West Virginia Resolution of Meeting of LLC Members to Make Specific Loan is a legal document that outlines the process and approval of a specific loan by the members of a Limited Liability Company (LLC) in West Virginia. This resolution is crucial for LCS seeking financial assistance or providing loans within the state. The content of the West Virginia Resolution of Meeting of LLC Members to Make Specific Loan should include the following relevant keywords: 1. Purpose: Clearly state the purpose of the resolution, which is to approve a specific loan transaction. This can be a loan to another business entity, an individual, or any other specific purpose as required. 2. Loan Amount: Specify the exact amount of the loan being considered by the LLC members. It is essential to mention the currency and any specific instructions related to the loan amount, such as disbursal in installments or all at once. 3. Terms and Conditions: Outline the loan's terms and conditions, including the interest rate, repayment schedule, and any additional fees or penalties involved. These terms should be discussed and agreed upon by the members before drafting the resolution. 4. Approval Process: Describe the procedure for approving the loan within the LLC. This may include a requirement for a majority vote or unanimous consent from the members. It is crucial to follow the LLC's operating agreement and any applicable laws regarding loan approvals. 5. Signatories: List the names and signatures of the LLC members who have approved the loan resolution. Each member should have their signature next to their printed name for legal documentation purposes. Different types or variations of West Virginia Resolution of Meeting of LLC Members to Make Specific Loan may include: 1. Short-Term Loan Resolution: When the LLC intends to provide a loan for a short duration, typically less than a year, with specified repayment terms. 2. Long-Term Loan Resolution: In cases where the LLC plans to grant a loan with an extended repayment schedule, usually exceeding one year. This type of resolution may involve more detailed terms and interest calculations. 3. Revolving Credit Resolution: LCS may establish a revolving credit resolution enabling them to provide loans repeatedly to the same borrower or entity. This resolution would allow the LLC members to approve a specific line of credit for a specific borrower. 4. Working Capital Loan Resolution: LCS requiring immediate funds for business operations may draft a specific resolution addressing the loan purpose for working capital needs. It is essential to consult legal counsel or an attorney familiar with West Virginia LLC laws to ensure compliance and accuracy when drafting a West Virginia Resolution of Meeting of LLC Members to Make Specific Loan.

West Virginia Resolution of Meeting of LLC Members to Make Specific Loan

Description

How to fill out West Virginia Resolution Of Meeting Of LLC Members To Make Specific Loan?

Have you been in a placement the place you need to have files for possibly company or individual reasons virtually every day? There are a lot of legitimate papers web templates available online, but discovering ones you can rely is not simple. US Legal Forms offers a huge number of type web templates, much like the West Virginia Resolution of Meeting of LLC Members to Make Specific Loan, that are published in order to meet federal and state specifications.

Should you be already knowledgeable about US Legal Forms web site and have a merchant account, merely log in. Following that, you can download the West Virginia Resolution of Meeting of LLC Members to Make Specific Loan design.

If you do not offer an bank account and would like to begin using US Legal Forms, abide by these steps:

- Discover the type you require and make sure it is for your proper city/region.

