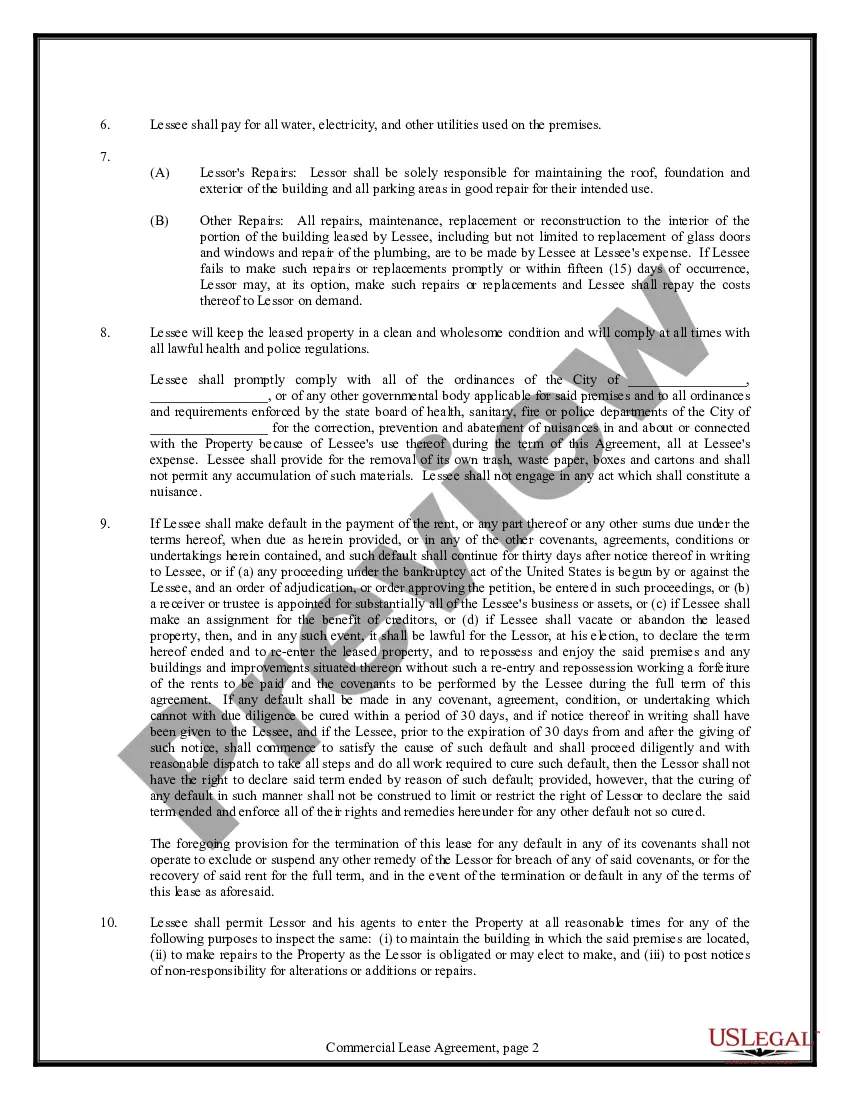

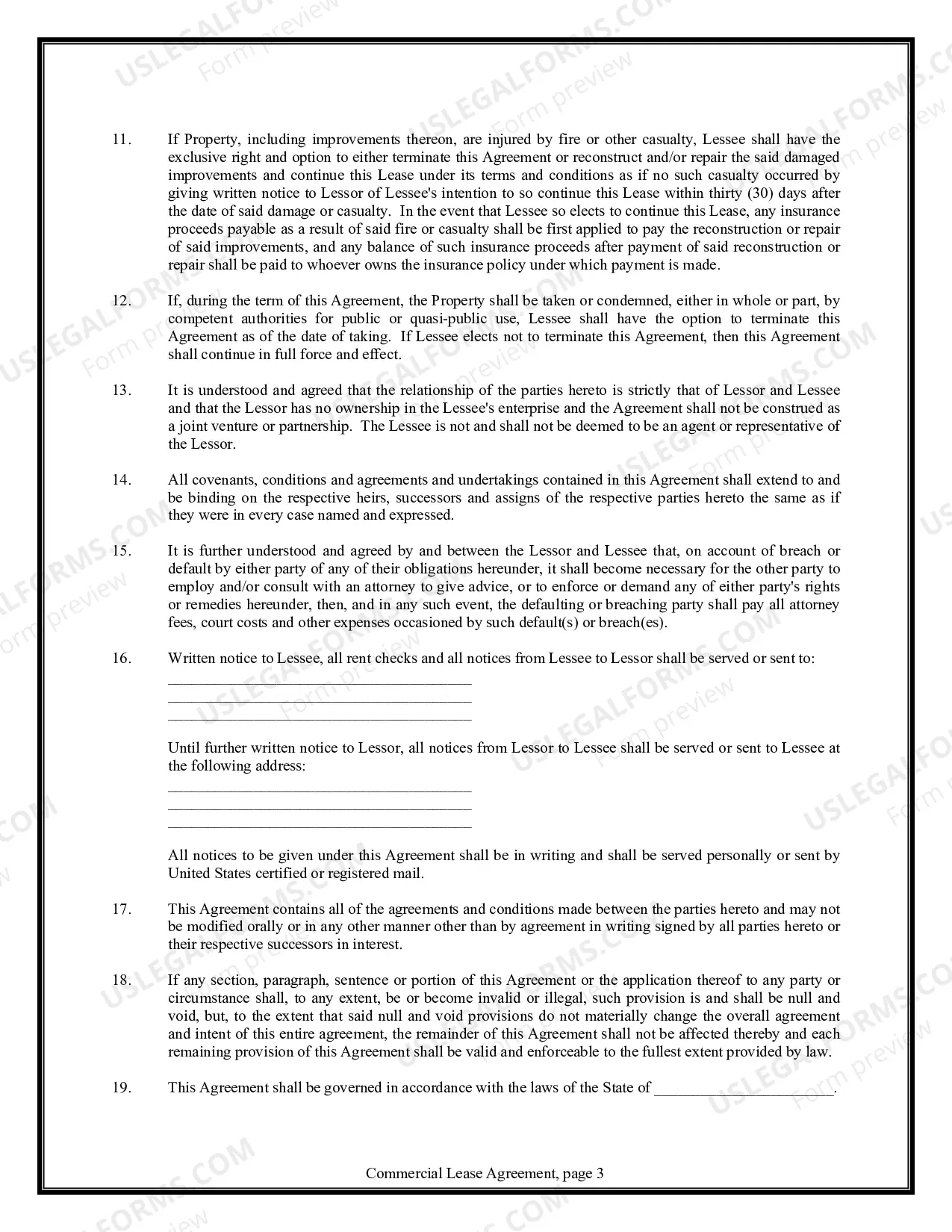

West Virginia Commercial Lease Agreement for Restaurant is a legally binding document that outlines the terms and conditions between a landlord and a tenant for leasing a commercial space specifically for restaurant purposes in the state of West Virginia. This agreement ensures that both parties are fully aware of their rights and responsibilities, avoiding any potential disputes or misunderstandings. The West Virginia Commercial Lease Agreement for Restaurant includes several essential elements to safeguard the interests of both the landlord and the tenant. These elements include the identification of the parties involved, the property description, lease term, rental payment details, security deposit, maintenance responsibilities, construction and alterations clauses, insurance requirements, and dispute resolution procedures. In West Virginia, there might be different types of Commercial Lease Agreements for Restaurants, depending on the specific needs and circumstances of the involved parties. Some of these variations may include: 1. Triple Net Lease Agreement: This type of lease agreement requires the tenant to pay for all additional expenses related to the property, such as property taxes, building insurance, and maintenance costs, in addition to the fixed rent. 2. Percentage Lease Agreement: In this type of agreement, the landlord will receive a percentage of the tenant's monthly or yearly sales revenue, on top of the base rent. This is a common arrangement for restaurants, as it allows the landlord to benefit from the restaurant's success. 3. Gross Lease Agreement: A gross lease agreement requires the tenant to pay a fixed amount of rent that includes all operating expenses and utilities associated with the property. The landlord is responsible for paying any additional costs. It is important for landlords and tenants to carefully consider their specific requirements and financial capabilities before entering into any type of West Virginia Commercial Lease Agreement for Restaurant. Seeking legal advice or assistance is highly recommended ensuring compliance with state laws and to protect both parties' rights and interests.

