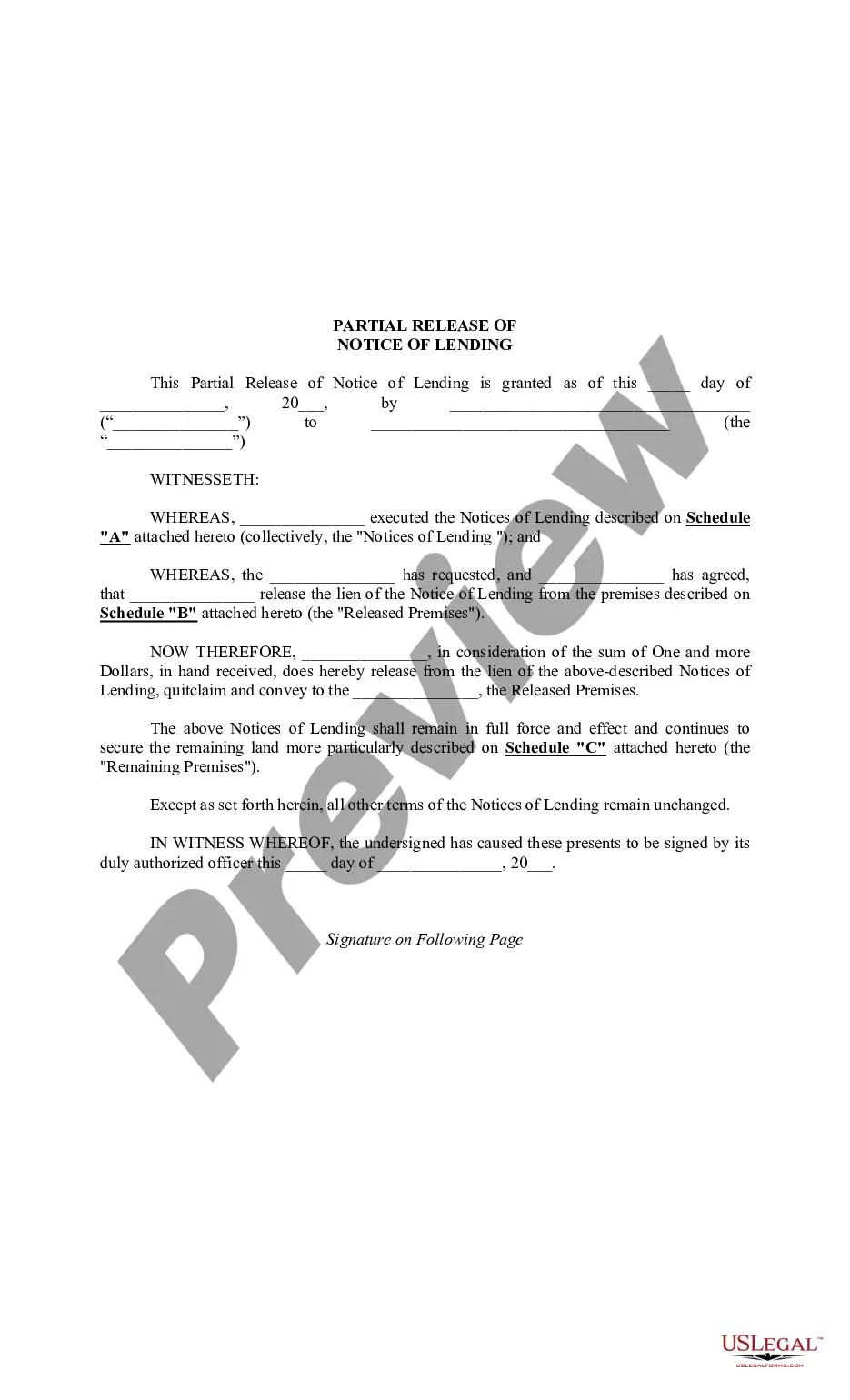

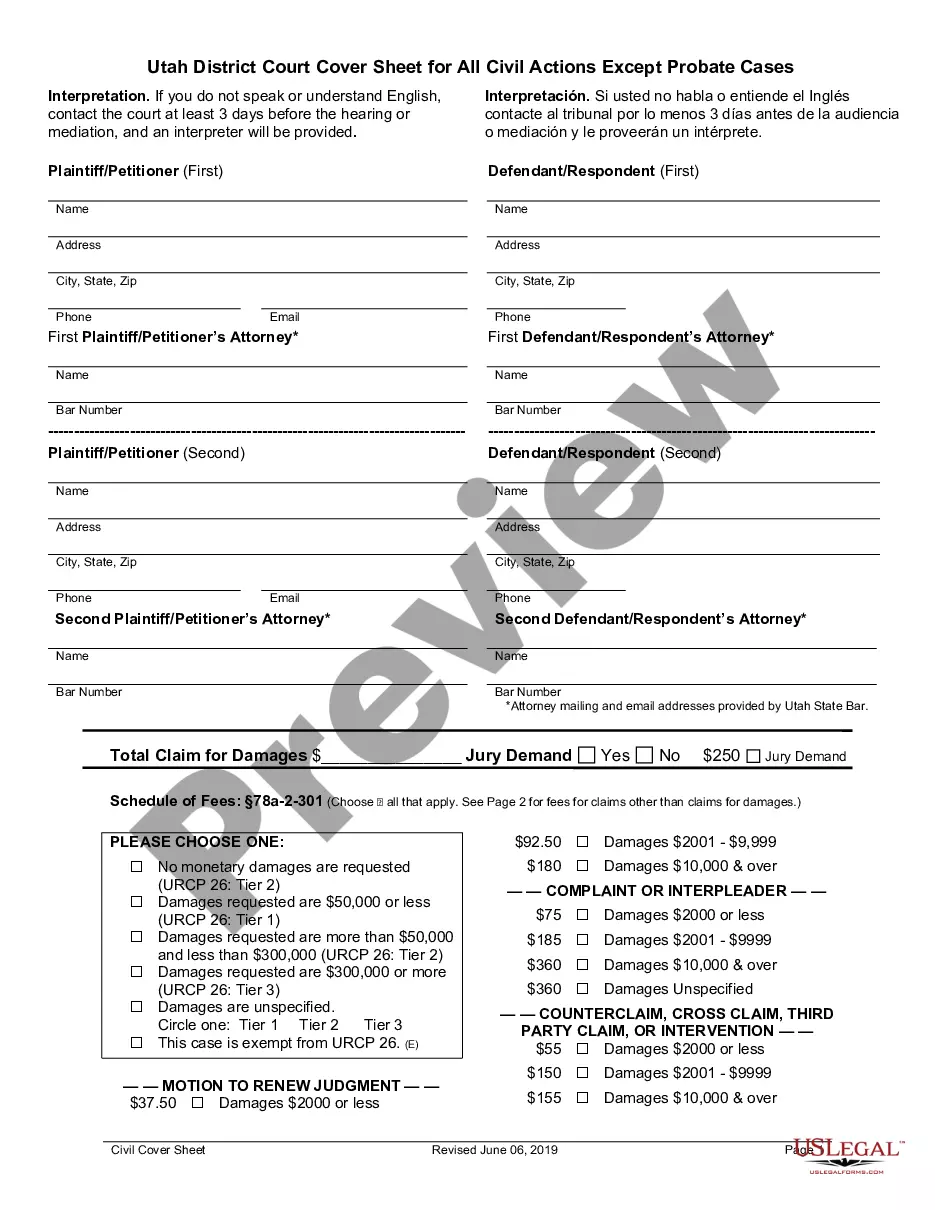

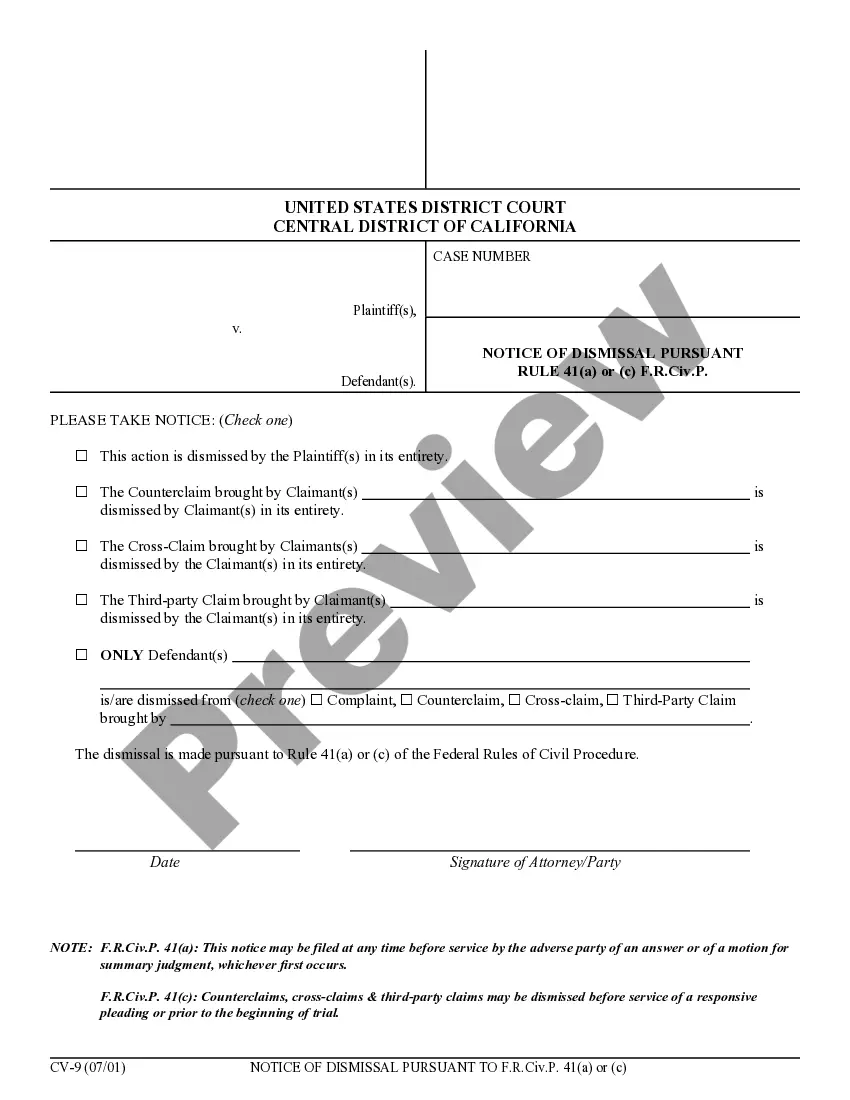

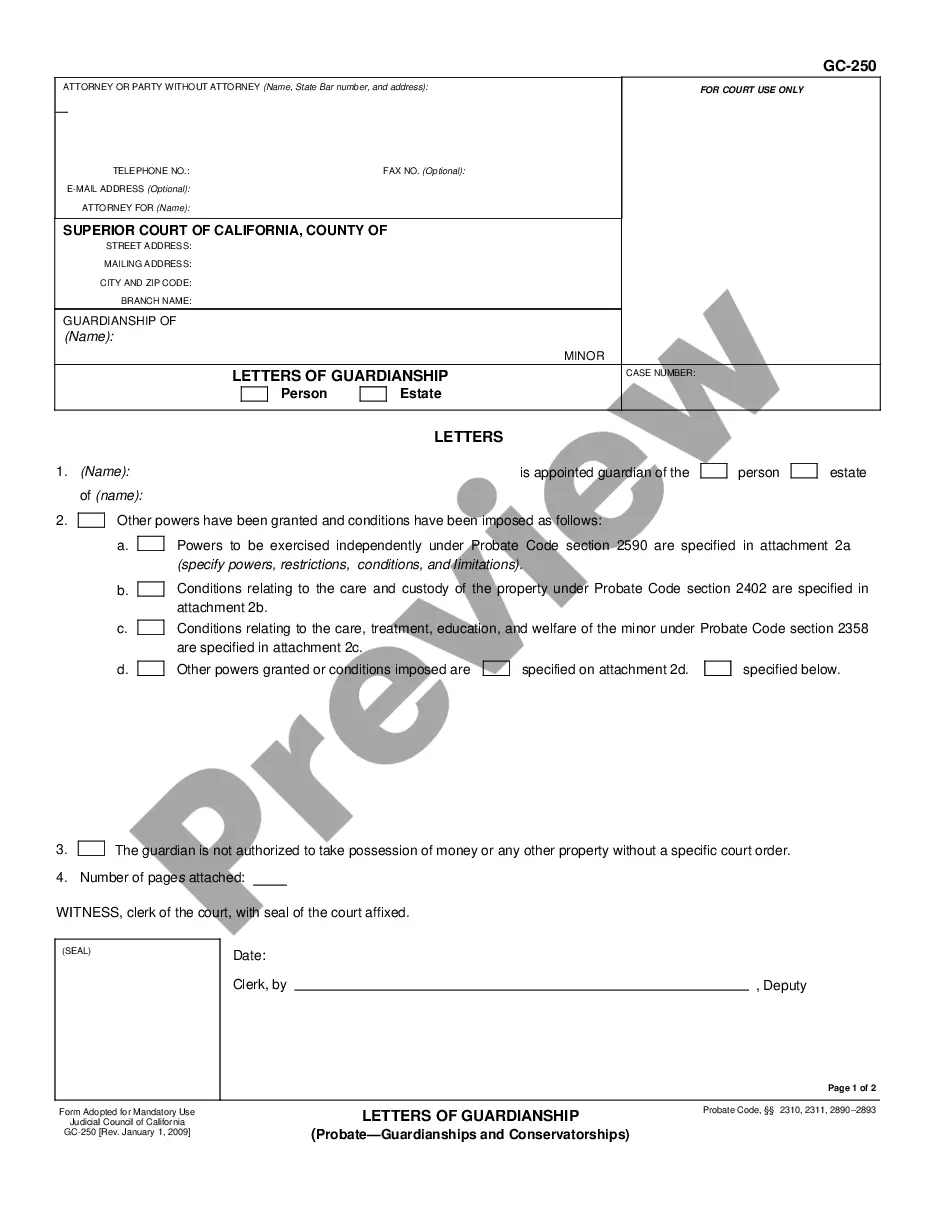

The West Virginia Agreement for Sale of Assets of Corporation is a legally binding document that outlines the terms and conditions for the transfer of assets owned by a corporation to another party. This agreement is commonly used in West Virginia and plays a crucial role in facilitating the acquisition or sale of a company's assets. The Agreement for Sale of Assets of Corporation in West Virginia covers various aspects of the transaction, including the identification and description of the