West Virginia Prospectus of Scudder Growth and Income Fund The West Virginia Prospectus of Scudder Growth and Income Fund provides potential investors with a comprehensive overview of this investment opportunity. The Prospectus outlines key details, investment strategies, risk factors, and other pertinent information that investors need to make informed decisions about the fund. With a focus on growth and income, this fund aims to provide long-term capital growth and regular income through a diversified portfolio. Keywords: West Virginia, Prospectus, Scudder Growth and Income Fund, investment opportunity, investment strategies, risk factors, long-term capital growth, regular income, diversified portfolio. Types of West Virginia Prospectus of Scudder Growth and Income Fund: 1. Equity-based Growth and Income Fund: This type of fund invests primarily in equities or stocks of companies with the potential for capital appreciation over the long term. The fund focuses on generating both growth and income by carefully selecting fundamentally strong stocks from various industries. 2. Fixed Income-based Growth and Income Fund: This type of fund primarily invests in fixed income securities such as bonds, treasury bills, and other debt instruments. The goal is to generate income for investors through regular interest payments while also aiming for capital appreciation. The fund managers assess credit quality, duration, and interest rate outlook to construct a diversified fixed income portfolio. 3. Balanced Growth and Income Fund: This fund combines both equity and fixed income investments to achieve a balanced approach to growth and income. By diversifying the portfolio across various asset classes, this type of fund aims to provide investors with both capital appreciation potential and regular income. The fund managers strategically allocate assets based on market conditions and individual securities' attractiveness. 4. Sector-specific Growth and Income Fund: This variation of the Scudder Growth and Income Fund concentrates its investments within specific sectors of the economy, such as technology, healthcare, or energy. By focusing on specific industries, these funds seek growth and income opportunities unique to those sectors, but with potentially higher risk due to lack of diversification. 5. Global Growth and Income Fund: This fund extends its investment horizon beyond the domestic market and seeks growth and income opportunities globally. It invests in both developed and emerging markets, aiming to capture the potential growth and income from diverse economies. Global funds require thorough analysis of geopolitical risks, foreign currency exposure, and market conditions worldwide. These various types of West Virginia Prospectus of Scudder Growth and Income Fund offer investors different investment strategies and risk profiles to suit their financial goals and risk tolerance. It is essential for potential investors to carefully review the prospectus of each fund type to understand its specific investment objectives, fee structure, historical performance, and risk factors before making any investment decisions.

