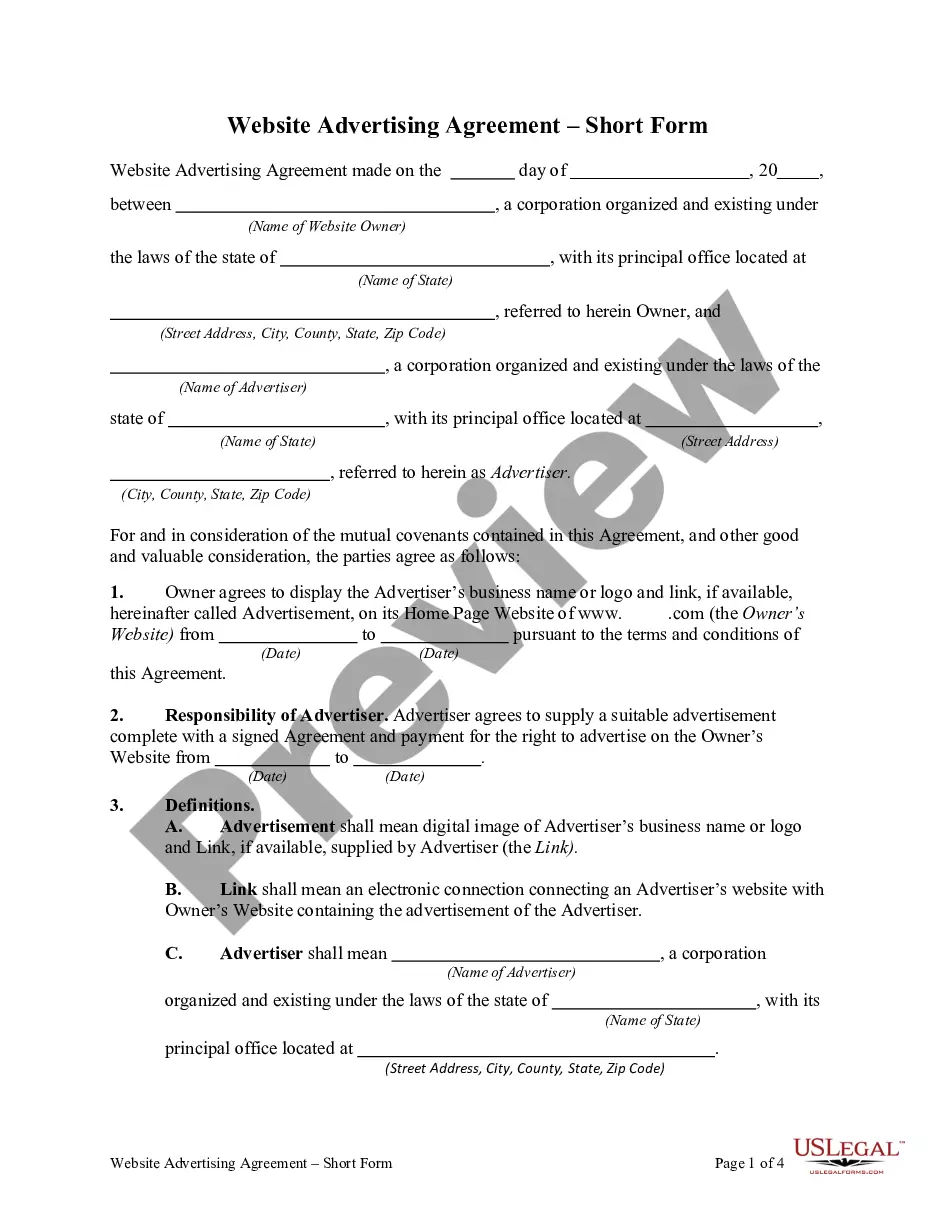

West Virginia Agreement for Auditing Services between Accounting Firm and Municipality

