West Virginia Agreement and Plan of Merger for conversion of corporation into Maryland Real Estate Investment Trust

Description

How to fill out Agreement And Plan Of Merger For Conversion Of Corporation Into Maryland Real Estate Investment Trust?

US Legal Forms - one of the greatest libraries of lawful kinds in the USA - delivers a variety of lawful papers layouts you are able to download or print out. Utilizing the web site, you will get a huge number of kinds for organization and personal uses, categorized by classes, suggests, or search phrases.You will discover the newest variations of kinds like the West Virginia Agreement and Plan of Merger for conversion of corporation into Maryland Real Estate Investment Trust within minutes.

If you already have a monthly subscription, log in and download West Virginia Agreement and Plan of Merger for conversion of corporation into Maryland Real Estate Investment Trust from the US Legal Forms catalogue. The Obtain option can look on every form you perspective. You get access to all previously delivered electronically kinds from the My Forms tab of your own account.

If you wish to use US Legal Forms for the first time, allow me to share straightforward instructions to obtain started out:

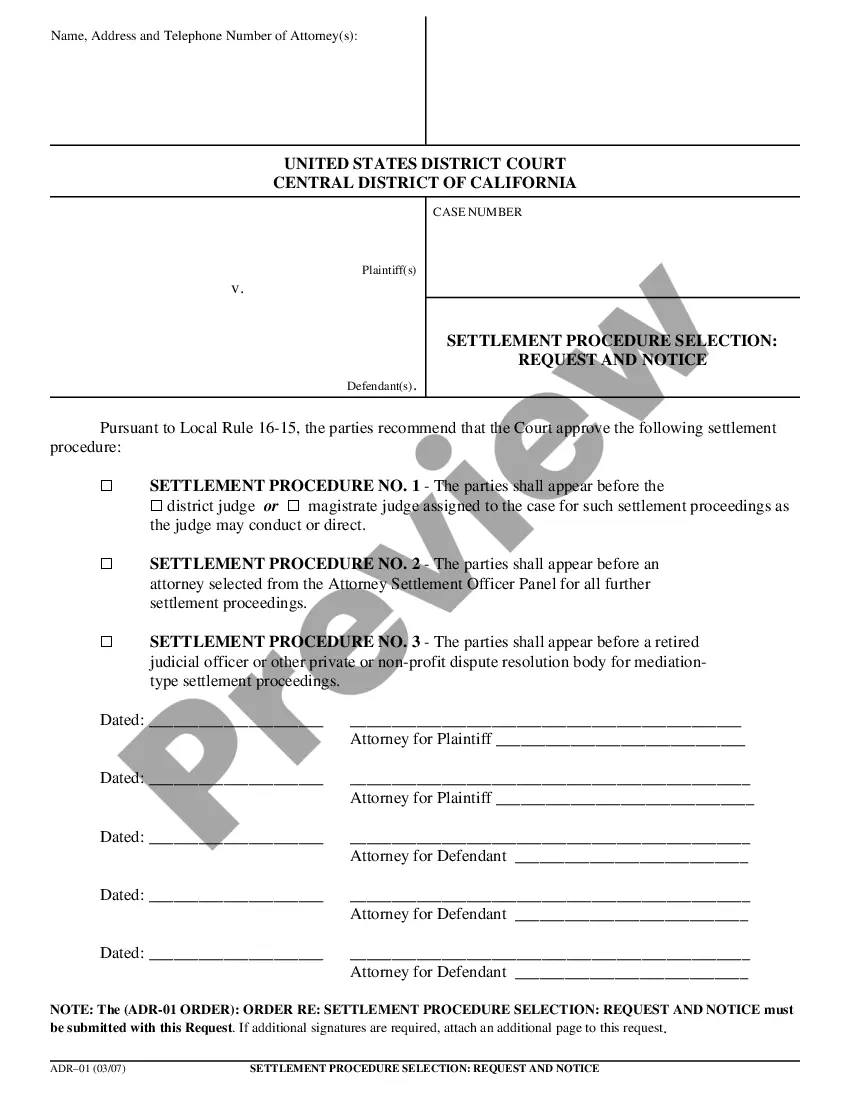

- Make sure you have selected the best form for your personal area/state. Go through the Review option to check the form`s information. Look at the form outline to actually have chosen the appropriate form.

- If the form does not fit your needs, make use of the Look for area on top of the monitor to obtain the one who does.

- In case you are satisfied with the form, verify your selection by visiting the Get now option. Then, choose the costs strategy you favor and give your references to sign up for the account.

- Approach the transaction. Make use of your charge card or PayPal account to accomplish the transaction.

- Choose the file format and download the form on your gadget.

- Make adjustments. Load, edit and print out and sign the delivered electronically West Virginia Agreement and Plan of Merger for conversion of corporation into Maryland Real Estate Investment Trust.

Each and every template you added to your money lacks an expiry date and is your own property for a long time. So, if you would like download or print out another copy, just go to the My Forms portion and click on around the form you will need.

Obtain access to the West Virginia Agreement and Plan of Merger for conversion of corporation into Maryland Real Estate Investment Trust with US Legal Forms, the most comprehensive catalogue of lawful papers layouts. Use a huge number of specialist and state-particular layouts that meet up with your business or personal needs and needs.