West Virginia Buy-Sell Agreement with Life Insurance to Fund Purchase of Deceased Partner's Interest in a Professional Partnership is a legally binding agreement designed to protect the interests of partners in a professional partnership in the event of the death of a partner. By utilizing life insurance policies, this agreement ensures a smooth transfer of ownership shares and financial stability for the surviving partners. In West Virginia, there are primarily two types of Buy-Sell Agreements with Life Insurance to Fund Purchase of Deceased Partner's Interest in a Professional Partnership: 1. Cross-Purchase Agreement: In this type of agreement, each partner agrees to purchase the deceased partner's interest in the partnership using life insurance policies. Each partner owns a life insurance policy on the life of the other partners, and in the event of a partner's death, the surviving partners receive the insurance proceeds to buy the deceased partner's interest. 2. Entity-Purchase Agreement: Also known as a stock redemption agreement, this type of agreement requires the professional partnership itself to purchase the deceased partner's interest using life insurance. The partnership owns life insurance policies on each partner, and the partnership becomes the beneficiary of the policies. When a partner dies, the partnership receives the insurance proceeds to buy the deceased partner's interest. In both types of agreements, the policy proceeds provide the necessary funds to facilitate the purchase of the deceased partner's interest, ensuring financial stability for the surviving partners and the smooth continuity of the professional partnership. The West Virginia Buy-Sell Agreement with Life Insurance to Fund Purchase of Deceased Partner's Interest in a Professional Partnership typically includes clauses specifying the trigger events for the agreement, such as the death of a partner. It also outlines the valuation method for determining the value of the deceased partner's interest in the partnership. This agreement takes into account the unique circumstances of each professional partnership and provides a legal framework for the transaction, allowing for a seamless transition in ownership and safeguarding the partnership's financial stability. It ensures that the deceased partner's family receives a fair value for their interest while providing the surviving partners with the means to continue operating the partnership effectively. Partnering with an attorney familiar with West Virginia laws regarding professional partnerships and buy-sell agreements is essential to draft and implement a comprehensive West Virginia Buy-Sell Agreement with Life Insurance to Fund Purchase of Deceased Partner's Interest in a Professional Partnership that meets the specific needs and requirements of the partners involved.

West Virginia Buy-Sell Agreement with Life Insurance to Fund Purchase of Deceased Partner's Interest in a Professional Partnership