assets being sold, the purchase price, payment terms, and any conditions or representations made by either party. It specifies the specific assets being transferred, such as real estate, equipment, inventory, intellectual property, contracts, customer lists, goodwill, and any liabilities assumed by the buyer. This agreement provides legal protection for both the seller and the buyer, ensuring that each party understands their rights and obligations throughout the transfer process. It may include provisions for warranties, indemnification, and dispute resolution mechanisms, enhancing the security and clarity of the transaction. In West Virginia, there may be various types of Agreement for Sale of Assets of Corporation, including: 1. General Agreement for Sale of Assets of Corporation: This is a standard agreement used when a corporation sells its assets to another party, covering a wide range of assets and conditions. 2. Real Estate Agreement for Sale of Assets of Corporation: Specifically tailored for transactions involving the sale of real estate assets owned by a corporation, this agreement focuses on property-related details, such as property description, title issues, and closing procedures. 3. Intellectual Property Agreement for Sale of Assets of Corporation: This type of agreement is specifically designed for the transfer of intellectual property assets, including patents, trademarks, copyrights, or trade secrets. It addresses the assignment and ownership rights of these intangible assets. 4. Asset Purchase Agreement with Liabilities Assumed: In cases where the buyer explicitly agrees to assume certain liabilities of the corporation, this type of agreement ensures that all obligations and responsibilities are clearly defined. It is crucial to consult legal professionals when drafting or executing the West Virginia Agreement for Sale of Assets of Corporation to ensure compliance with state laws and to safeguard the best interests of all parties involved.

