?

US Legal Forms - one of the biggest libraries of lawful varieties in the USA - delivers a wide range of lawful document themes you can acquire or print out. Using the website, you will get thousands of varieties for organization and person functions, categorized by classes, states, or keywords and phrases.You will discover the latest models of varieties just like the West Virginia Employment of Bookkeeper within minutes.

If you already have a subscription, log in and acquire West Virginia Employment of Bookkeeper from your US Legal Forms local library. The Download option can look on each kind you perspective. You gain access to all in the past saved varieties within the My Forms tab of your bank account.

If you want to use US Legal Forms initially, listed here are basic instructions to help you get started:

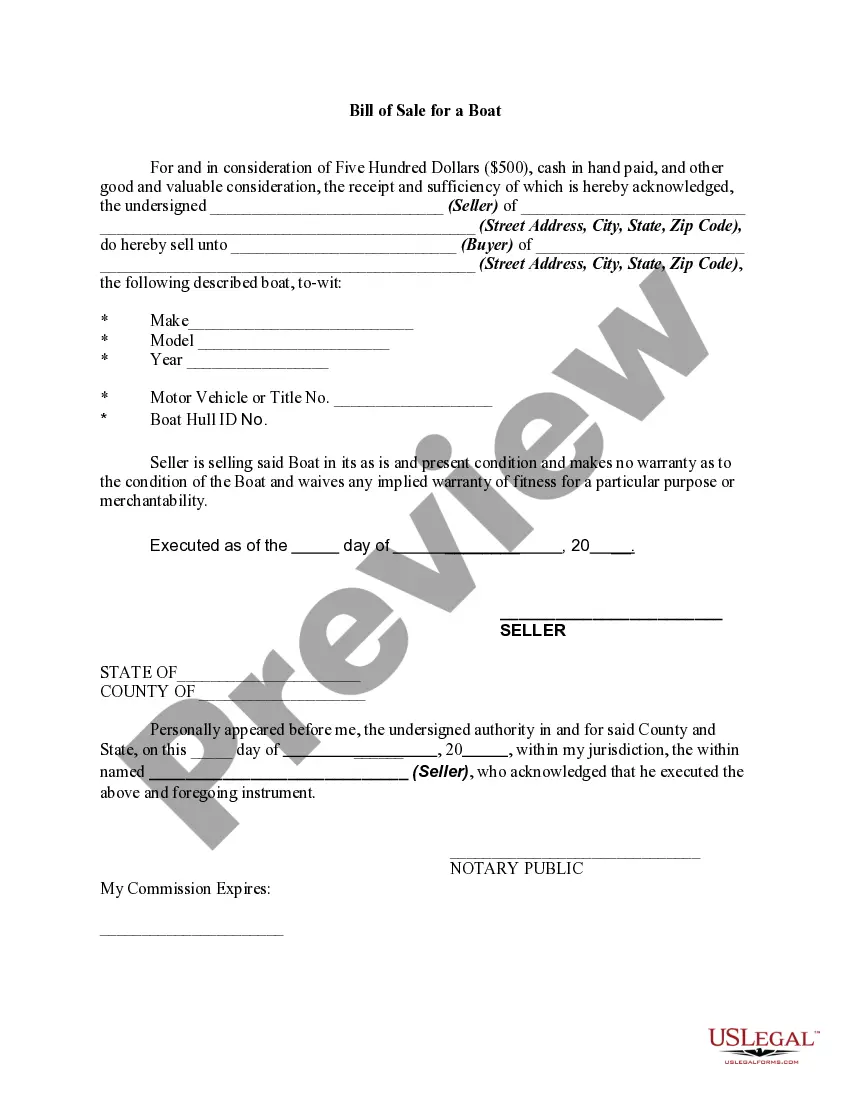

- Make sure you have picked out the right kind for the metropolis/county. Click the Preview option to review the form`s content material. Read the kind information to ensure that you have selected the correct kind.

- In the event the kind does not match your demands, take advantage of the Lookup area at the top of the monitor to find the one that does.

- If you are happy with the form, validate your choice by clicking the Purchase now option. Then, choose the costs plan you want and offer your references to sign up for an bank account.

- Procedure the purchase. Make use of bank card or PayPal bank account to perform the purchase.

- Find the format and acquire the form on your system.

- Make adjustments. Fill up, modify and print out and sign the saved West Virginia Employment of Bookkeeper.

Each and every web template you included in your bank account does not have an expiry particular date and is also the one you have permanently. So, if you would like acquire or print out an additional copy, just check out the My Forms segment and click on in the kind you will need.

Gain access to the West Virginia Employment of Bookkeeper with US Legal Forms, probably the most comprehensive local library of lawful document themes. Use thousands of professional and condition-specific themes that meet your company or person requirements and demands.

Form popularity

FAQ

Highest paying cities in South Africa for Bookkeepers 1. Germiston, Gauteng. 5 salaries reported. R 18 595. per month.

Is being a bookkeeper hard? Yes. For the every so busy small business owner, finding the time and energy to properly maintain your books can be a taxing and arduous task.

20ac37,585 (EUR)/yr The average bookkeeper gross salary in Ireland is 20ac37,585 or an equivalent hourly rate of 20ac18. In addition, they earn an average bonus of 20ac639. Salary estimates based on salary survey data collected directly from employers and anonymous employees in Ireland.

Working ConditionsMost bookkeepers work a standard forty hours per week. They mostly work in pleasant offices. The pace of the work is steady and often repetitive, particularly for bookkeeping clerks. Some overtime may be expected during periodic book balancing and at the end of the fiscal year.

According to the Bureau of Labor Statistics (BLS), the median annual bookkeeper salary is $40,240 per year, with a median hourly rate of $19.35. Bookkeeping salaries vary depending on the individual's education, level of experience, and location. As bookkeepers gain experience, their salaries can increase.

Is being a bookkeeper hard? Yes. For the every so busy small business owner, finding the time and energy to properly maintain your books can be a taxing and arduous task.

Employment of bookkeeping, accounting, and auditing clerks is projected to decline 3 percent from 2020 to 2030. Despite declining employment, about 170,200 openings for bookkeeping, accounting, and auditing clerks are projected each year, on average, over the decade.

Bookkeeping, accounting, and auditing clerks work in offices. Bookkeepers who work for multiple firms may visit their clients' places of business. They often work alone, but sometimes they collaborate with accountants, managers, and auditing clerks from other departments.

What are the duties and responsibilities of a Bookkeeper? On a day-to-day basis, Bookkeepers complete data entry, collect transactions, track debits and maintain and monitor financial records. They also pay invoices, complete payroll, file tax returns and even maintain office supplies.

Bookkeeping is a great starting point if you are interested in the field but not fully committed and want to test the waters. You may also be an ideal bookkeeping candidate if you want a good job with a respectable wage and decent security but may not be looking for a long-term career.