Description

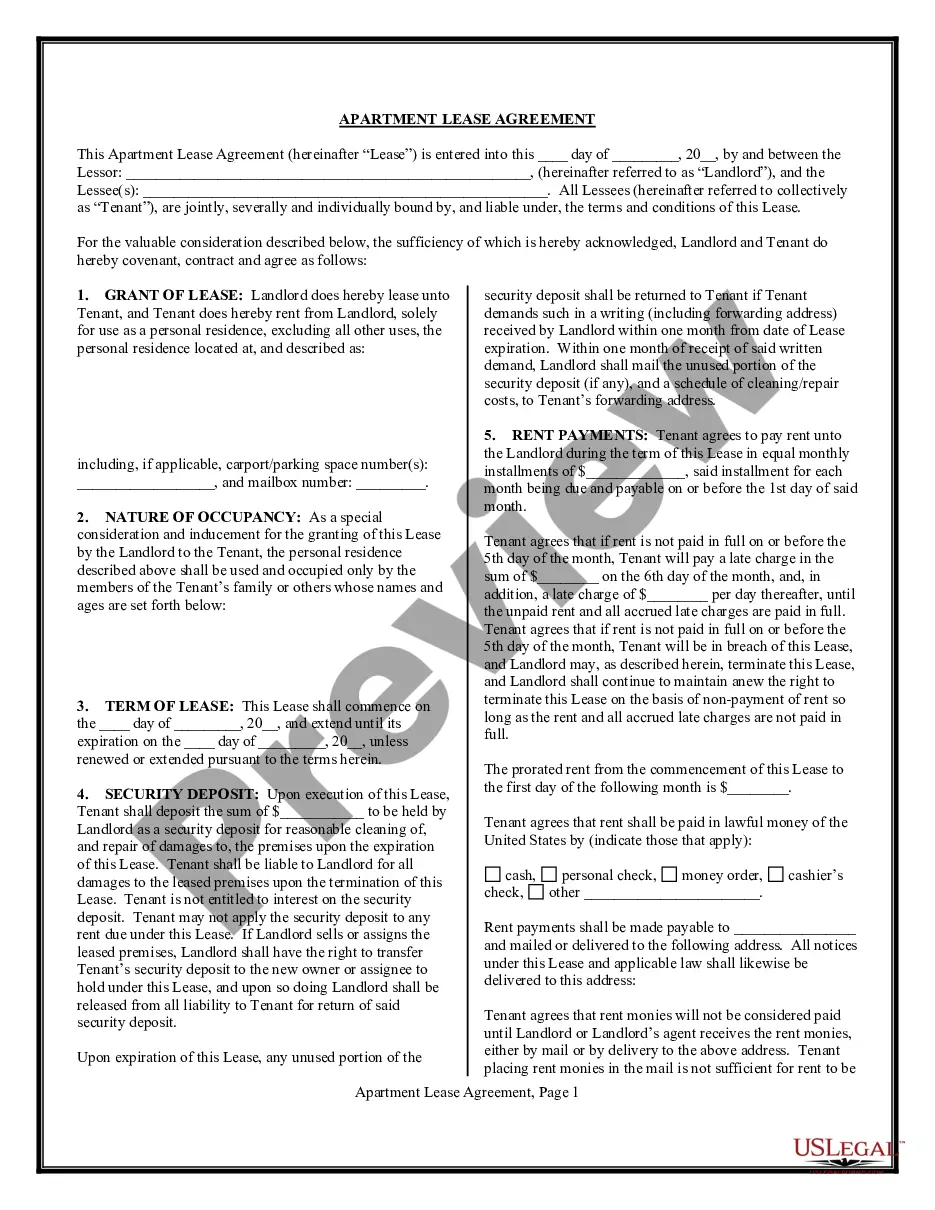

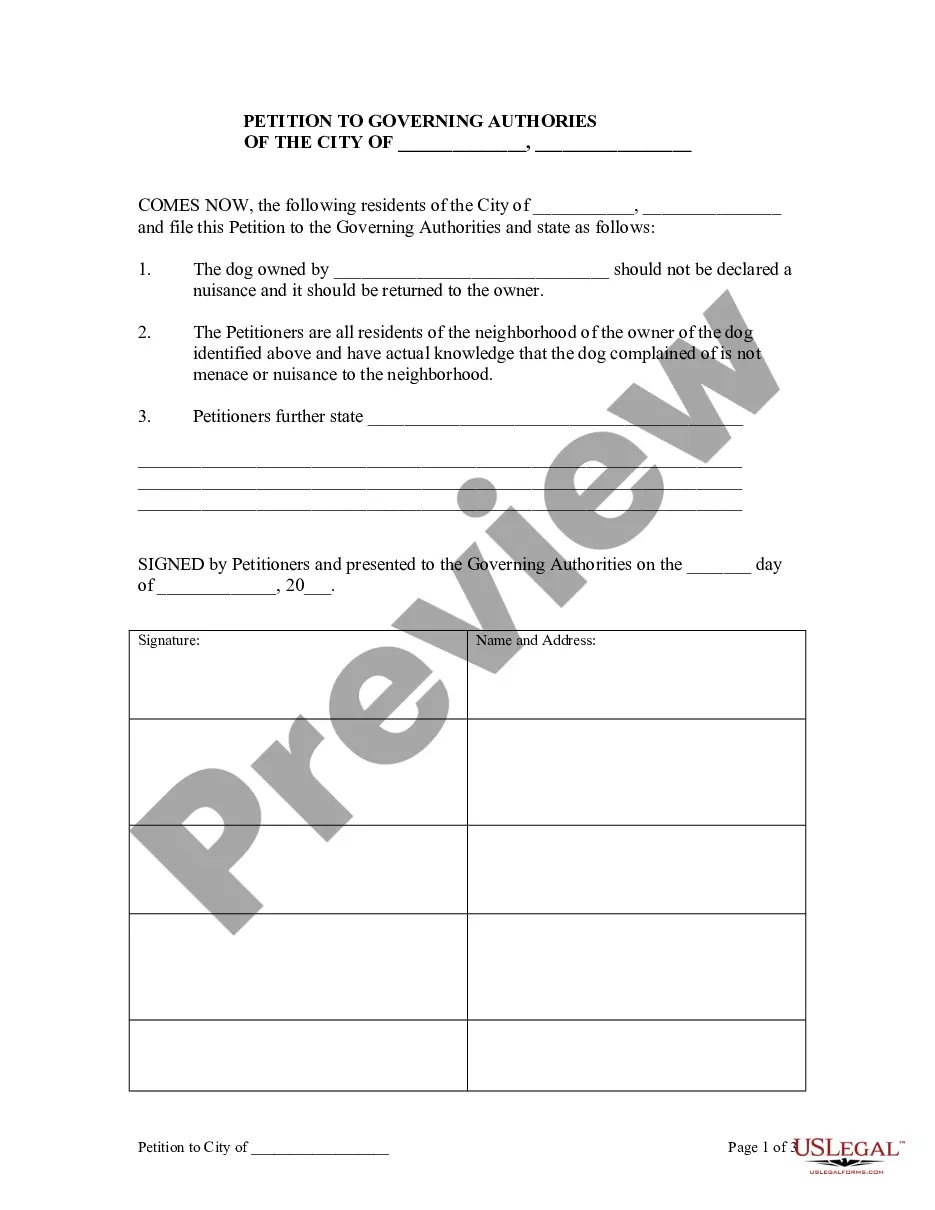

How to fill out Agreement For Auditing Services Between Accounting Firm And Municipality?

US Legal Forms - one of several most significant libraries of lawful kinds in the United States - delivers a wide range of lawful record web templates you are able to download or printing. Using the internet site, you will get 1000s of kinds for enterprise and specific purposes, sorted by groups, suggests, or keywords.You will discover the most recent models of kinds such as the West Virginia Agreement for Auditing Services between Accounting Firm and Municipality within minutes.

If you already possess a monthly subscription, log in and download West Virginia Agreement for Auditing Services between Accounting Firm and Municipality in the US Legal Forms collection. The Download key can look on each kind you look at. You have access to all in the past delivered electronically kinds within the My Forms tab of the account.

If you want to use US Legal Forms for the first time, listed below are simple guidelines to get you started out:

- Ensure you have selected the right kind for your area/area. Select the Preview key to analyze the form`s content material. Look at the kind description to actually have selected the right kind.

- If the kind doesn`t fit your needs, utilize the Research field near the top of the display screen to find the one that does.

- If you are content with the shape, affirm your choice by clicking the Acquire now key. Then, opt for the pricing prepare you want and supply your accreditations to register for an account.

- Method the transaction. Make use of your bank card or PayPal account to finish the transaction.

- Choose the structure and download the shape in your system.