West Virginia Agreement for Sale of Assets of Corporation

Description

How to fill out West Virginia Agreement For Sale Of Assets Of Corporation?

Are you in a situation where you need paperwork for either business or personal purposes almost every day.

There is an assortment of authentic document templates accessible online, but locating reliable ones is often challenging.

US Legal Forms offers thousands of form templates, including the West Virginia Agreement for Sale of Assets of Corporation, which are crafted to fulfill federal and state regulations.

Once you find the correct form, click Buy now.

Choose the pricing plan you desire, enter the required information to set up your account, and pay for the order using your PayPal or credit card.

- If you are already acquainted with the US Legal Forms site and have an account, simply Log In.

- Then, you can download the West Virginia Agreement for Sale of Assets of Corporation template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Obtain the form you need and ensure it is for your specific city/region.

- Utilize the Review button to examine the form.

- Check the details to confirm you have selected the correct form.

- If the form is not what you are looking for, use the Search field to find one that fits your needs and preferences.

Form popularity

FAQ

Yes, you can register a foreign company in the US by following the specific state regulations for foreign entities. Each state has its own process, often requiring documentation like a Certificate of Good Standing from your home country or state. By doing this correctly, you can leverage various business opportunities, including the West Virginia Agreement for Sale of Assets of Corporation.

To register a foreign corporation in West Virginia, you must complete the required application and submit it to the Secretary of State. Be sure to include a resolution that authorizes the corporation to do business in West Virginia. Additionally, you will need to provide a Certificate of Existence from your home state. This process ensures that you can effectively utilize a West Virginia Agreement for Sale of Assets of Corporation.

West Virginia follows a market-based sourcing approach for tax purposes. This means that revenue is sourced to the location where the customer receives the benefit of the service or product. Understanding this can be beneficial when structuring sales and agreements, especially in a West Virginia Agreement for Sale of Assets of Corporation.

To officially close an LLC, you must file articles of dissolution with the state. Additionally, settle any outstanding debts and notify creditors and stakeholders. Keeping these steps in mind will ensure a smooth transition if you are involved in a West Virginia Agreement for Sale of Assets of Corporation.

A federal tax extension can often apply to state taxes, but this varies by state. In West Virginia, a federal extension usually extends the time to file your state taxes as well. Keeping this in mind is essential when working on a West Virginia Agreement for Sale of Assets of Corporation.

Dissolving a corporation involves several steps, including filing articles of dissolution and settling debts. You should also notify stakeholders and handle tax obligations. If you are navigating a West Virginia Agreement for Sale of Assets of Corporation, having a clear dissolution plan is crucial.

When a corporation is terminated, it ceases to exist legally. This process can result from voluntary dissolution, failure to file taxes, or other factors. Understanding the implications of termination is vital, especially when dealing with a West Virginia Agreement for Sale of Assets of Corporation.

West Virginia uses a single sales factor apportionment method. This approach focuses solely on the sales made within the state for taxation purposes. Understanding this can help you effectively navigate your tax responsibilities associated with the West Virginia Agreement for Sale of Assets of Corporation.

Yes, West Virginia imposes a corporate income tax on corporations operating within the state. This tax affects your overall financial planning and decisions, especially when entering agreements, such as the West Virginia Agreement for Sale of Assets of Corporation. Keeping track of your tax obligations ensures a smoother transaction.

West Virginia does accept federal extensions for various taxes, including corporate income tax. This means if you gain a federal extension, you can also benefit from the same in West Virginia. It's important to keep this in mind when preparing a West Virginia Agreement for Sale of Assets of Corporation.