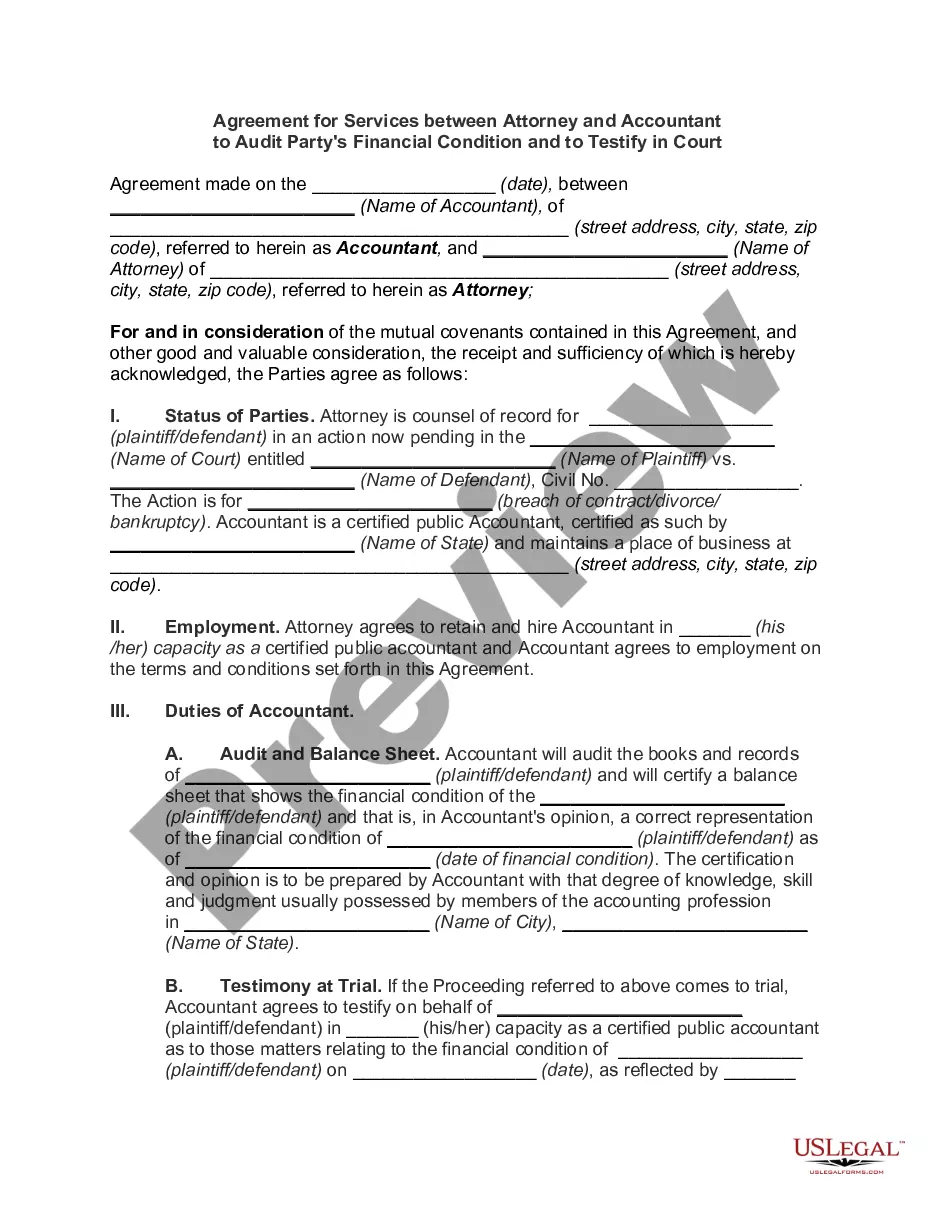

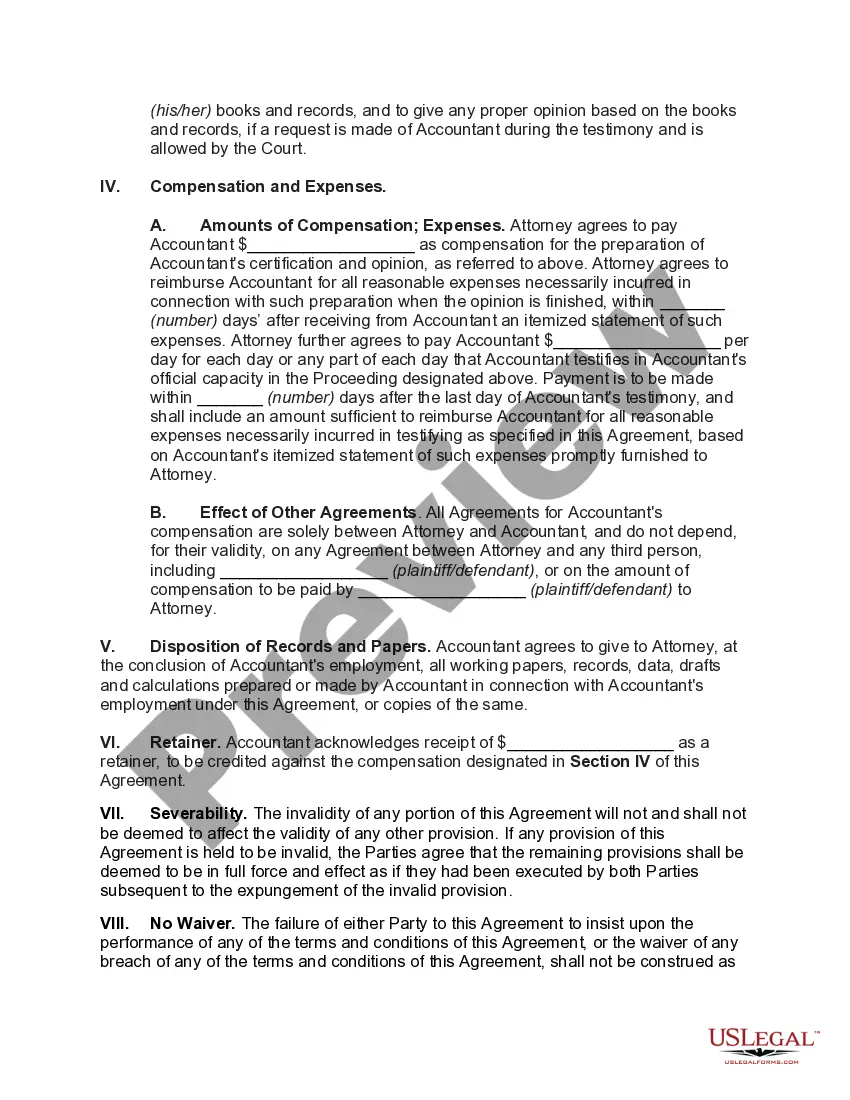

West Virginia Agreement for Services between Attorney and Accountant to Audit Party's Financial Condition and to Testify in Court

Description

How to fill out Agreement For Services Between Attorney And Accountant To Audit Party's Financial Condition And To Testify In Court?

US Legal Forms - one of the most significant libraries of authorized kinds in the USA - delivers an array of authorized document templates it is possible to acquire or printing. While using web site, you may get 1000s of kinds for organization and personal functions, categorized by categories, says, or key phrases.You will find the newest versions of kinds just like the West Virginia Agreement for Services between Attorney and Accountant to Audit Party's Financial Condition and to Testify in Court within minutes.

If you currently have a monthly subscription, log in and acquire West Virginia Agreement for Services between Attorney and Accountant to Audit Party's Financial Condition and to Testify in Court from your US Legal Forms collection. The Obtain key will show up on every single kind you look at. You have accessibility to all formerly acquired kinds from the My Forms tab of your account.

If you would like use US Legal Forms initially, allow me to share easy directions to help you get began:

- Ensure you have picked out the correct kind for your metropolis/area. Go through the Preview key to examine the form`s content material. Read the kind description to actually have selected the appropriate kind.

- When the kind does not fit your requirements, take advantage of the Look for field near the top of the monitor to find the one that does.

- When you are happy with the shape, affirm your selection by visiting the Get now key. Then, select the prices strategy you like and give your credentials to sign up to have an account.

- Method the purchase. Utilize your credit card or PayPal account to complete the purchase.

- Choose the structure and acquire the shape in your gadget.

- Make adjustments. Complete, change and printing and sign the acquired West Virginia Agreement for Services between Attorney and Accountant to Audit Party's Financial Condition and to Testify in Court.

Every format you added to your bank account lacks an expiration date which is your own property permanently. So, if you wish to acquire or printing one more copy, just visit the My Forms portion and click around the kind you will need.

Get access to the West Virginia Agreement for Services between Attorney and Accountant to Audit Party's Financial Condition and to Testify in Court with US Legal Forms, probably the most substantial collection of authorized document templates. Use 1000s of professional and state-distinct templates that meet up with your company or personal requirements and requirements.