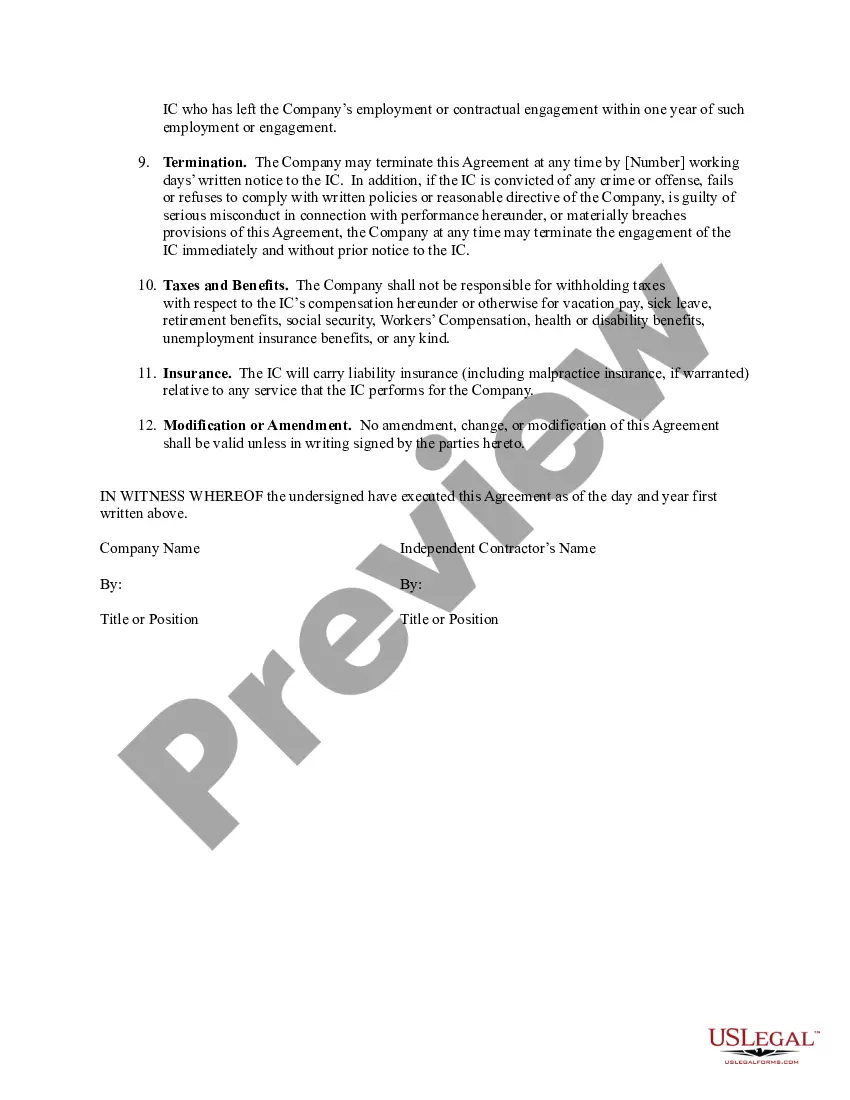

West Virginia Sample Self-Employed Independent Contractor Agreement — for ongoing relationship Overview: A West Virginia Sample Self-Employed Independent Contractor Agreement for an ongoing relationship is a legally binding document that outlines the terms and conditions between a self-employed independent contractor and a client in the state of West Virginia. This agreement establishes the rights and responsibilities of both parties, ensuring a smooth and professional working relationship. Key Terms and Clauses: 1. Parties: Identify the names and addresses of the independent contractor and the client involved in the agreement. 2. Services: Clearly define the services to be provided by the independent contractor. Include details such as the nature of the work, project milestones, and deadlines. 3. Payment: Specify the agreed-upon compensation structure, payment method, and schedule. Discuss reimbursements for any authorized expenses incurred. 4. Relationship of the Parties: Clarify that the independent contractor status is not an employment relationship and no employee benefits will be provided. 5. Term and Termination: State the duration of the agreement and the conditions under which either party may terminate it. Include any notice periods required. 6. Confidentiality and Non-Disclosure: Address the protection of confidential information and intellectual property rights throughout and after the agreement's term. 7. Independent Contractor's Representations: Confirm that the independent contractor possesses the necessary skills, qualifications, and licenses to perform the required services. 8. Indemnification: Specify that the independent contractor will indemnify and hold harmless the client from any claims, losses, or damages arising from the services provided. 9. Dispute Resolution: Describe the procedures to follow in case of a dispute and state the jurisdiction for resolving any legal matters. 10. Governing Law: Determine that the agreement is governed by the laws of the state of West Virginia. Types of West Virginia Sample Self-Employed Independent Contractor Agreements for ongoing relationships: 1. West Virginia Independent Contractor Agreement for IT Services: Tailored specifically for independent contractors providing IT or software-related services. 2. West Virginia Independent Contractor Agreement for Marketing Services: Designed for independent contractors offering marketing, advertising, or promotional services. 3. West Virginia Independent Contractor Agreement for Consulting Services: Suitable for independent contractors providing professional consulting services in various fields. 4. West Virginia Independent Contractor Agreement for Construction Services: Geared towards self-employed contractors engaged in construction, renovation, or maintenance services. In conclusion, a West Virginia Sample Self-Employed Independent Contractor Agreement for an ongoing relationship is a crucial legal document that ensures both parties' rights and obligations are clearly defined and understood. It protects the interests of the independent contractor and the client while fostering a productive and sustainable working relationship in accordance with West Virginia state laws.

