West Virginia Returned Items Report

Description

How to fill out Returned Items Report?

You might spend time online attempting to locate the legal document template that meets the federal and state requirements you need.

US Legal Forms provides a vast selection of legal forms that are reviewed by professionals.

You can download or print the West Virginia Returned Items Report from my services.

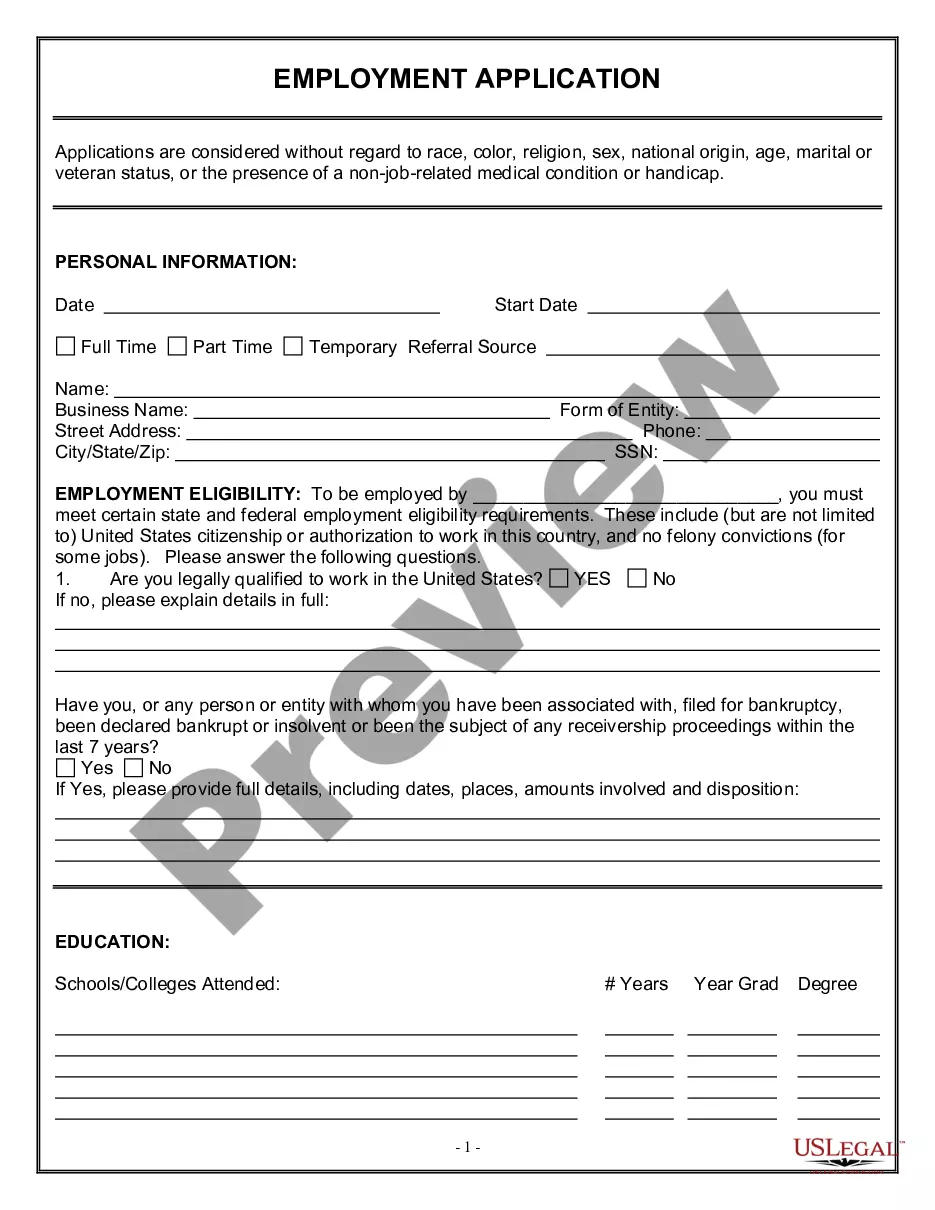

If available, utilize the Preview button to examine the document template as well.

- If you possess a US Legal Forms account, you can sign in and hit the Acquire button.

- Following that, you can fill out, modify, print, or sign the West Virginia Returned Items Report.

- Every legal document template you purchase is yours forever.

- To obtain another copy of the purchased form, navigate to the My documents tab and click the appropriate button.

- If this is your first time using the US Legal Forms website, follow the simple instructions below.

- First, confirm that you have selected the correct document template for your preferred area/city.

- Review the form description to ensure you have chosen the right one.

Form popularity

FAQ

To complete the back of a West Virginia title, you need to fill in the buyer's information, including their name and address. Additionally, sign and date the transfer section to finalize the sale. If you're unsure about specific requirements, consulting the West Virginia Returned Items Report can clarify any concerns.

Form IT-140 is the Form used for the Tax Amendment. You can prepare a 2021 West Virginia Tax Amendment Form on eFile.com, however you cannot submit it electronically. In comparison, the IRS requires a different Form - Form 1040X - to amend an IRS return (do not use Form 1040 for an IRS Amendment).

Generally, you will need a copy of your completed federal income tax return (Form 1040, 1040A or 1040EZ), any supporting federal schedules (A, C, D, E, F), your W-2 wage forms and 1099 income forms showing Virginia tax withheld, Virginia Schedule ADJ and Virginia Schedule CR.

WV/NRW-4. NOTICE OF REVOCATION OF NONRESIDENT INCOME TAX AGREEMENT.

A Family Tax Credit is available to certain individuals or families that may reduce or eliminate their West Virginia personal income tax. You may be entitled to this credit if you meet certain income limitations and family size. Individuals who file their income tax return with zero exemptions cannot claim the credit.

You must make quarterly estimated tax payments if your estimated tax liability (your estimated tax reduced by any state tax withheld from your income) is at least $600, unless that liability is less than ten percent of your estimated tax.

You must file a resident return and report all of your income in the same manner as any other resident individual unless you did not maintain a physical presence in West Virginia for more than 30 days during the taxable year.

West Virginia utilized a personal income tax rate ranging from 3 percent to 6.5 percent in 2017. An individual's tax liability varies according to his or her tax bracket. A tax bracket is the income range to which a tax rate applies.

GENERAL INFORMATION The Economic Opportunity Tax Credit is available to qualified businesses that make a qualified investment (on or after January 1, 2003) in a new or expanded business in West Virginia and, as a result of this investment, create at least twenty (20) new jobs.

You must file a resident return and report all of your income in the same manner as any other resident individual unless you did not maintain a physical presence in West Virginia for more than 30 days during the taxable year.