West Virginia Commercial Lease Agreement for Restaurant

Description

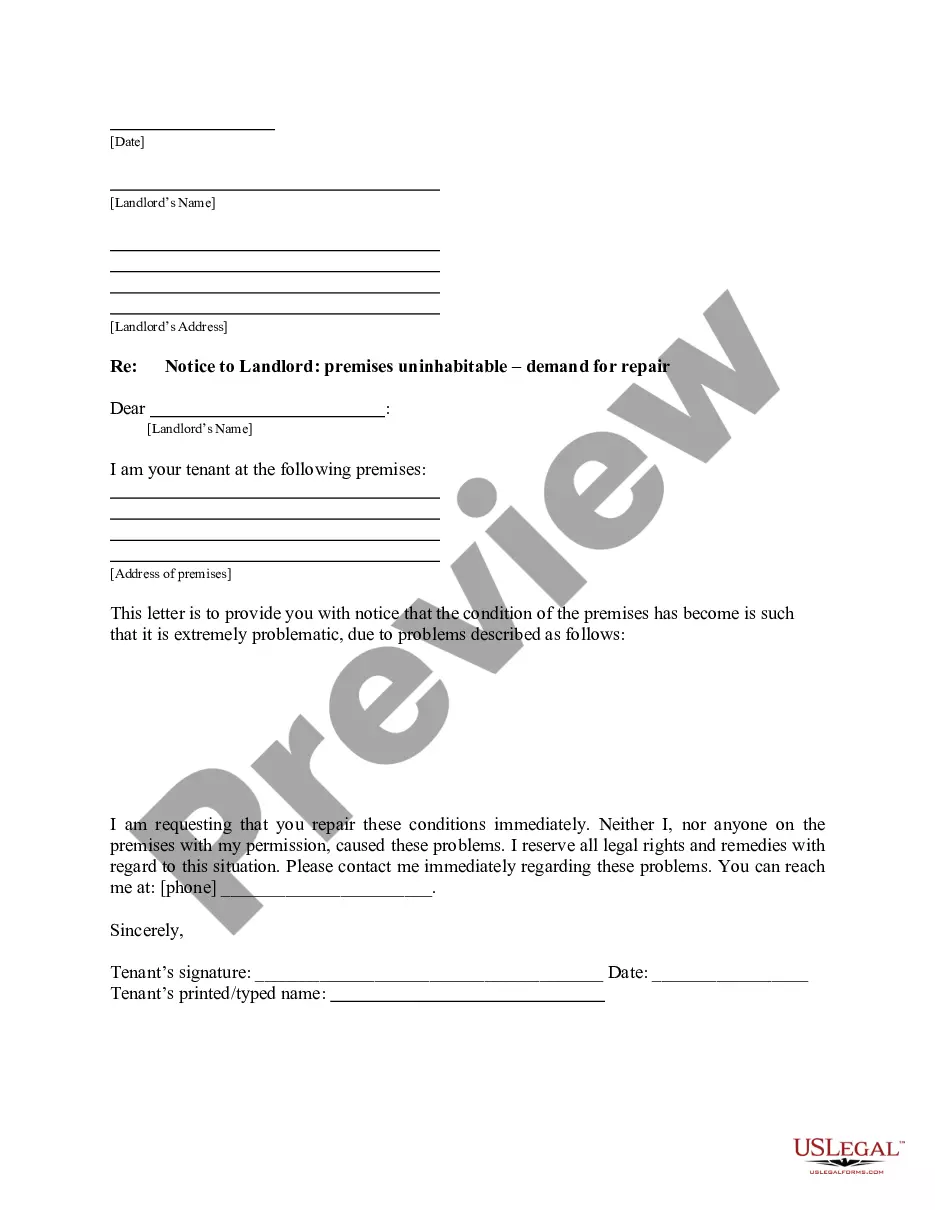

How to fill out West Virginia Commercial Lease Agreement For Restaurant?

