West Virginia Payroll Deduction - Special Services

Description

How to fill out Payroll Deduction - Special Services?

If you desire to finalize, obtain, or create legal document templates, utilize US Legal Forms, the premier collection of legal forms, accessible online.

Take advantage of the site's user-friendly and efficient search to locate the documents you require.

A multitude of templates for business and personal purposes are organized by categories and titles, or keywords.

Step 3. If you are dissatisfied with the template, utilize the Search field at the top of the screen to find alternative legal form formats.

Step 4. Once you find the form you need, click on the Get now button. Select the pricing plan you prefer and enter your details to register for an account.

- Utilize US Legal Forms to find the West Virginia Payroll Deduction - Special Services with just a few clicks.

- If you are already a US Legal Forms member, sign in to your account and click the Obtain button to find the West Virginia Payroll Deduction - Special Services.

- You can also access forms you previously purchased from the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the steps below.

- Step 1. Confirm you have chosen the form for the correct city/state.

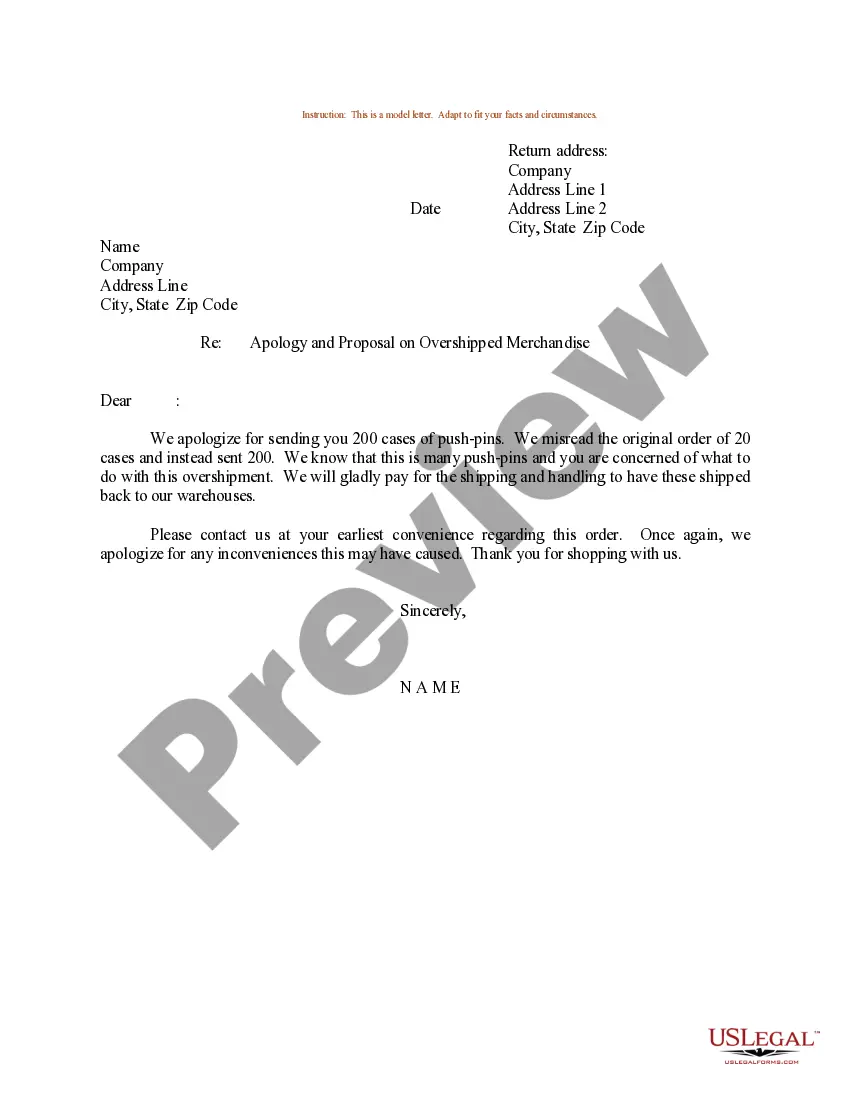

- Step 2. Use the Preview option to review the content of the form. Be sure to read the details.

Form popularity

FAQ

Some common voluntary payroll deduction plan examples include: 401(k) plan, IRA, or other retirement savings plan contributions. Medical, dental, or vision health insurance plans. Flexible spending account or pre-tax health savings account contributions.

Deductions can be grouped into three categories: the standard deduction, itemized deductions and above-the-line deductions.

20 popular tax deductions and tax credits for individualsChild tax credit.Child and dependent care tax credit.American opportunity tax credit.Lifetime learning credit.Student loan interest deduction.Adoption credit.Earned income tax credit.Charitable donations deduction.More items...

Payroll deductions are the specific amounts that you withhold from an employee's paycheck each pay period. There are two types of deductions: voluntary deductions, such as health insurance and 401(k) deductions, and mandatory deductions (those required by law), such as federal income taxes and FICA taxes.

Common itemized deductions include interest on a mortgage loan, unreimbursed healthcare costs, charitable contributions, and state and local taxes. Please consult a tax professional to determine whether a standard deduction or itemizing works for your financial situation.

Sales taxes. You have the option of deducting sales taxes or state income taxes off your federal income tax.Health insurance premiums.Tax savings for teacher.Charitable gifts.Paying the babysitter.Lifetime learning.Unusual business expenses.Looking for work.More items...?

Mandatory Payroll Tax DeductionsFederal income tax withholding.Social Security & Medicare taxes also known as FICA taxes.State income tax withholding.Local tax withholdings such as city or county taxes, state disability or unemployment insurance.Court ordered child support payments.07-Aug-2012

Voluntary Deductions Along with health, life and disability insurance, these voluntary payroll deductions may include union dues, retirement or 401(k) contributions and flexible spending accounts for health care and dependent care expenses.

What are payroll deductions?Income tax.Social security tax.401(k) contributions.Wage garnishments.Child support payments.