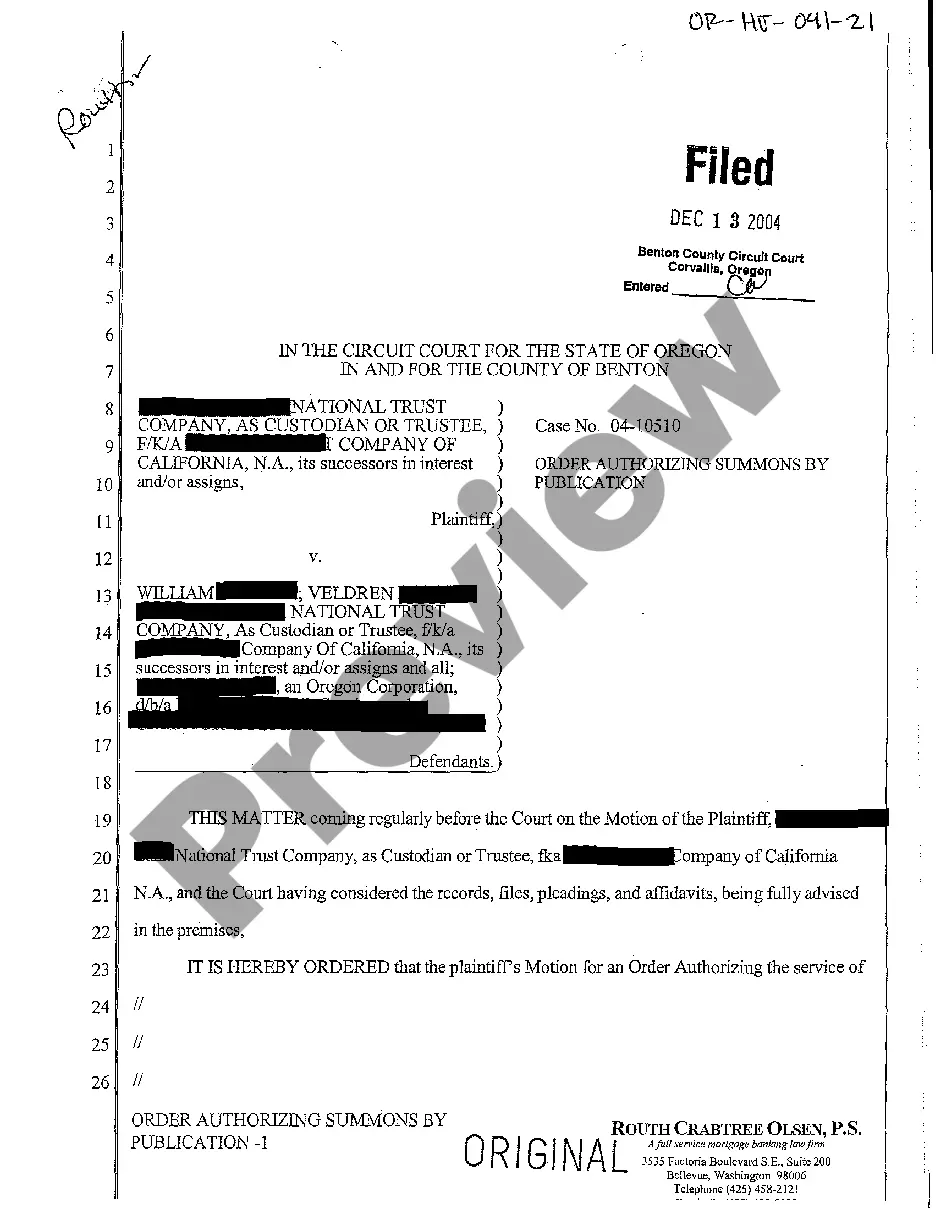

- Take advantage of the Preview button to review the form.

- Look at the information to ensure that you have chosen the correct type.

- When the type is not what you`re looking for, utilize the Look for area to obtain the type that meets your requirements and specifications.

- Once you obtain the proper type, click Get now.

- Choose the pricing plan you desire, fill out the required information to make your bank account, and purchase the order with your PayPal or charge card.

- Pick a convenient data file formatting and download your backup.

Discover all of the papers web templates you may have purchased in the My Forms menus. You may get a additional backup of West Virginia Resolution of Meeting of LLC Members to Make Specific Loan any time, if necessary. Just select the required type to download or print out the papers design.

Use US Legal Forms, one of the most extensive collection of legitimate kinds, in order to save time and prevent mistakes. The services offers appropriately made legitimate papers web templates that you can use for a selection of reasons. Create a merchant account on US Legal Forms and start producing your lifestyle easier.

Form popularity

FAQ

A corporate resolution is a legal document that outlines actions a board of directors will take on behalf of a corporation. by Staff.

A banking resolution is a necessary business document for corporations, both for-profit and nonprofit. While resolutions for LLCs are not legally required, they may still be needed in order to document the company decisions.

An LLC Corporate Resolution Form is a document that describes the management and decision-making processes of the LLC. While LLCs are generally not required to draft a resolution form, it is highly beneficial and important for all businesses to draft corporate resolutions.

An LLC corporate resolution is a record of a decision made through a vote by the board of directors or LLC members. Limited liability companies (LLCs) enjoy specific tax and legal benefits modeled after a corporate structure, although they are not corporations.

Most LLC Resolutions include the following sections:Date, time, and place of the meeting.Owners or members present.The nature of business or resolution to discuss, including members added or removed, loans made, new contracts written, or changes in business scope or method.More items...

How to Write a ResolutionFormat the resolution by putting the date and resolution number at the top.Form a title of the resolution that speaks to the issue that you want to document.Use formal language in the body of the resolution, beginning each new paragraph with the word, whereas.More items...?16-Jun-2021

How To Write a Corporate Resolution Step by StepStep 1: Write the Company's Name.Step 2: Include Further Legal Identification.Step 3: Include Location, Date and Time.Step 4: List the Board Resolutions.Step 5: Sign and Date the Document.

Most LLC Resolutions include the following sections:Date, time, and place of the meeting.Owners or members present.The nature of business or resolution to discuss, including members added or removed, loans made, new contracts written, or changes in business scope or method.More items...

Loan Resolution means that certain Resolution, adopted by the Board of the City on March 8, 2021, authorizing a loan under a loan agreement between the Borrower and the Issuer to finance the Project.

An LLC resolution is a written record of important decisions made by members that describes an action taken by the company and confirms that members were informed about it and agreed to it.