US Legal Forms - one of the most significant libraries of legitimate types in the United States - delivers a wide range of legitimate file web templates you can obtain or print. Using the web site, you may get 1000s of types for organization and individual uses, sorted by types, claims, or keywords.You will find the most up-to-date types of types like the West Virginia Commercial Lease Agreement for Restaurant in seconds.

If you have a membership, log in and obtain West Virginia Commercial Lease Agreement for Restaurant through the US Legal Forms library. The Download key will show up on each kind you view. You have access to all previously downloaded types in the My Forms tab of your own profile.

If you wish to use US Legal Forms the first time, here are simple recommendations to obtain started:

- Be sure you have picked out the right kind to your area/area. Click on the Review key to review the form`s articles. Browse the kind outline to actually have chosen the proper kind.

- In case the kind does not match your demands, use the Research field near the top of the display screen to get the one who does.

- If you are content with the form, verify your choice by simply clicking the Buy now key. Then, choose the prices strategy you favor and supply your qualifications to register to have an profile.

- Method the financial transaction. Use your Visa or Mastercard or PayPal profile to finish the financial transaction.

- Choose the structure and obtain the form in your gadget.

- Make modifications. Load, edit and print and sign the downloaded West Virginia Commercial Lease Agreement for Restaurant.

Each and every web template you added to your bank account lacks an expiry particular date which is yours permanently. So, if you would like obtain or print another copy, just visit the My Forms area and then click on the kind you will need.

Gain access to the West Virginia Commercial Lease Agreement for Restaurant with US Legal Forms, by far the most extensive library of legitimate file web templates. Use 1000s of expert and express-certain web templates that fulfill your small business or individual demands and demands.

Form popularity

FAQ

You can usually choose to have a leased car for 24, 36 or 48 months, with a 36-month deal being the average term. Depending on your preference and budget, one type of contract will suit you over the others.

The three most common types of leases are gross leases, net leases, and modified gross leases....3 Types of Leases Business Owners Should UnderstandThe Gross Lease. The gross lease tends to favor the tenant.The Net Lease. The net lease, however, tends to favor the landlord.The Modified Gross Lease.

Moll says that most lease terms for restaurants are about five years long, with additional five year options added on. If you're looking for a better monthly rate or more money to cover renovations, you might need to consider signing on for a longer term.

6-Month Leases They're a good middle ground between affording landlords enough time and a little security to determine if the tenants will be a good property fit, while also having the option of non-renew at 6 months without dealing with a potential eviction situation if the tenants aren't working out.

This lease structure makes the tenant responsible for the majority of costs. Specifically, the tenant pays the base rent, property but also taxes, insurance, utilities, and maintenance. This even includes standard property repairs associated with the commercial space being occupied.

A Triple Net Lease (NNN Lease) is the most common type of lease in commercial buildings. In a NNN lease, the rent does not include operating expenses. Operating expenses include utilities, maintenance, property taxes, insurance and property management.

Commercial leases are typically three to five years. That guarantees enough rental income for the landlords to recoup their investment. Leases are often negotiable, but for a commercial lease, landlords frequently allow customization of the space for the sake of the renting business.

term lease gives you the benefit of being able to relocate if you need more space, but a longterm lease will ensure that you don't have to take on the expense of moving shortly after getting settled. Typically, landlords will offer you a better deal if you lock in to a longterm lease.

Here are 10 key financial commercial lease clauses that you should keep a close eye on throughout your lease term.Rent And Default.Rent Increase Steps/Percentages.Profit-Sharing Or Revenue-Based Rent.Options.Operating Expenses.Rent Incentives And Reimbursements.Janitorial Services.Electricity.More items...?

Normally commercial landlords are responsible for any structural repairs such as foundations, flooring, roof and exterior walls, and tenants are responsible for non-structural repairs such as air conditioning or plumbing.