A West Virginia Revocable Letter of Credit, also known as a "WV RLC," is a financial instrument commonly used in business transactions to provide a guarantee of payment to the beneficiary (usually the seller or supplier) by the issuing bank. This type of letter of credit is revocable, which means it can be modified or canceled by the issuing bank without the consent of the beneficiary. This flexibility allows the issuing bank to adjust or revoke the terms of the credit if the circumstances warrant such action, giving the bank more control over its obligations. The West Virginia Revocable Letter of Credit is widely accepted in business transactions within West Virginia and beyond. It offers reassurance to the beneficiary that they will receive payment as agreed upon, ensuring a level of security and trust in the transaction. Keywords: 1. West Virginia: Refers to the geographical region where the Revocable Letter of Credit is applicable. 2. Revocable Letter of Credit: The specific type of financial instrument being described, indicating that it can be modified or canceled by the issuing bank. 3. Financial Guarantee: The purpose of the letter of credit is to provide assurance to the beneficiary that payment will be made by the issuing bank. 4. Business Transactions: The context in which the Revocable Letter of Credit is typically used, often in commercial agreements. 5. Beneficiary: The party who will receive the payment as indicated in the letter of credit, often the seller or supplier. 6. Issuing Bank: The financial institution that creates and guarantees the letter of credit on behalf of the buyer (applicant) and agrees to pay the beneficiary. 7. Security and Trust: The associated benefits of utilizing a Revocable Letter of Credit, as it instills confidence in both parties involved in the transaction. 8. Modify or Cancel: The inherent flexibility of the West Virginia Revocable Letter of Credit, allowing the issuing bank to alter or terminate the credit as necessary. Types of West Virginia Revocable Letter of Credit: 1. Commercial Letter of Credit: Primarily used in trade transactions, providing payment assurance to the beneficiary for the purchase of goods or services. 2. Standby Letter of Credit: Used as a guarantee of payment in the event of non-performance or non-payment by the applicant as stated in the agreement. 3. Revolving Letter of Credit: An arrangement where the letter of credit becomes automatically reinstated after each payment, allowing for multiple draw downs up to a specified limit. 4. Back-to-Back Letter of Credit: Issued based on an existing letter of credit, effectively using the first letter of credit as collateral for obtaining a second letter of credit. In conclusion, the West Virginia Revocable Letter of Credit is a flexible financial instrument that provides security to beneficiaries in business transactions within the region. Its revocable nature allows the issuing bank to modify or cancel the credit, providing more control over its obligations. Different types of West Virginia Revocable Letter of Credit include commercial, standby, revolving, and back-to-back letters of credit.

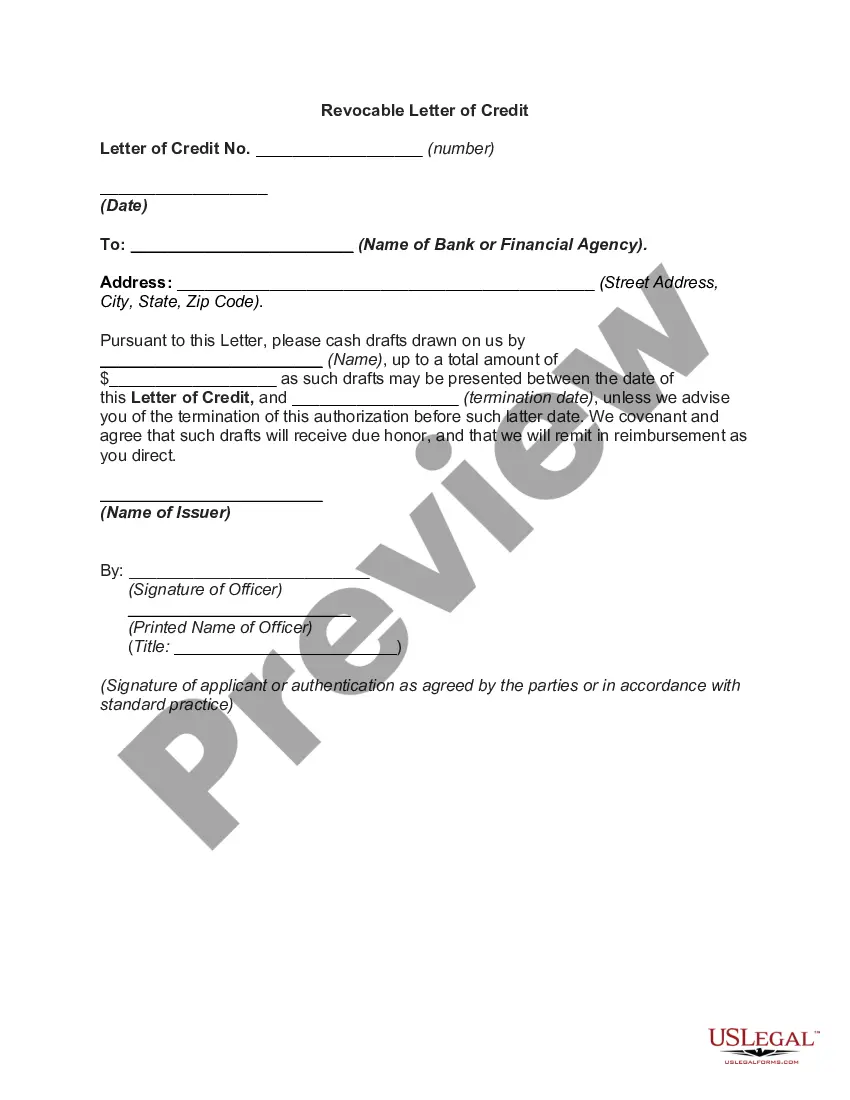

West Virginia Revocable Letter of Credit

Description

How to fill out West Virginia Revocable Letter Of Credit?

Are you currently in the place where you need to have paperwork for either company or personal functions virtually every time? There are tons of lawful file themes available on the Internet, but locating kinds you can depend on isn`t simple. US Legal Forms provides thousands of kind themes, much like the West Virginia Revocable Letter of Credit, which can be published to fulfill federal and state specifications.

In case you are presently familiar with US Legal Forms website and possess your account, merely log in. After that, it is possible to acquire the West Virginia Revocable Letter of Credit web template.

Should you not offer an account and want to begin to use US Legal Forms, abide by these steps:

- Get the kind you want and ensure it is for the appropriate town/state.

- Utilize the Preview key to analyze the form.

- Read the description to ensure that you have selected the appropriate kind.

- In the event the kind isn`t what you`re searching for, utilize the Search industry to find the kind that fits your needs and specifications.

- When you get the appropriate kind, simply click Get now.

- Opt for the prices prepare you need, fill out the specified information and facts to create your money, and pay money for the order making use of your PayPal or charge card.

- Pick a practical paper file format and acquire your backup.

Discover each of the file themes you may have bought in the My Forms food selection. You can aquire a additional backup of West Virginia Revocable Letter of Credit any time, if needed. Just go through the necessary kind to acquire or print out the file web template.

Use US Legal Forms, by far the most extensive selection of lawful kinds, to save lots of some time and steer clear of errors. The services provides expertly made lawful file themes which can be used for a range of functions. Generate your account on US Legal Forms and begin generating your life a little easier.