West Virginia Sample Self-Employed Independent Contractor Agreement - for ongoing relationship

Description

How to fill out West Virginia Sample Self-Employed Independent Contractor Agreement - For Ongoing Relationship?

Are you currently within a position in which you need papers for either business or person reasons virtually every day? There are a lot of lawful papers themes available on the Internet, but getting versions you can rely isn`t easy. US Legal Forms gives a large number of develop themes, much like the West Virginia Sample Self-Employed Independent Contractor Agreement - for ongoing relationship, that happen to be published to satisfy federal and state needs.

Should you be presently knowledgeable about US Legal Forms internet site and also have a free account, basically log in. Afterward, you can acquire the West Virginia Sample Self-Employed Independent Contractor Agreement - for ongoing relationship web template.

If you do not have an bank account and would like to begin using US Legal Forms, abide by these steps:

- Find the develop you require and ensure it is for your correct metropolis/region.

- Use the Preview option to review the form.

- Browse the information to actually have chosen the proper develop.

- In case the develop isn`t what you are searching for, make use of the Research industry to obtain the develop that suits you and needs.

- If you obtain the correct develop, just click Get now.

- Pick the costs program you would like, submit the desired information and facts to generate your account, and buy your order making use of your PayPal or bank card.

- Select a handy paper structure and acquire your backup.

Discover each of the papers themes you have purchased in the My Forms food list. You may get a more backup of West Virginia Sample Self-Employed Independent Contractor Agreement - for ongoing relationship at any time, if required. Just click on the needed develop to acquire or print the papers web template.

Use US Legal Forms, by far the most substantial selection of lawful forms, to save efforts and stay away from errors. The assistance gives expertly manufactured lawful papers themes that can be used for a variety of reasons. Generate a free account on US Legal Forms and commence generating your way of life a little easier.

Form popularity

FAQ

The fixed, periodic compensation of a partner (often referred to as guaranteed payments or the partner's draw) is therefore self-employment income rather than employee wages. A partner's salary is reported to the partner on a Schedule K-1 as a guaranteed payment rather than on a Form W-2.

How do I create an Independent Contractor Agreement?State the location.Describe the type of service required.Provide the contractor's and client's details.Outline compensation details.State the agreement's terms.Include any additional clauses.State the signing details.

Ten Tips for Making Solid Business Agreements and ContractsGet it in writing.Keep it simple.Deal with the right person.Identify each party correctly.Spell out all of the details.Specify payment obligations.Agree on circumstances that terminate the contract.Agree on a way to resolve disputes.More items...

Here are some steps you may use to guide you when you write an employment contract:Title the employment contract.Identify the parties.List the term and conditions.Outline the job responsibilities.Include compensation details.Use specific contract terms.Consult with an employment lawyer.Employment.More items...?

Such a partner who devotes time and energy in the conduct of the trade of business of the partnership, or in providing services to the partnership as an independent contractor, is a self- employed individual rather than a common law employee.

If your independent contractor agreement contains a provision that allows the parties to terminate the relationship at any time, revise the agreement to include a notice provision with at least some kind of a notice period required for termination of the contract.

Partners in a partnership (including certain members of a limited liability company (LLC)) are considered to be self-employed, not employees, when performing services for the partnership.

Yes. The contractor should receive a 1099 form if the LLC is treated as a partnership as well as a single-member LLC (disregarded entity).

Second, as an independent contractor, your spouse will have to pay his or her own self-employment taxes since you will not be doing payroll taxes as if he or she were an employee.

What Is an Independent Contractor? An independent contractor is a self-employed person or entity contracted to perform work foror provide services toanother entity as a nonemployee. As a result, independent contractors must pay their own Social Security and Medicare taxes.