West Virginia Accord and Satisfaction Release Agreement Regarding Dispute between Two Corporations and Shareholders Regarding Obligations under Stock Option Agreement

Description

How to fill out Accord And Satisfaction Release Agreement Regarding Dispute Between Two Corporations And Shareholders Regarding Obligations Under Stock Option Agreement?

If you need to total, obtain, or produce lawful record web templates, use US Legal Forms, the biggest collection of lawful varieties, which can be found on the Internet. Use the site`s simple and convenient look for to find the files you need. Different web templates for organization and individual purposes are sorted by categories and suggests, or keywords and phrases. Use US Legal Forms to find the West Virginia Accord and Satisfaction Release Agreement Regarding Dispute between Two Corporations and Shareholders Regarding Obligations under Stock Option Agreement with a number of clicks.

If you are previously a US Legal Forms buyer, log in to your accounts and click on the Down load button to obtain the West Virginia Accord and Satisfaction Release Agreement Regarding Dispute between Two Corporations and Shareholders Regarding Obligations under Stock Option Agreement. You can also gain access to varieties you in the past acquired from the My Forms tab of the accounts.

If you use US Legal Forms for the first time, follow the instructions listed below:

- Step 1. Be sure you have selected the form for that proper city/country.

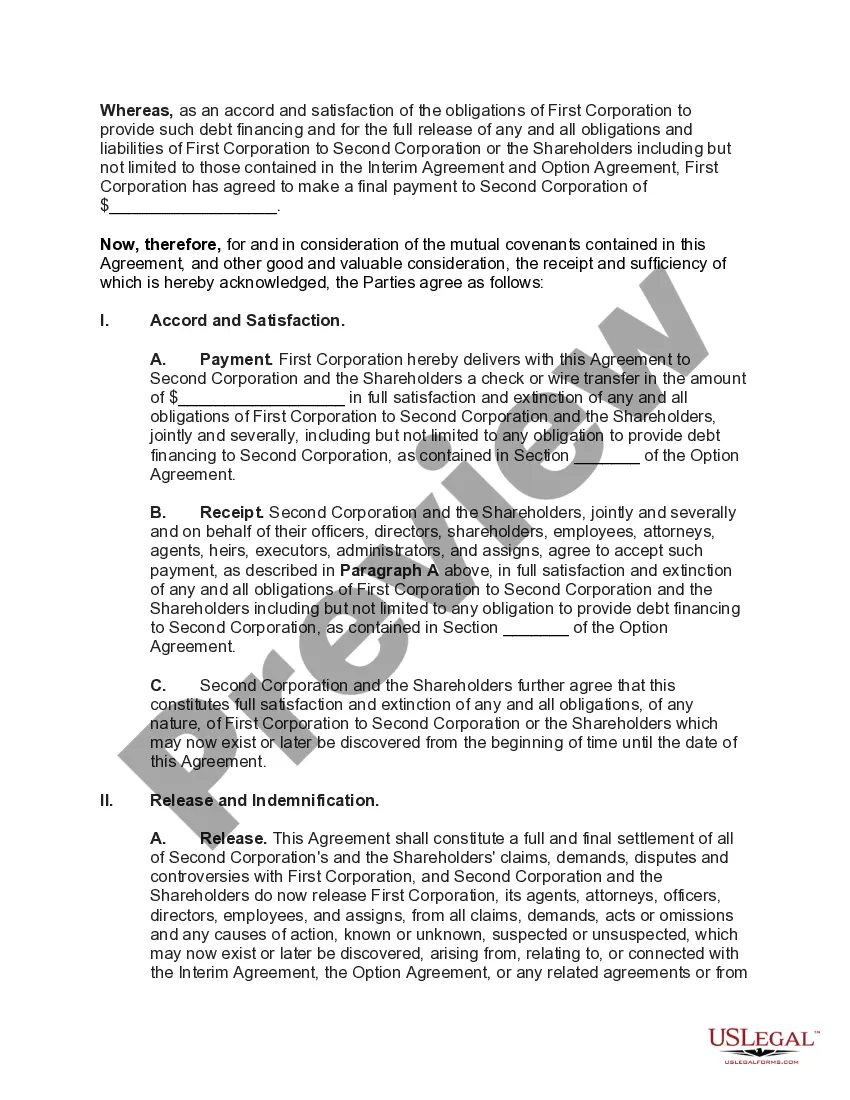

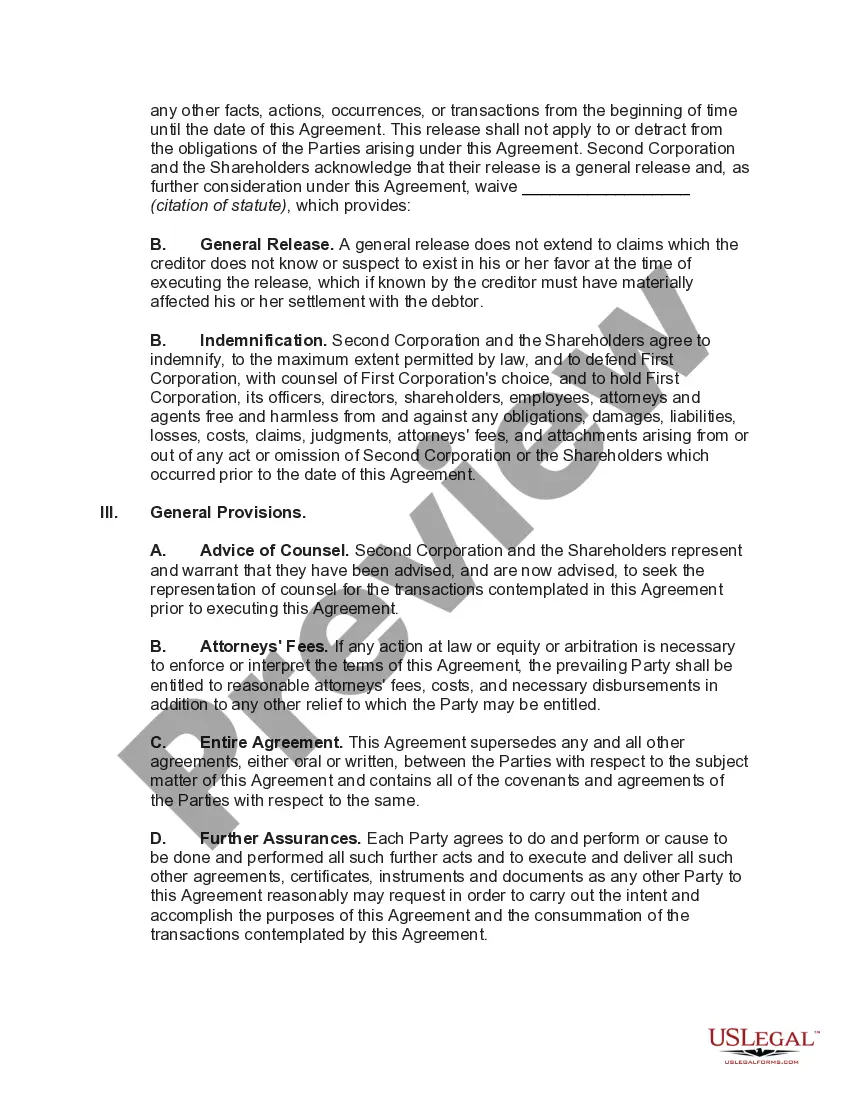

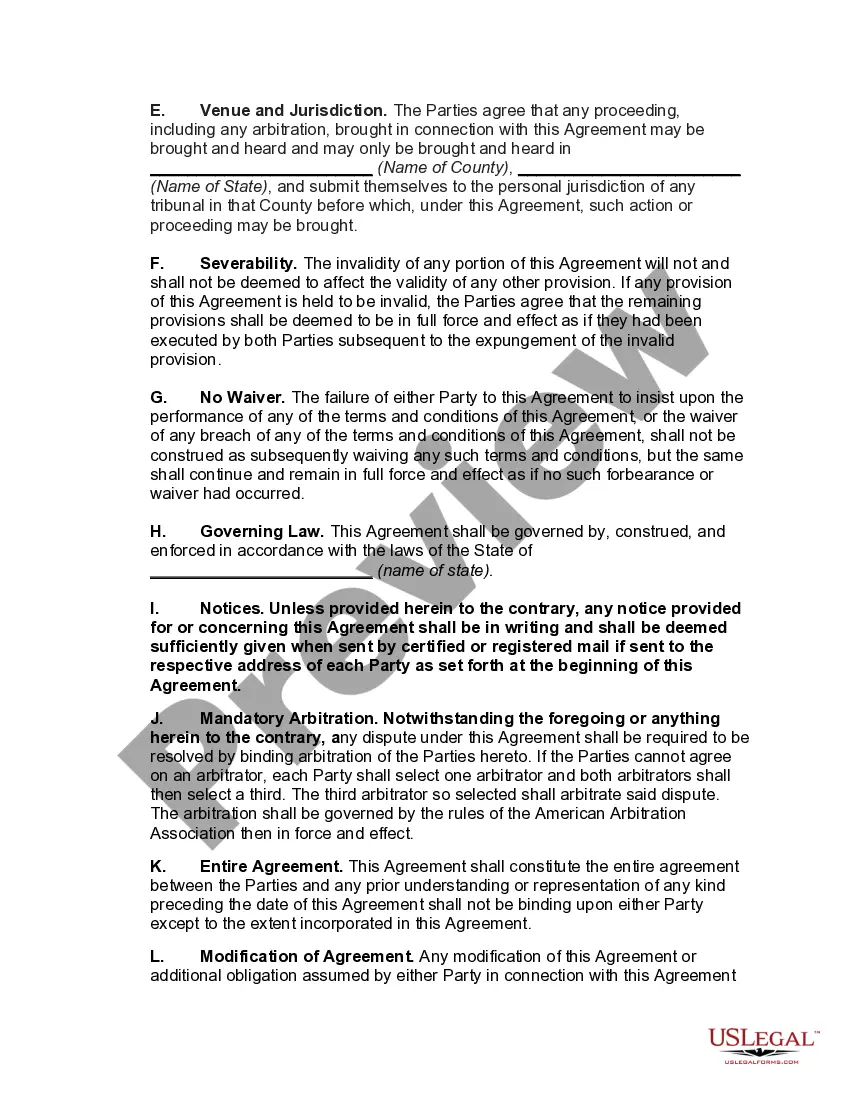

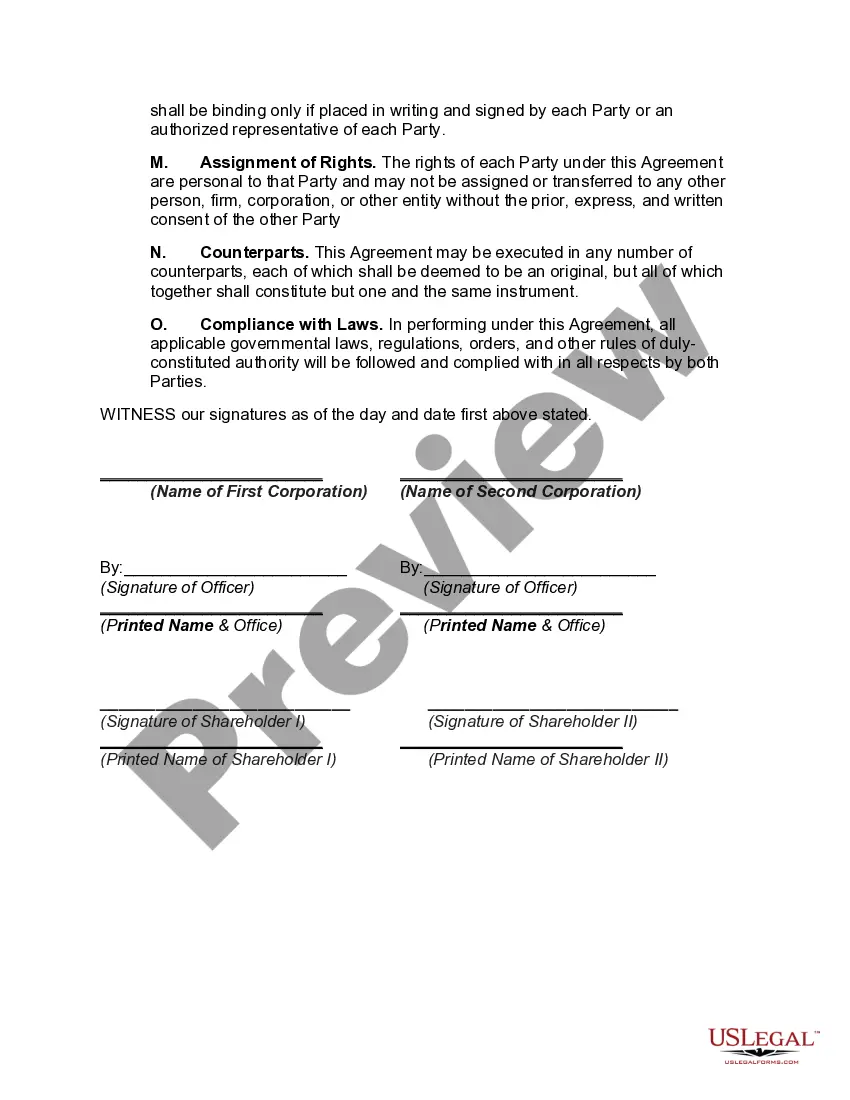

- Step 2. Utilize the Review method to look over the form`s articles. Never forget to learn the information.

- Step 3. If you are not satisfied using the type, use the Research discipline near the top of the display to get other versions of your lawful type format.

- Step 4. Upon having discovered the form you need, go through the Acquire now button. Select the costs program you favor and add your accreditations to register for the accounts.

- Step 5. Procedure the purchase. You may use your credit card or PayPal accounts to finish the purchase.

- Step 6. Choose the formatting of your lawful type and obtain it on your system.

- Step 7. Comprehensive, revise and produce or indication the West Virginia Accord and Satisfaction Release Agreement Regarding Dispute between Two Corporations and Shareholders Regarding Obligations under Stock Option Agreement.

Each lawful record format you get is yours forever. You have acces to each type you acquired inside your acccount. Click on the My Forms section and pick a type to produce or obtain again.