Description

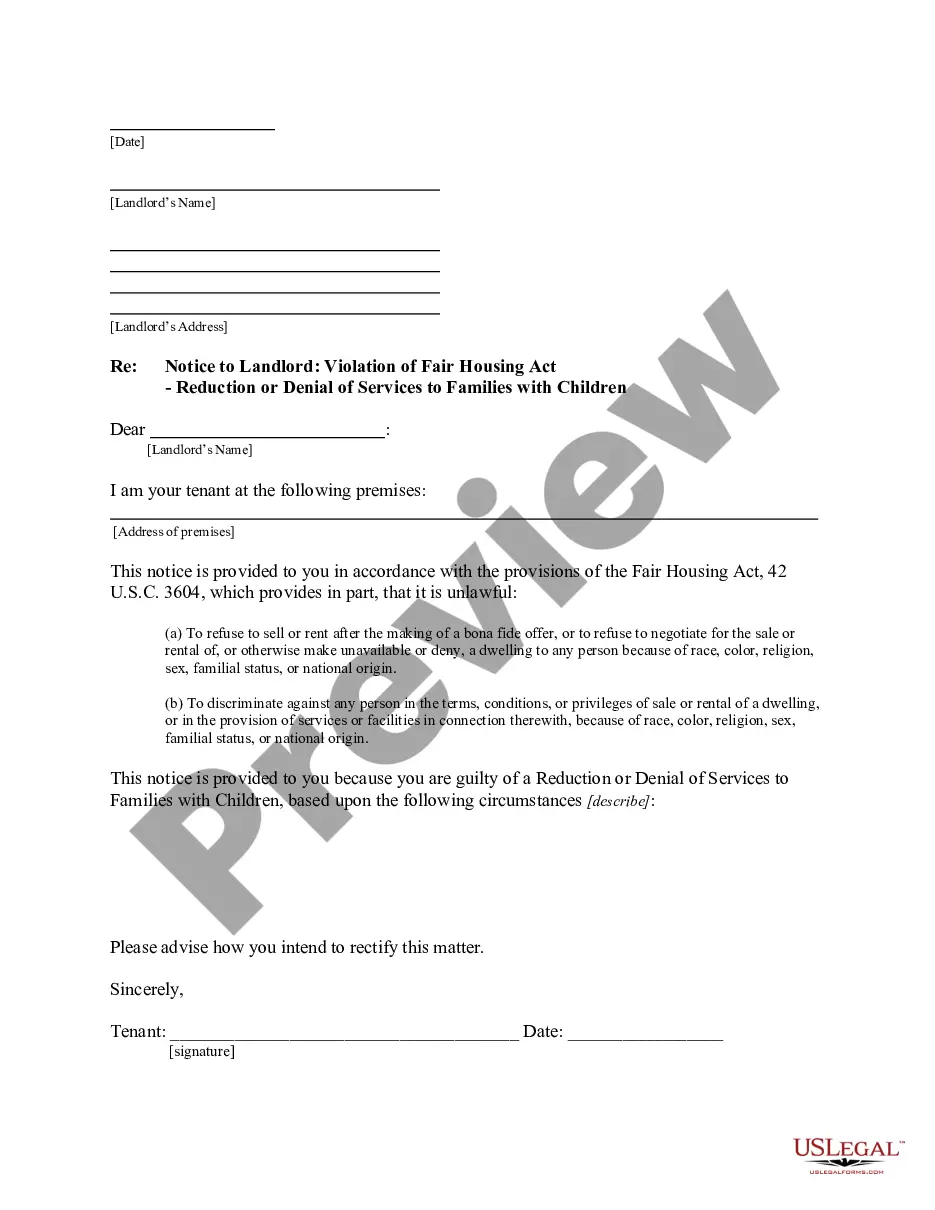

How to fill out West Virginia Buy-Sell Agreement With Life Insurance To Fund Purchase Of Deceased Partner's Interest In A Professional Partnership?

Selecting the appropriate legitimate document template can be challenging.

It goes without saying that there are numerous templates accessible online, but how do you locate the authentic form you require.

Utilize the US Legal Forms website. This service provides thousands of templates, including the West Virginia Buy-Sell Agreement with Life Insurance to Fund Purchase of Deceased Partner's Interest in a Professional Partnership, suitable for business and personal purposes.

You can preview the form using the Review button and read the form description to confirm that it is suitable for your needs.

- All forms are vetted by professionals and comply with federal and state regulations.

- If you are currently registered, Log In to your account and click the Acquire button to obtain the West Virginia Buy-Sell Agreement with Life Insurance to Fund Purchase of Deceased Partner's Interest in a Professional Partnership.

- Use your account to browse the legal forms you have previously purchased.

- Visit the My documents tab of your account to download another copy of the document you need.

- If you are a new user of US Legal Forms, here are some simple guidelines to follow.

- First, ensure you have selected the correct form for your location.

Form popularity

FAQ

In a cross purchase buy-sell agreement, each business owner buys a life insurance policy on the other owner(s). With multiple owners, this can get very complex and complicated. Instead, try a trusteed cross purchase buy-sell, in which a third-party (acting as trustee) takes care of the buy-sell arrangement.

The four types of buy sell agreements are:Cross-purchase agreement.Entity purchase agreement.Wait-and-See.Business-continuation general partnership.

purchase agreement is a document that allows a company's partners or other shareholders to purchase the interest or shares of a partner who dies, becomes incapacitated or retires. The mechanism often relies on a life insurance policy in the event of a death to facilitate that exchange of value.

One common question we receive when discussing key person benefits is What is a buy/sell agreement? A buy/sell agreement, also known as a buyout agreement, is a contract funded by a life insurance policy that can help minimize the turmoil caused by the sudden departure, disability or death of a business owner or

Life insurance is an effective tool that business owners can use to implement the provisions of a buy-sell agreement by providing liquidity at the death of an owner to both his or her business and family.

There are four common buyout structures:Traditional cross purchase plan. Each owner who is left in the business agrees to purchase the co-owner's shares if that individual dies or leaves the business.Entity redemption plan.One-way buy sell plan.Wait-and-see buy sell plan.

Life insurance proceeds provide liquidity for ordinary living expenses and estate tax liability. Buy-sell agreements can be structured under various forms, including 1) entity redemption, 2) cross purchase, 3) cross endorsement, 4) wait-and-see and 5) a one-way agreement.

One common question we receive when discussing key person benefits is What is a buy/sell agreement? A buy/sell agreement, also known as a buyout agreement, is a contract funded by a life insurance policy that can help minimize the turmoil caused by the sudden departure, disability or death of a business owner or

Interesting Questions

More info

The consumer may waive some of those provisions by providing written permission to the seller. However, not all consumer agreements provide for waiver of all the provisions.