West Virginia Prospectus of Scudder growth and income fund

Description

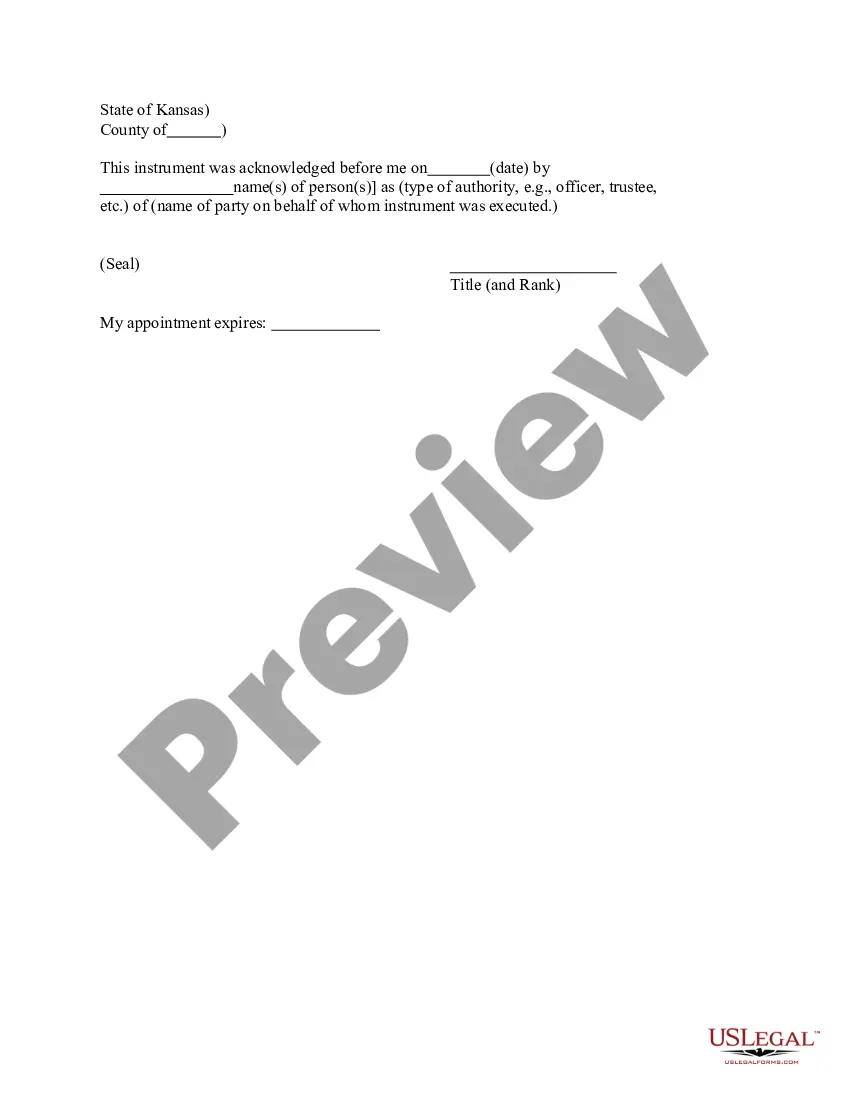

How to fill out West Virginia Prospectus Of Scudder Growth And Income Fund?

Are you in the situation where you require documents for either business or individual functions nearly every time? There are a lot of legitimate papers themes available on the Internet, but discovering versions you can trust is not simple. US Legal Forms gives a large number of type themes, such as the West Virginia Prospectus of Scudder growth and income fund, which are composed to meet state and federal needs.

When you are already acquainted with US Legal Forms site and possess a free account, basically log in. Afterward, you may download the West Virginia Prospectus of Scudder growth and income fund format.

Should you not provide an bank account and want to begin using US Legal Forms, abide by these steps:

- Discover the type you will need and ensure it is to the proper town/area.

- Make use of the Review option to check the shape.

- Look at the information to actually have chosen the appropriate type.

- In the event the type is not what you`re seeking, utilize the Look for industry to find the type that meets your requirements and needs.

- When you discover the proper type, click on Buy now.

- Pick the costs strategy you need, submit the required info to make your bank account, and purchase an order utilizing your PayPal or credit card.

- Choose a practical paper format and download your backup.

Locate each of the papers themes you might have purchased in the My Forms menus. You can aquire a further backup of West Virginia Prospectus of Scudder growth and income fund anytime, if required. Just click the necessary type to download or printing the papers format.

Use US Legal Forms, one of the most substantial variety of legitimate forms, in order to save some time and avoid faults. The service gives expertly created legitimate papers themes which can be used for a range of functions. Generate a free account on US Legal Forms and commence generating your daily life a little easier.

Form popularity

FAQ

A Money Market fund is a mutual fund that invests in short-term, higher quality securities. Designed to provide high liquidity with lower risk, stability of capital and typically higher yields than some other cash products.

A money market mutual fund is a type of mutual fund that invests in high-quality, short-term debt instruments, cash, and cash equivalents. Though not exactly as safe as cash, money market funds are considered extremely low risk on the investment spectrum and thus carry close to the risk-free rate of return.

Effective February 6, 2006, Scudder Investments will change its name to DWS Scudder and the Scudder funds will be renamed DWS funds. The Trusts/Corporations that the funds are organized under will also be renamed DWS.

A mutual fund is a pool of money managed by a professional Fund Manager. It is a trust that collects money from a number of investors who share a common investment objective and invests the same in equities, bonds, money market instruments and/or other securities.