Remain competitive and obtain, and produce the West Virginia Accord and Satisfaction Release Agreement Regarding Dispute between Two Corporations and Shareholders Regarding Obligations under Stock Option Agreement with US Legal Forms. There are millions of specialist and condition-specific varieties you may use for your organization or individual requires.

Form popularity

FAQ

A good shareholders agreement should set out the decisions a shareholder-director may and may not make without agreement from others. These are known as reserved matters. Disclosure of decision making is also important. A shareholder-director may be able to make decisions that aren't reported to other shareholders.

Operating agreements are used for limited liability companies with multiple members, and shareholder agreements are used for corporations with multiple shareholders. These documents can help ensure that your business is set up correctly so that you avoid business operation issues in the future.

We have 5 steps. Step 1: Decide on the issues the agreement should cover. ... Step 2: Identify the interests of shareholders. ... Step 3: Identify shareholder value. ... Step 4: Identify who will make decisions - shareholders or directors. ... Step 5: Decide how voting power of shareholders should add up.

Bylaws ensure the corporation adheres to a certain standard and that everyone knows their role in the company. A shareholders' agreement differs from bylaws because it is an optional arrangement that only regulates the shareholders' relationship among themselves.

A shareholders' agreement includes a date; often the number of shares issued; a capitalization table that outlines shareholders and their percentage ownership; any restrictions on transferring shares; pre-emptive rights for current shareholders to purchase shares to maintain ownership percentages (for example, in the ...

However, drafting a shareholder agreement requires careful consideration of a range of critical issues, such as ownership structure, transferability of shares, voting rights, management structure, decision-making procedures, dividend distribution, dispute resolution mechanisms, confidentiality, termination provisions, ...

A shareholders' agreement includes a date; often the number of shares issued; a capitalization table that outlines shareholders and their percentage ownership; any restrictions on transferring shares; pre-emptive rights for current shareholders to purchase shares to maintain ownership percentages (for example, in the ...

Purpose of shareholder agreement 1.2 The Shareholders are entering into this Shareholder Agreement to provide for the management and control of the affairs of the Corporation, including management of the business, division of profits, disposition of shares, and distribution of assets on liquidation.