- Make alterations. Load, edit and printing and signal the delivered electronically West Virginia Agreement for Auditing Services between Accounting Firm and Municipality.

Each design you put into your money lacks an expiration day and is yours eternally. So, if you want to download or printing another version, just go to the My Forms section and click around the kind you will need.

Get access to the West Virginia Agreement for Auditing Services between Accounting Firm and Municipality with US Legal Forms, one of the most comprehensive collection of lawful record web templates. Use 1000s of specialist and state-certain web templates that satisfy your organization or specific needs and needs.

Form popularity

FAQ

The State Auditor's Chief Inspector Division ensures that financial accountability is present at the local level of government by annually conducting and overseeing over 700 financial audits of counties, municipalities, boards of education and other miscellaneous local boards and authorities.

John ?JB? McCuskey is West Virginia's 21st State Auditor. He is currently in his second term, first elected in 2016.

Today, West Virginia State Auditor JB McCuskey.

Steps for conducting a financial audit Understand your goals. ... Decide what to include in your audit. ... Gather and organise your materials. ... Begin data analysis. ... Consider financial security. ... Examine tax reporting status. ... Compile a report.

The California State Auditor ensures the effective and efficient use and management of public funds and programs. We provide nonpartisan, accurate, and timely assessments of California government's financial and operational activities.

We ultimately determine whether government agencies are efficient, effective, fulfilling their missions, and complying with the law. Our office is also responsible for audits that are mandated by state law, such as our annual review of the state judicial system.